Zoho Books Integration

Keeping track of the salaries you pay your employees is as important as paying them on time. The wages you pay and the taxes you deposit need to be kept track of using accounting software. Posting accounting entries manually after every pay run could be time-consuming.

This is where integrating Zoho Payroll with Zoho Books comes to the rescue. Zoho Books is an end-to-end accounting software for your business.

When you integrate with Zoho Books, all your payroll transactions from Zoho Payroll will be recorded as journal entries in Zoho Books. All your payroll expenses and tax liabilities will be automatically recorded in the correct Expense and Liability accounts. This will be reflected in your Profit and Loss statement so that your Net Profit in Zoho Books is accurate.

Set up the Integration

To integrate Zoho Payroll with Zoho Books:

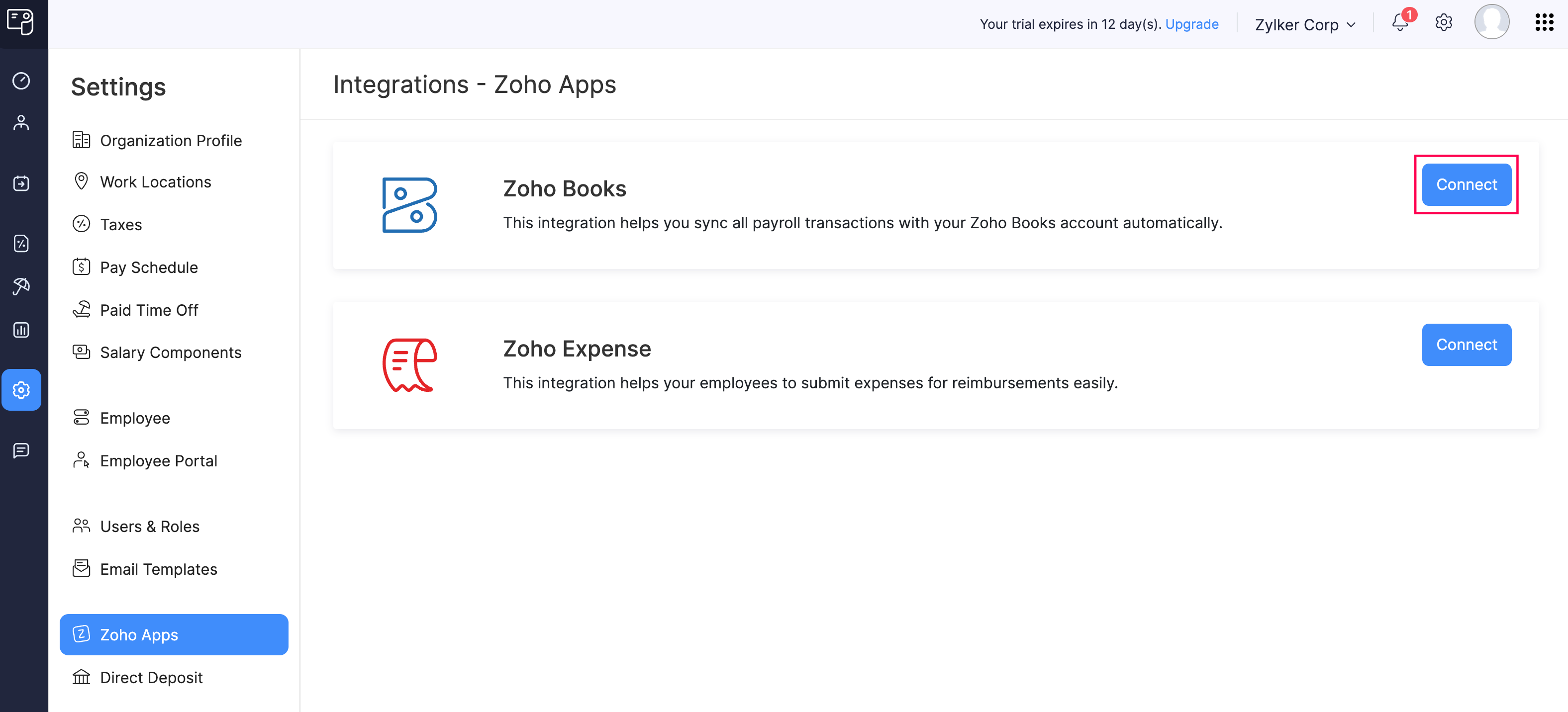

- Go to Settings and click Zoho Apps.

