Regular Payroll

A regular payroll refers to the standard and recurring process of paying salaries to your employees based on a recurring pay schedule.

Processing a regular payroll involves several essential steps, including:

- Calculating the gross pay (total earnings before deductions) and net pay (earnings after taxes and deductions) for each employee.

- Withholding the correct amount of taxes and other deductions.

- Making payments to employees.

- Maintaining accurate records for compliance and tax reporting requirements.

PREREQUISITE Before you can start running payrolls for your organization, make sure you have completed the following:

Running a regular payroll in Zoho Payroll involves four main steps:

- Processing a regular payroll

- Reviewing and updating a regular payroll

- Submitting and approving a regular payroll

- Recording payment for a regular payroll

Process a Regular Payroll

To process a regular payroll:

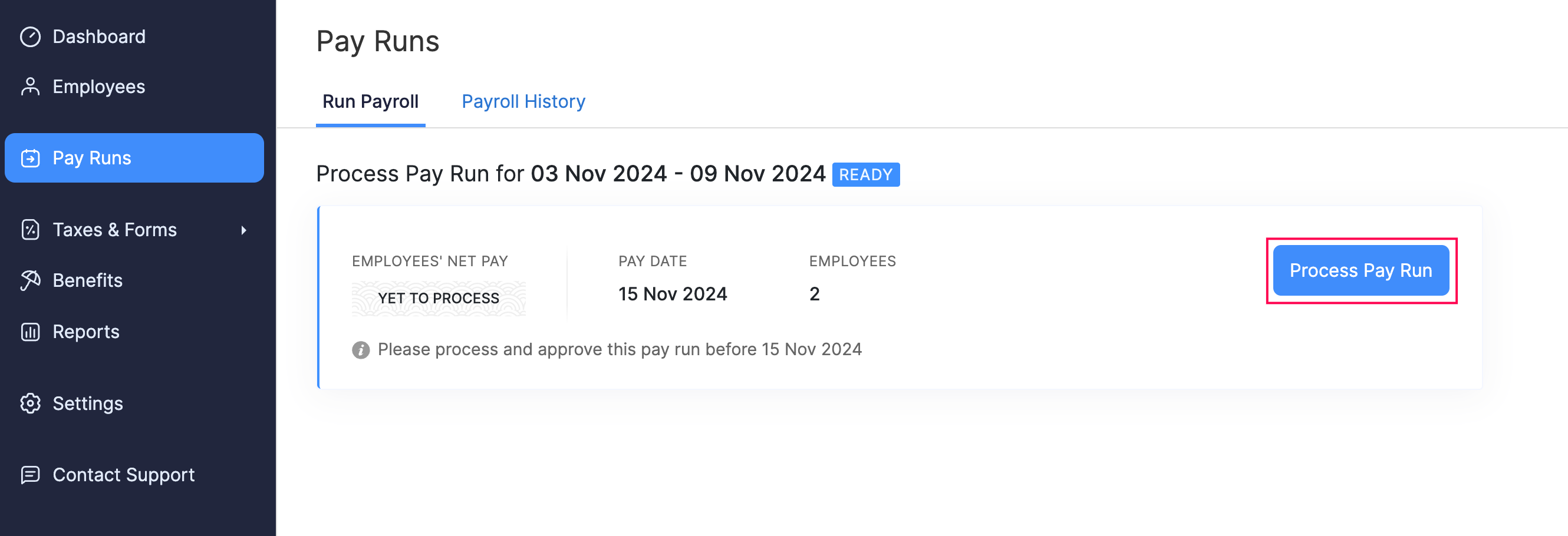

- Click Pay Runs on the left sidebar. Your upcoming payrolls will be listed under the Run Payroll tab.

- Click Process Pay Run.

The regular payroll will be created in Draft status.

Review and Update a Regular Payroll

While a payroll is in Draft status, you can review employee details and make necessary changes before proceeding for approval. You can add hours for additional job roles.

Add Hours for Additional Job Roles

If an employee holds multiple roles in your organization, each with a different pay rate, you can include hours worked under each role in the payroll.

