Taxes

In this section, you can update your organisation’s tax information. These details help us generate Form 16 for your employees.

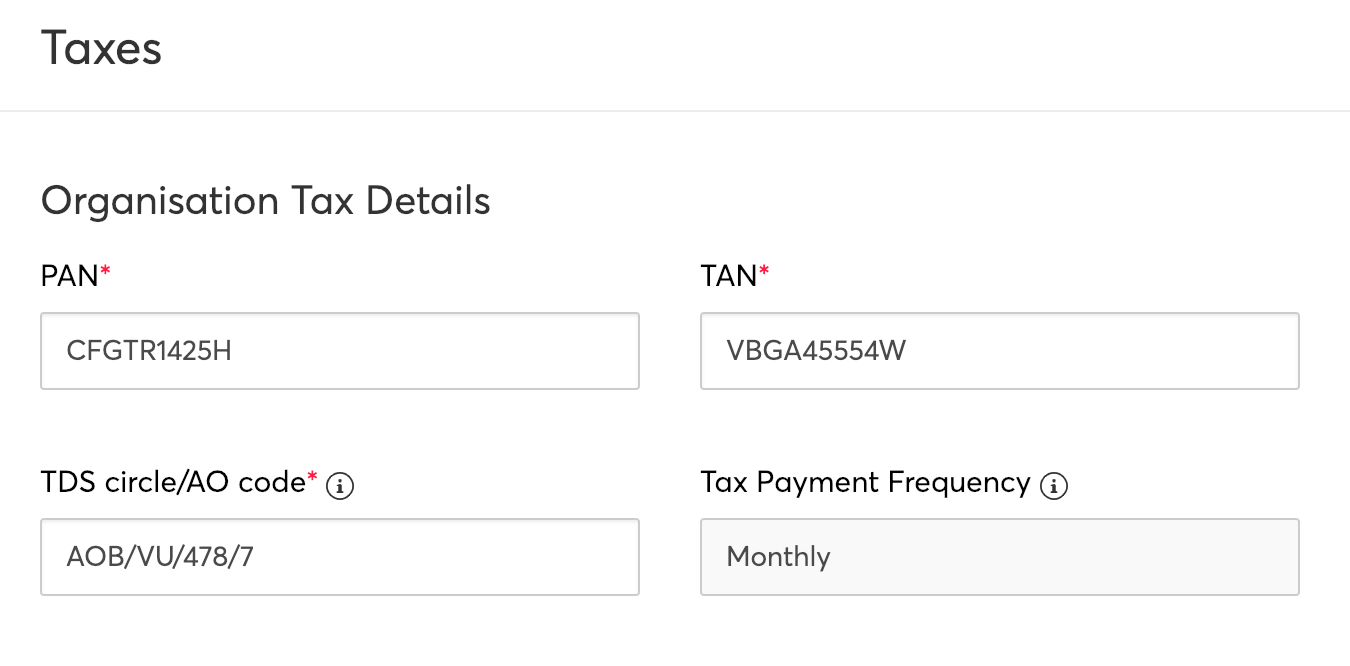

- Go to Settings > Taxes.

- Enter/update the following details:

PAN

The Permanent Account Number (PAN) card is a vital document for any taxpayer. PAN is a 10-character number consisting of letters and digits. Any corporate organisation doing business in India requires a PAN card whether it is registered in India or abroad.

TAN

Tax Deduction and Collection Account Number (TAN) is a unique 10 digit alpha numeric code whose primary purpose is deduction or collection of tax. All businesses who deduct or collect tax must have a TAN, quoting it in their TDS or TCS documents.

TDS Circle / AO Code

AO Code (Assessing Officer Code) is a combination of Area Code, AO Type, Range Code and AO Number. You can get this number from the Income Tax Office or by logging into your online Income Tax Account and navigating to the ‘My Profile’ section.

Tax Payment Frequency

Tax Payment Frequency tells us how often you deposit your Tax Deducted at Source (TDS) to the Income Tax Department. It will be set as Monthly by default. If your business follows a different tax payment frequency, write to us at support@zohopayroll.com and we’ll enable it for you.

