Salary Components

Salary components are the different parts that make up an employee’s total salary. These include earnings and deductions, which determine the gross pay and the final take-home salary of your employees.

Earnings

Earnings refer to any type of compensation or income an employee receives during a specific pay period (such as weekly, biweekly, or monthly). These earnings may be taxable or non-taxable based on the earning type and the applicable regulations.

By default, Zoho Payroll includes the following earnings types:

- Regular Pay

- Over Time Pay

- Severance Pay

- Double Pay

- Bonus

- Commission

- Leave Encashment

These default earnings are pre-configured and cannot be edited, marked as inactive, or deleted.

In addition to the default earnings, you might need to create custom earnings specific to your organization. For example, if you offer a unique allowance or a performance-based incentive, you can add new earnings to Zoho Payroll. Once added, these custom earnings can be assigned to employees, and you can choose to edit, mark as inactive, or delete them as needed.

Add an Earning

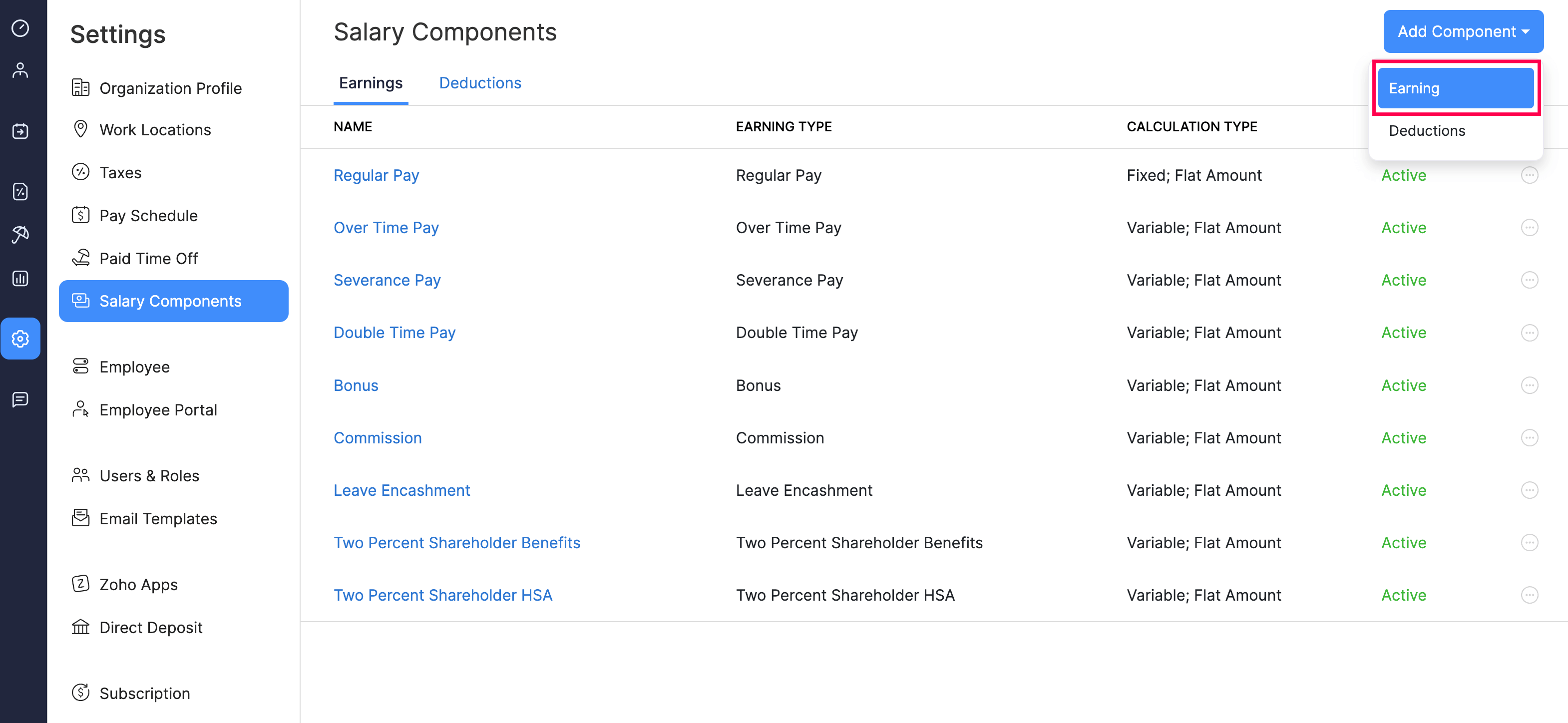

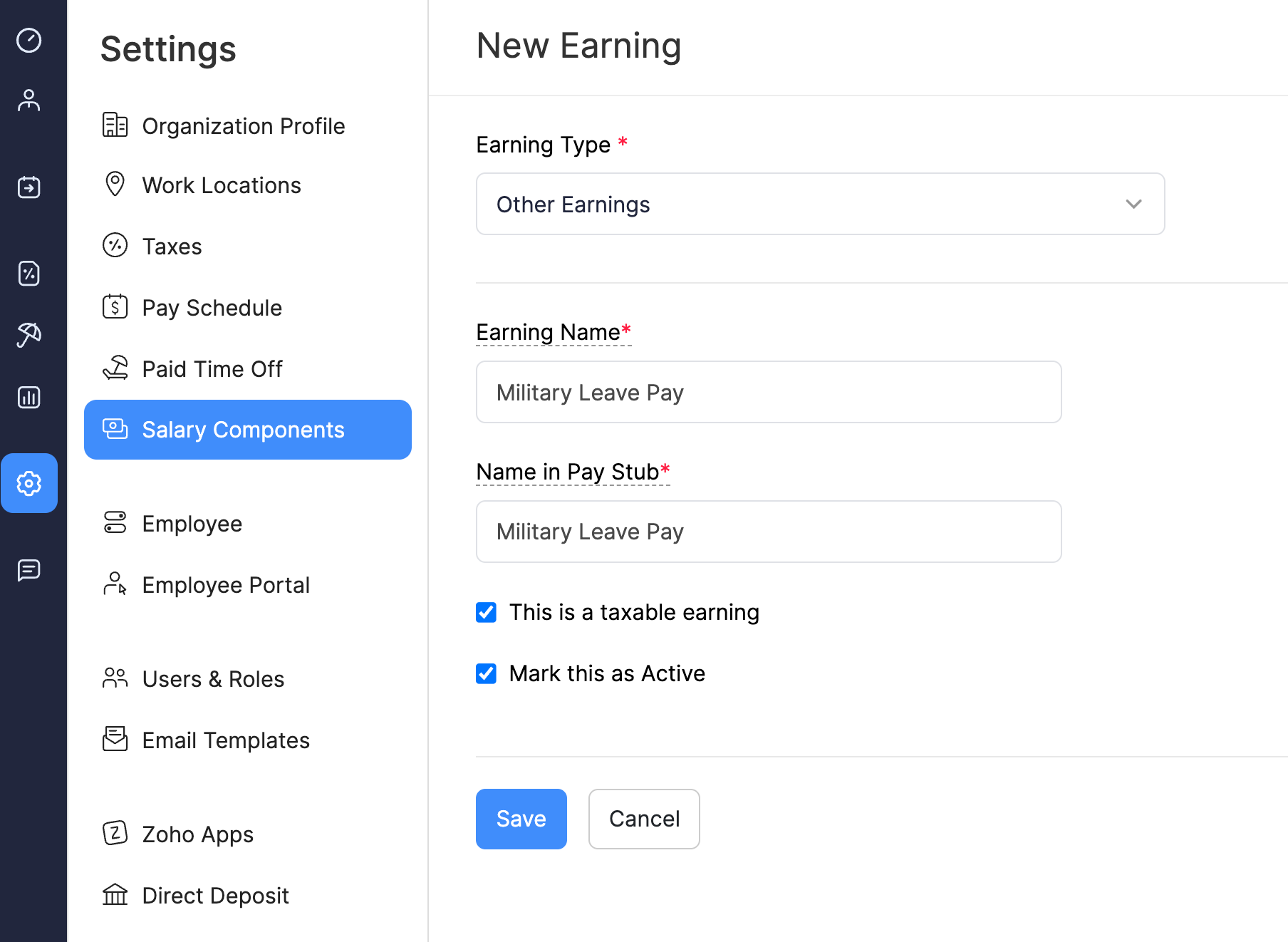

To add a new earning:

- Go to Settings and navigate to Salary Components.

