Income TDS

The Government of India introduced TDS (Tax Deducted at Source) to collect taxes directly from the source of income, ensuring a steady flow of revenue. The tax amount is deducted by the customer at the time of payment for a transaction and then deposited with the government.

You can apply TDS to the transactions you create in Zoho Books. Here is a list of transactions where you can apply TDS:

- Quotes

- Sales Orders

- Invoices

- Credit Notes

- Recurring Invoices

- Customer Debit Notes

- Payments Received

- Purchase Orders

- Bills

- Recurring Bills

- Vendor Credits

- Bill of Supply

- Vendor Advance

TDS

Tax Deducted at Source (TDS) is the tax collected by the government at the source of income. The tax is deducted from the taxable amount when making payments to vendors at the time of sale. TDS can be applied to various sources of income, such as rent, salary, etc.

When Should TDS be Deducted?

The Income Tax Department sets the rates for TDS deductions. In a transaction, the person or organisation receiving the payment is called the deductee, while the person or organisation deducting TDS from the payment made is called the deductor. TDS is deducted before making the payment, and the tax amount is then deposited with the government. TDS is deducted for all kinds of payments (cash, cheque, or credit), and it is linked to the PAN of both parties.

Scenario: Patricia is a freelancer providing graphic design services. She has completed a project for her client Aaron and issued an invoice for ₹1,00,000. The applicable TDS rate for her services is 10%. Aaron will deduct 10% of the invoice amount as TDS before making the payment (10% of ₹1,00,000) and pay Patricia the remaining ₹90,000. Aaron will then deposit the ₹10,000 with the government and provide Patricia with a TDS certificate, which she can use while filing her income tax return to claim credit for the tax deducted.

Apply TDS to Transactions in Zoho Books

You can apply TDS to the transactions you create in Zoho Books in two ways:

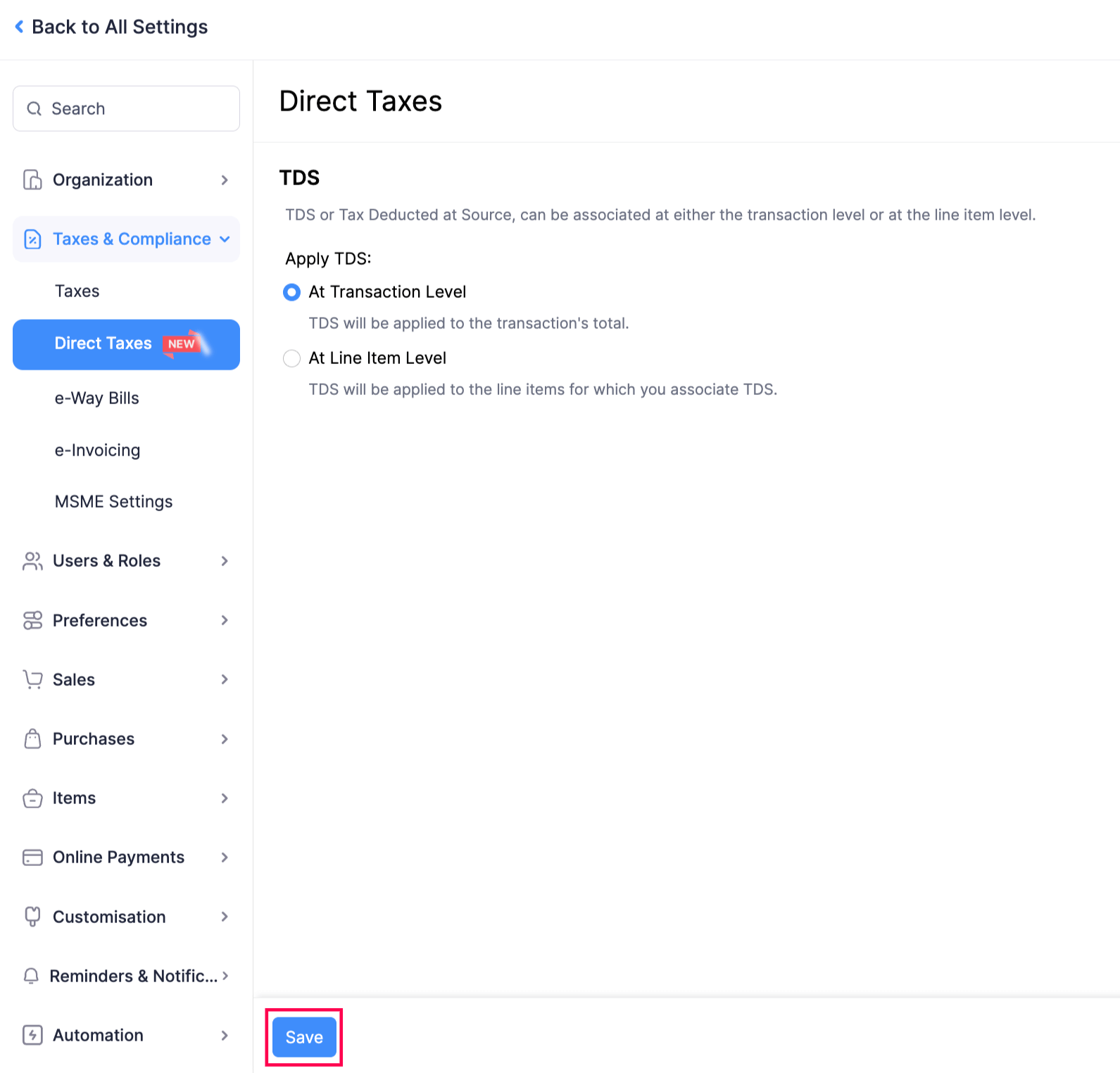

By default, you can apply TDS to your transactions at the transaction level. You can also configure the preferences to apply TDS to your transactions. Here’s how:

Go to Settings.

Select Direct Taxes under Taxes & Compliance.

Select the required TDS preference and click Save.

Apply TDS at Transaction Level

To apply TDS at the transaction level:

- Go to the required transaction in which you want to apply TDS.

- Select the option TDS in the Total section below the Item Table.

- Select the applicable tax from the dropdown. It will be applied to the Sub Total of your transaction.

- If you want to use a new TDS rate that is not listed in the dropdown, select Manage TDS from the dropdown, create a new TDS tax rate, and apply it to the transaction.

- Click

- Save and Send - To send the transaction to your customer, or

- Save as Draft - To send the transaction later to your customer.

The TDS tax has been applied at the transaction level.

