Social Security Summary

The Social Security Summary Report provides a concise overview of various benefits offered to employees, detailing both employee and employer contributions. For each benefit, the report displays the benefit name, the amount contributed by employees, the corresponding contribution made by the employer, and the total combined contribution.

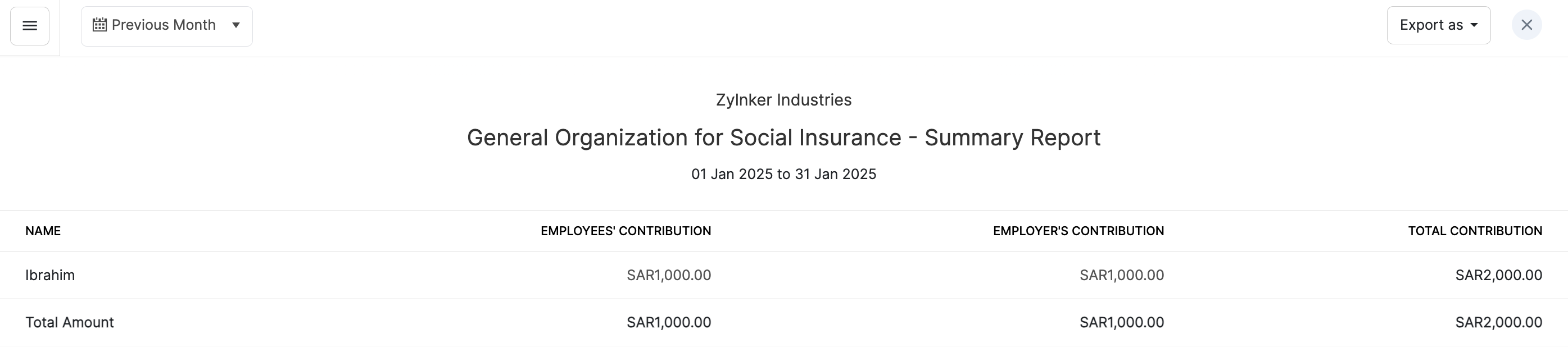

General Organization for Social Insurance (GOSI) - Summary Report

The General Organization for Social Insurance (GOSI) - Summary Report offers a comprehensive overview of social insurance contributions as mandated by Saudi Arabia’s social security system. GOSI is a government organization in the Kingdom of Saudi Arabia responsible for overseeing social insurance programs, which provide financial support to employees in cases of retirement, disability, injury, or death.

This report tracks the contributions made by both employees and employers over a specified period, ensuring compliance with local labor regulations. It also helps organizations monitor their social insurance obligations and manage payroll contributions accurately.

Columns in GOSI - Summary Report

The columns in this report include:

| Column | Description |

|---|---|

| Name | This column displays the names of employees enrolled in the GOSI scheme. |

| Employees’ Contribution | This column reflects the mandatory contribution made by each employee toward their social insurance fund. |

| Employer’s Contribution | This column outlines the employer’s required contribution on behalf of the employee, as per GOSI regulations. |

| Total Contribution | This column presents the combined total of both employee and employer contributions toward GOSI. |

