Prior Payroll in Zoho Payroll

If you’ve started using Zoho Payroll in the middle of a financial year, it is of paramount importance that you import the details of all the pay runs that you’ve run this year.

The Prior Payroll feature in Zoho Payroll helps you seamlessly transfer your historical payroll data from a previous payroll provider. This ensures a smooth transition to Zoho Payroll by retaining all past payroll records, allowing you to continue payroll processing without any disruptions or gaps in your data.

With Prior Payroll, you can import important historical payroll data like employee pay, tax deductions, benefits, and other essential payroll details. Accurate tax reporting and compliance rely on maintaining historical payroll records. By importing your prior data, you ensure compliance with tax requirements.

SCENARIO A blockchain solar company switched from another payroll provider to Zoho Payroll. To ensure that the transition goes smoothly, they need to import their historical payroll data, covering details from previous months, to have a complete record for each employee. By enabling Prior Payroll, the company can continue processing payroll without any interruptions and ensure that employee payroll data, such as tax deductions and benefits, is accurately reflected.

Enable Prior Payroll

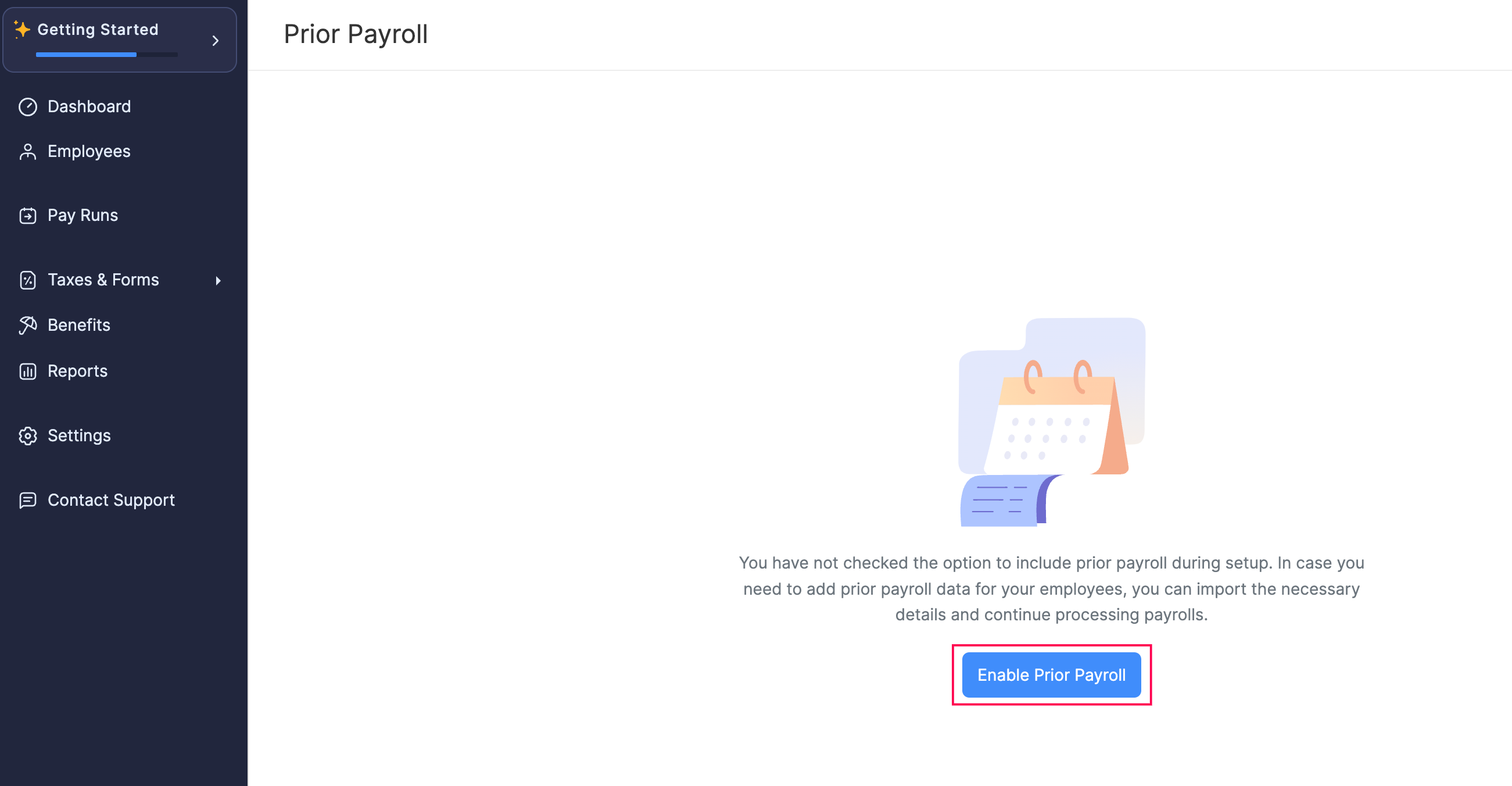

If you had chosen to not record prior payroll during setup and want to enable prior payroll later, go to the Dashboard module > Getting Started > Configure Prior Payroll > Enable Prior Payroll.

Configure Prior Payroll

PREREQUISITE Before configuring Prior Payroll, ensure you’ve complete the following:

- Agree to the Terms of Service: Accept Zoho Payroll’s terms to enable the Prior Payroll feature and proceed with data import.