- Click the Add Component dropdown at the top right and select Earning.

- Enter the Earning Name. This name must be unique from other earnings.

- Enter the name for the Name in Pay Stub field. This is how the earning will appear on the employee’s pay stub.

- Tick or untick This is a taxable earning option based on your preference.

- Tick Mark this as Active if you wish to make the earning active and use it in upcoming payrolls.

- Click Save.

Once saved, this earning can be used in payrolls, and you can assign it to employees.

Edit an Earning

NOTE You can edit only the earnings that are of the type Other Earnings.

To edit an earning:

- Go to Settings and navigate to Salary Components.

- Click an earning that is of the type Other Earnings.

- Make the necessary changes.

- Click Save.

The earning will be updated.

Mark an Earning as Inactive

When an earning type is no longer relevant but you want to retain its history or reuse it in the future, you can mark it as inactive instead of deleting it. This ensures the earning is no longer available for new payrolls, while still preserving the record.

NOTE You can mark an earning as inactive only if it is of the type Other Earnings.

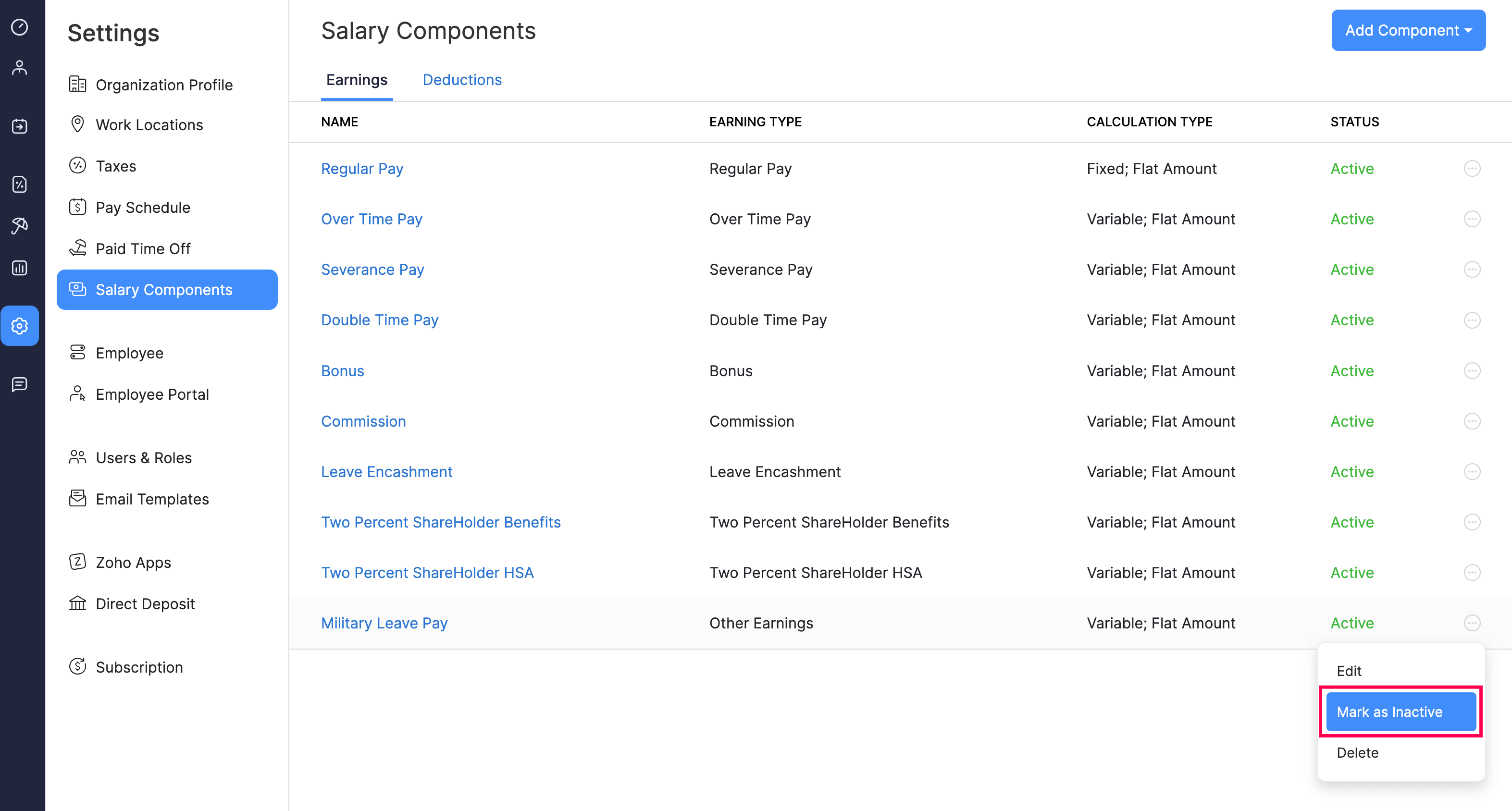

To mark an earning as inactive:

- Go to Settings and navigate to Salary Components.

- Click the more icon next to an earning.

- Select Mark as Inactive.

The earning will be marked as inactive, and you will not be able to associate it with any of your employees in future payrolls.

Delete an Earning

NOTE You can delete only the earnings that are of the type Other Earnings.

PREREQUISITE The earnings must not be associated with any employees in any payrolls.

WARNING Deleting an earning is permanent and cannot be undone.