- Click Connect next to Zoho Books.

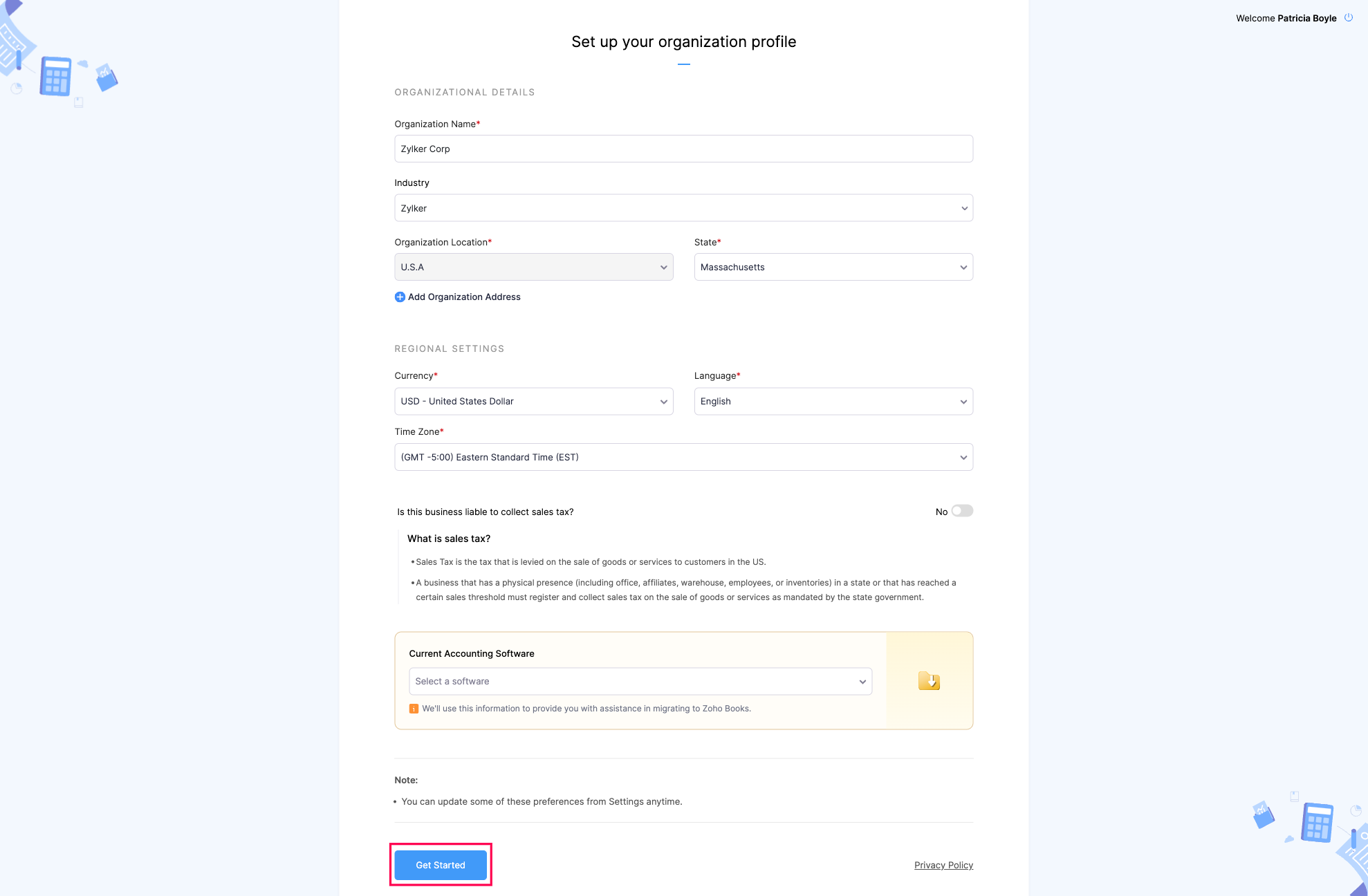

- Click Join Organization in the pop-up window. You’ll be redirected to a page where you can set up your Zoho Books organization profile.

- Enter the required details and click Get Started.

Now, your Zoho Payroll organization will be integrated with Zoho Books.

