Vehicle Perquisite Calculation for Employer-provided Cars

In some organisations, employers provide vehicles to their employees for transportation. This will be counted as a perquisite offered to the employee by the organisation. Zoho Payroll supports the handling of the vehicle perquisite in employees' salaries. Employers can enable this perquisite for employees for whom the company has provided cars.

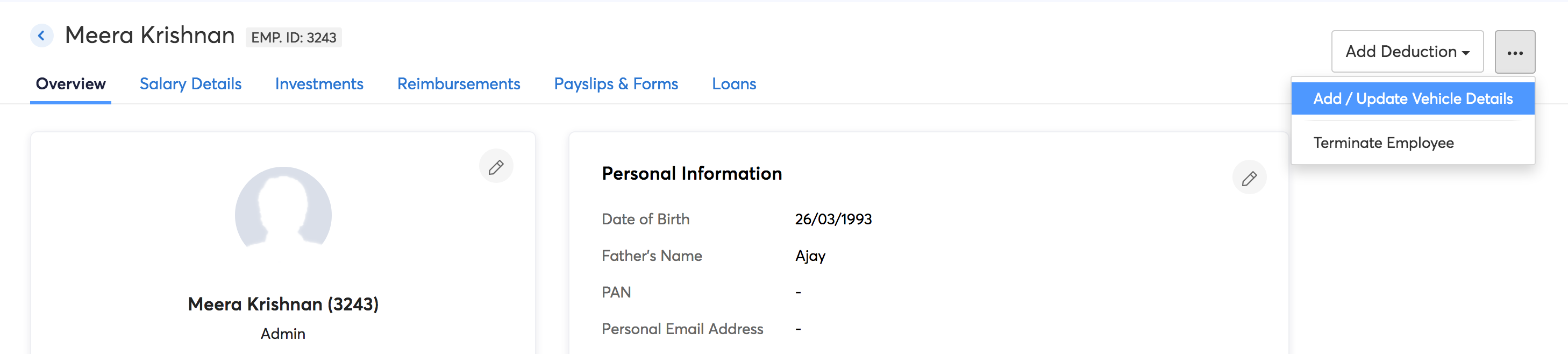

Adding/Updating Vehicle Details

To do this:

- Go to the Employees module.

- Go to the employee’s profile for whom you want to associate company provided car details.

- Click the More icon.

- Select Add/Update Vehicle Details.

- In the dialog box, select the relevant option regarding the vehicle.

- You will see the following options:

- Owner of the Car (Employer-owned (or) Hired for Employee // Employee-owned )

- Maintenance Cost Met By ( Employer // Employee )

- Cubic Capacity of Company Owned Car (Upto 1600CC // Greater than 1600CC)

- Is driver provided by company? (Yes // No)

- You will see the following options:

- Once this is done, the perquisite amount will be displayed on the screen. This amount is a system generated value based on predefined calculations.

- Click Save.

