GST TDS

GST TDS (Tax Deducted at Source under Goods and Services Tax) is a provision under Indian GST law where the recipient of goods or services must deduct a specified percentage from the payment to the supplier and remit it to the tax department. GST TDS is applicable only when the total value of such supply, under an individual contract, exceeds ₹2.5 lakh. The GST TDS rate is 2% (1% CGST + 1% SGST for intra-state transactions and 2% IGST for inter-state transactions).

Scenario: A government department contracts a supplier for services worth ₹2,50,000. As per GST TDS rules, 2% is deducted, amounting to ₹5,000. The supplier receives ₹2,45,000. This can be recorded in Zoho Books by creating a transaction with a payment of ₹2,45,000 and applying ₹5,000 as GST TDS.

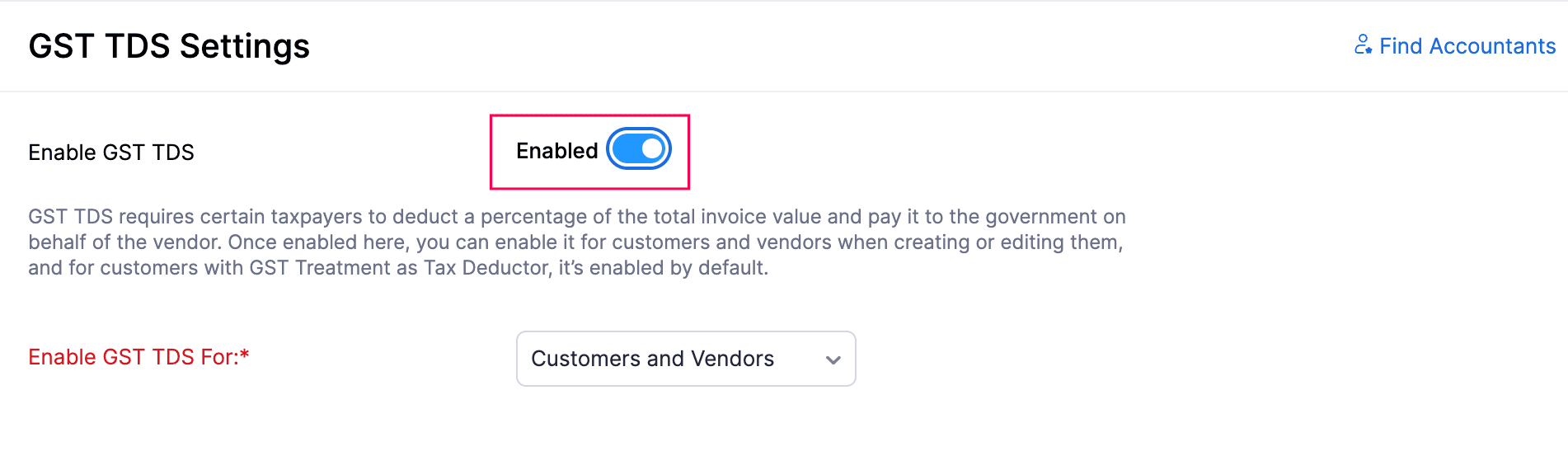

Enable GST TDS

Before deducting GST TDS from your transactions, you need to enable it. Here’s how:

- Go to Settings.

- Select Taxes under Taxes and Compliance.

- Navigate to GST TDS Settings.

- Slide the Enable GST TDS toggle.

- Select for whom you want to configure GST TDS in the Enable GST TDS For field. You can choose Customers, Vendors, or both.

- Click Save.

The GST TDS taxes will now be automatically populated in your organisation.

