Direct Taxes

The Direct Taxes section contains comprehensive reports related to the taxes of your organisation.

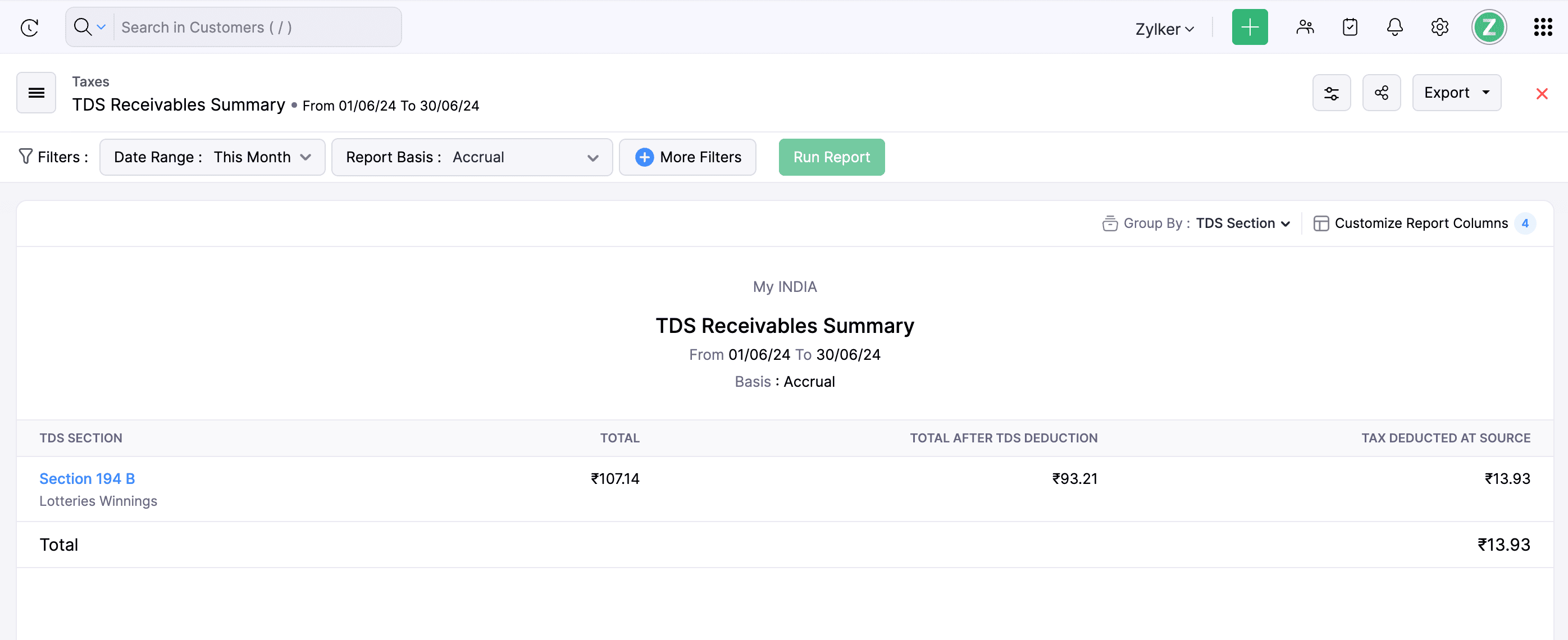

TDS Receivables Summary Report

A TDS receivables summary report summarises the total TDS deductions made on invoices, bills of supply, customer debit notes, and credit notes.

You can use this report to verify the TDS amount deducted and reported in your Form 26AS.

To view your Tax Receivables Summary report:

- Go to Reports on the left sidebar.

- Select TDS Receivables Summary under Taxes.

Note: You can click each TDS section to view the details of its TDS receivables.

The TDS Receivables Summary report contains the following columns:

- TDS Section: This specifies the section and its description.

- Total: The total amount of the invoice, bill of supply, customer debit note, or credit notes before TDS deduction.

- Total After TDS Deduction: This is the amount remaining after TDS is deducted from the original amount.

- Tax Deducted At Source: The TDS deducted from the original amount.

To customise your report:

- Go to Reports on the left sidebar.

- Select TDS Receivables Summary under Taxes.

Customise the report based on the following filters:

| Filter | Description |

|---|---|

| Date Range | Select the date range for which you want to generate the report. You can also configure a custom date range. |

| Report Basis | The report can be filtered on Accrual and Cash basis. |

| Group By | The report can be grouped by either Customer or TDS Section, with the default grouping set to TDS Section. |

| Customize Report Columns | You can customise columns in the report, and the default columns will be displayed based on the Group By field. |

| More Filters | The report can be further filtered by customer and branch names. |

Yes

Yes