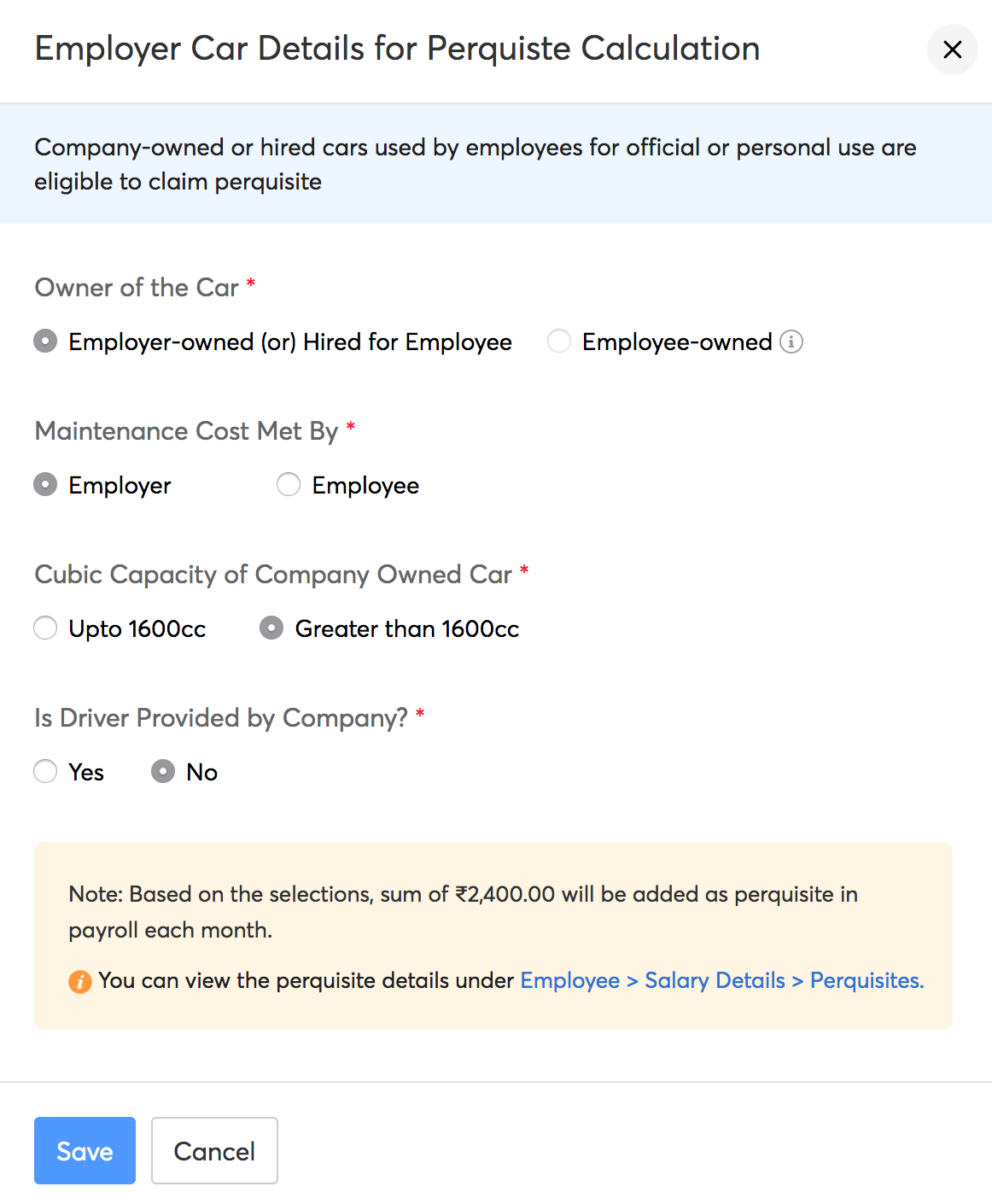

If you wish to modify the perquisite amount, you can enter the values under Employees > Employee profile > Salary Details > Perquisites > Cars/Other automotive. Any difference between the pre-configured amount and the new amount will be shown as a correction amount in the payslip.

Calculations

Based on the different combinations of the options given, the perquisite value will be calculated and displayed. The perquisite for each month is given below:

- Car owned/hired by Employer

- Expense / Maintenance cost met by Employer

- Engine capacity upto 1600CC with driver - ₹2,700.00 (perquisite amount of ₹1,800.00 for car and ₹900 for driver)

- Engine capacity upto 1600CC without driver - ₹1,800.00

- Engine capacity above 1600CC with driver - ₹3,300.00 (perquisite amount of ₹2,400.00 for car and ₹900 for driver),

- Engine capacity above 1600CC without driver - ₹2,400.00

- Expense / Maintenance cost met by Employee

- Engine capacity upto 1600CC with driver - ₹1,500.00 (perquisite amount of ₹600.00 for car and ₹900 for driver),

- Engine capacity upto 1600CC without driver - ₹600.00

- Engine capacity above 1600CC with driver - ₹1,800.00 (perquisite amount of ₹900.00 for car and ₹900 for driver)

- Engine capacity above 1600CC without driver - ₹900.00

- Expense / Maintenance cost met by Employer

Let us consider a scenario where we work out the perquisite details for an employee having a company-provided car with a 1600CC engine and a driver.

- Employee’s Monthly CTC = ₹40,000;

- Basic - ₹20,000;

- HRA - ₹10,000;

- Driver reimbursement - ₹2000;

- Fuel reimbursement - ₹1,500;

- Other allowances - ₹5,000;

- PF - ₹1,500.