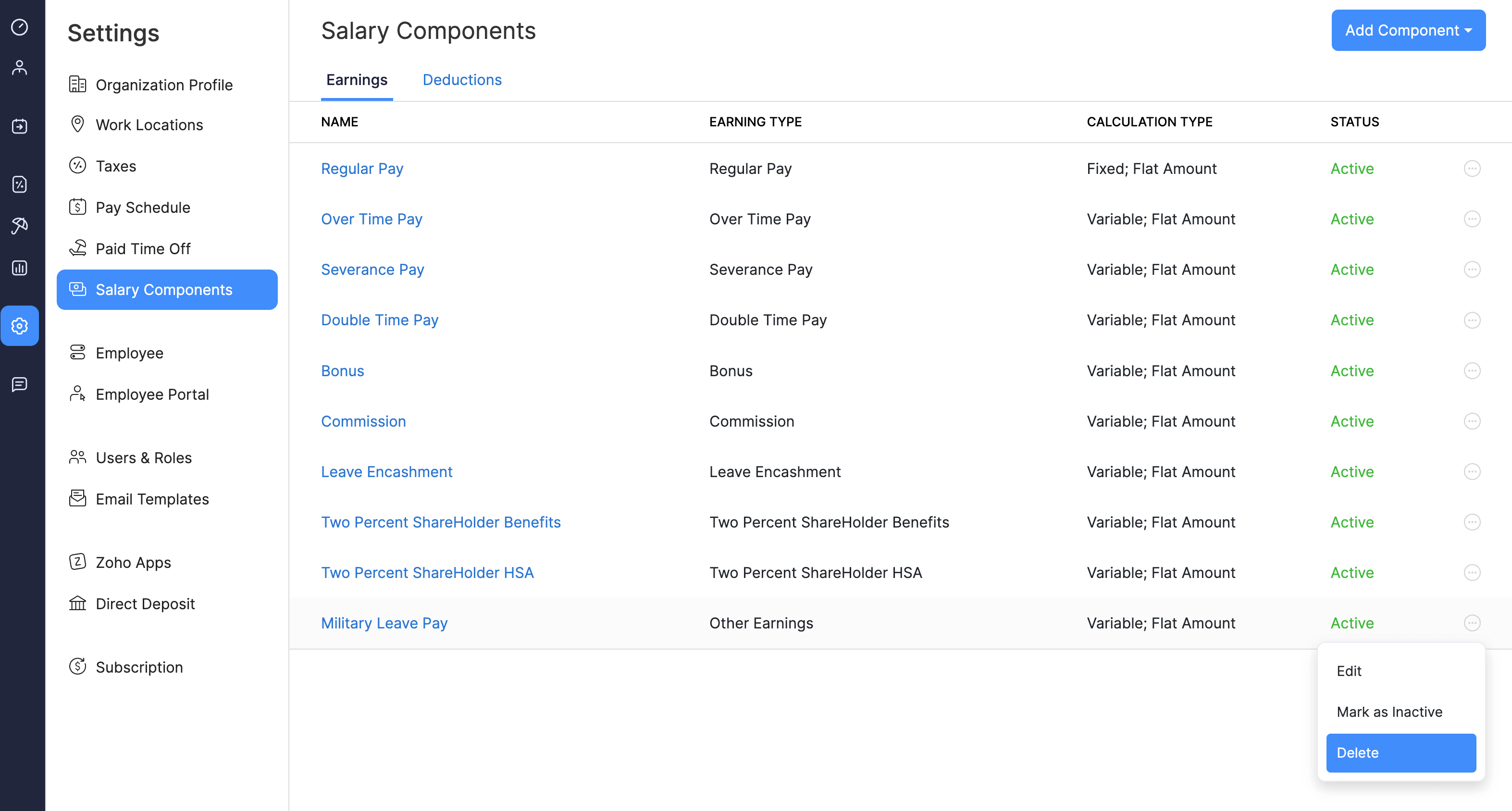

To delete an earning:

- Go to Settings and navigate to Salary Components.

- Click the more icon next to an earning.

- Select Delete.

- In the popup that appears, click Yes.

The earning will be deleted.

Deductions

Deductions refer to amounts subtracted from an employee’s gross salary to arrive at the final take-home pay. These deductions can be for taxes, retirement contributions, garnishments, or other employee-related expenses.

For example, deductions may include voluntary contributions or court-ordered wage garnishments. These deductions must be applied in compliance with local and federal laws.

In Zoho Payroll, you can add new deductions, assign them to employees, and manage the following actions:

Add a Deduction

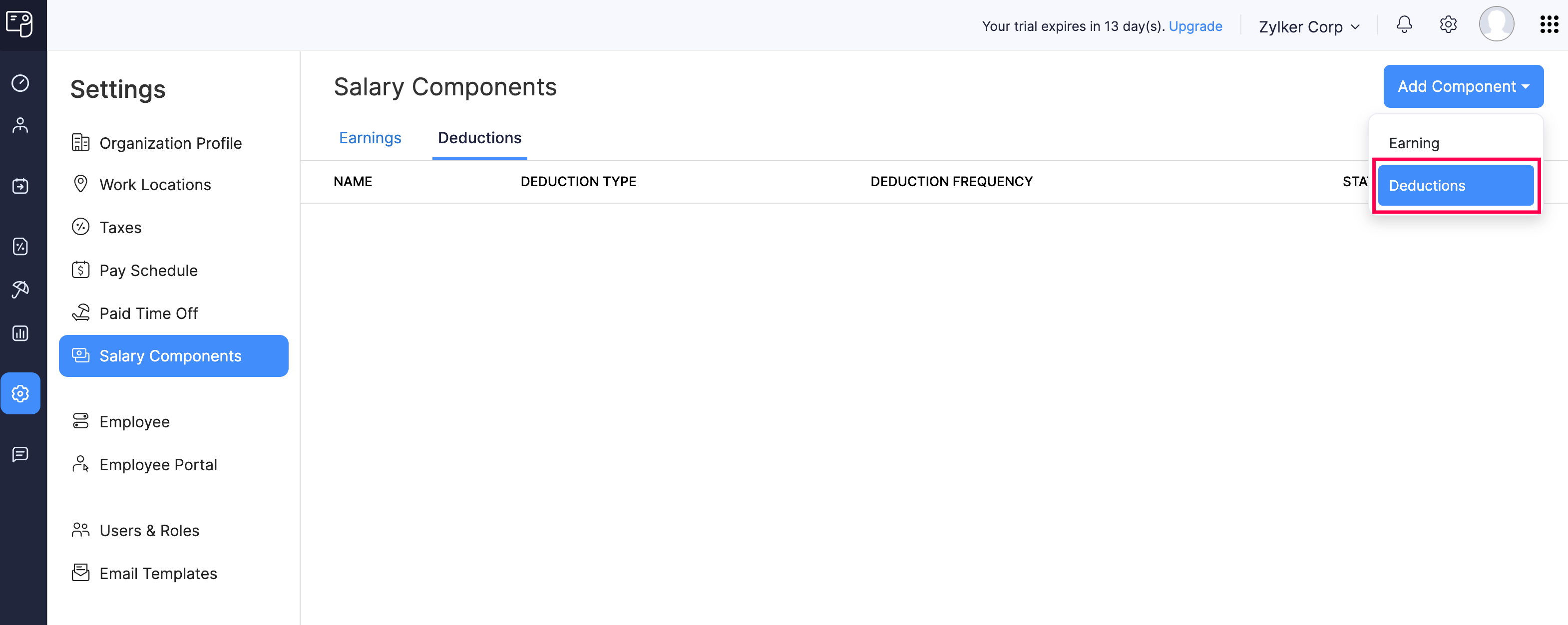

To add a new deduction:

- Go to Settings and navigate to Salary Components.

- Click the Add Component dropdown at the top right and select Deductions.

