- Timing is everything

- What’s getting shoppers excited: A look at major shopping events

- Click, tap, or stroll: Where are shoppers making their purchases?

- Budget breakdown

- Shopping preferences

- AI’s impact on the shopping experience

- Gifts galore

- Turning the lens: The retailer’s perspective

- Your roadmap to the 2024 holiday season

Timing is everything

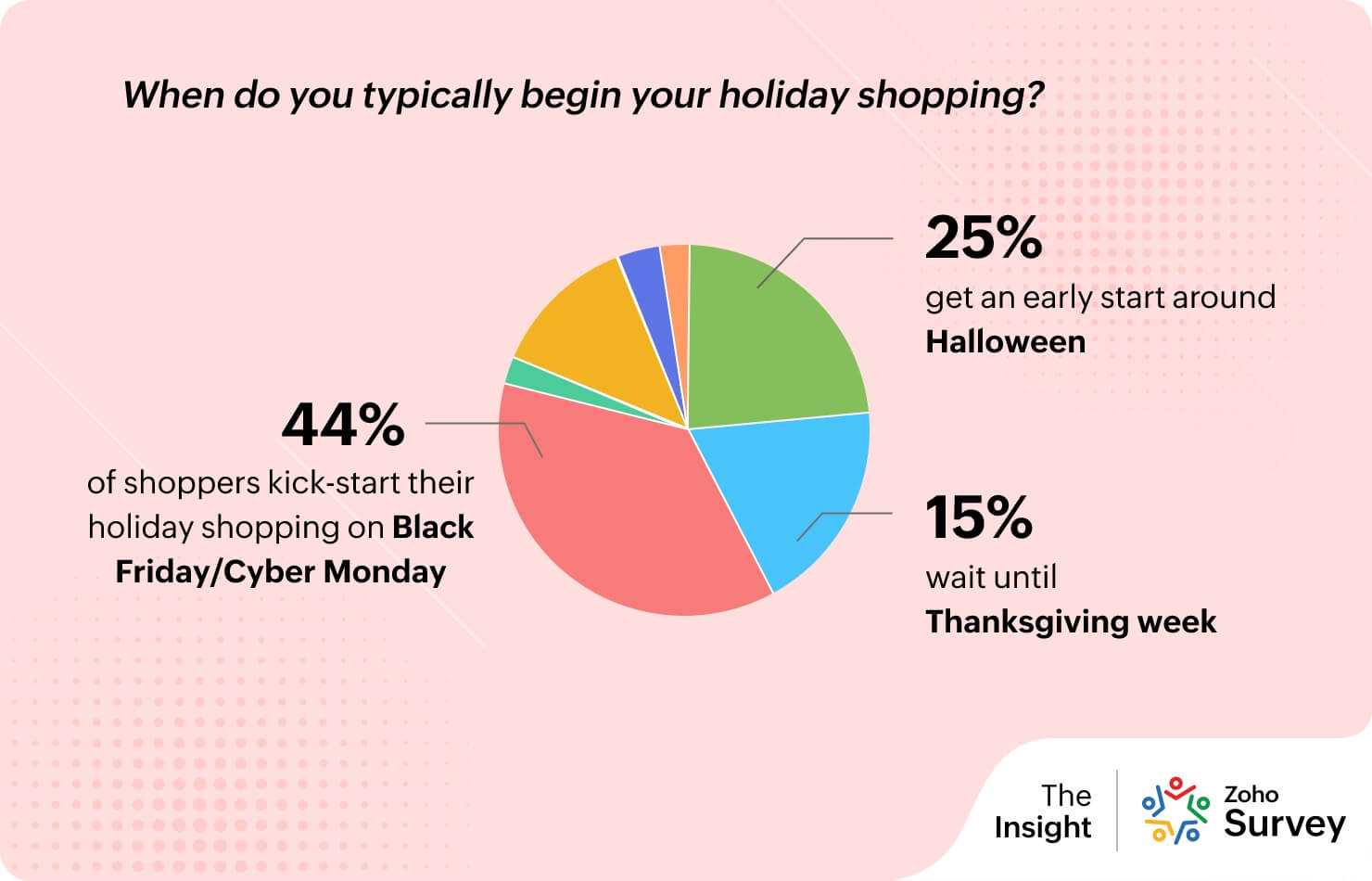

For holiday shopping, some dive in early to snag the best deals, while others wait for the festive rush. We wanted to find out—when do most people kickoff their holiday shopping spree?

Black Friday and Cyber Monday dominate as the top shopping kickoff for the holiday season, with nearly 44% of shoppers gearing up to take advantage of deals during this time. However, there’s a considerable segment—25%—that starts early, catching those pre-Halloween sales, indicating a shift towards more proactive, spread-out spending.

Tip: Begin marketing early-bird specials for the eager shoppers, and prepare for those who prefer last-minute deals by stocking up and offering special promotions closer to the big holidays.

While Black Friday still reigns, a quarter of shoppers planned to get a head start before Halloween.

What’s getting shoppers excited: A look at major shopping events

We asked shoppers which holiday shopping events get their hearts racing, and the results paint a vivid picture.

Black Friday continues to dominate as the most anticipated shopping event, with a whopping 57% of shoppers eager to snag deals that day. This excitement dwarfs other sales events, showing that the tradition of lining up (or logging in) for those unbeatable discounts is still going strong. Cyber Monday follows closely, maintaining its appeal for the digital-savvy crowd, while Thanksgiving also remains a favorite for those who love to combine sales with festivities.

Tip: Time your biggest promotions and create buzz leading up to Black Friday and Cyber Monday.

While Black Friday steals the spotlight, there’s still plenty of interest in Boxing Day sales, with 23% of shoppers keeping an eye on post-holiday deals

Click, tap, or stroll: Where are shoppers making their purchases?

As shoppers prepare for the holiday season, their chosen shopping destinations reveal much about where the action will be.

