Automate your banking workflows

Trigger approval flows instantly

Whether it’s a high-value loan application or a customer’s request for account closure, route form responses to the right stakeholders automatically. Set conditions to trigger multi-level approvals and track each step without chasing updates.

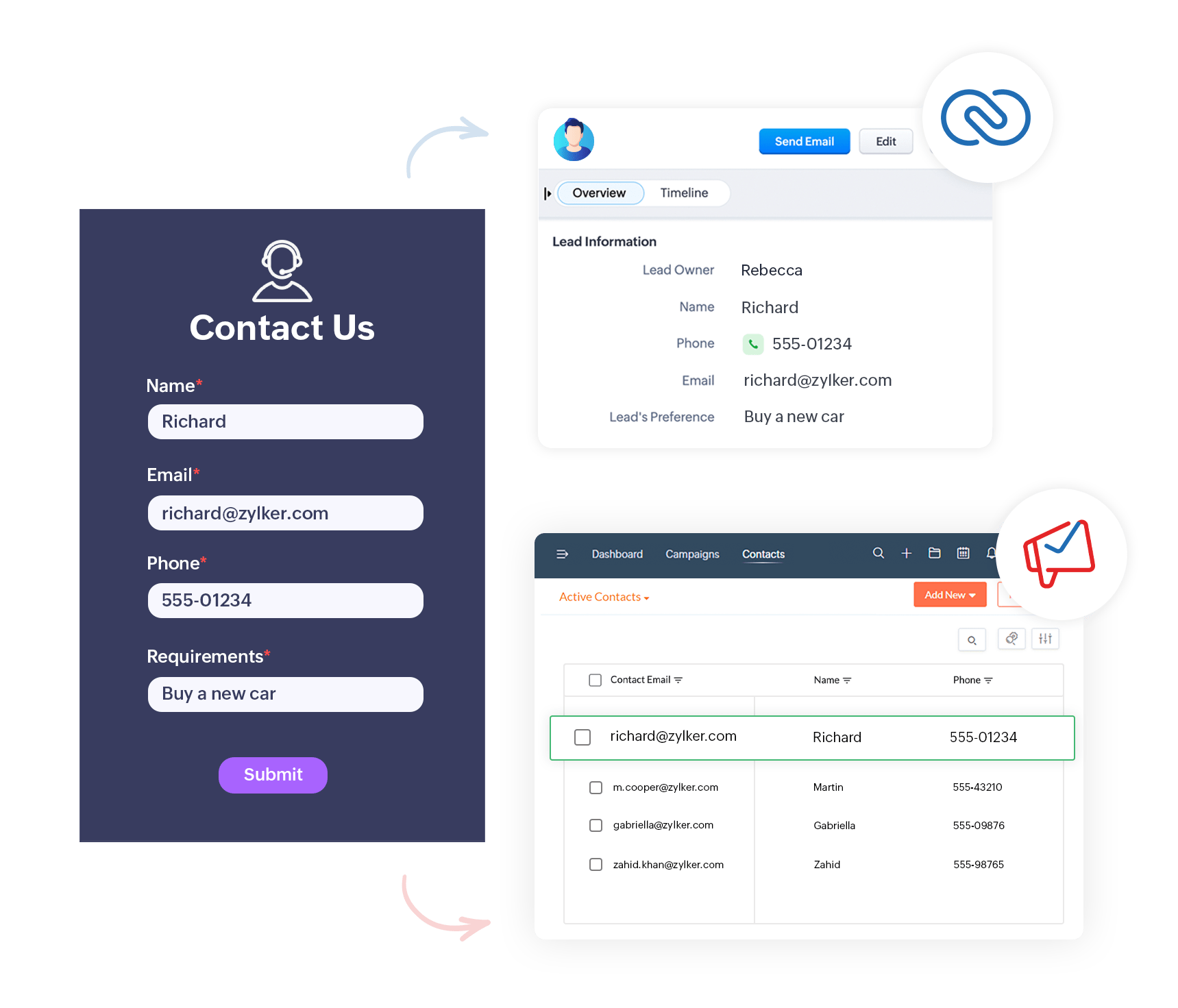

Push data where it’s needed automatically

Connect your banking forms with tools like Zoho CRM, Zoho Creator, or other third-party apps to create a connected ecosystem. When a customer submits a request or application, their data can instantly populate in the integrated service.

