- HOME

- Taxes & compliance

- Learn about VAT Registration in Saudi Arabia

Learn about VAT Registration in Saudi Arabia

Business owners in the KSA have started registering for VAT from October, 2017. This guide explains the process involved in registering your business for VAT.

Who should register under VAT?

The thresholds for businesses to register for VAT are based on the value of their taxable supplies, which include standard-rated supplies, zero-rated supplies, reverse charges received, and imported goods.

- Mandatory registration

Businesses that make an annual taxable supply of goods and services greater than 375,000 SAR are required to register for VAT with the ZATCA (Zakat, Tax and Customs Authority). The mandatory registration threshold is calculated on the basis of the taxable turnover in either the past twelve months or the upcoming twelve months.

- Voluntary registration

Voluntary registration provides significant benefits for companies, since it allows the deduction of input tax. There are two groups for whom VAT is optional:

Businesses which make an annual taxable supply of goods and services greater than 187,500 SAR but less than 375,000 SAR are eligible to register voluntarily.

Firms that have taxable sales greater than 375,000 SAR and exclusively sell zero-rated products (such as certain medical products, international transportation, and exports to non-GCC countries) can register voluntarily.

Businesses generating less than 187,500 SAR annual revenue, and businesses that provide goods and services which are exempt from VAT, cannot register for VAT.

Non-KSA resident registration

Non-KSA residents who make taxable sales and purchases in the Kingdom are required to register for and pay VAT. In order to register for VAT, non-resident businesses must appoint a tax representative based in KSA.

Once the representative is approved by ZATCA, the representative will be able to file VAT returns, make VAT payments, and correspond with ZATCA on the taxpayer’s behalf. So if the business fails to pay tax for an extended period of time, the tax representative may be required to pay it.

Each non-KSA business should provide the following details of the tax representative:

- Tax Identification Number (if they have one)

- ID number (such as a Saudi, Iqama, or GCC ID)

- Mobile number

- Email address

VAT group registration

Two or more legal people are allowed to register as a group if the same entity or individual owns at least 50% or more than the other group members. These groups should apply using ZATCA’s electronic application form.

For a group to be eligible, the following conditions must be met:

- All group members must perform an economic activity

- All group members must be legal residents of the Kingdom of Saudi Arabia

- At least one member must independently meet the taxable sales threshold for VAT registration

Once the group’s application is approved for registration, VAT will be calculated on a combined basis as follows:

Net VAT of the group = Combined output VAT of the group members - Combined input VAT of the group members

VAT registration database

A database containing the VAT registration numbers of suppliers and customers will be available in the ZATCA portal. Business owners can use this database to verify the registration numbers of their suppliers or customers.

Registration deadlines

ZATCA has already opened up VAT registration for businesses. The deadline for VAT registration depends on the annual taxable sales of the business:

- Businesses with annual taxable sales over 1,000,000 SAR must register by December 20, 2017,

- Businesses with annual taxable sales less than 3,75,000 SAR and under 1,000,000 SAR must register by December 20, 2018.

Registration process

To initiate the registration process, the business owner should submit an application form.

VAT registration application

An application should be filled by businesses registering under VAT. The form contains the following details:

- The official name of the person

- Physical address of regular abode or place of business

- Email address

- Existing electronic identification number issued by the ZATCA (if any)

- Commercial Registration (CR) number

- Value of annual supplies or annual expenses

- Effective date of registration, or alternative date as requested

The person applying for registration may be asked by the ZATCA officials to provide documentation to validate the information furnished. The documents should be submitted within 20 days following the date of request.

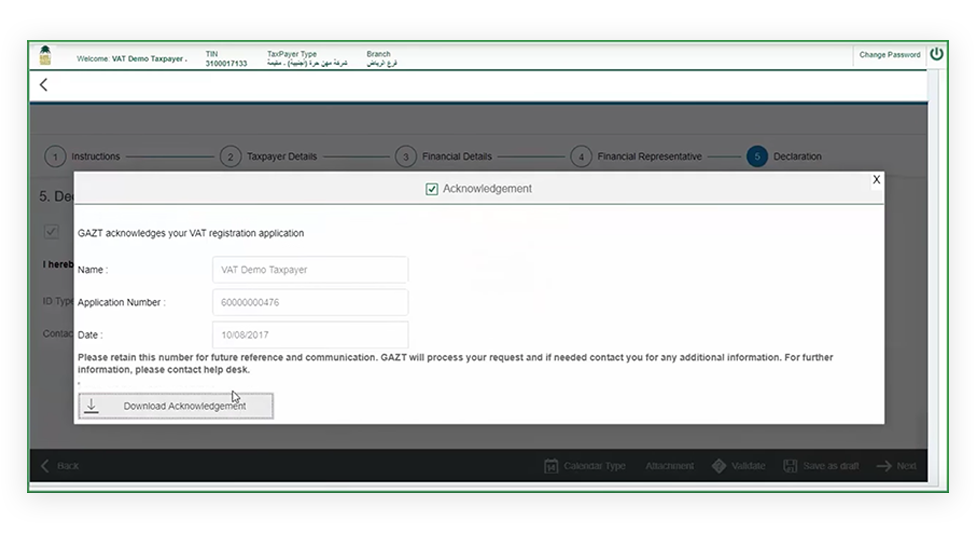

Once the application is accepted by the ZATCA officials, the applicant will receive a certificate of registration. This certificate will contain the TIN (Tax Identification Number) and the date on which registration takes effect.