TDS Override

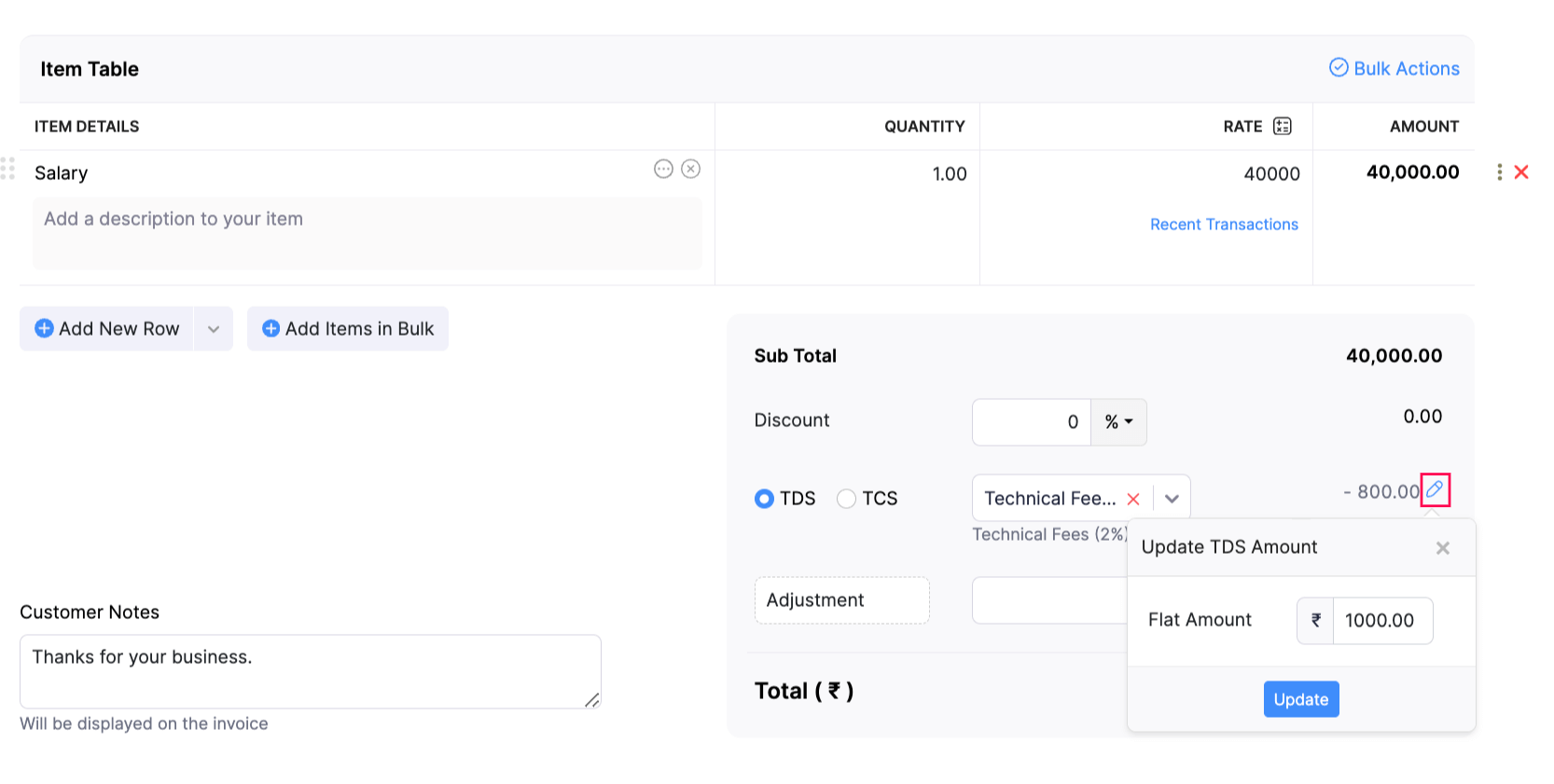

Once you add a TDS rate to your transaction, you will also be able to update the TDS amount deducted from the taxable amount of your transaction. To override TDS in a transaction (say, Invoices):

Go to the required transaction in which you want to override the TDS.

Select the option TDS in the Total section below the Item Table.

Select the required TDS from the dropdown. The TDS selected will be applied to the Sub Total of your transaction.

Click the Edit icon near the TDS amount deducted from your transaction.

In the pop-up that appears, enter the required amount to be deducted.

Click Update. The TDS amount to be deducted from the transaction will be updated accordingly.

Click

- Save and Send - To send the transaction to your customer, or

- Save as Draft - To send the transaction later to your customer.

Note: You can override TDS only at the transaction level.