Schedule reports with no manual effort

Set up automated delivery of daily, weekly, or monthly reports to key departments. Whether it’s lead collection, or KYC records, your reports land right in your inbox, always accurate, always on time.

Bank-level security, built in

- Every form you create with Zoho Forms is encrypted with SSL, ensuring that data in transit remains private and secure.

- Zoho Forms helps your organization stay compliant with the EU’s General Data Protection Regulation (GDPR), with features like data access requests, deletion requests, and consent checkboxes.

- Host forms on a custom domain with HTTPS enabled, maintaining brand consistency while ensuring data security.

- Protect sensitive information by encrypting specific form fields, ensuring that data such as personal identification numbers remain confidential.

- With Zoho Forms, you are always prepared for internal or external audits. Every change made to a form or entry is logged. Track who did what, and when, with complete audit trails.

- Keep a log of all emails sent through Zoho Forms, including notifications and confirmations, ensuring communication trails are documented for compliance purposes.

- Automatically delete form submissions after a defined period, ideal for managing storage and complying with data minimization principles.

Digitize customer onboarding

Traditional onboarding often means long queues, paper forms, and manual document verification. Zoho Forms eliminates these hassles with a seamless, end-to-end digital experience. Capture customer details using secure online forms. Allow customers to upload ID proofs and address documents right from their phone or laptop. Integrate e-signatures to finalize onboarding without in-person visits.Trigger automatic approval flows across departments for quick processing.

Loan & credit card applications

Applying for a loan or credit card shouldn’t be a paperwork nightmare. Zoho Forms simplifies the process while maintaining data accuracy and privacy. Design multi-page forms to collect comprehensive applicant details including income, employment, and existing liabilities. Use conditional logic to display only relevant fields based on applicant responses. Pre-qualify applicants by validating inputs while they fill out the form. Automatically send confirmation emails and SMS, enhancing transparency. Route submissions to the right team based on loan type for faster follow-up.

Smooth and scheduled customer visits

Managing footfall at your branches is key to efficiency & customer satisfaction, especially during high-demand periods. Customize available time slots & let customers pre-book appointments through mobile forms. Send instant confirmation messages to both customers and staff, reducing no-shows.

Effortless audits

Banks operate under tight regulatory scrutiny. Zoho Forms helps you maintain audit-readiness with structured digital data collection and automated reporting. Create internal checklists for branch inspections, risk assessments, or regulatory reviews. Ensure consistency by marking critical fields as mandatory. Schedule recurring reports to keep compliance officers and teams updated.

