Categories

- What is a cash flow statement?

- Why does it matter?

- Where does it fit in financial reporting?

- Cash flow statement methods

- The two types of cash flow statement accounting frameworks

- Key sections of a cash flow statement

- Basic cash flow statement categorization

- Preparing a cash flow statement

- How the indirect cash flow statement method looks in Zoho Tables

- So what’s the bottom line?

- Ready to get started?

What is a cash flow statement?

A cash flow statement is a financial report that tracks the cash inflows and outflows of a business over a specific period. It provides insights into a company's liquidity and overall financial health. Essentially, it serves as a map of cash movements within the business, helping you understand how money flows in and out.

Why does it matter?

Clearly detailing actual cash inflows and outflows helps stakeholders understand whether a company can sustain its operations, invest in growth, and meet its obligations.

Cash flow statements are essential for businesses of all sizes. Similar to a balance sheet, they're utilized by owners, managers, and investors to assess a company's financial health. By revealing the sources of cash inflows and the destinations of cash outflows, this statement allows a company to plan effectively, ensuring it has enough cash to cover expenses and pursue expansion in the short and long term.

Positive trends in operating cash flow generally signal a healthy, self-sustaining business, while persistent negative cash flow is a red flag.

According to Harvard Business School, some business leaders argue that cash flow statements are the most important among the three financial reports that are required for assessing the financial health of an organization.

Where does it fit in financial reporting?

The cash flow statement is one of the three core components of financial reporting, alongside balance sheets and income statements (aka profit and loss statements). Let's briefly look at what they are:

1. Balance sheet

This report displays what the company owns and owes at a specific point in time.

2. Profit and loss statement

This report details how much the company earned and spent over a given period.

3. Cash flow statement

This report shows the actual cash movements during that same period.

Together, these reports provide a comprehensive view of a company’s financial position and performance.

Cash flow statement methods

This refers to how the cash flow statement's report or calculation is prepared.

Direct method

This method lists actual cash transactions.

Indirect method

This method adjusts net profit for non-cash items and changes in working capital.

The two types of cash flow statement accounting frameworks

There are two main global standards of accounting frameworks that govern how a cash flow statement is prepared and presented. In simple terms, this means what is allowed or recommended, such as which method to use, how to classify certain items, and more.

Now, let's briefly look at what they are:

1. IFRS (International Financial Reporting Standards)

This framework is issued by the International Accounting Standards Board (IASB) and is used in over 140 countries, including the EU and India.

Key features

This framework allows for both direct and indirect methods for reporting operating cash flow (but encourages the direct method).

It provides more flexibility in classifying interest and dividends:

Interest paid:

This can be categorized as either operating or financing activities.

Interest received & dividends received:

This can be classified as either operating or investing activities.

Dividends paid:

This can be categorized as either operating or financing activities.

It emphasizes the

2. US GAAP (Generally Accepted Accounting Principles)

This framework is issued by the Financial Accounting Standards Board (FASB) and is used primarily in the United States.

Key features

This framework allows both direct and indirect methods, but indirect is more commonly used.

It provides more rigid classifications:

Interest paid & received:

This will be categorized under operating activities

Dividends received:

This will be categorized under operating activities

Dividends paid:

This will be categorized under financing activities

It emphasizes rules and detailed guidance.

Key Sections of a Cash Flow Statement

There are three sections in a cash flow statement. Let's look at them:

Operating Activities

This reflects the core day-to-day business activities that generate revenue and expenses, like selling products or providing services.

Investing Activities

This reflects cash flows related to the acquisition and disposal of long-term assets and investments. These are not part of the company's core operations but are crucial for its growth and expansion.

Note: This activity usually shows negative cash flow in growing companies (because they’re investing for future returns). It also helps investors assess how much the company is spending on its future operations.

Financing Activities

This represents cash flows related to how a business raises capital and repays it. This means interactions with the owners and creditors of the company and shows how a company funds its operations and growth outside of its core business.

Basic cash flow statement categorization

Cash flow categorization by type

When preparing the statement, each cash flow is categorized by its type. As mentioned earlier, accounting rules provide guidance on this.

According to IFRS, if a cash flow isn’t classed as investing or financing, it's considered operating. This means that regular items like sales revenue, rent, payroll, and interest on loans (related to everyday business) fall into operating.

Cash related to long-term assets, such as buying or selling factories, equipment, or securities, is classified as investing.

Cash related to changes in equity or debt is labeled as financing.

Cash flow categorization by handling non-cash items

Another key part of this categorization is how non-cash items are handled. For example, depreciation is a non-cash expense—it lowers net income but does not involve cash.

Using the indirect method, we add depreciation back to net income because it doesn't use cash.

Similarly, if a company sells goods on credit, we subtract the increase in accounts receivable from net income to show that those sales haven’t brought in cash yet.

Essentially, the cash flow statement corrects the effects of accrual accounting: it adds back non-cash charges and adjusts for timing differences, showing only actual cash movements. Items that don’t involve cash at all, like issuing stock for a non-cash asset, are not included in cash flows (but they are usually mentioned elsewhere).

Preparing a Cash Flow Statement

Gather financial data.