Configure the Integration

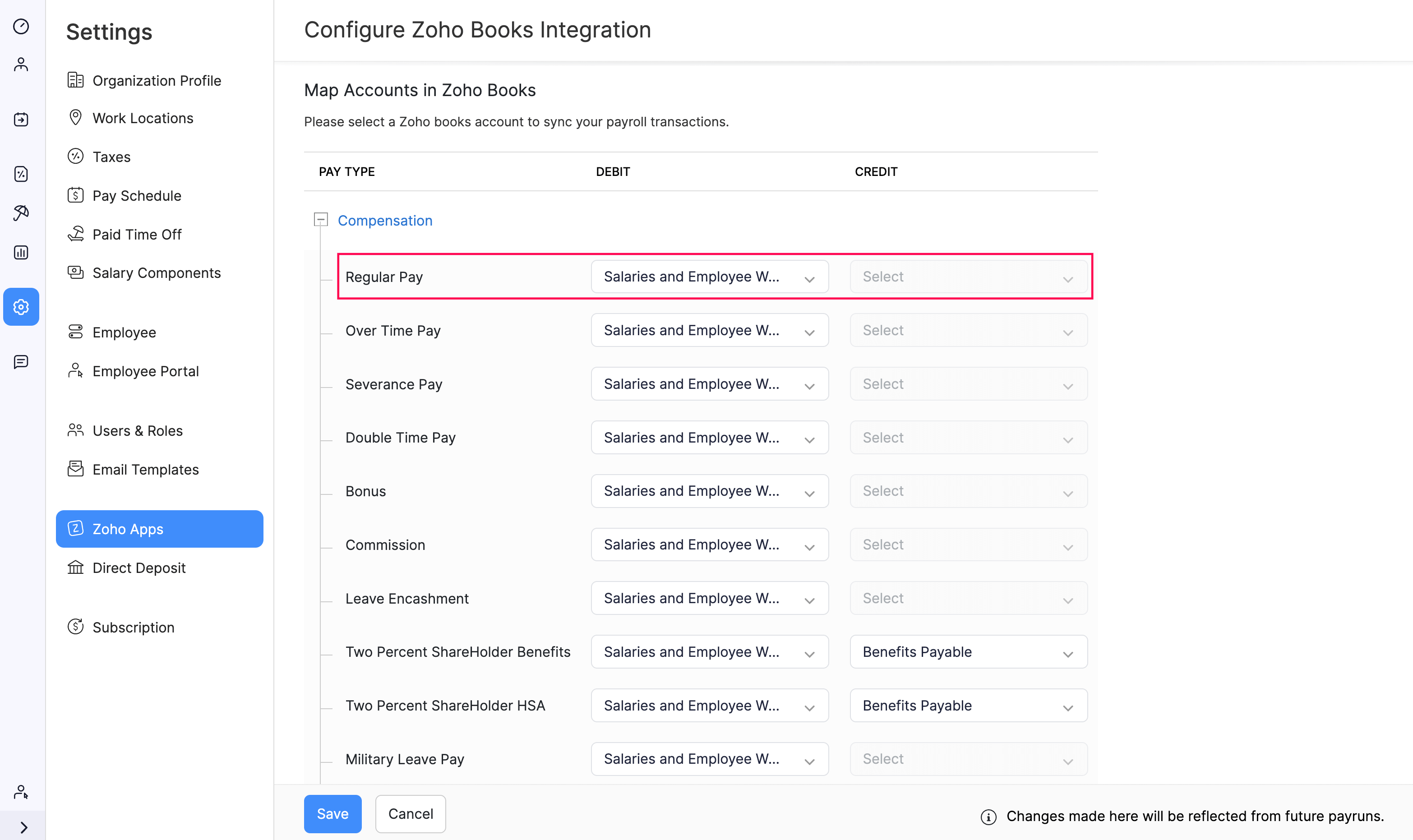

Once you’ve integrated with Zoho Books, you can configure the integration by selecting the accounts in which you want to record the payroll transactions. For instance, you can choose to track all tax deductions under a single account or use different accounts for each deduction type. You can also create sub-accounts in Zoho Books based on your requirements and associate them with Zoho Payroll.