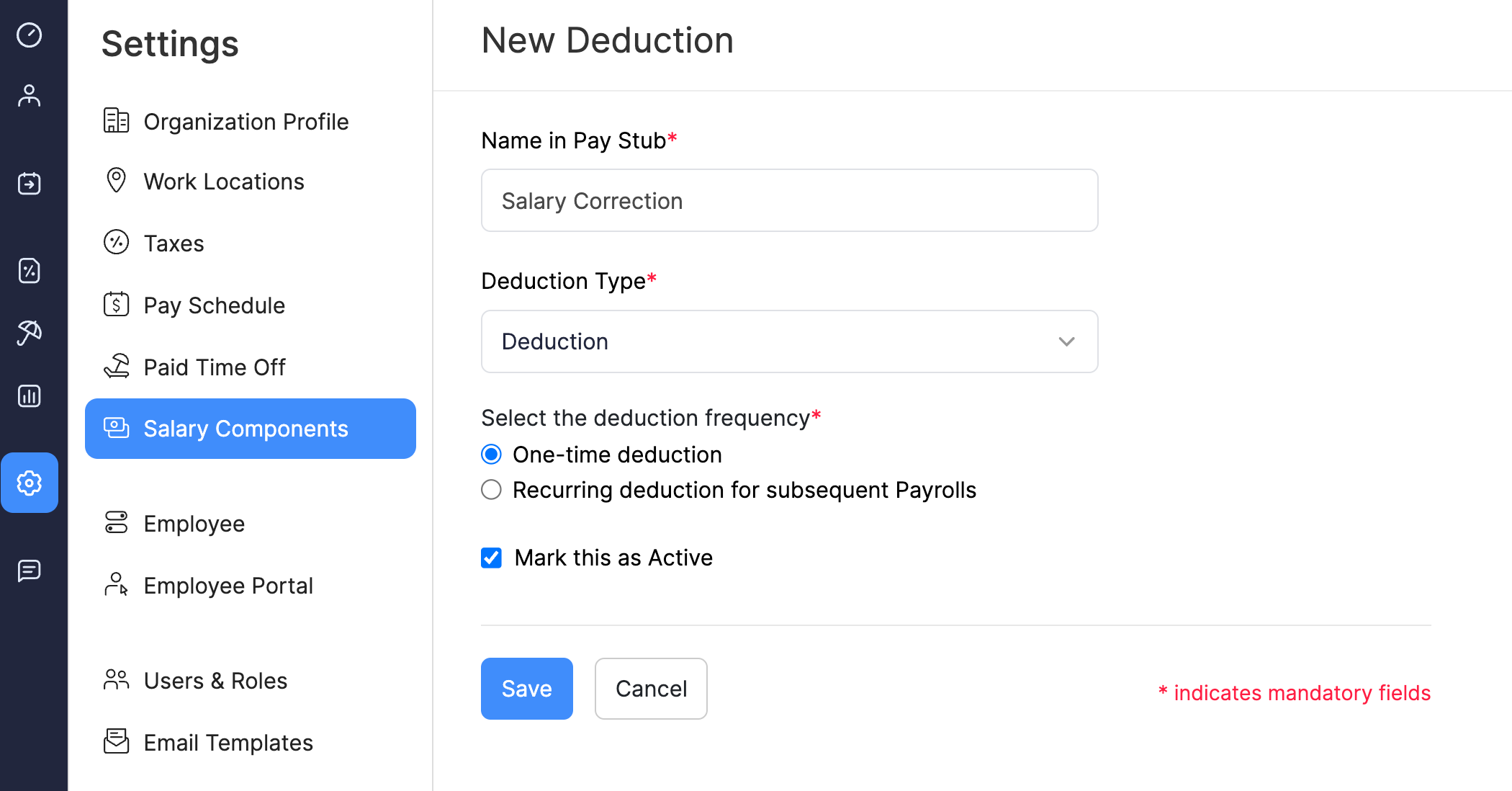

- Enter the deduction’s name in the Name in Pay Stub field. This is how the deduction will appear on the employee’s pay stub.

- Select the deduction type:

- Deduction

- Garnishment

- Child Support Garnishment

- Select the deduction frequency:

- One-time deduction

- Recurring deduction

- Tick Mark this as Active to make the deduction available for payrolls.

- Click Save.

The deduction will be created, and you can assign it to employees as needed.

Edit a Deduction

NOTE If you have assigned the deduction to employees, you cannot edit the deduction type and deduction frequency.

To edit a deduction:

- Go to Settings and navigate to Salary Components.

- Click a deduction.

- Make the necessary changes.

- Click Save.

The deduction will be updated.

Mark a Deduction as Inactive

When a deduction is no longer relevant but you want to retain its history or reuse it in the future, you can mark it as inactive instead of deleting it. This allows you to keep the deduction’s records while preventing its use in future payrolls.