NOTE This feature is available only for certain plans of Zoho Payroll. Visit our pricing page to check if it’s available in your current plan.

PREREQUISITE Ensure you’ve configured additional job roles for the employee in the Employees module.

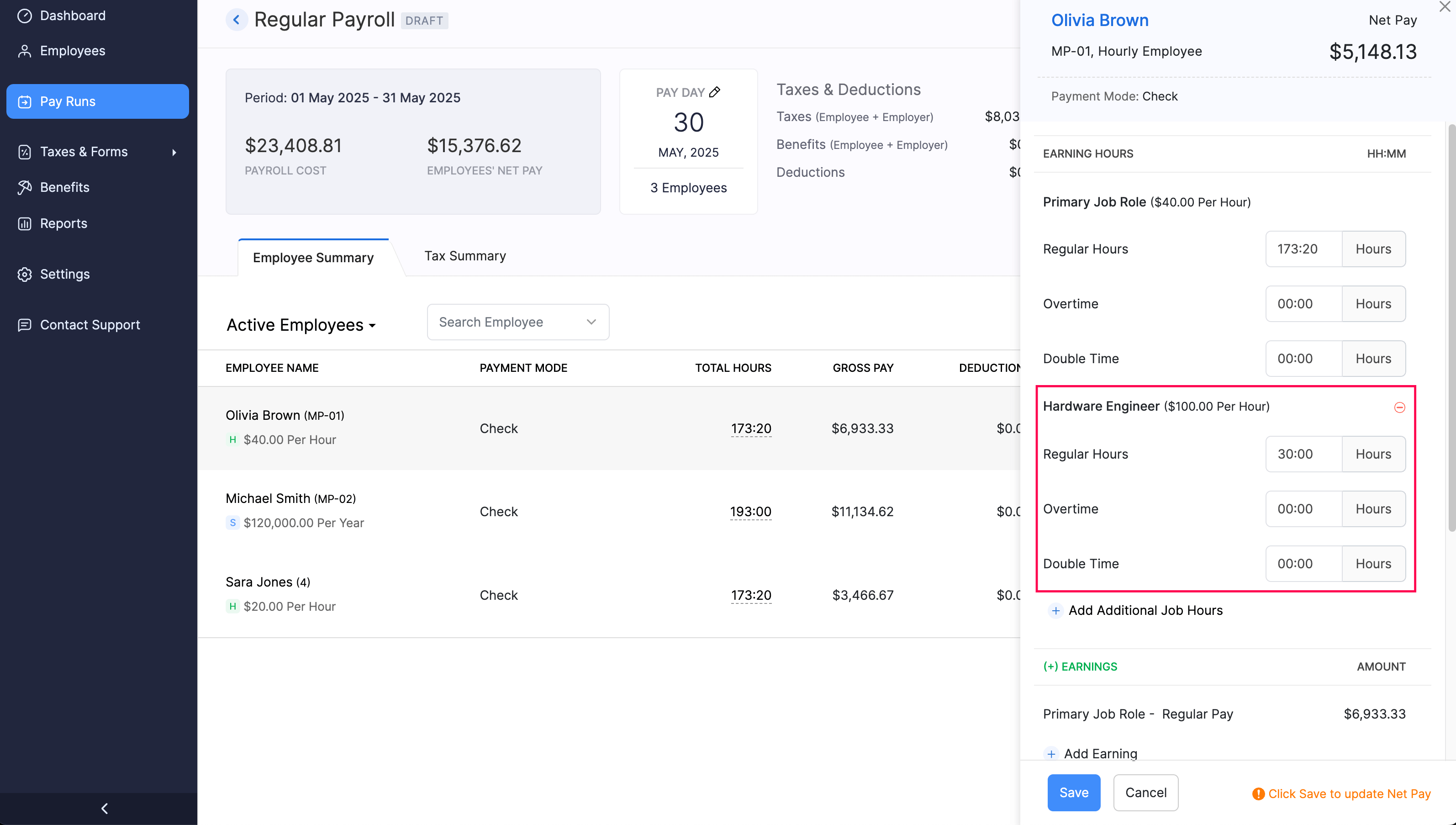

To add hours additional job roles:

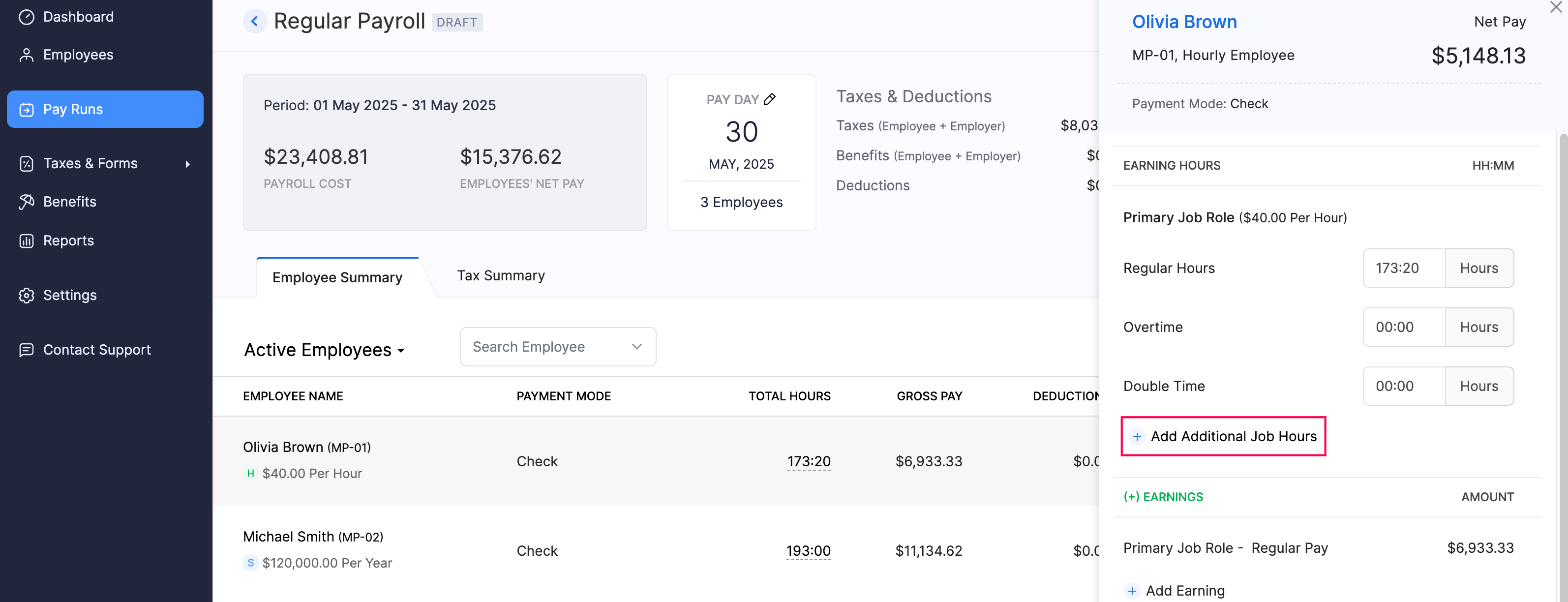

- Click Pay Runs on the left sidebar.

- Open a regular payroll in the Draft status.

- Select an employee for whom you want to add hours.

- In the payroll details panel, click + Add Additional Job Hours.

- Choose the additional job role.

- Enter the number of Regular Hours, Overtime hours, and Double Time hours worked for that role.

- Click Save.

Zoho Payroll will automatically recalculate the employee’s wages and taxes based on the updated information.

Submit and Approve a Regular Payroll

PREREQUISITE Ensure you have sufficient funds in your bank account to cover both employee salaries and applicable taxes.

NOTE The Approval feature is available only for certain plans of Zoho Payroll. Visit our pricing page to check if it’s available in your current plan.

WARNING Once a regular payroll is approved, it cannot be edited or deleted.