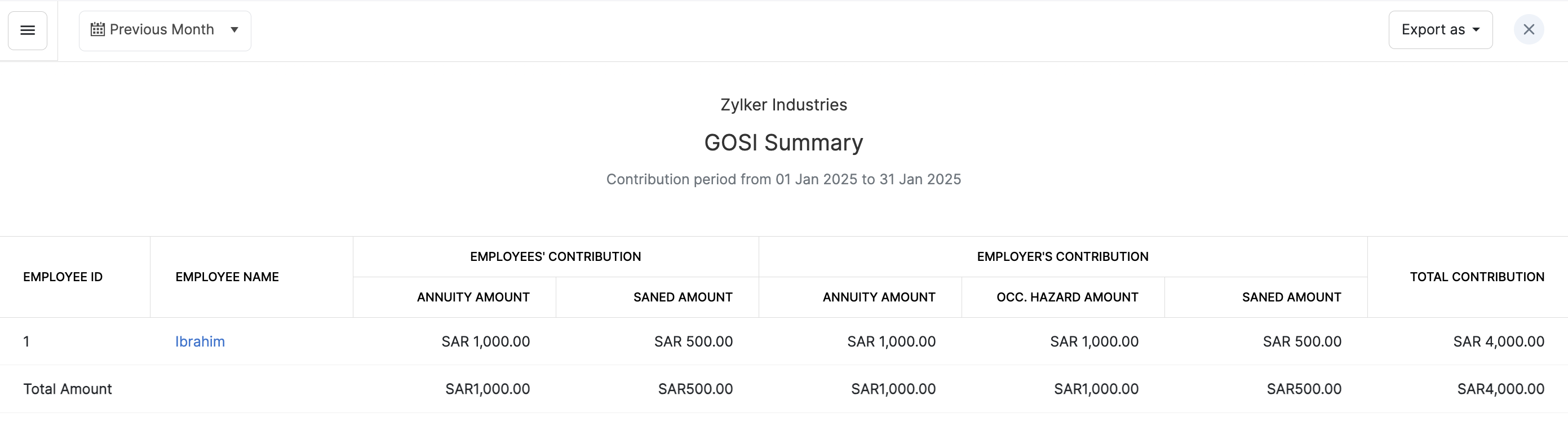

General Organization for Social Insurance (GOSI) - Detailed Summary Report

The General Organization for Social Insurance (GOSI) - Detailed Summary Report offers an in-depth breakdown of social insurance contributions as mandated by Saudi Arabia’s GOSI regulations. While the standard GOSI report provides a high-level overview of total contributions made by both employees and employers, the Detailed Summary Report goes a step further by categorizing these contributions into specific components—such as annuity, SANED (unemployment insurance), and occupational hazard amounts.

This granular view allows organizations to track each element of their social insurance obligations separately, ensuring greater compliance accuracy and offering better insights into the financial contributions made by both parties. This level of detail is particularly useful for audits, financial planning, and internal reviews.

Columns in the GOSI - Detailed Summary Report

The columns in this report include:

| Column | Description |

|---|---|

| Employee ID | This column uniquely identifies each employee, serving as a reference for individual payroll records. |

| Employee Name | Displays the names of employees enrolled in the GOSI program for easy identification. |

| Employees’ Contribution | Reflects the total contribution made by employees, broken down into: |

| - Annuity Amount | The amount contributed by employees toward their retirement fund. |

| - SANED Amount | The contribution made by employees toward the unemployment insurance program (SANED). |

| Employer’s Contribution | Reflects the total contribution made by employers on behalf of employees, including: |

| - Annuity Amount | The employer’s contribution toward the employee’s retirement fund. |

| - Occupational Hazard Amount | The amount contributed by employers for coverage against workplace-related injuries or hazards. |

| - SANED Amount | The employer’s contribution to the unemployment insurance program. |

| Total Contribution | The sum of both employee and employer contributions across all categories, representing the total GOSI payment. |

Similarly, you will be able to generate report summaries for SPF, PIFFS, SIO, GRSIA, and GPSSA summaries based on employees’ origin country.

Columns in other Social Security Benefits

| Column | Description |

|---|---|

| Benefit Name | This column lists the specific social security benefits provided to employees. |

| Employees’ Contribution | This field indicates the monetary amount deducted from employees’ salaries for a particular benefit, showcasing the individual financial responsibility of each employee. |

| Employer’s Contribution | This column displays the corresponding amount contributed by the employer towards the specified benefit. |

| Total Contribution | The total contribution is the sum of both the employees’ and employers’ contributions. It provides a comprehensive view of the overall financial investment in each benefit. |