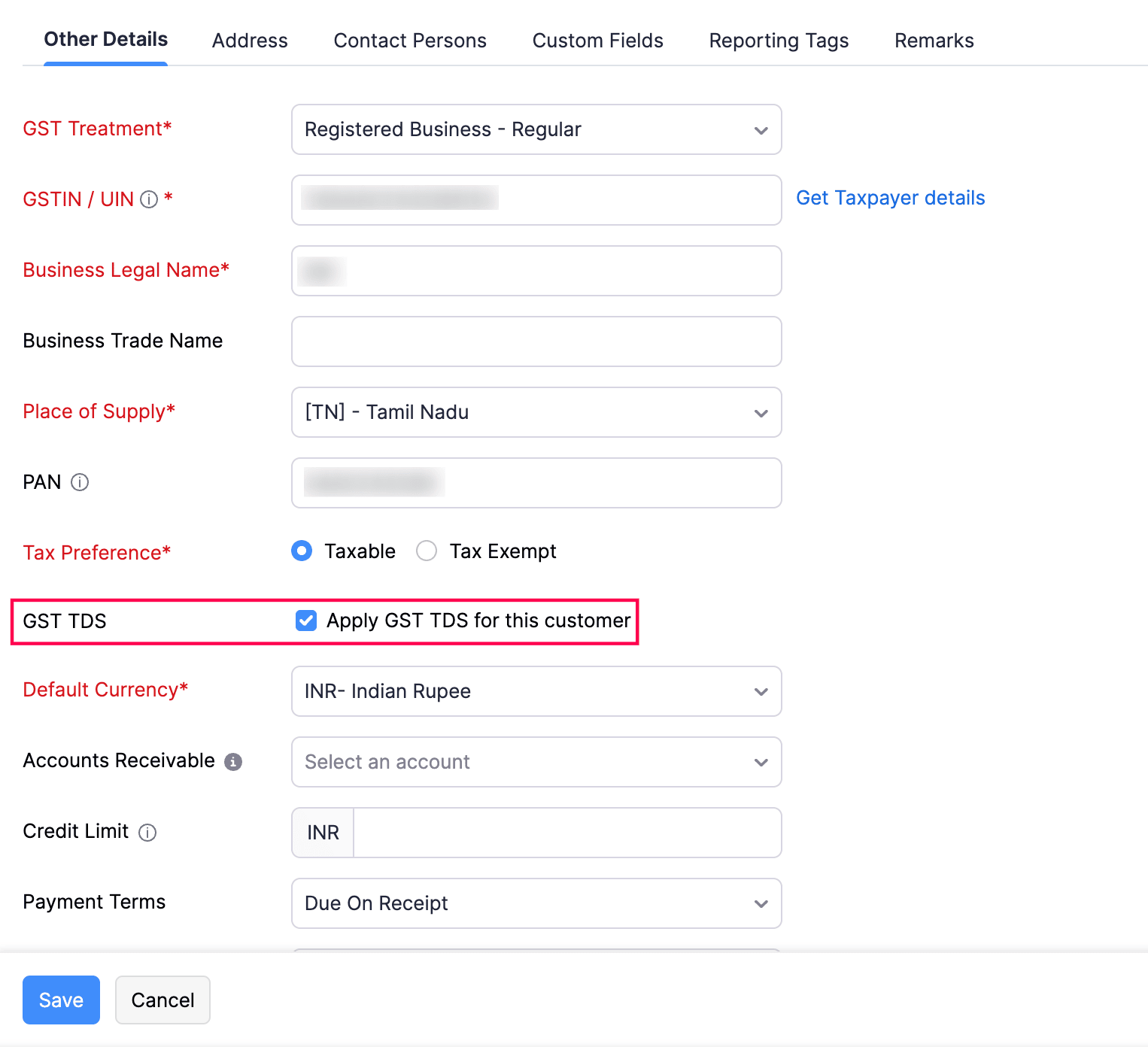

Create Customers or Vendors

To create a customers and enable GST TDS:

Go to Sales on the left sidebar and select Customers.

Click + New in the top-right corner of the page.

Enter the required details in the New Customer page.

In the Other Details section:

- Select the GST Treatment of the customer.

- Check the option Is GST TDS applicable?

Note: If you select Tax Deductor as the GST Treatment for the customer, the Is GST TDS applicable? option will be enabled by default. Please note that this applies only during customer creation, and not for vendors.

- Click Save.

Similarly, you can create vendors and enable GST TDS for them in the vendor creation page.