Online shopping is undoubtedly leading the way this holiday season, with 47% of respondents preferring online marketplaces for their gift hunting. In-store shopping at large retail chains also remains popular, favored by 22% of respondents. Meanwhile, malls and shopping centers make up a smaller slice, with 11% choosing to head out for a more traditional shopping experience.

The trend towards online shopping is consistent across generations, but Gen X tops the chart with 49% opting for online platforms (a slightly higher rate than the other groups). Meanwhile, Gen Z and Millennials stand out for showing more openness towards social commerce on platforms like Instagram and Facebook. However, the results also reflected a blend of both traditional and digital shopping habits across all generations.

Tip: While online marketplaces are a clear favorite, don’t neglect the enduring appeal of in-person shopping. More than 40% of consumers in our survey still plan to buy gifts at places like malls, department stores, large retail chains, and local businesses.

While social commerce is making waves, it hasn’t yet fully captured the holiday shopping crowd’s attention.

Budget breakdown

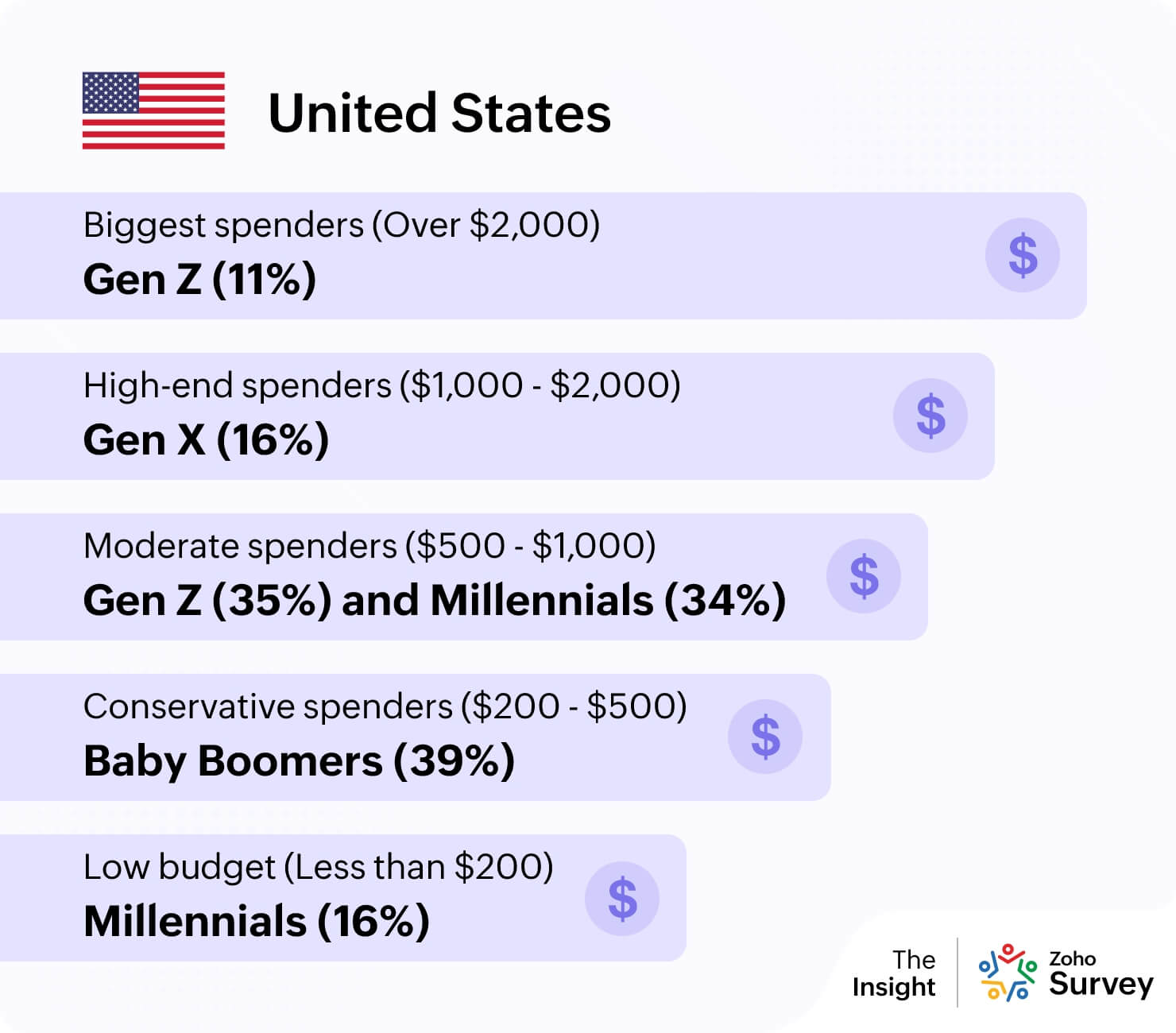

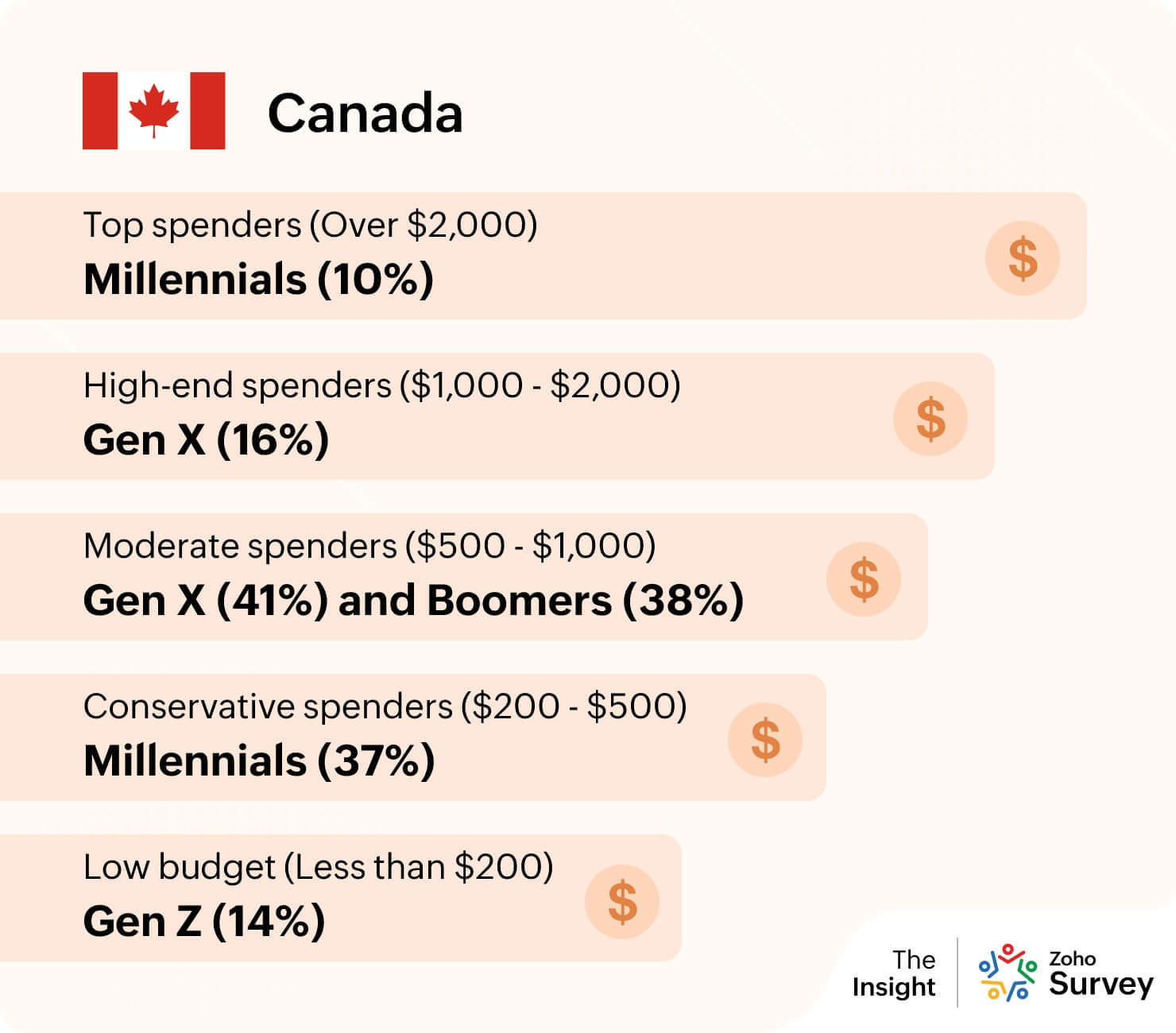

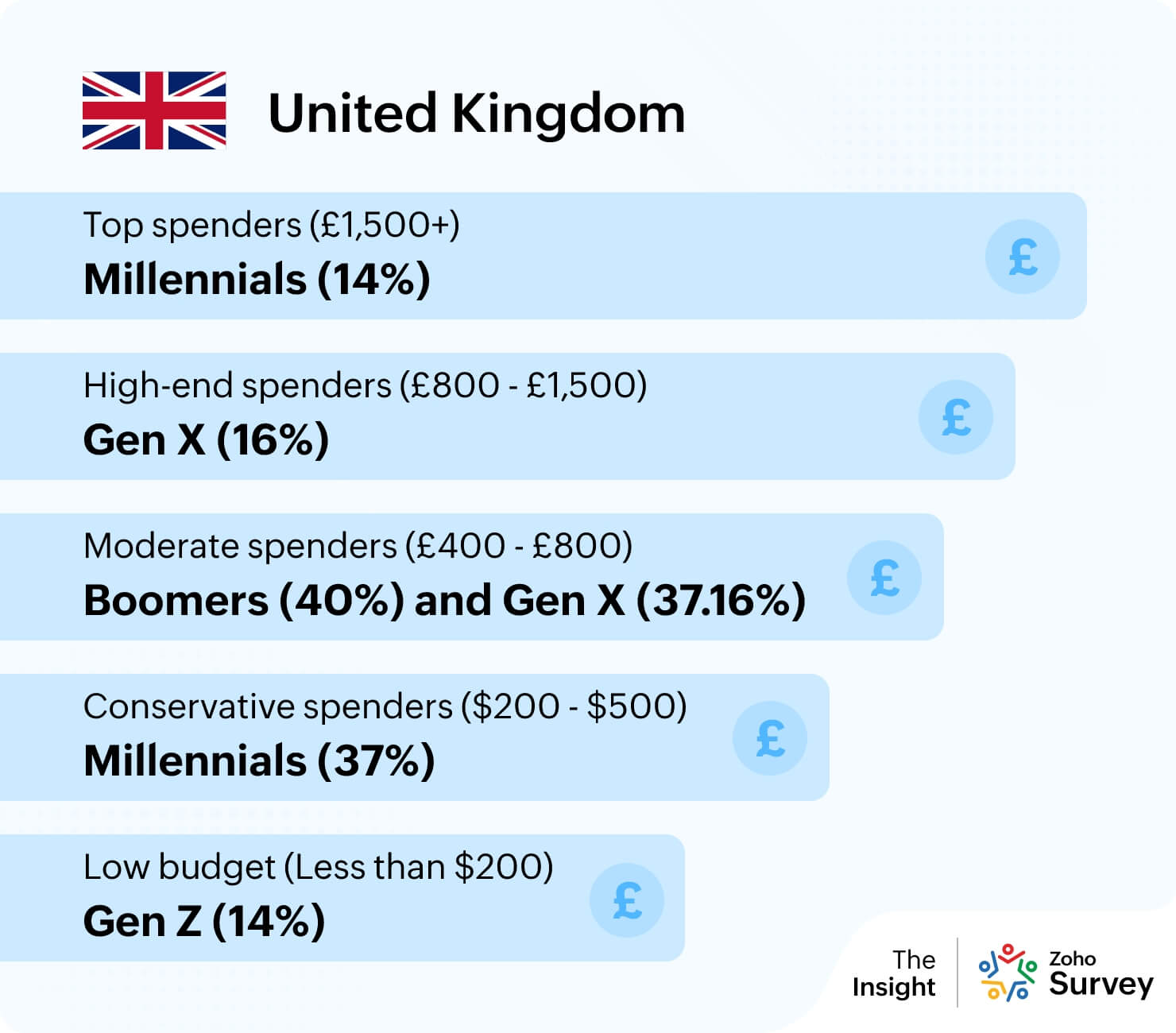

Total budget

This holiday season, each generation is setting aside a unique budget to make the most of the festivities. Here’s a quick look at how much they’re planning to spend.

Holiday budgets this year paint a nuanced picture of consumer sentiment across generations. Rather than a one-size-fits-all approach, the data reflects a spectrum of priorities—some focused on staying within limits, others ready to indulge. This isn’t just about numbers; it’s a reminder that holiday shopping can capture both the careful planning and the anticipation of the season.

