Add Employees

Adding essential employee information to Zoho Payroll is crucial to processing payrolls, calculating net pay, and withholding federal and state tax amounts.

NOTE Employers must report new hires to the state. To learn how to report new hires, use these resources published by the Office of Child Support Enforcement (OCSE):

To add an employee:

- Go to the Employees module.

- Click Add Employee.

- Provide the required details in each of the below steps:

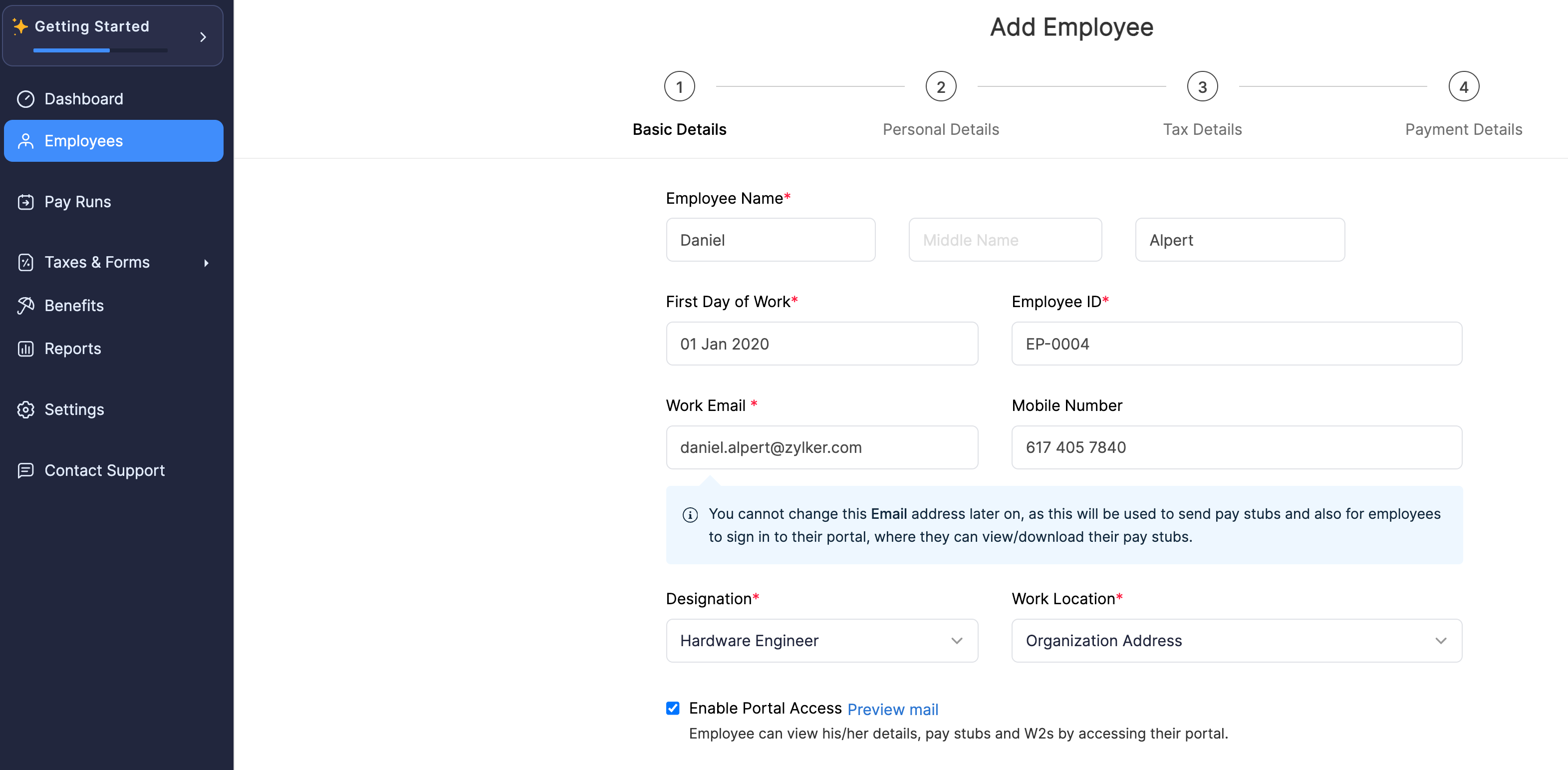

Basic Details

- Provide the employee’s basic details:

| Field Name | Description |

|---|---|

| Employee Name | Enter the employee’s first name, middle name, and last name. |

| First Day of Work | Enter the employee’s date of joining. |

| Employee ID | Provide a unique identification number for the employee. |

| Designation | Select the employee’s job title. PRO TIP: You can add a new designation by clicking New Designation in the dropdown. |

| Work Email | Enter the employee’s official work email address. This email address will be used to:

|

| Work Location | Select the location where the employee primarily works from. PRO TIP: You can add a new work location by clicking New Work Location in the dropdown. Learn more about Work Locations. |

- Select the Enable Portal Access option if you want your employee to access your organization’s Employee Portal. Enabling this will send an email invite to the employee’s Work Email asking them to join the Employee Portal.

INSIGHT The Employee Portal is a dedicated space for your employees where they can:

- Sign and submit their withholding forms

- Configure payment authorization

- Access their personal, compensation, and tax details

- Download their pay stubs

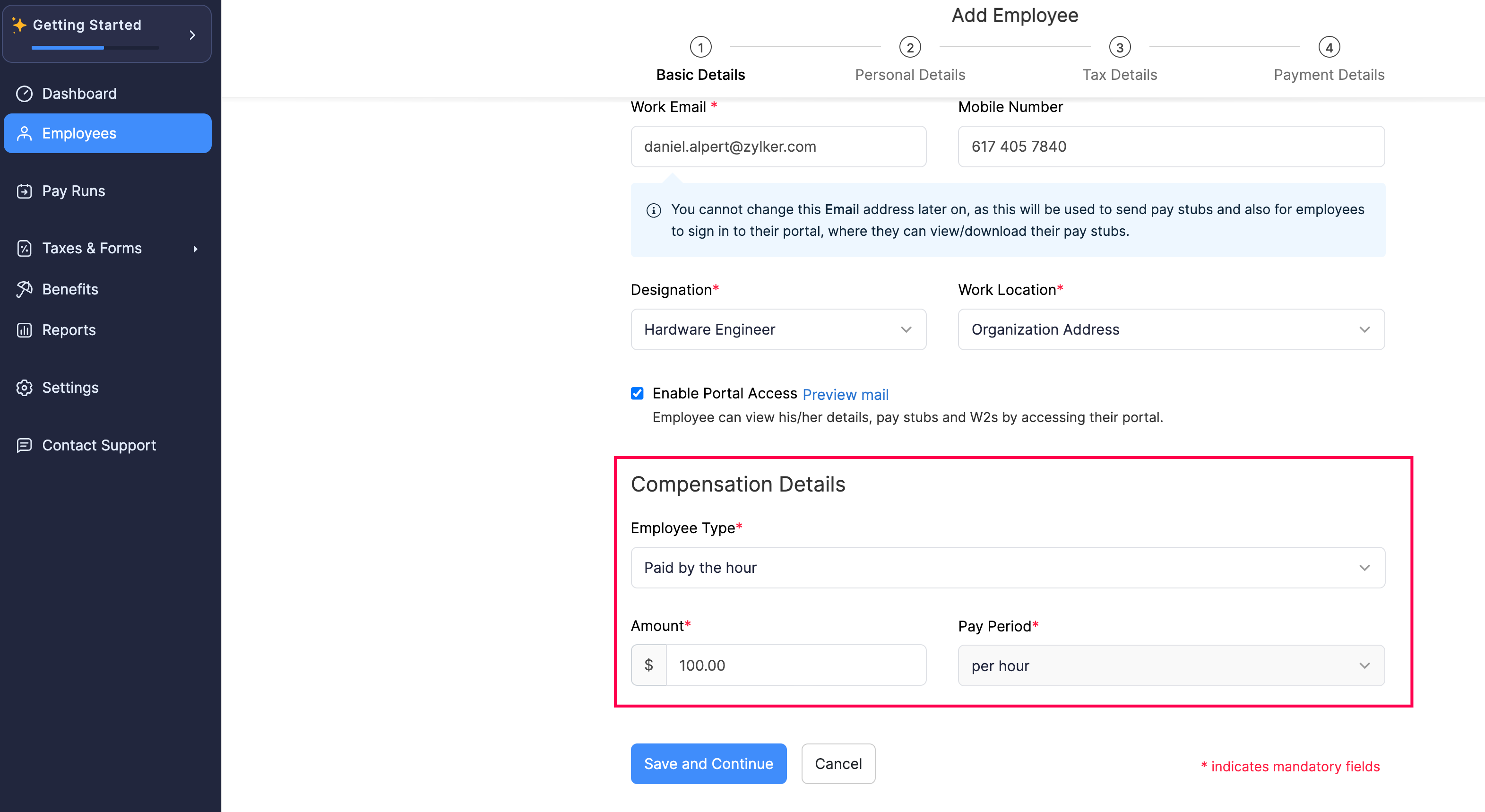

- Provide the employee’s compensation details:

Feild Name | Description |

|---|---|

| Employee Type | Select the employee’s compensation type:

|

| Amount | Enter the compensation amount for your employee.

|

| Pay Period | Select if the entered compensation amount is for an hour or a year in case of a salaried employee. |

INSIGHT

- Zoho Payroll lets you compensate your Hourly employees for the overtime hours they work in a pay period.

- Salaried employees cannot be compensated for overtime hours they work.

Learn more about Overtime Pay on the U.S. Department of Labor Website.

- Click Save and Continue. You’ll be redirected to the employee’s Personal Details page.