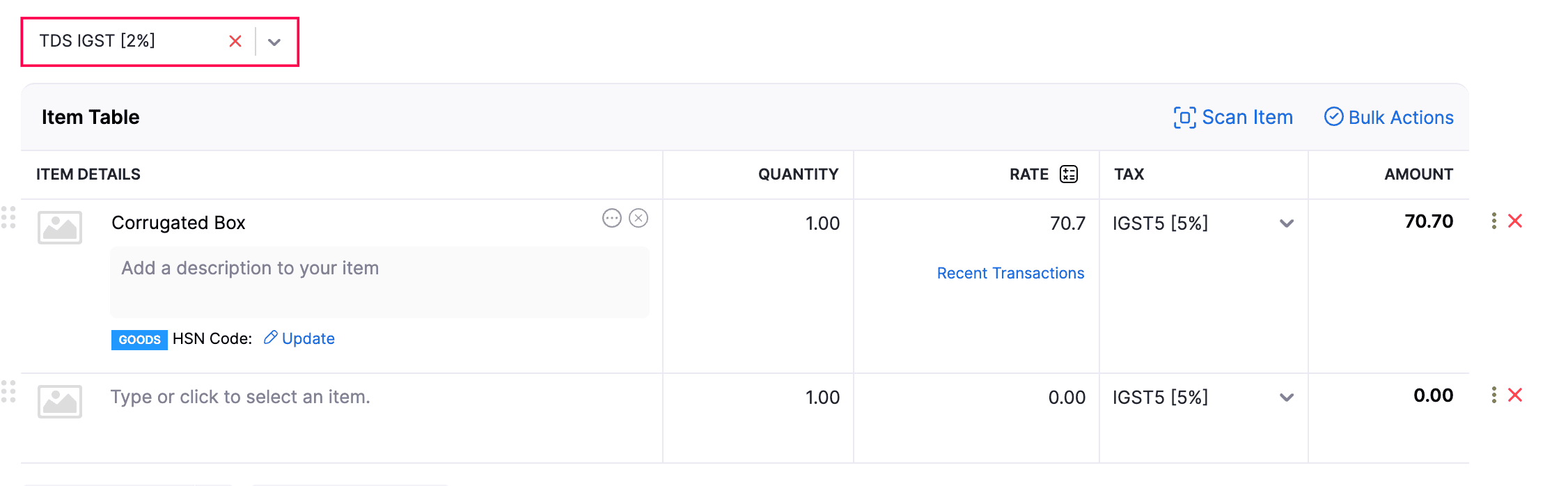

Create Transactions

You can create invoices and bills and deduct GST TDS on them. Let’s see how you can create an invoice and deduct GST TDS:

- Go to Sales on the left sidebar and select Invoices.

- Click + New in the top-right corner of the page.

- In the New Invoice page, enter all the required details.

- Click Select a GST TDS above the Items table and select a GST TDS tax from the dropdown.

Note: The Select a GST TDS dropdown will be displayed only when GST TDS is enabled for the customer or vendor.

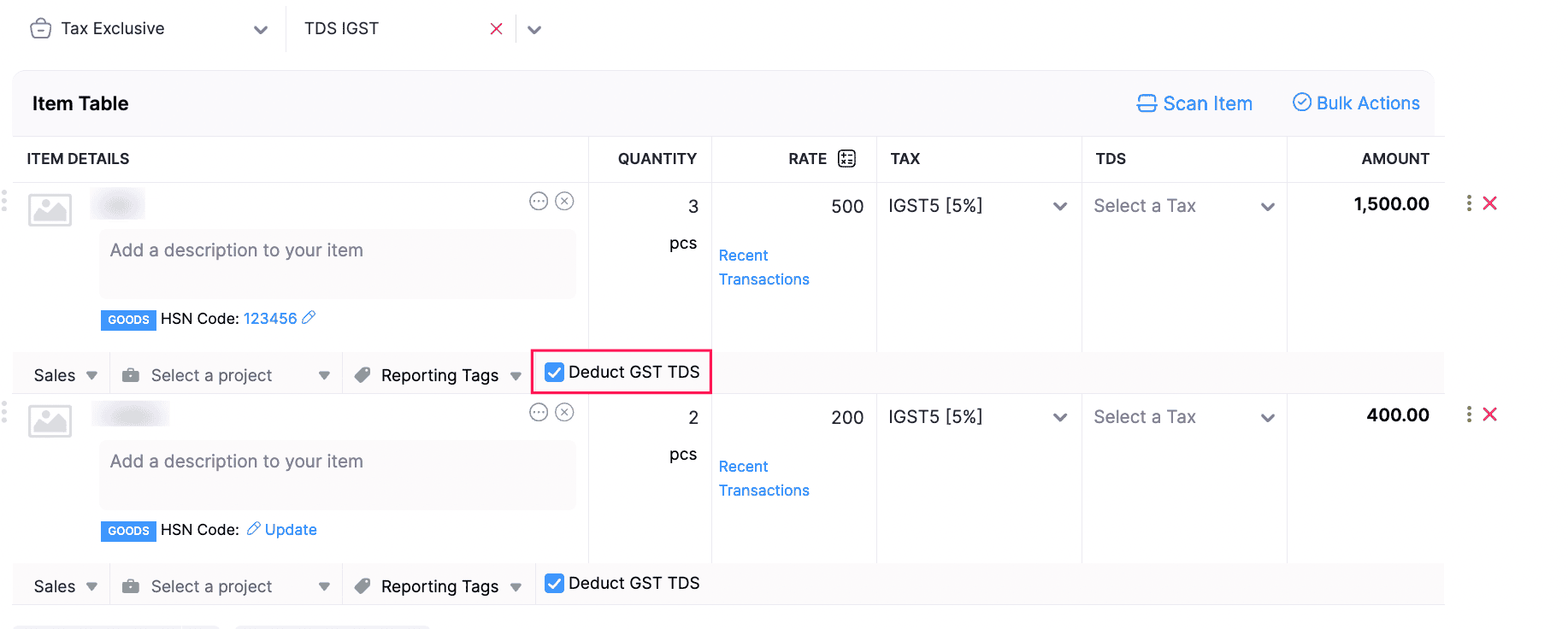

- GST TDS will be applied to all the line-items in your transaction. To remove GST TDS from a specific line-item, click More next to the item’s Amount field. From the dropdown, select Show Additional Information and uncheck the Deduct GST TDS option.