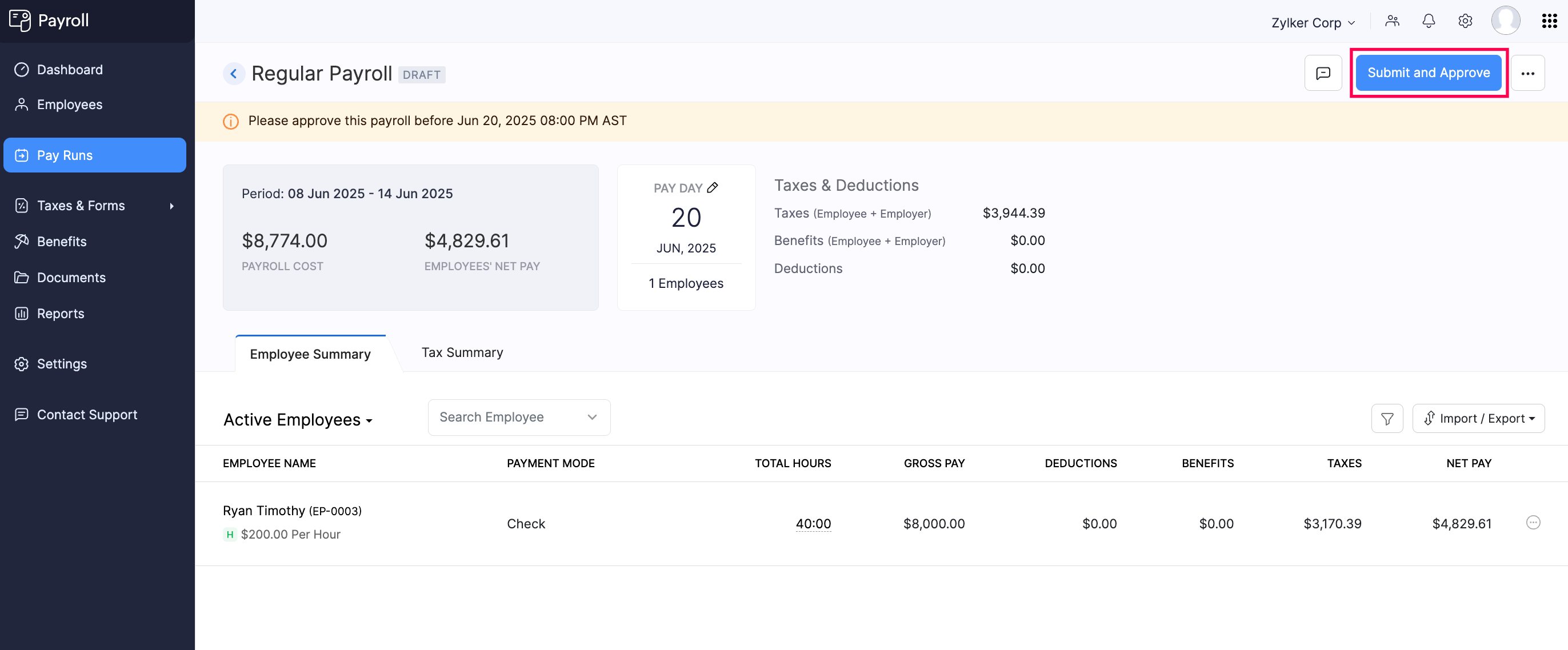

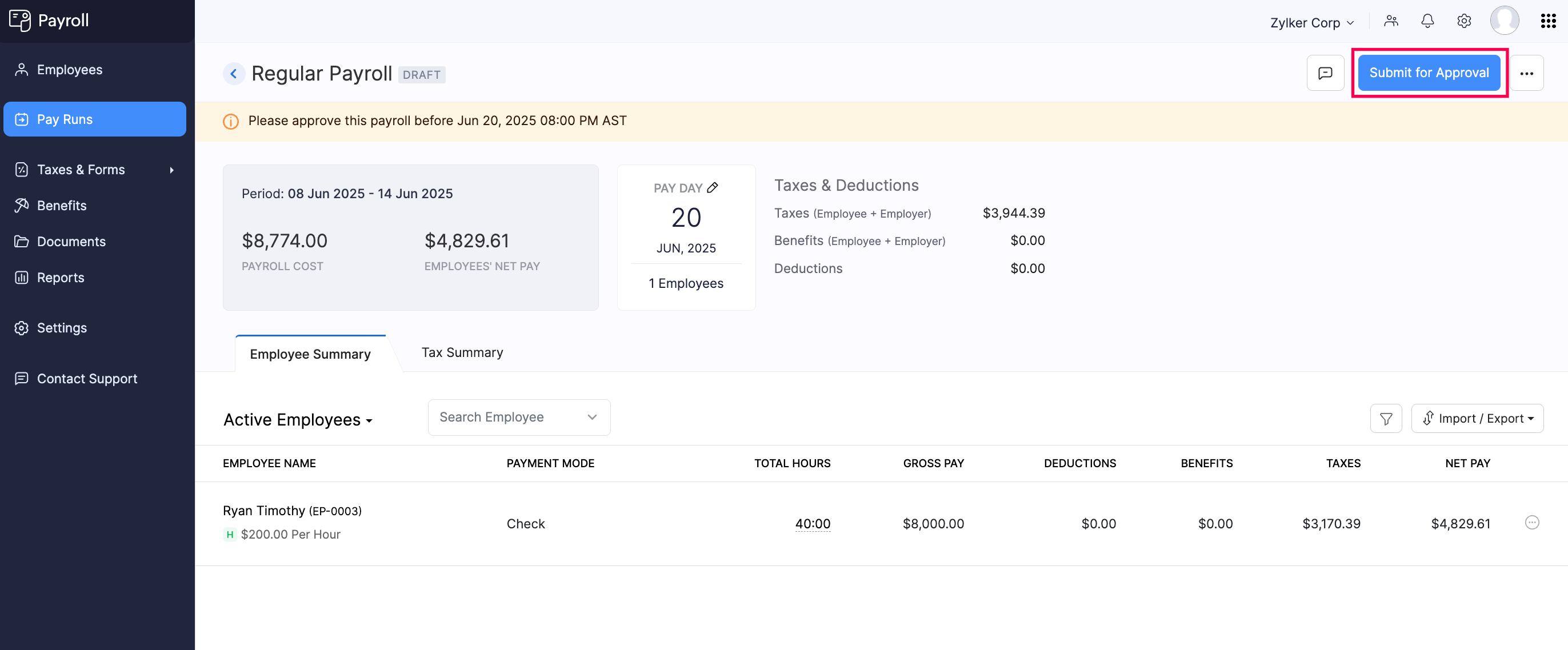

To submit or approve a payroll:

- Go to the Pay Runs module.

- Click Process Pay Run.

- Depending on your role and permissions, follow one of these paths:

If you have approval permissions (such as an admin or finance head), click Submit and Approve on the top right.

If you don’t have approval permissions, click Submit for Approval on the top right. An authorized user will then review and approve the payroll.

INSIGHT If you have enabled Zoho Books integration, you can choose to post the journal entry for the payroll transaction in Zoho Books. The transaction will be recorded under the account configured during the integration setup.

Once your regular payroll is approved, Zoho Payroll will automatically deposit salaries into employees’ bank accounts on the scheduled pay date if you’ve set up Direct Deposit for your organization and employees. The applicable taxes will also be debited from your bank account and paid to the respective agencies.