Registration procedure

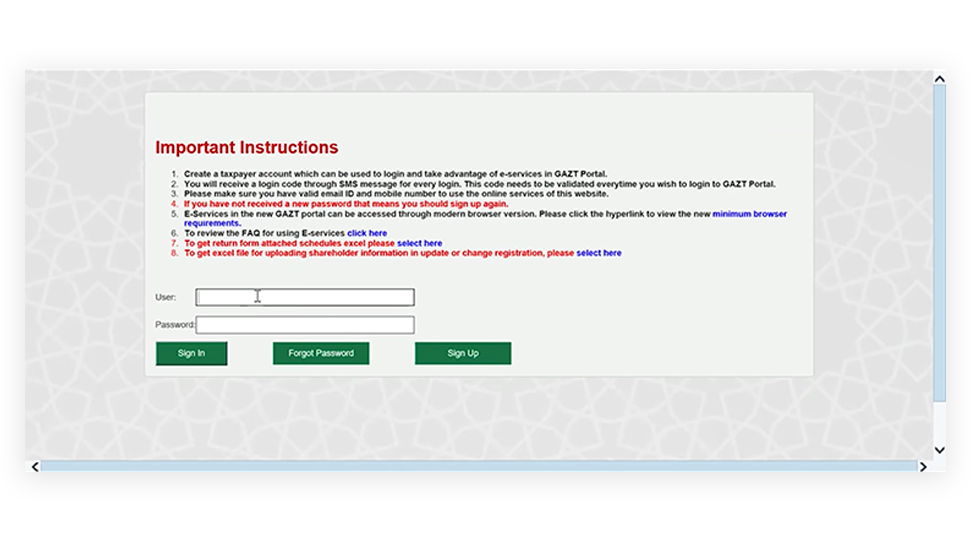

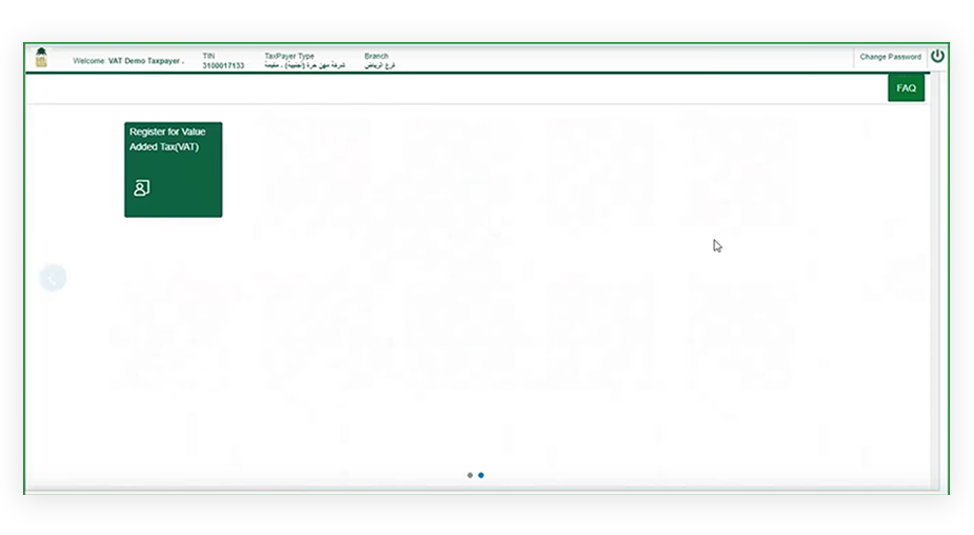

Businesses can register by logging on to the online VAT registration portal on ZATCA website and following the procedure stated below.

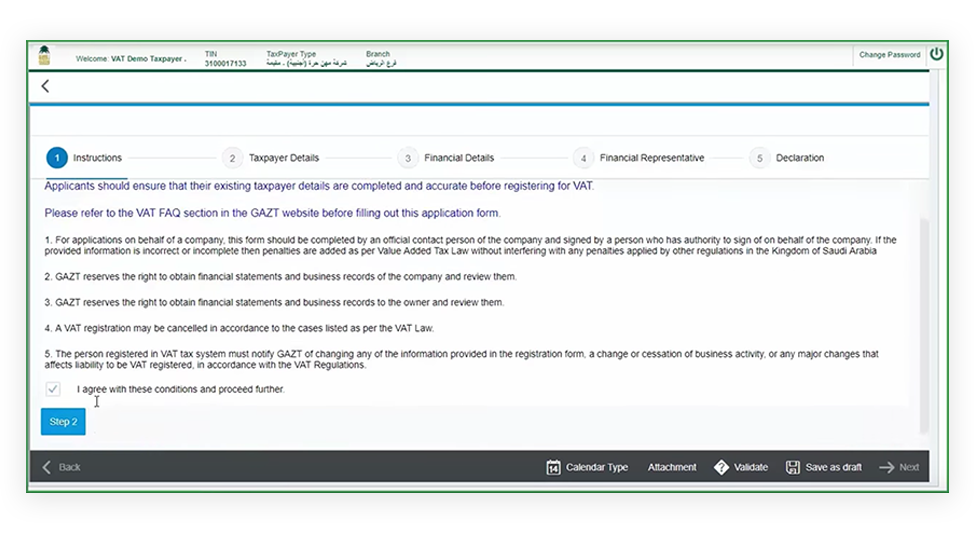

- Home page

This page contains instructions to help taxpayers with the registration process.