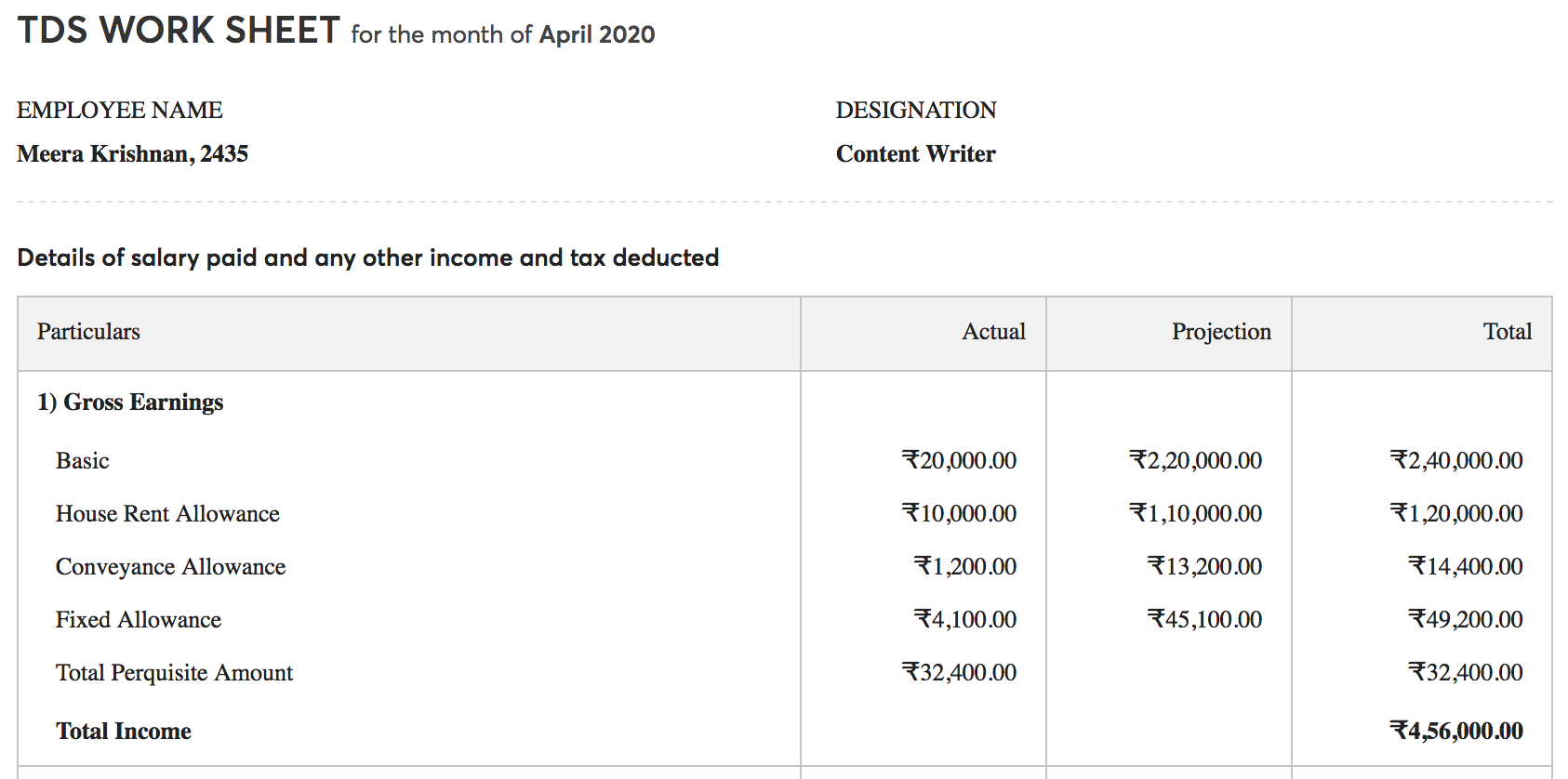

Now, for the company-provided car, ₹1800 will be provided for car maintenance and ₹900 for driver amounting to a perquisite amount of ₹2700. The perquisite value in the image below is calculated for two months.

For reimbursements, once the employee submits the necessary bills, they will get

- Driver reimbursement - ₹2000

- Fuel reimbursement - ₹1,500

But the ₹2,700 for vehicle maintenance of a company-provided car will be automatically included as a perquisite in the employee’s salary. For this, the employee need not submit any bills and this amount will not be exempted from tax.

TDS worked out for the entire fiscal year in terms of perquisite would be as follows:

At the moment, Zoho Payroll supports automatic perquisite for only employer-owned / company-hired vehicles.

However, perquisite for employee-owned car can be calculated once the employer enters the perquisite details manually under Employees > Employee profile > Salary Details > Perquisites > Cars/Other automotive.

Employee-owned cars will be calculated as a perquisite only if the car is used for both private and official purposes. So, the perquisite values will be:

- If car engine capacity ≤ 1600CC, perquisite is 1,800 p.m. + 900 p.m. if driver is provided

- If car engine capacity > 1600CC, perquisite is 2,400 p.m. + 900 p.m. if driver is provided

Here too, only the perquisite amount will be considered for tax calculation out of the total reimbursement amount (if any).