- Configure Your Pay Schedule: Set the pay frequency and dates to align your imported historical payroll data with Zoho Payroll’s schedule.

- Set up Direct Deposit and Payment Authorization: Authorize Zoho Payroll to facilitate direct deposits, ensuring smooth payment continuity with your historical data.

Follow the steps below to configure Prior Payroll and import historical payroll data from your previous payroll provider.

If Prior Payroll is not enabled in your organization, start by enabling it.

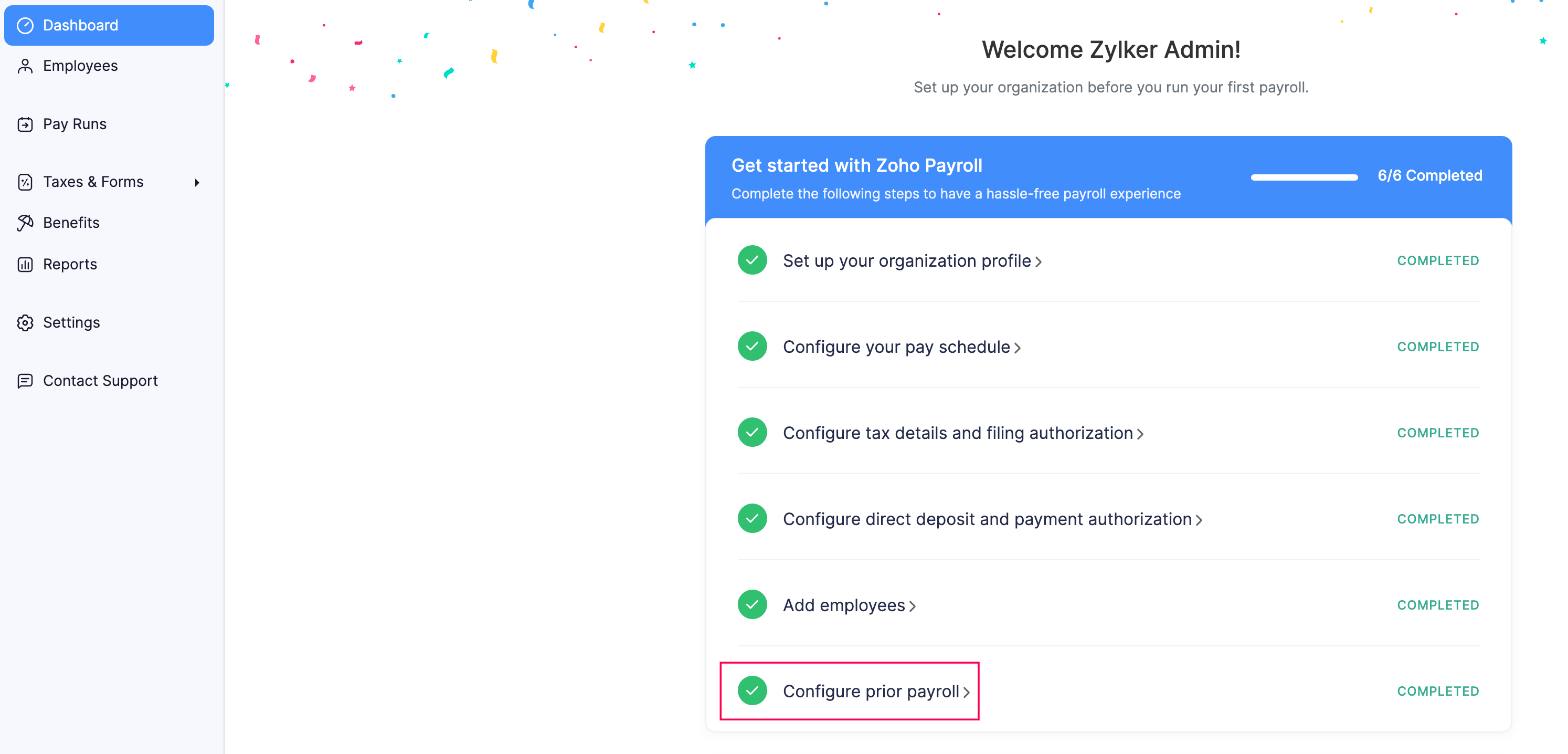

- Go to the Dashboard on the left sidebar and click Getting Started.

- Here, you can view a list of tasks that you need to complete before you can start processing your monthly pay runs. Click Configure Prior Payroll.

- Click Enable Prior Payroll.

Next, confirm that your organization’s basic payroll details, like the number of employees and previous provider information, are the latest official details.

You may need to contact support.usa@zohopayroll.com to update it. Please share the following details in your email:

- Number of Employees

- Previous Payroll Provider (select from a list of providers)

- Payroll History Access Method (choose between authorized access, provided reports, or previous provider account ID)

- Account ID (if the access method is “Previous provider account ID”)

Once you provide this information, we will update your payroll profile as needed.

After your payroll profile is updated, you’ll get access to the Previous Payroll Provider Access tool. This allows you to connect with your previous provider’s data for easy transfer. Here, you’ll see detailed steps on the Prior Payroll screen for setting permissions and adding any necessary users.

Once setup is complete, we will start transferring your historical data. During this period, payroll processing in Zoho Payroll will be temporarily paused.

While your data is being transferred, you’ll see a Processing message. Wait until this is complete before starting new payrolls.

After you receive confirmation that Prior Payroll setup is complete, you can start using Zoho Payroll with all past data securely imported.