Choose the direct or indirect method.

Calculate cash from operating activities.

Calculate cash from investing activities.

Calculate cash from financing activities.

Reconcile totals.

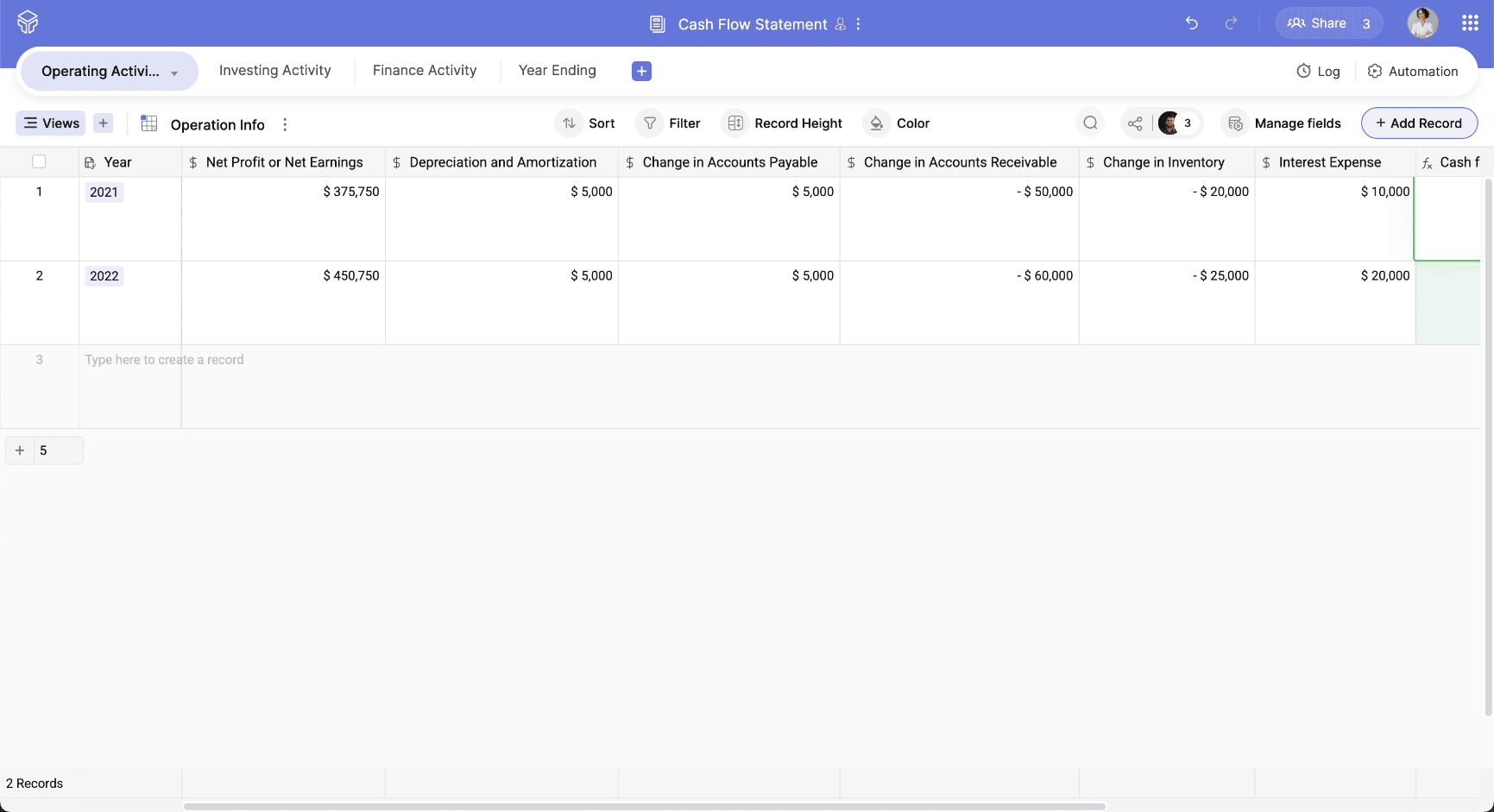

How the indirect cash flow statement method looks in Zoho Tables

Here we've used the indirect method, where it starts with the net profit and adjusts for:

Non-cash items (like depreciation)

Changes in working capital (like receivables, payables)

Zoho Tables' cash flow statement template with sample content via the indirect method

Net Income

$375,750

+ Depreciation and amortization

+ $5,000

– Increase in accounts receivable

- $50,000

+ Increase in accounts payable

+ $5,000

– Inventory increase

- $20,000

Interest expense

+ $10,000

Net cash from operating activities

$325,750

Cash flow statement for 2021 from operating activities in a tabular format

Please Note: Operating activities are the most sustainable source of cash flow. A positive cash flow signals healthy finances.

So what’s the bottom line?

Mastering cash flow statements empowers businesses of all sizes to take control of their finances, make informed decisions, and plan confidently for the future.

Ready to get started?

Start tracking your business's cash flow with Zoho Tables' free cash flow statement template and simplify your financial planning today!

Get started in 3 steps

Pick a template

Load the template in Zoho Tables

Customize it as needed