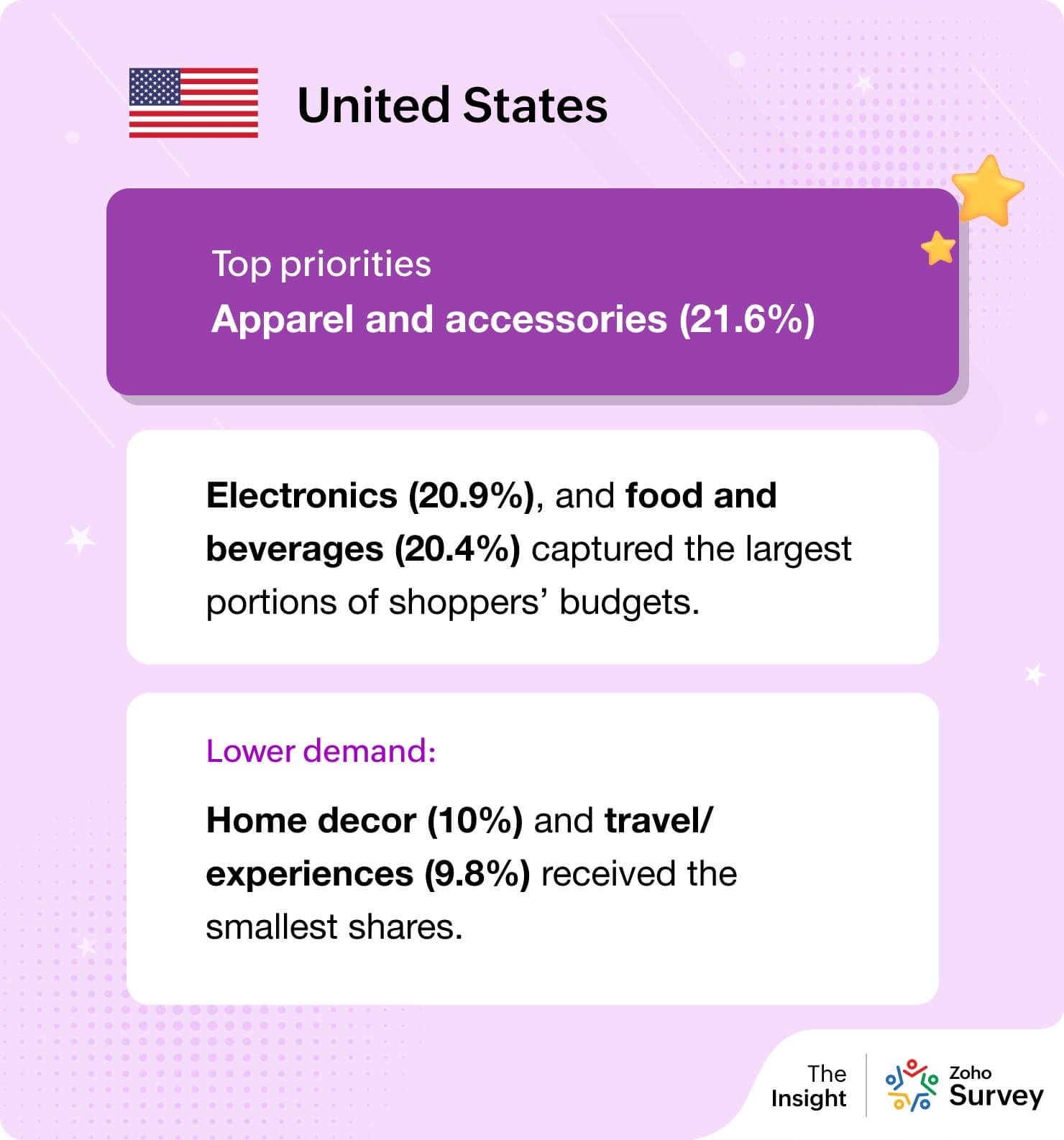

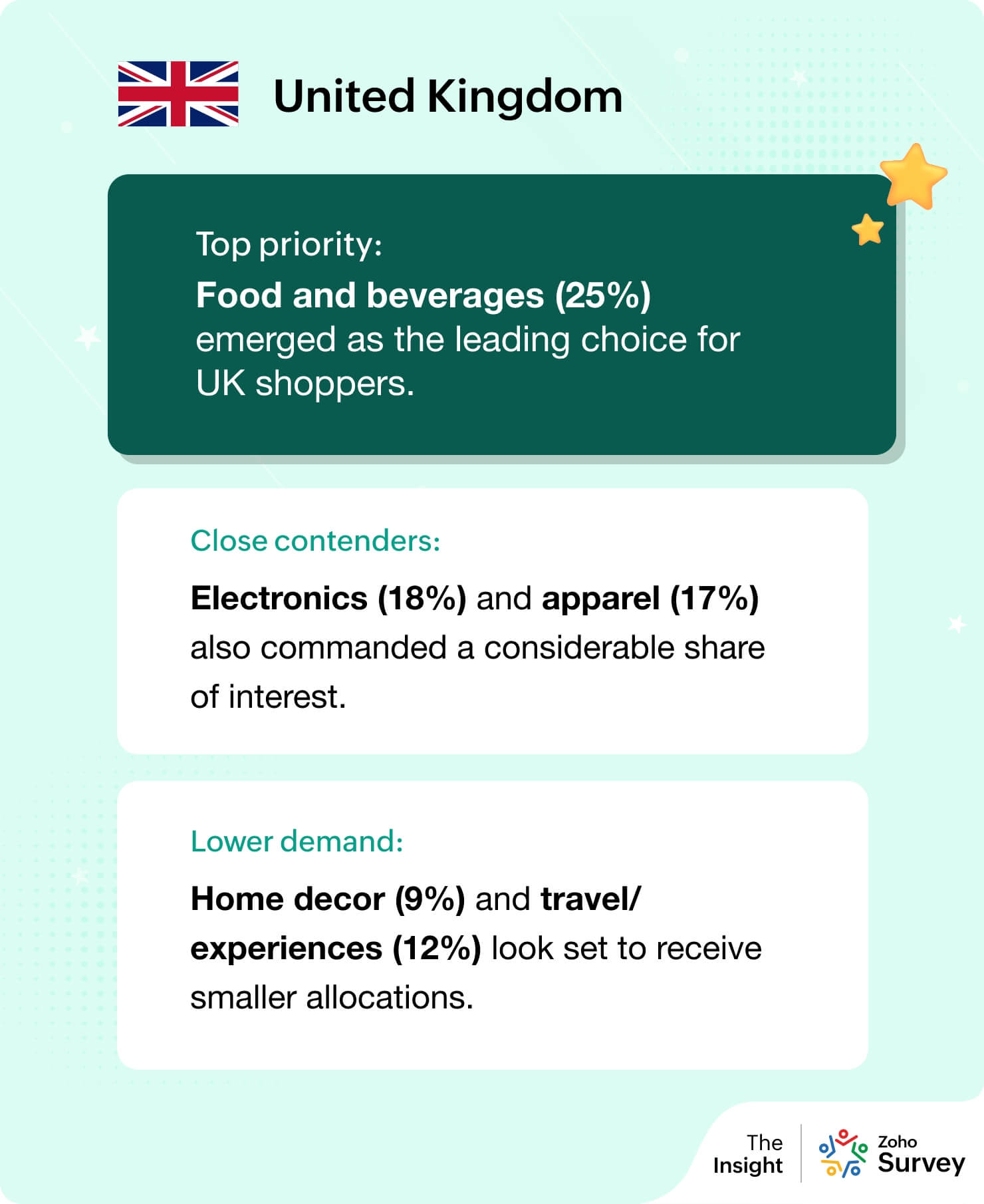

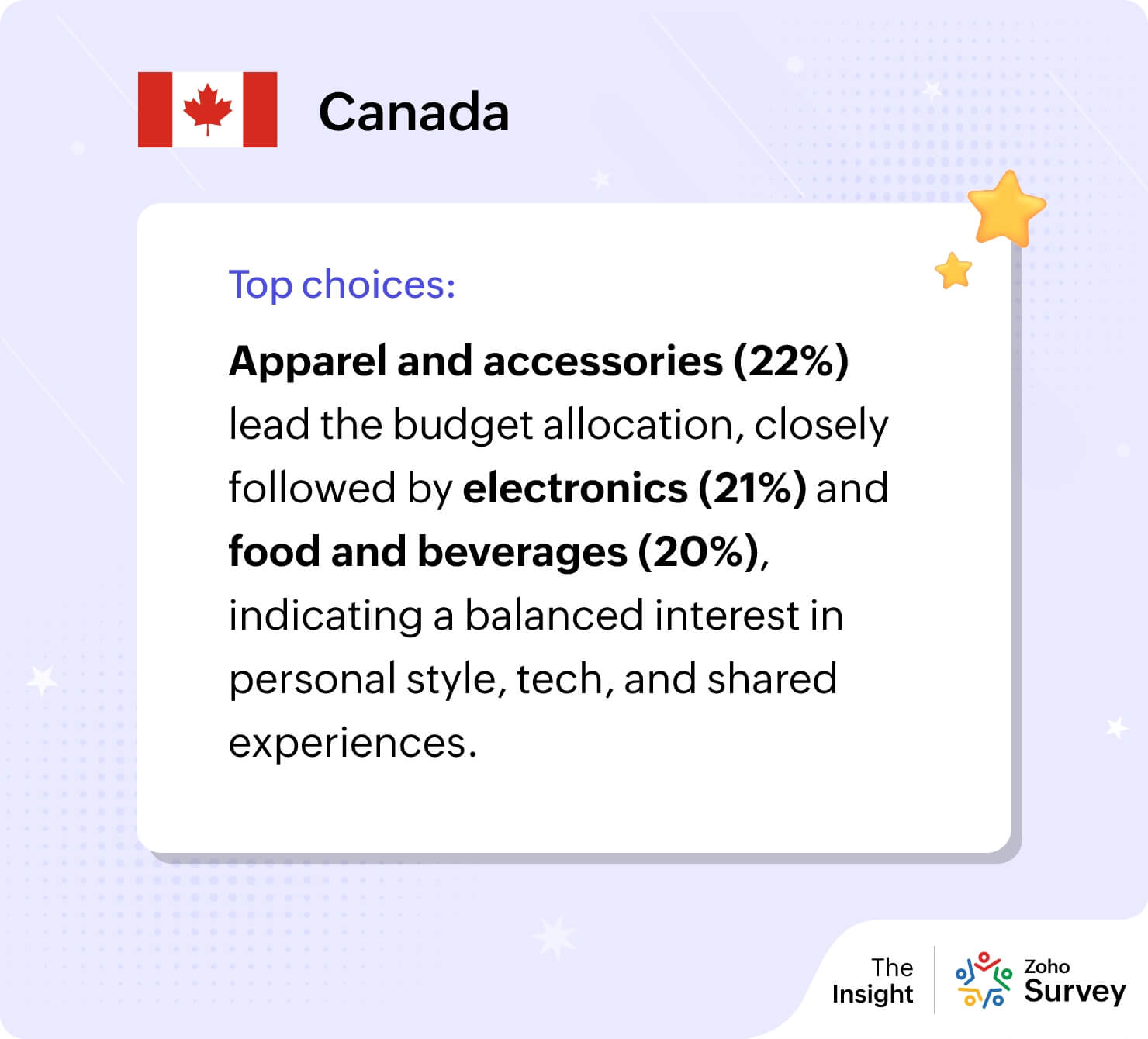

With holiday budgets set, the next question is: Where will shoppers put their money to work? Let’s take a closer look at how consumers are dividing their budgets across various categories.

Tip: Leverage regional spending insights to create product bundles that resonate. For example, in the UK, retailers can try pairing holiday-themed food baskets with cozy decor items like candles or blankets.

Shopping preferences

These days, a seamless shopping experience isn’t just nice to have—it’s essential. Shoppers are no longer willing to wait in long lines or deal with confusing checkout systems. And why should they?

Decision drivers:

Product quality, discounts, and promotions are the top factors that influence shopping decisions, followed closely by convenience. Personalization is least influential.

Checkout priorities:

Security first: Over 62% of shoppers said they prioritize secure transactions, even if it means a slower checkout experience. About 31% indicated they prefer a quicker shopping experience, focusing on convenience. Only 6% of shoppers said they’re unconcerned about online security during transactions.

Payment preferences:

Upfront payments: A notable 84% of shoppers prefer to pay in full for their holiday purchases. Only 10% opt for installments, while 6% choose the “buy now, pay later” option.

Discovering deals: How shoppers get notified

Online marketplaces (26%) lead as the primary source for holiday promotion discovery. Search engine ads and in-store promotions are also significant, each attracting 15% of shoppers. Despite the digital shift, 8% of shoppers still value word-of-mouth recommendations, highlighting its enduring importance.

Tip: To make the most of shoppers’ preferences, prioritize delivering a seamless and secure online experience, as consumers increasingly value safe transactions. Simultaneously, ensure your promotional efforts are heavily focused on online channels—particularly marketplaces and social media.