TDS Surcharge

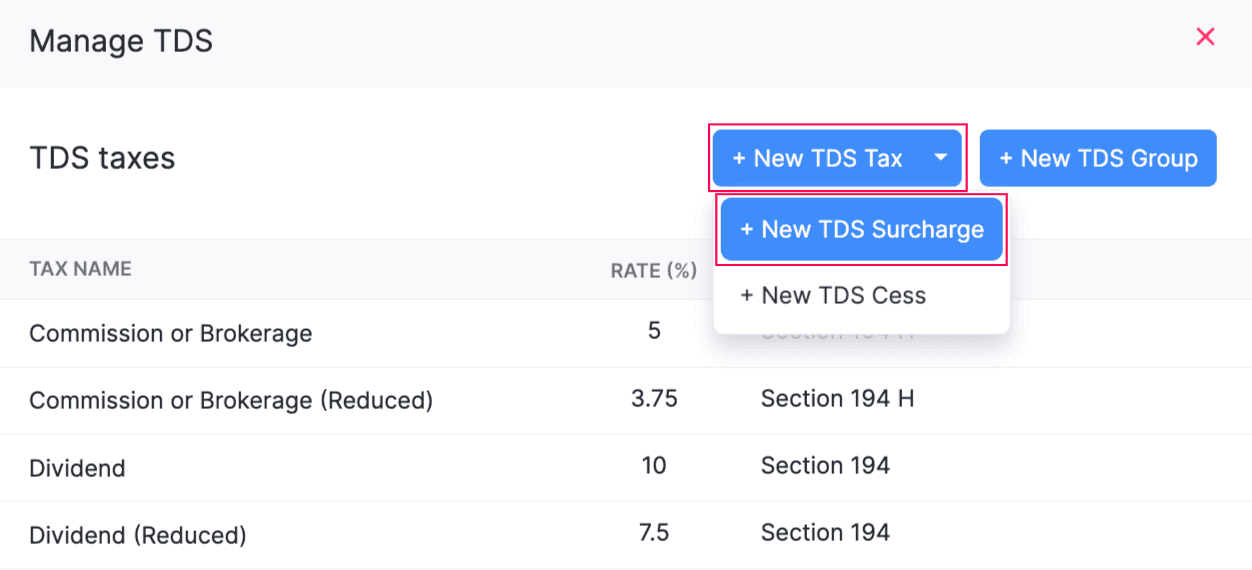

TDS surcharge is an extra charge added to the TDS amount for payments made to high-income individuals or entities. It is calculated on the TDS amount to ensure those with higher earnings pay more in taxes. To create a TDS surcharge for the transactions:

Go to the required transaction for which you want to create a TDS surcharge.

Check the option TDS in the Total section below the Item Table.

Click Manage TDS from the dropdown.

In the pop-up that appears, click + New TDS Tax in the top right corner, and select + New TDS Surcharge from the dropdown.

Enter the Tax Name and the Rate for the TDS surcharge.

Click Edit to select the Tax Payable Account and the Tax Receivable Account to track the TDS surcharge for the transaction.

Click Save.

Now, you can either apply the TDS surcharge to your transaction directly or along with another TDS tax as a TDS group by clicking + New TDS Group in the top right corner of the Manage TDS pop-up.

Pro Tip: You can also create TDS groups by clicking the + New TDS Group button on the top right corner of the page and selecting the required TDS rates to group them as one.