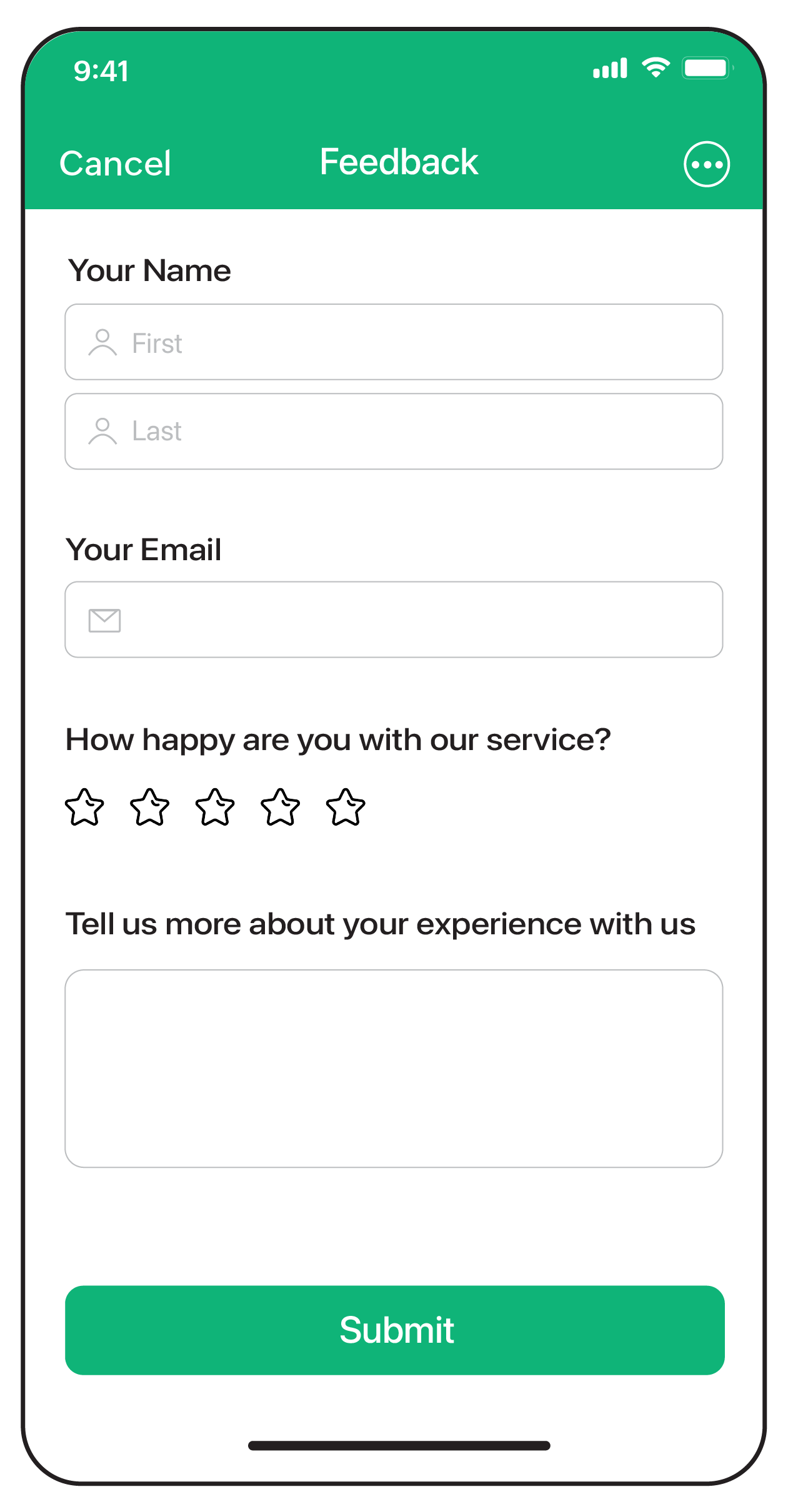

Listen, act, & improve

Customer reviews are essential to a bank’s reputation. Whether it’s about services or digital channels, Zoho Forms helps you collect and act on these reviews systematically. Deploy branded customer review forms on your website or put up your form as a QR code for customers to scan and fill out after branch visits. Route concerns to relevant teams: loans, savings, or digital banking for faster resolution.

Serve customers on-the-go

Customers expect access to banking services wherever they are. Zoho Forms helps banks go beyond brick-and-mortar boundaries and reach users wherever they are. Whether it’s opening an account or requesting a loan, forms are fully responsive and optimized for mobile, allowing customers to fill them out on the go without downloading any app.