AI’s impact on the shopping experience

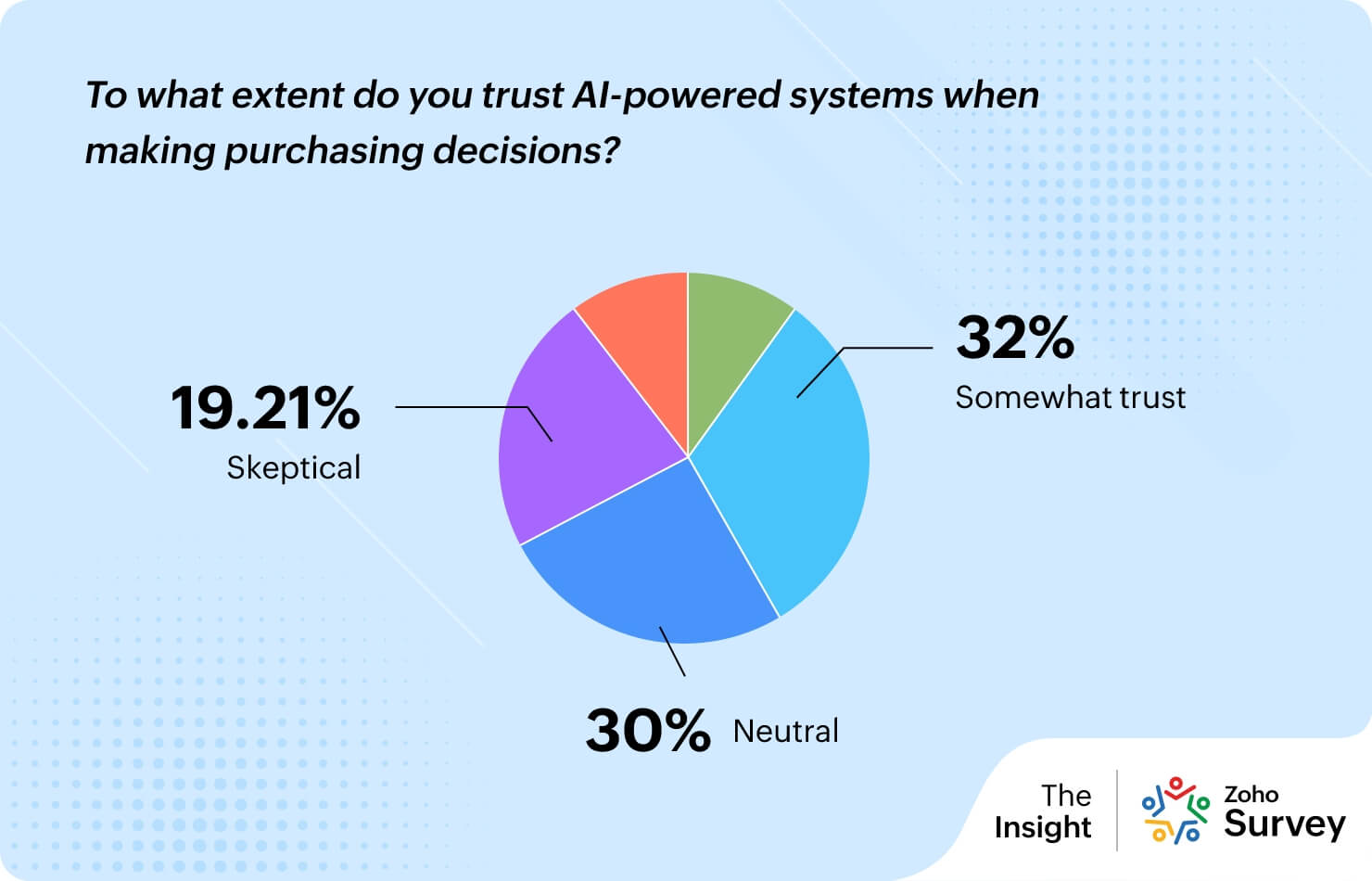

With AI-powered personalization making waves in retail, it’s essential to understand how much shoppers actually trust these technologies and the impact they feel it has on their shopping experience.

Trust in AI:

A significant portion of shoppers remains cautious, with only 9% expressing full trust in AI-driven recommendations. The majority either somewhat trust AI (32%) or remain neutral (30%), reflecting a lingering hesitation about relying on AI in decision-making.

Perceived impact:

Despite the caution, many shoppers do acknowledge the benefits of AI personalization. However, over half report feeling no noticeable improvement in their experience, pointing to an opportunity for retailers to refine and better target these efforts.