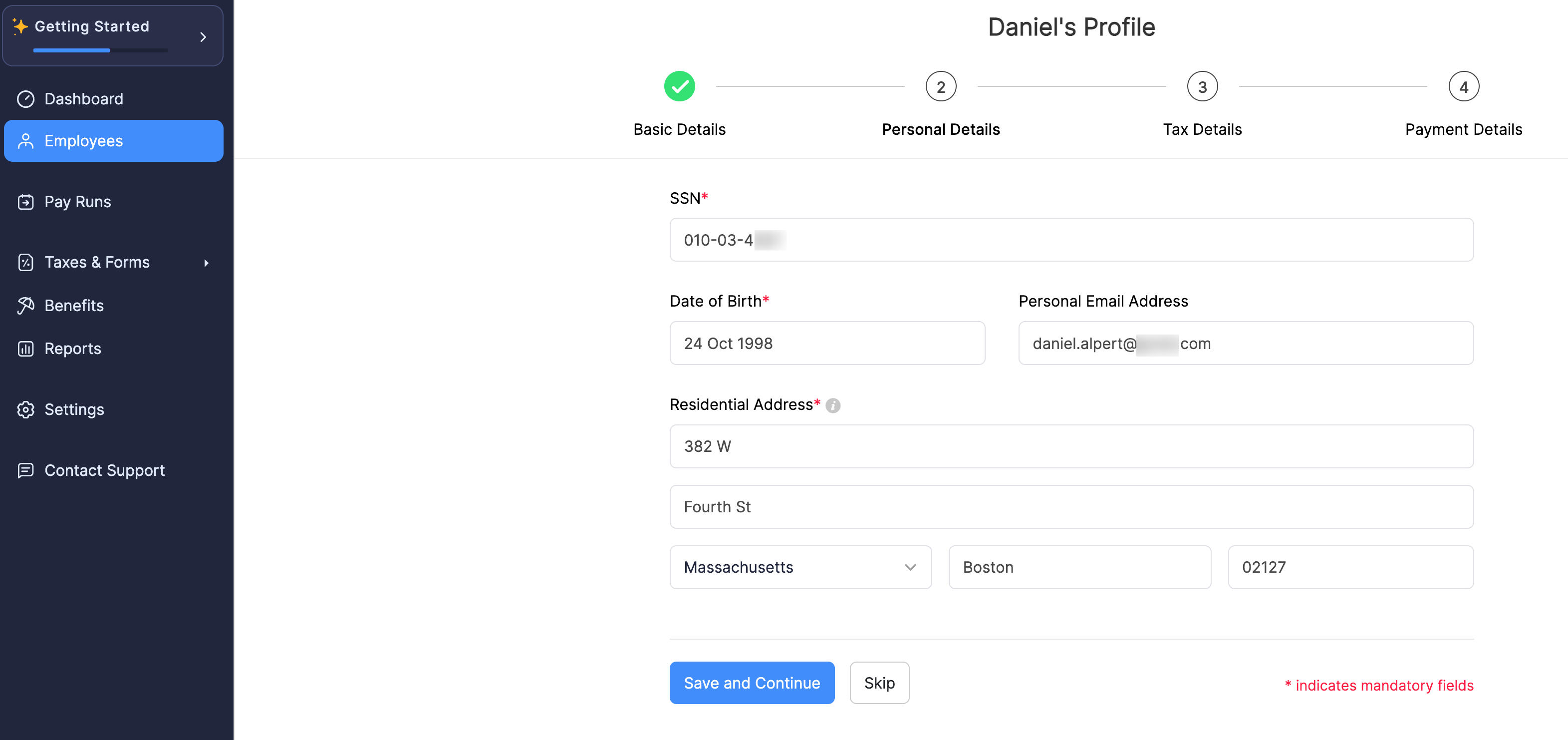

Personal Details

- Provide the employee’s personal details:

| Field Name | Description |

|---|---|

| SSN | Enter your employee’s 9-digit Social Security Number (SSN). |

| Date of Birth | Enter your employee’s date of birth. |

| Mobile Number | Enter your employee’s mobile number. |

| Personal Email Address | Enter your employee’s personal email address. |

| Residential Address | Edit the employee’s home address. This must be a valid address within the state where your business operates. |

- Click Save and Continue. You’ll be redirected to the employee’s Tax Details page.