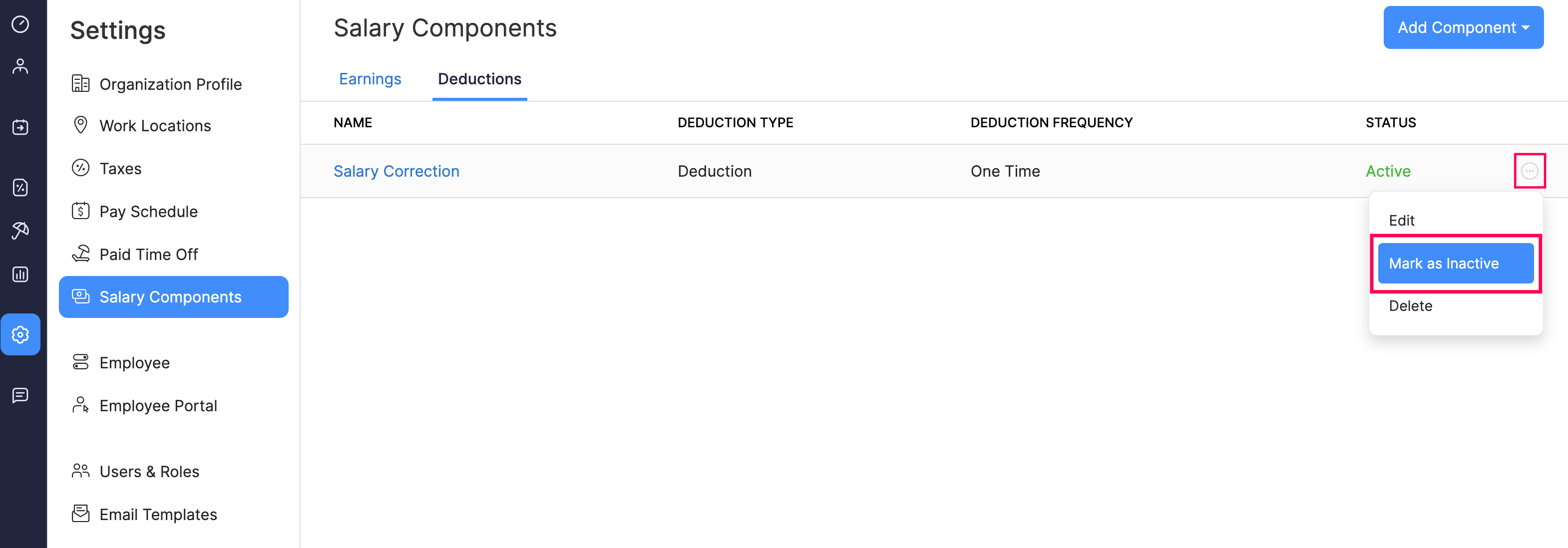

To mark a deduction as inactive:

- Go to Settings and navigate to Salary Components.

- Click the more icon next to a deduction.

- Select Mark as Inactive.

The deduction will be marked as inactive.

Delete a Deduction

PREREQUISITE The deduction must not be assigned to any employees.