The human touch:

Are consumers ready to fully embrace chatbots, or do they crave human interaction when seeking assistance?

The data reveals a strong preference for human representatives, with over 40% of respondents stating that they wouldn’t trust a brand that relies solely on chatbots. Interestingly, half of the respondents feel that having a human is beneficial but not essential, suggesting that while people are reluctant, they remain open to automation.

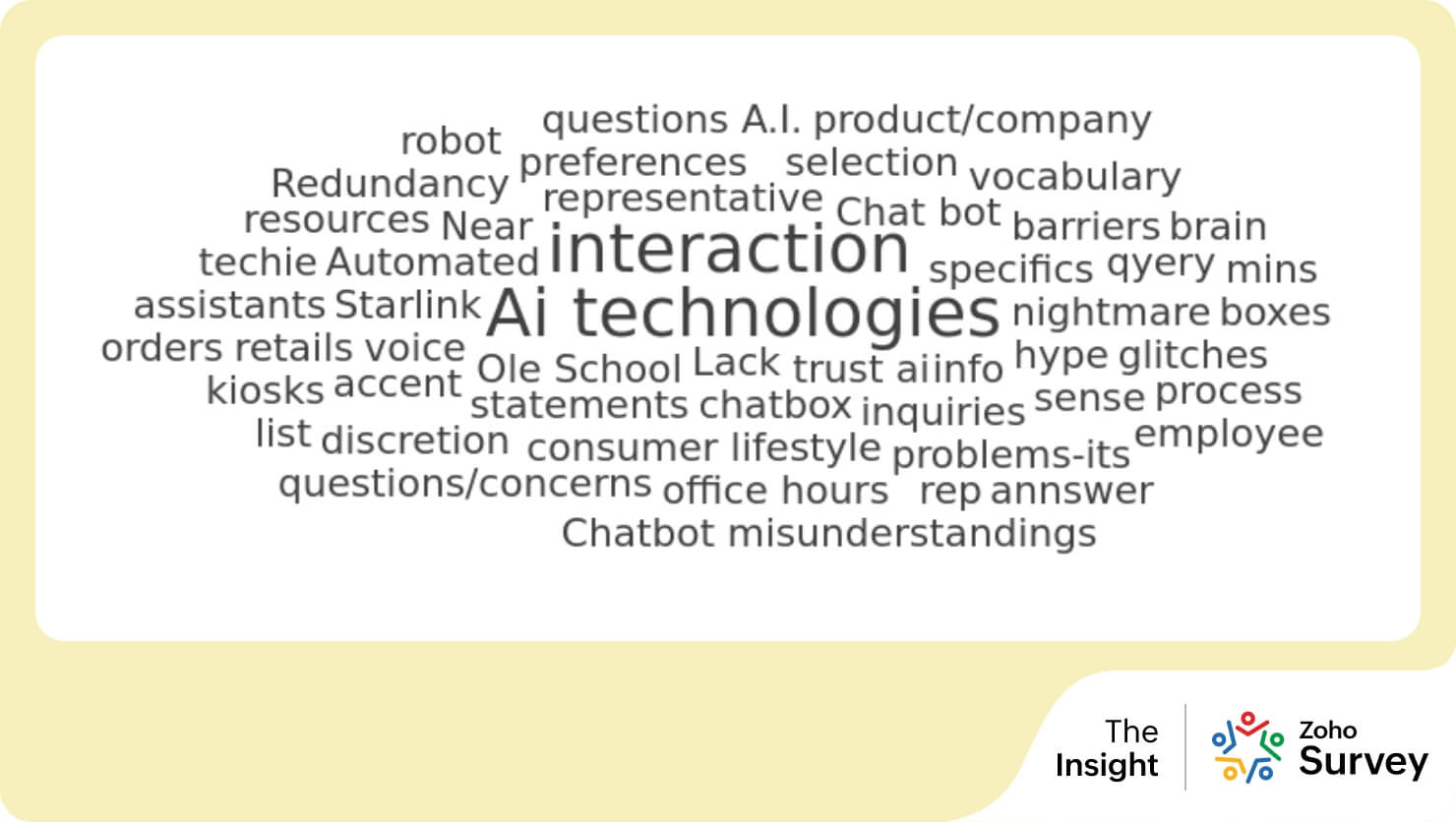

Challenges with AI chatbots

While AI chatbots aim to streamline customer support, many users feel let down by the lack of human nuance.