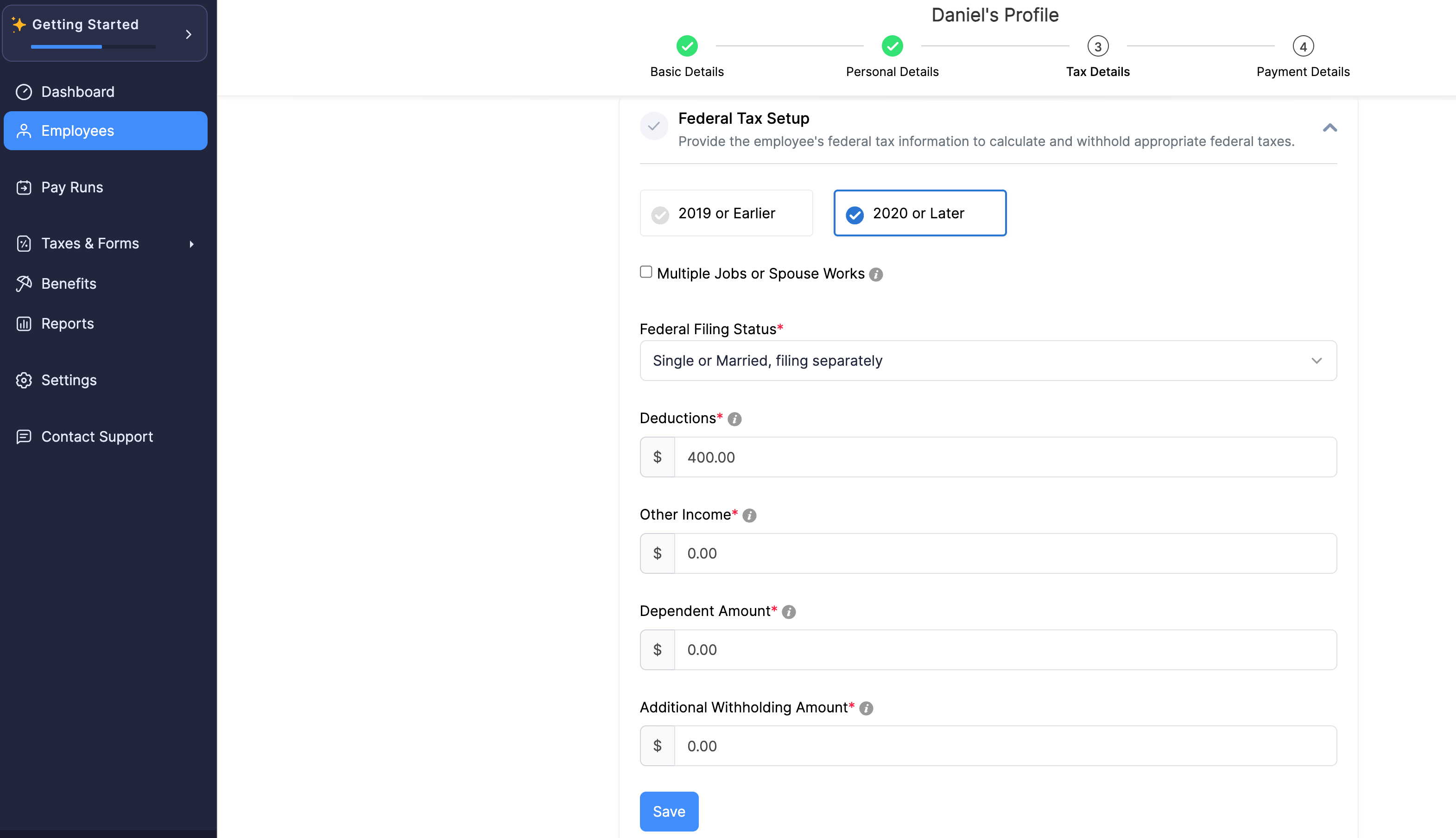

Tax Details

- Provide the employee’s federal tax details:

| Field Name | Description |

|---|---|

| “2019 or Earlier” or “2020 or Later” | Choose 2019 or Earlier if:

Choose 2020 or Later for new hires (employees who join on or after 1 January 2020) and existing employees who submit the latest version of Form W-4. |

| Multiple Jobs or Spouse Works | Select this if the employee holds more than one job. You can find this information in Step 2 of the employee’s Form W-4. |

| Federal Filing Status | Select the employee’s federal filing status:

You can find this information in Step 1(c) of the employee’s Form W-4. |

| Dependent Amount | Enter the total amount that the employee wants to claim for their dependents. You can find this information in Step 3 of the employee’s Form W-4. |

| Additional Withholding Amount | Enter the additional tax amount that the employee wants to be withheld for each pay period. You can find this information in Step 4(c) of the employee’s Form W-4. |

| Other Income | Enter the income amount that the employee is expecting from other sources like interests, dividends, and retirement income. You can find this information in Step 4(a) of the employee’s Form W-4. |

| Deductions | Enter the amount of deductions other than the standard deduction amount that the employee wants to claim. You can find this information in Step 4(b) of the employee’s Form W-4. |

- Click Save.

