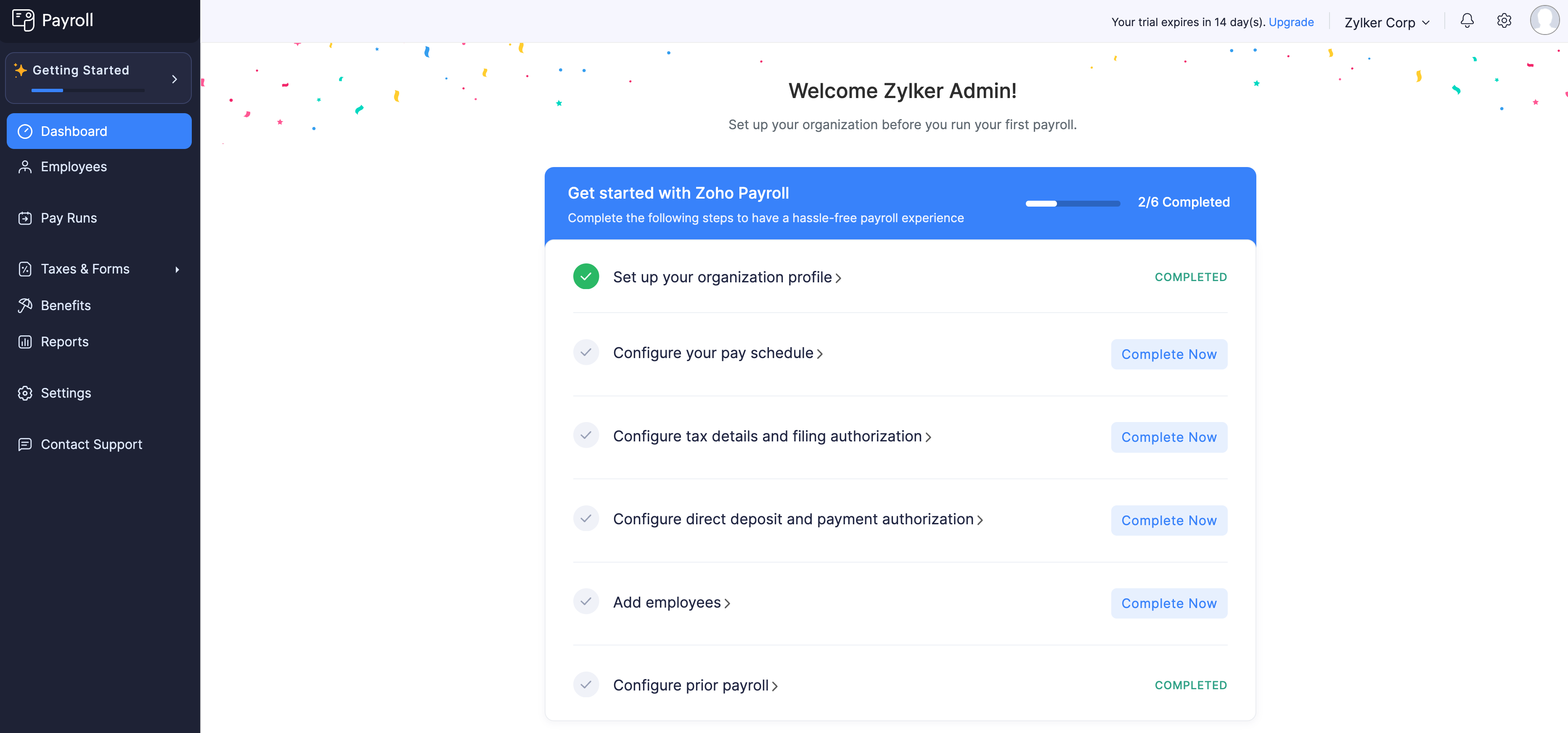

Getting Started with Zoho Payroll

After creating an organization in Zoho Payroll, the first page you’ll see is the Getting Started module. This module guides you through the essential steps required to set up your organization and get payroll-ready. By completing these steps, you ensure that your organization is prepared to run its first payroll. The module simplifies the onboarding process with guided checklists, helping you configure everything from pay schedules to direct deposits.

Key Steps to Get Started

Configure Pay Schedule

The Pay Schedule is the backbone of your payroll process. It defines how frequently you pay your employees and helps you maintain a consistent payroll timeline. Zoho Payroll allows you to create weekly, bi-weekly, semi-monthly, monthly, or quarterly pay schedules based on your business needs.

Configure Taxes

Staying compliant with tax regulations is crucial for any business. The Taxes module in Settings allows you to set up federal, state, and local tax details for your organization. By accurately configuring your tax details, Zoho Payroll automates tax calculations, withholdings, payments, and filings. This setup ensures your payrolls are error-free and fully compliant with tax regulations.

Configure Direct Deposit

Configuring Direct Deposit for your organization is a key step in automating salary and tax payments.

Once you complete the direct deposit setup for your organization and employees:

- Employee salaries will be deposited directly into their bank accounts.

- Applicable federal, state, and local taxes will be paid directly to the respective tax authorities.

This setup eliminates the need for physical checks, offering a faster and more reliable payment method.

Add Employees

Adding employees to Zoho Payroll is crucial for processing payrolls, calculating net pay, and withholding federal, state, and local taxes.

The Employees module allows you to enter essential employee information, including basic details, personal details, tax details, and payment details. You can also invite employees to the Employee Portal, where they can view pay stubs, compensation details, and access tax forms.

Configure Prior Payroll

If you have previously processed payroll outside Zoho Payroll, the Prior Payroll module helps you import previous payroll data accurately. By entering prior payroll details, you ensure continuity and compliance, allowing Zoho Payroll to calculate taxes, deductions, and year-to-date amounts seamlessly.

Once you complete all the steps in the Getting Started module, you can begin processing payroll for your organization.