WARNING Deleting a deduction is permanent and cannot be undone.

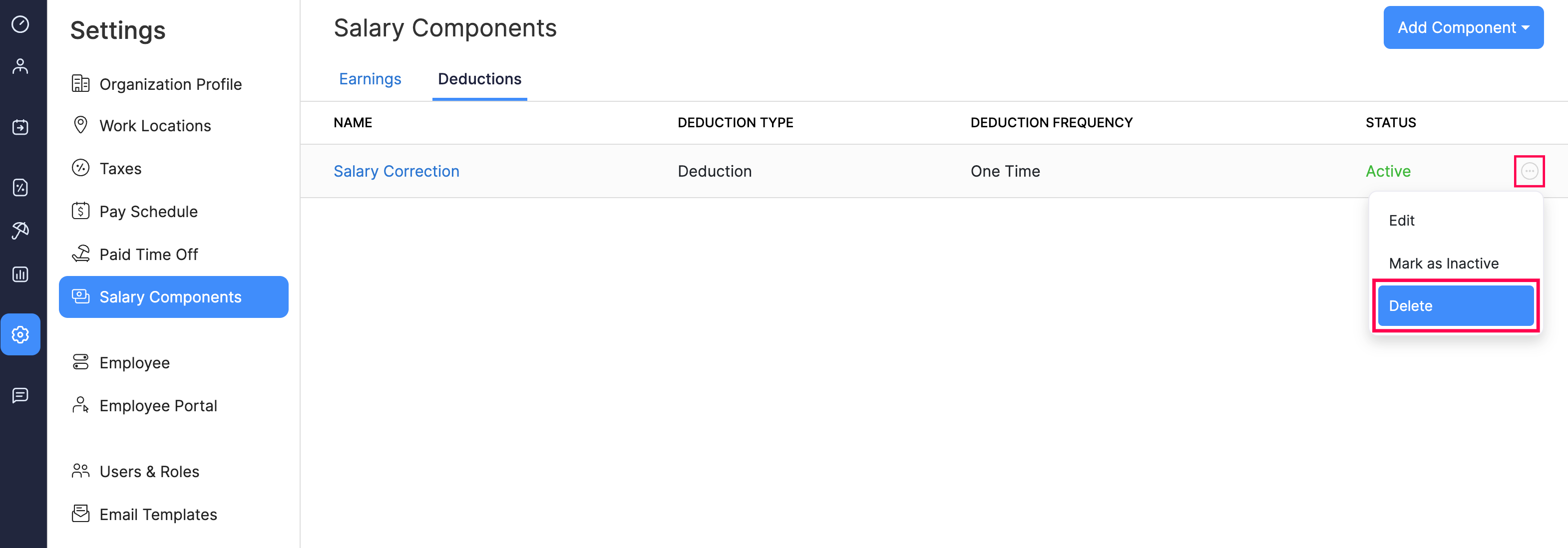

To delete a deduction:

- Go to Settings and navigate to Salary Components.

- Click the more icon next to a deduction.

- Select Delete.

- In the popup that appears, click Yes.

The deduction will be deleted.