- Provide the employee’s state tax details, such as their state filing status, allowance details, and so on. The information collected in this section varies for different states.

- Click Save.

- Provide the information required in the Additional Information section. The information collected in this section varies for different states.

- Click Save. You’ll be redirected to the Payment Details section.

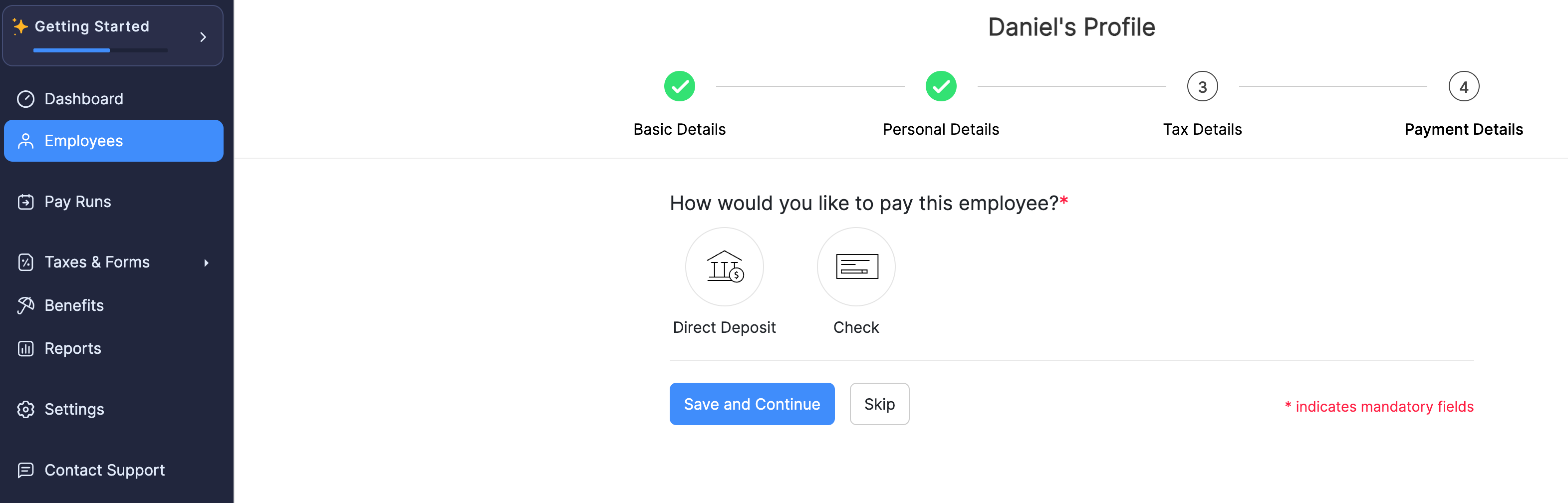

Payment Details

- Select the Payment Mode.