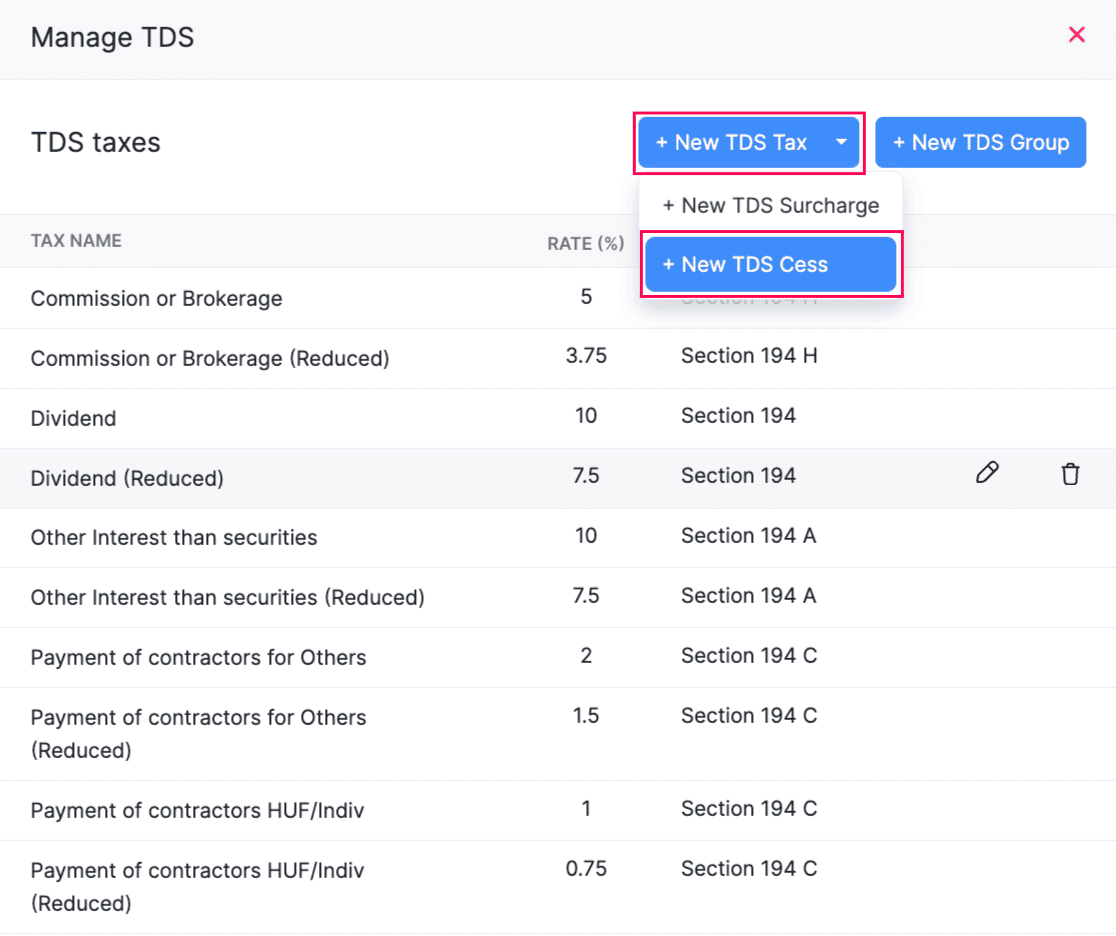

TDS Cess

TDS Cess is the additional tax that is levied on the TDS that is deducted from a transaction. It is levied on various purposes like education, health, infrastructure, etc. To create a TDS Cess for the transactions:

Go to the required transaction in which you want to create a TDS cess.

Check the option TDS in the Total section below the Item Table.

Click Manage TDS from the dropdown.

In the pop-up that appears, click + New TDS Tax in the top right corner, and select + New TDS Cess from the dropdown.

Enter the Tax Name and the Rate for the TDS cess.

Click Edit to select the Tax Payable Account and the Tax Receivable Account to track the TDS cess for the transaction.

Click Save.

Note: You can create TDS cess and TDS surcharge taxes only for bills.