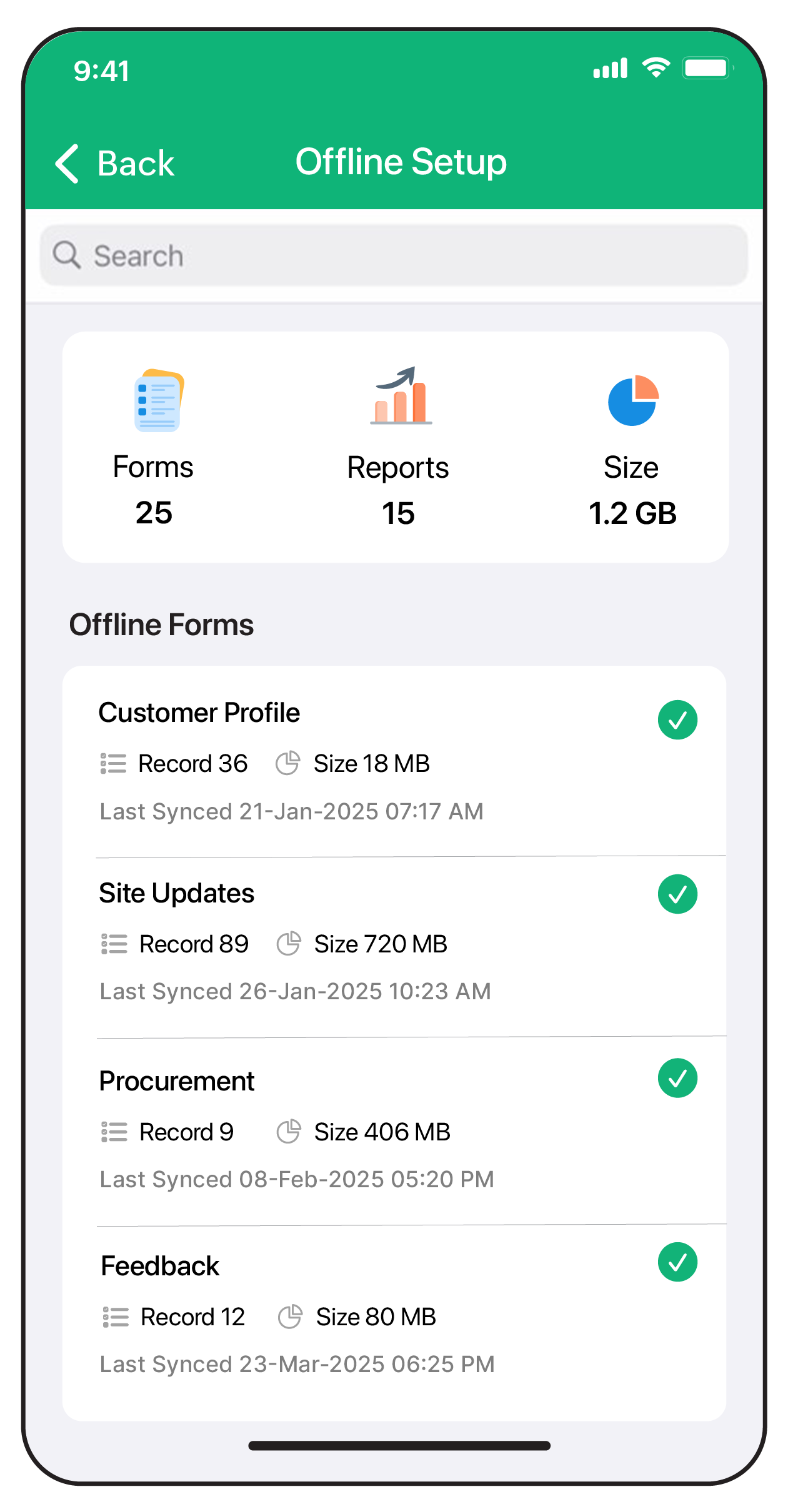

Offline data collection for field banking camps

Conducting banking drives in rural areas? Collect data without an internet connection. Field agents can gather responses using mobile devices, and the data syncs automatically once reconnected.