Pro tip: If you have many line items with GST TDS applied by default, but you only want it applied to specific line items, manually unchecking each one can be time-consuming. To apply GST TDS to only specific items, click Bulk Actions at the top right of the item table and select Bulk Update Line Items. Then choose Remove GST TDS to clear it from all line items, and manually select Deduct GST TDS for the specific ones you want.

- You can view the total GST TDS deducted for the transaction in the GST TDS section.

- Click Save.

Similarly, you can create bills for your vendors, and deduct GST TDS.

Note: The GST TDS deduction will not be applied to the total invoice amount and will not impact any accounts directly. It can only be recorded at the time of payment.

Record Payment

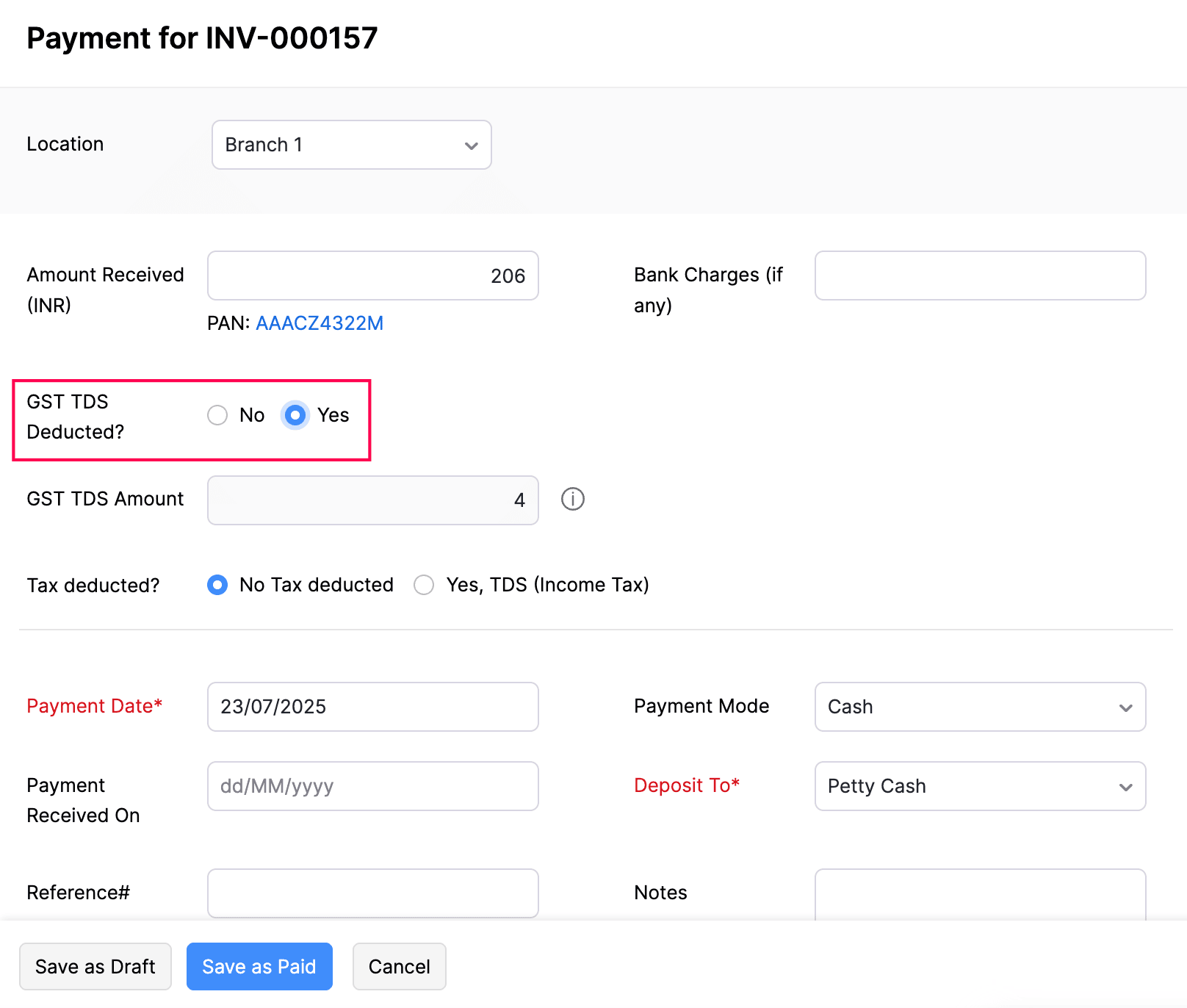

While recording a payment for your invoices and bills, you can record the GST TDS deducted from the transaction. Let’s see how you can do this in an invoice:

- Go to Sales on the left sidebar and select Invoices.

- Click Record Payment at the top of the invoice’s Details page, and select Record Payment from the dropdown.