Responses like, “Lack of instant and intellectual response” and “Chatbots often misunderstand my questions and provide irrelevant answers, making it frustrating to get support,” reflect a recurring frustration.

Others share that they “just end up in a loop” or find that “Chatbots don’t understand human feelings and emotions.”

For some, it’s a matter of lifestyle, as one person noted, “They cater to city-bound consumer lifestyles. I live where the only internet we can get is Starlink.”

Another respondent expressed frustration with “Errors on discounted items—the machine keeps giving me the regular price.”

These voices reveal a collective sentiment: while AI-driven support has promise, for many, the human touch remains irreplaceable.

Tip: Leverage AI to streamline the basics but don’t lose sight of the human touch—where complexity arises, empathy shines.Tip: Leverage AI to streamline the basics but don’t lose sight of the human touch—where complexity arises, empathy shines.

Gifts galore

What really makes the holidays, holidays? It’s the thrill of gifts—both giving and receiving. But as a smart seller, you’re not just focused on the wrapping paper; you’re thinking about what’s going to fly off the shelves this season. Let’s dive into the mindset of today’s shoppers and see where the gift-giving trends are headed.

How much are shoppers spending on gifts?

This holiday season, shoppers across the US, Canada, and the UK are leaning towards low to moderate budgets for gift-giving. Canadians stand out with a slightly higher inclination towards the upper spending brackets.

What’s topping consumers’ wish lists?

The gift preferences reveal a consistent trend across the U.S., Canada, and the U.K., with apparel and accessories, electronics, and gift cards consistently ranking as popular choices. Notably, beauty and wellness products hold a strong appeal in the U.K., slightly differentiating their preferences from North American shoppers.

It’s interesting to note that 62% of respondents have dependent children at home; toys and gaming consoles are a top priority in holiday gifting among this group.

Brands shoppers love

This season, certain brands hold a special place in shoppers’ hearts, capturing everything from luxury to practicality across various categories:

Perfumes: “Dior is my favorite brand when it comes to perfumes. It’s a brand my family and I have known for years, and I love their products.” Others share similar admiration for Roja, Tom Ford, and Valentino Uomo, celebrated for their sophisticated scents.

Watches and accessories: “Classy, slim, and elegant Omega and Patek Philippe watches” are top picks for those with a taste for elegance, while Rolex and Cartier are preferred for their legacy and quality. Ted Baker handbags and Marc Jacobs bags also make the list, praised for their durability and design.

Fitness and tech: “Garmin—perfect for my fitness,” shares one respondent, while Apple’s AirPods and ecosystem receive appreciation for their integration and ease of use. Google Nest joins the ranks for its user-friendly tech.

Kitchen and home: Practical choices shine here with Breville for espresso machines, Delonghi for kitchen appliances, and Keurig for coffee. One customer dreams of the classic Hermes Birkin bag—“a timeless piece that never goes out of style.”

Gift baskets and food: From Prada-inspired savory and sweet baskets to Pepperidge Farm gift sets, shoppers are thinking of both elegant and cozy treats. Chardonnay also makes a popular appearance, valued for its versatility.

Dior perfumes, Apple AirPods, and Michael Kors bags make multiple appearances on respondents’ wish lists.

Tip: Since apparel is at the top of holiday wish lists, make sure to stock up on trendy winter wear and accessories to meet demand. And with electronics also ranking high, think about products that combine the two categories, like the latest smartwatches and fitness bands.

Turning the lens: The retailer’s perspective

So what are other store owners like yourself doing to get ready for the holiday rush? Dive into the strategies and preparations market players are putting in place to make the most of this holiday wave!

Gearing up

Retailers are pulling out all the stops to stay ahead this holiday season.

With inventory top of mind for 42% of businesses, ensuring shelves stay stocked and products flow smoothly is the season’s main focus. Training extra staff and refining marketing campaigns also stand out as priorities aimed at enhancing the customer journey. And with fewer retailers diving into new tech, execution this season is focused on practical approaches to keep operations running smoothly.

Many retailers are proactively gearing up for the holiday season by ordering products well in advance and strengthening collaborations with local suppliers. Some are even shifting focus to digital products and experiences to reduce dependence on physical stock.

Data priorities

We wanted to find out which types of data retailers find most valuable in crafting those tailored shopping experiences that keep customers coming back.

Not surprisingly, purchase history takes the lead—knowing what customers bought (or left behind in their carts) gives brands a direct line to understanding preferences. Browsing behavior and demographics come next, signaling that it’s not just what customers buy, but how they navigate and who they are that informs sellers’ efforts to increase engagement.

How AI is driving profitability in retail

Notably, fast-moving consumer goods are seeing the most substantial profit boosts, thanks to AI’s ability to manage inventory and predict demand with remarkable accuracy. Similarly, AI is driving profitability in seasonal items, allowing retailers to align stock levels precisely with holiday demand. Even long-tail products—those niche items that may not typically receive as much attention—are benefiting from AI-driven insights, helping sellers capture more value from every segment of their catalog.

Shopping outlook

As retailers gear up for the holiday season, their outlook on the online versus in-store shopping dynamic is varied.

Tip: Prioritize making your inventory available online to meet the growing demand for convenience, but don’t overlook the in-store experience. A well-stocked, inviting store could draw in shoppers who crave more than just a quick click. Think of it as a dual strategy: seamless online access paired with a memorable in-store ambiance for those looking to shop both ways.

Your roadmap to the 2024 holiday season

The goal of this survey was simple to give you a clear view of what’s driving shoppers and how fellow businesses are gearing up for the season. We hope these insights will help you not just be better prepared for this year’s holiday season but also create long-term value by strategically aligning with your customers’ shopping habits.

Whether you’re optimizing stock, offering more personalized experiences, or sharpening your marketing game, these insights can be your secret weapon. Keep your ear to the ground, adapt quickly, and put the customer experience front and center.

Now that you’ve got the data, it’s time to make this season your best one yet!