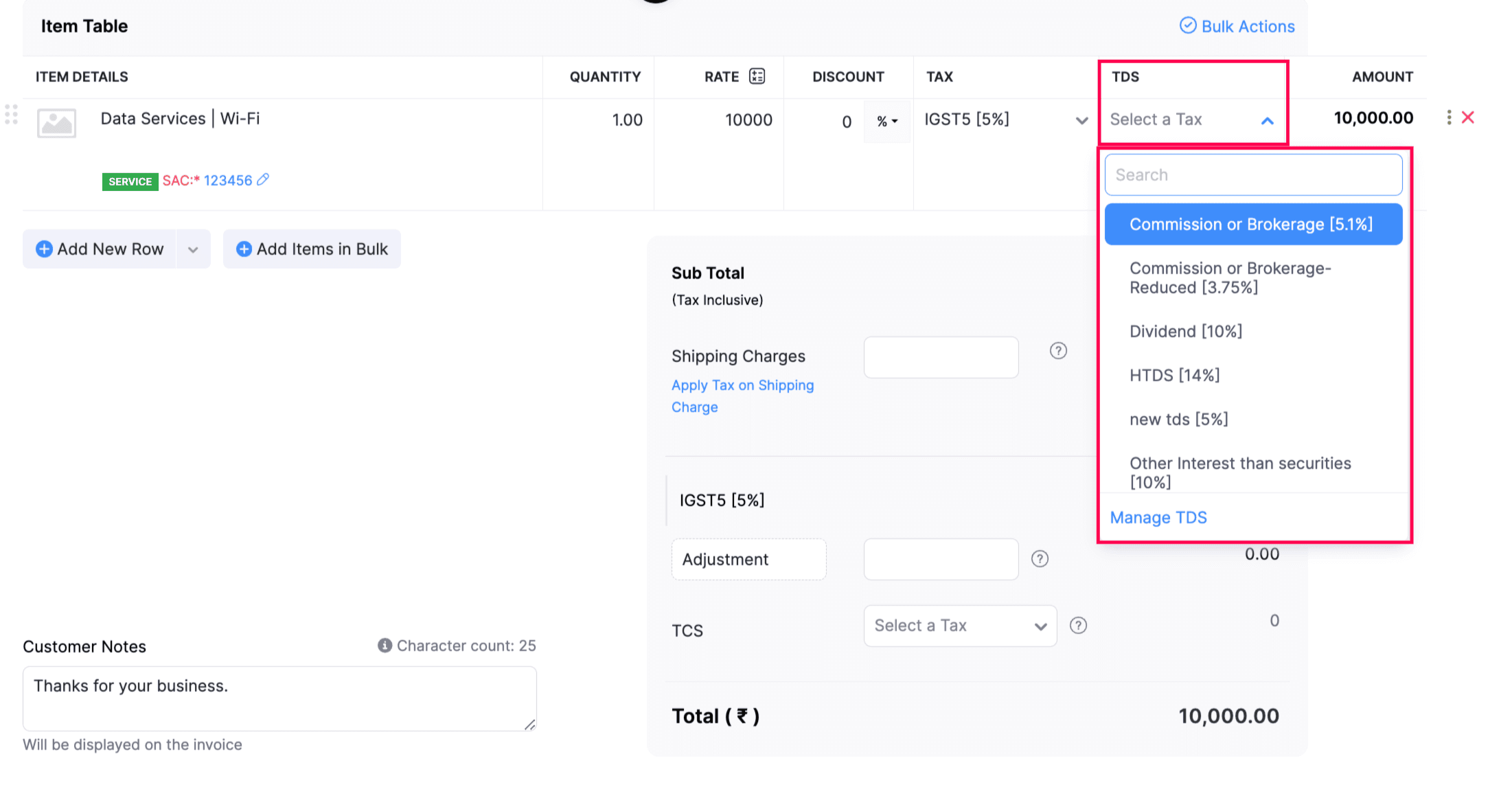

Apply TDS at Line Item Level

Zoho Books allows you to apply TDS to the transactions at line item level by configuring the Tax Preferences.

To apply TDS at line item level for the transactions you record in Zoho Books:

Select the required transaction for which you want to apply TDS at line item level.

Click + New in the top right corner of the page.

Enter the required details.

In the Item Table, select the required TDS for the line item in the TDS column.

Click Save and Send or Save as Draft.

The TDS tax has been applied at the line item level. You can also apply TDS cess and TDS surcharge to the TDS amount deducted from the transaction.

Apply TDS to Vendor Advance

Zoho Books allows you to apply TDS to the advance you pay your vendor, so you can deduct the required TDS amount from the advance payment and pay the remaining balance to your vendor. Learn more about applying TDS to vendor advances.

TDS Withheld

When you apply TDS to a transaction, the respective TDS amount will be deducted or withheld at the time of sale. You can record this withheld amount when you record the payment for the transaction in Zoho Books. Learn more about withholding TDS while recording payments.

Yes

Yes