To configure the integration:

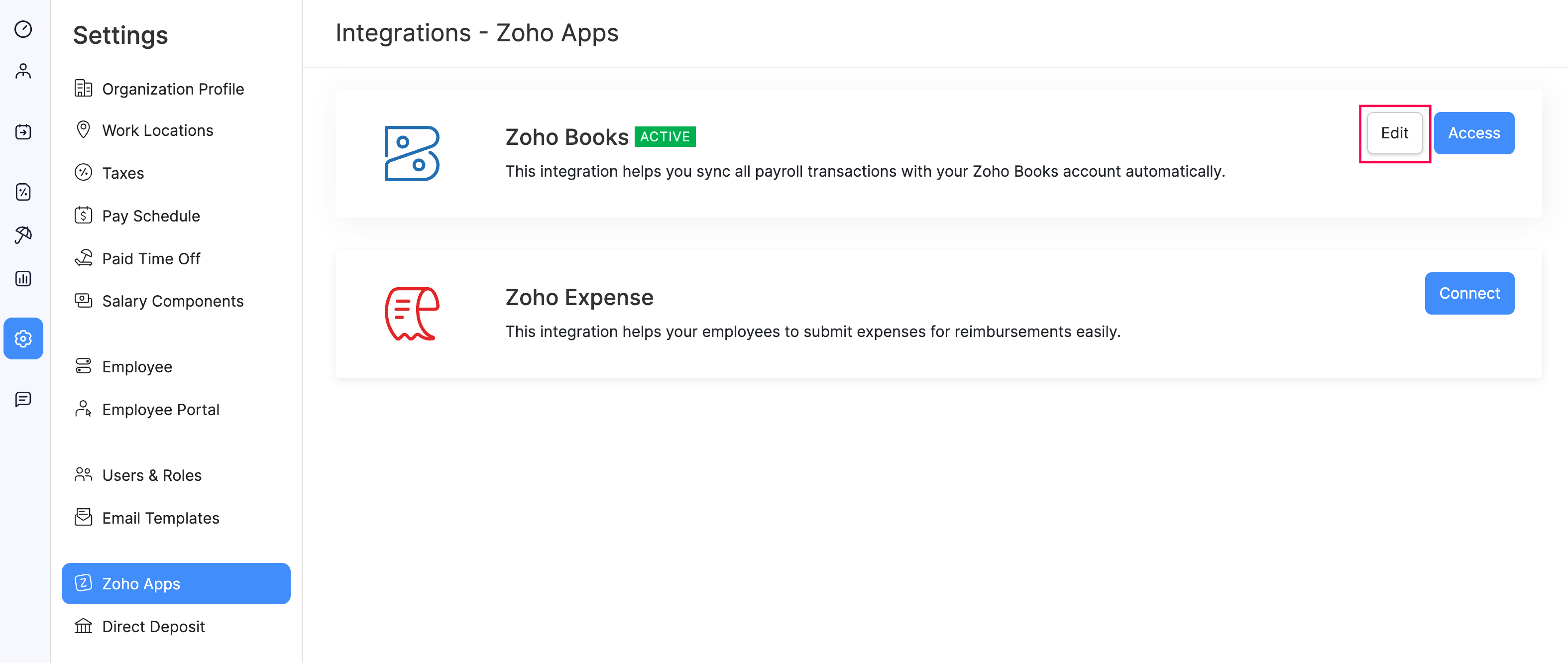

- Go to Settings and click Zoho Apps.

- Click Edit next to Zoho Books to navigate to the Configure Zoho Books Integration page.