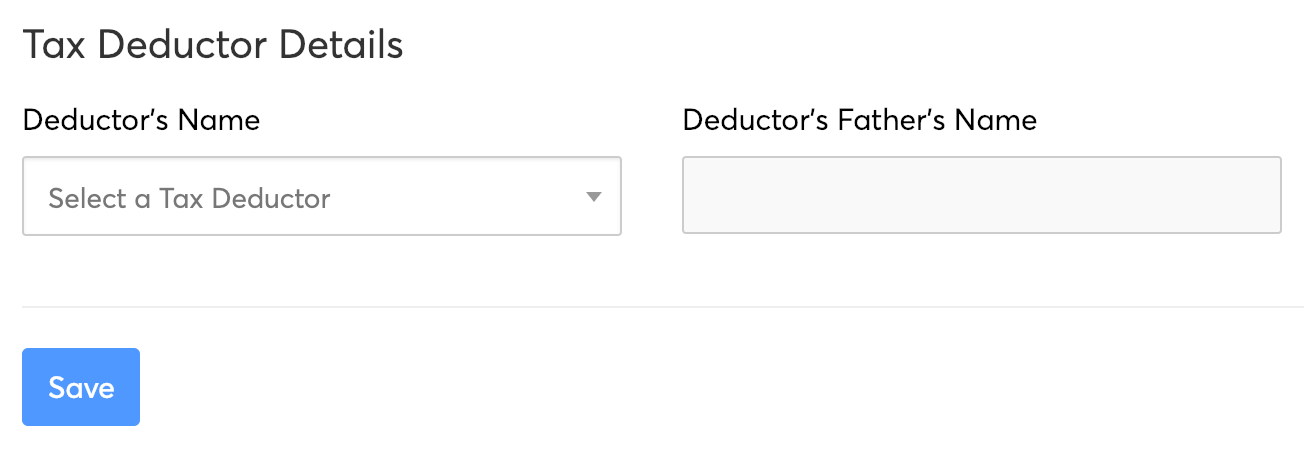

Tax Deductor Details

Tax Deductor is the person who is responsible for deducting income tax from each employee’s salary and depositing it to the Income Tax department. Select your organisation’s tax deductor from the drop-down and enter their father’s name.

Note: Tax Deductor should ideally be an employee in your organisation. Father’s name will be pre-filled in that case. Also, you cannot delete the employee who has been selected as a tax-deductor for your organisation.

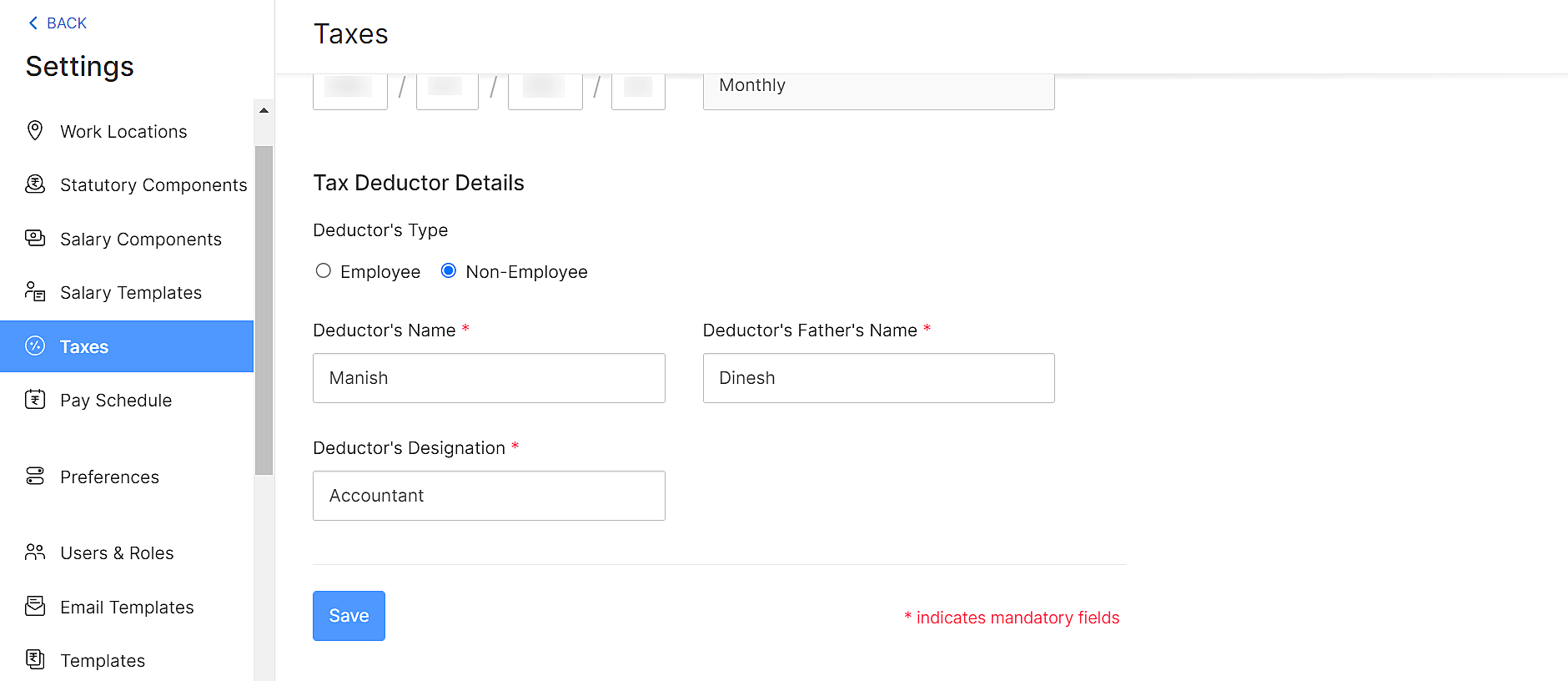

Add Non-Employee As Tax Deductor

You can now add a person who is not your employee, such as a third-party accountant or auditor, as a Tax Deductor in Zoho Payroll. The tax deductor will be responsible for remitting your tax to the government.

To add a tax deductor:

- Go to Settings on the top right corner of the page and navigate to Taxes.

- In Tax Deductor Details section, choose Deductor’s Type as Non-Employee.

- Enter your Deductor’s Name, Deductor’s Father’s Name and Deductor’s Designation in their respective fields.

- Click Save.

The person will be added as Tax Deductor in your Zoho Payroll organisation.

Zoho Payroll's support is always there to lend a hand. A well-deserved five-star rating!

Zoho Payroll's support is always there to lend a hand. A well-deserved five-star rating!