- Enter all the required details in the new page.

- Check the option Yes next to the GST TDS Deducted?.

- You can view the deducted GST TDS in the GST TDS Amount field.

Note: If you wish to record payment only for the deducted GST TDS, enter 0 in the Amount Received (INR) field.

- Click Record Payment.

Similarly, you can record bill payments and the deducted GST TDS.

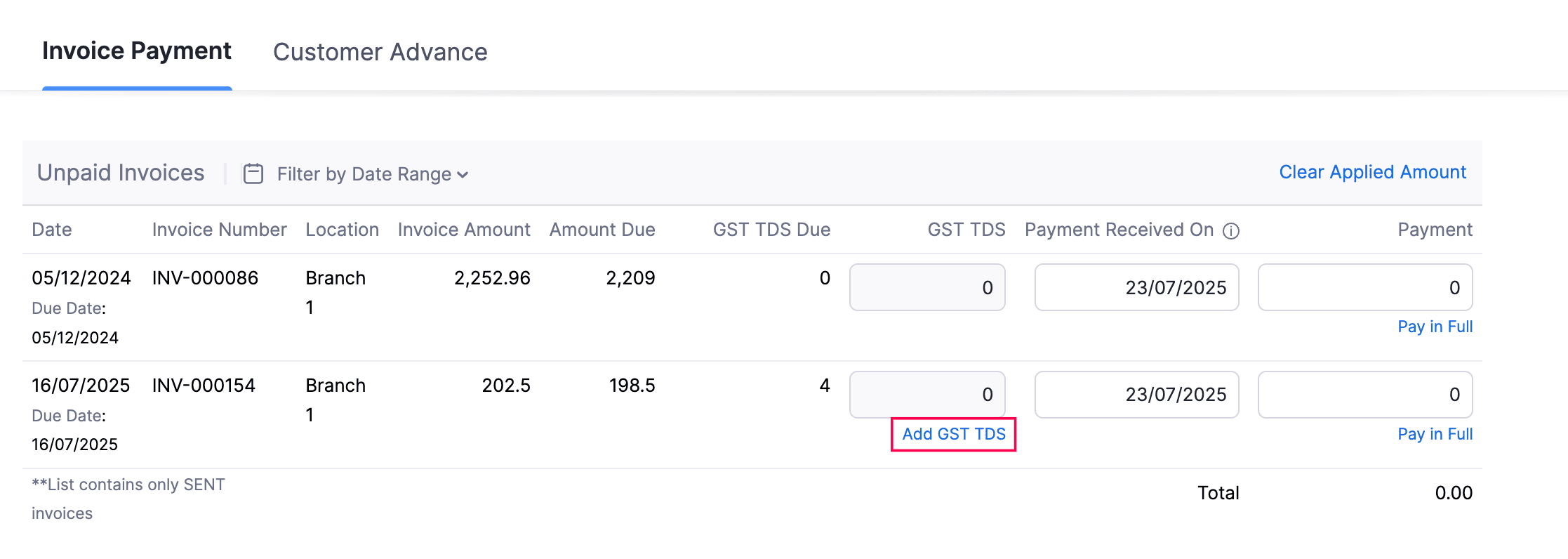

You also have the option to record GST TDS for an invoice payment through the Payments Received module. Here’s how:

Go to Sales on the left sidebar and select Payments Received.

Click + New.

Enter the required details.

In the Unpaid Invoices table:

- Click Add GST TDS below the GST TDS field for the invoice where you want to apply the GST TDS.

- You can click Clear GST TDS to clear the GST TDS applied to the invoice.

Click Save as Paid.

Note: If you want to record only the GST TDS and not the invoice payment amount, enter 0 in the Amount Received field.

Similarly, you can record GST TDS for a bill payment through the Payments Made module.

Yes

Yes