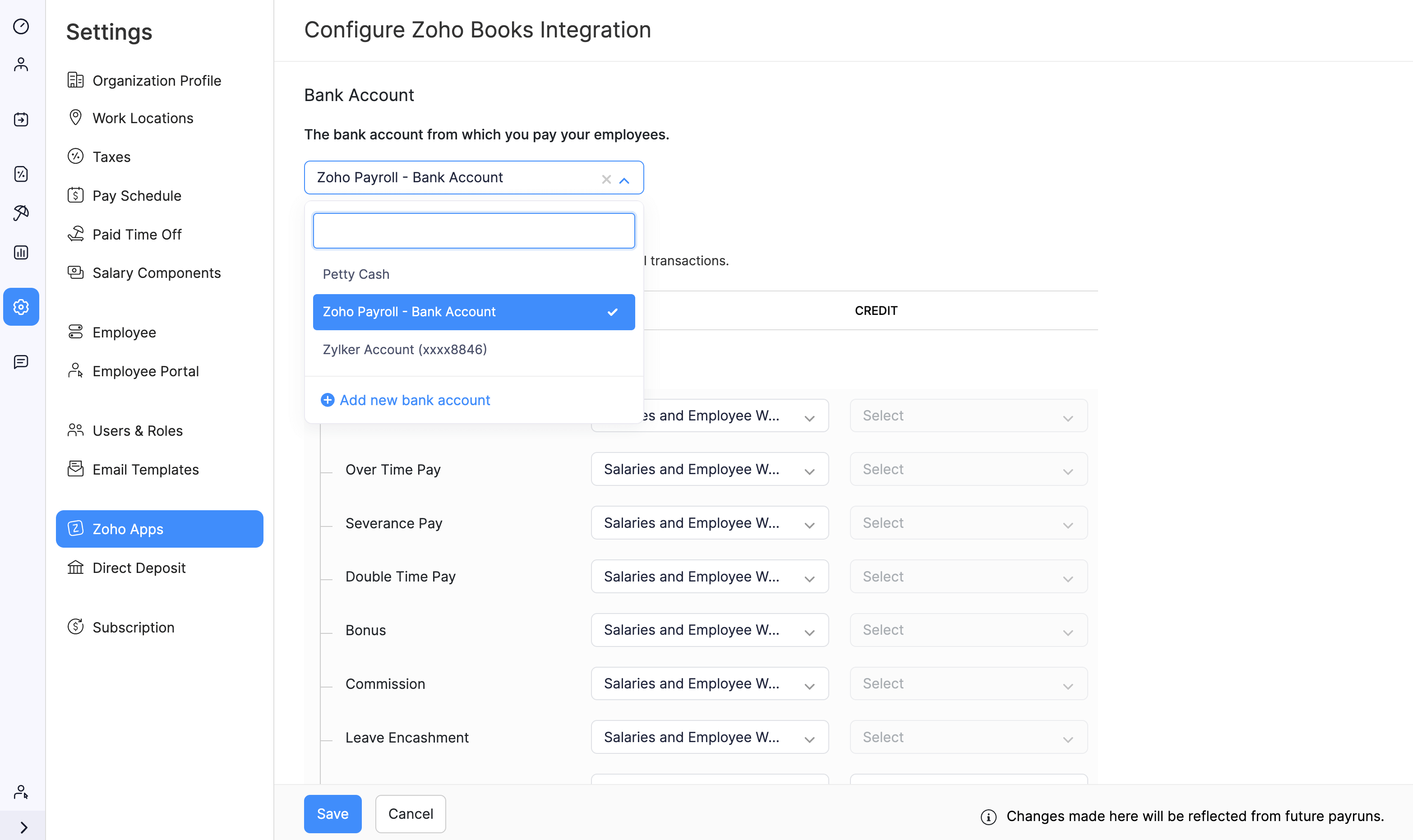

- Click the Bank Account dropdown and select the account from which payroll expenses are paid.

INSIGHT If you wish to use a new account, you can click + Add new bank account.

- In the Map Accounts in Zoho Books section, select the debit and credit accounts for each payroll transaction category (Compensation, Tax, Benefit, and Deduction). For example, map ‘Regular Pay’ to ‘Salaries and Employee Wages’ under Compensation.

- Click Save.

This configuration will be used to sync all your future payroll transactions with your Zoho Books account.

After you set up and configure the integration, Zoho Payroll will automatically post journal entries in Zoho Books when you approve a pay run. If you wish to view the journal entries, navigate to Manual Journals under the Accountant module in Zoho Books.

However, you have the flexibility to disable posting journal entries for a pay run, if required.

To disable posting journal entries:

- Navigate to the Pay Runs module in Zoho Payroll.

- Click Process Pay Run next to your upcoming pay run.

- Click Approve Payroll at the top-right.

- Unselect the Post Journal Entries option.

- Click Approve Payroll.

Now, your payroll will be approved without journal entries being posted in Zoho Books.

Reports

After enabling the integration, you will gain access to a new set of reports in Zoho Books related to Payroll:

- Payroll Summary

- Benefits Summary

- Employee Deductions

- Payroll Tax Summary

- Payroll Tax Payments

Once journal entries are posted in Zoho Books, the following reports will be primarily affected:

- Business Overview reports

- Profit and Loss

- Balance Sheet

- Accountant reports

- General Ledger

- Journal Report

- Trial Balance

Learn more about reports in Zoho Books.