Payment Mode | Description |

|---|---|

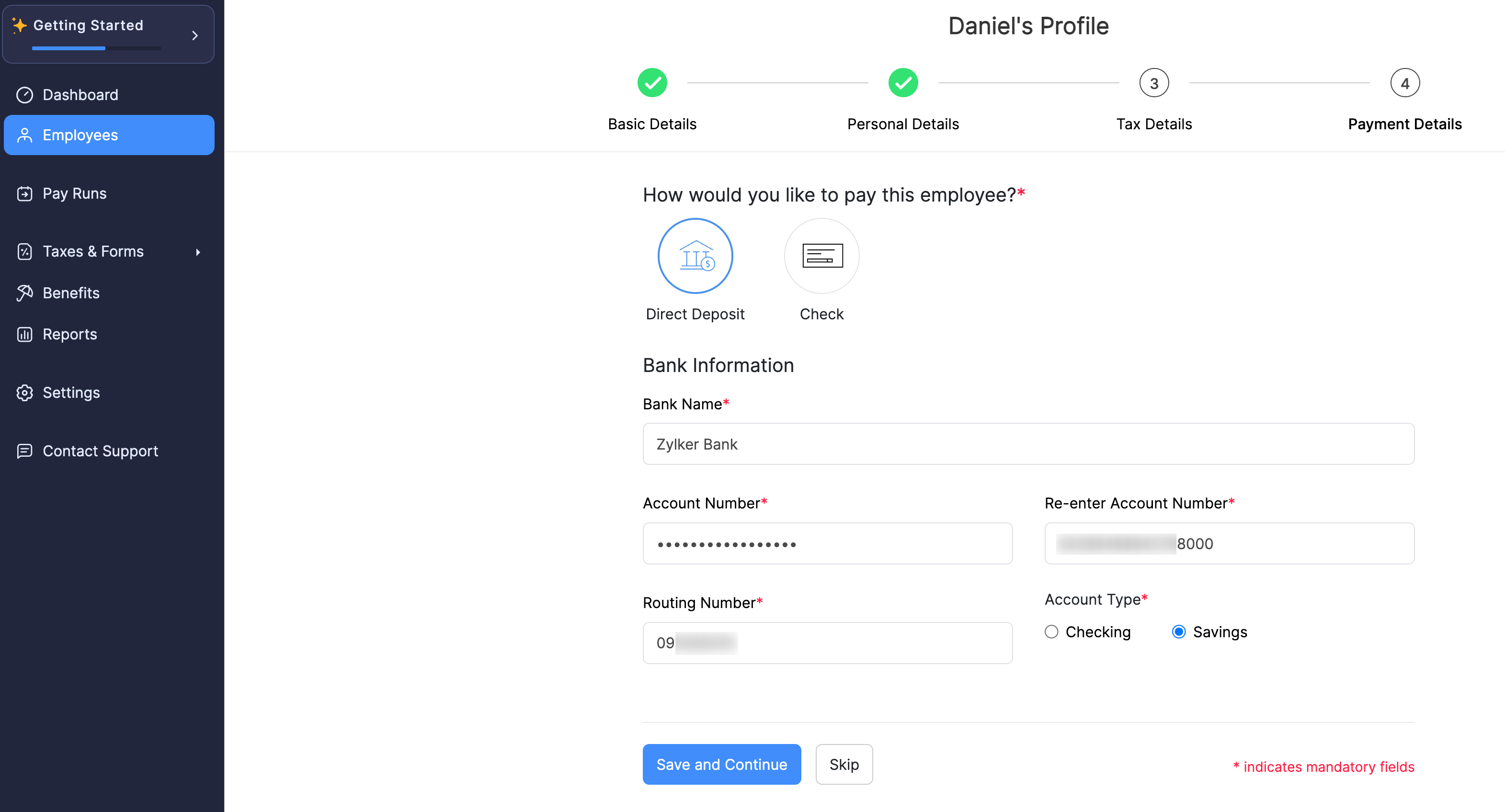

| Direct Deposit | PREREQUISITE: Direct Deposit must be configured for your organization before setting it up for employees. Provide the employee’s Bank Information to make direct deposit payments to them. |

| Check | You’ll need to pay your employees via check and then record payments manually for each payroll. |

- Click Save and Continue.

Employee’s Bank Information Required to set up Direct Deposit

Field Name | Description |

|---|---|

| Bank Name | Enter the name of the bank in which the employee holds an account and wants to receive payments from you. |

| Account Number | Enter the bank account number in which your employee wants to receive payments from you. |

| Routing Number | Enter the nine-digit routing number of the employee’s bank account. |

| Account Type | Select the type of bank account:

|

The employee’s profile will be added to Zoho Payroll.

You can assign benefits and deductions to the employee. You can also configure sick leave and vacation leave policies for the employee.