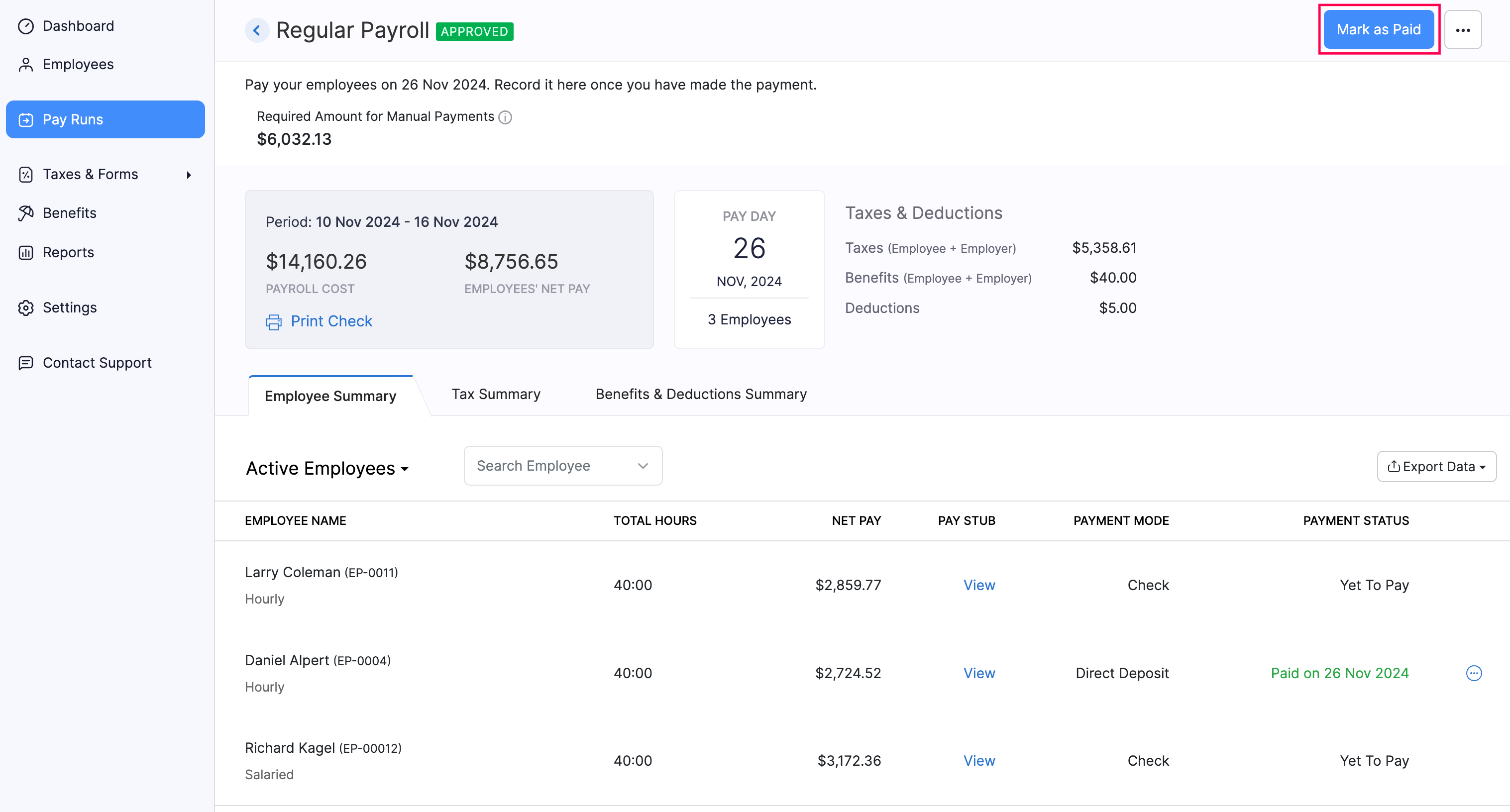

Record Payment for a Regular Payroll

If you’re paying employees manually via check, cash, or other methods, you can mark the payment as recorded on the payday.

To record payment for a regular payroll:

- Go to the Pay Runs module and open a payroll in the Payment Due status.

- Click Mark as Paid on the top right.

PRO TIP To record payment for individual employees instead of recording for the payroll as a whole, click Mark as Paid next to the corresponding employee.

- In the pop-up that appears, select the Paid Through Account and Payment Mode.

- Enable Send pay stub notification email to all employees if you want to email the pay stub to your employees. Otherwise, leave it disabled.

- Click Save.

The payroll will now be marked as Paid, and the applicable federal, state, and local taxes will be generated under the Taxes module.