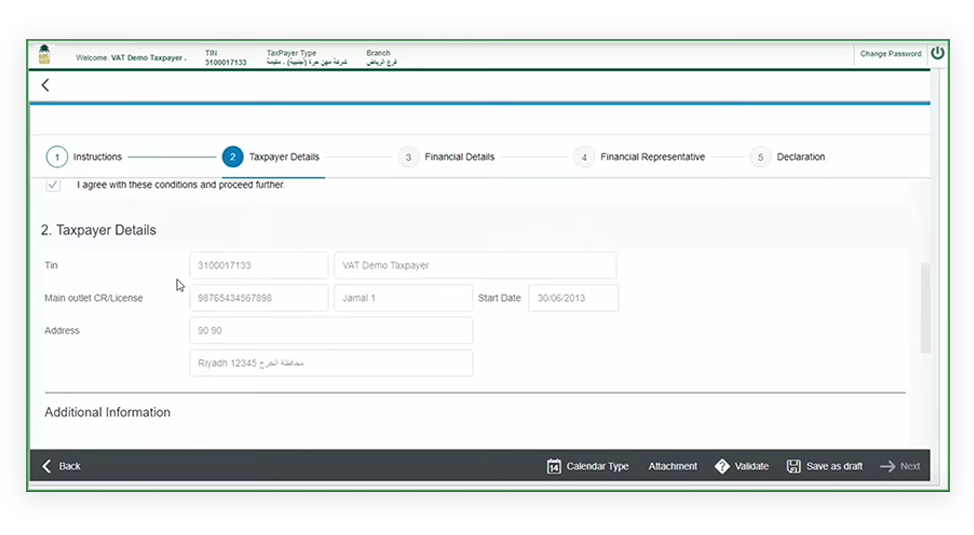

- Taxpayer details

In the second page, the taxpayer must furnish details like:

a. The IBAN (International Bank Account Number) to be associated with the business’s VAT account.

b. The date on which the business became eligible for VAT.

c. Whether the business is involved in import or export of goods/services.

Certain details like the business’s TIN (Tax Identification Number), CR (Commercial Registration number), and address are also listed. These details will be auto-filled by ZATCA based on pre-existing records for each business.

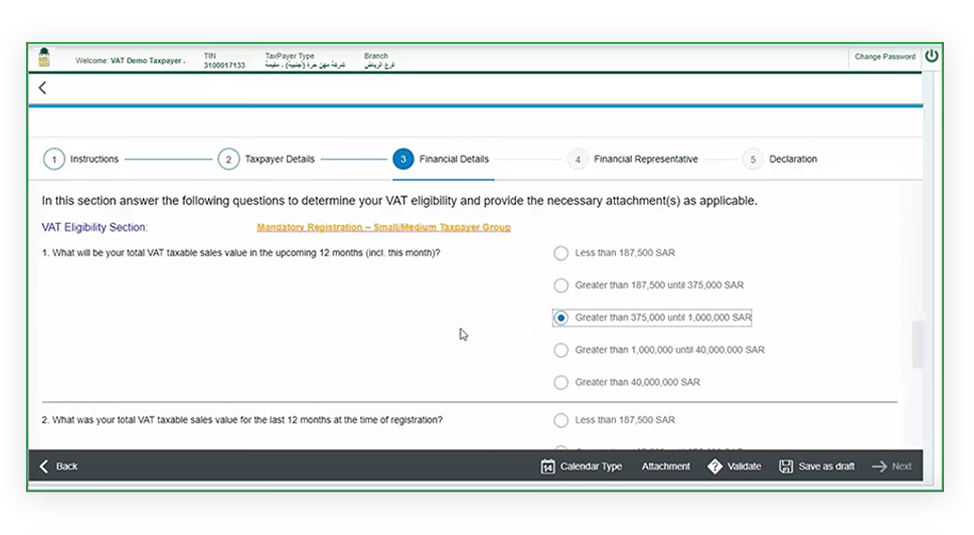

- Financial details

The third page collects the following financial details, based on which the business’s VAT eligibility will be assessed:

- VAT taxable supplies (expected over the next 12 months)

- VAT taxable supplies (past 12 months)

- VAT taxable purchases (expected over the next 12 months)

- VAT taxable purchases (past 12 months)

Documents validating the revenue and expense claims (income statements, custom reports, etc) can be attached. Attaching these documents is encouraged, but not mandatory.

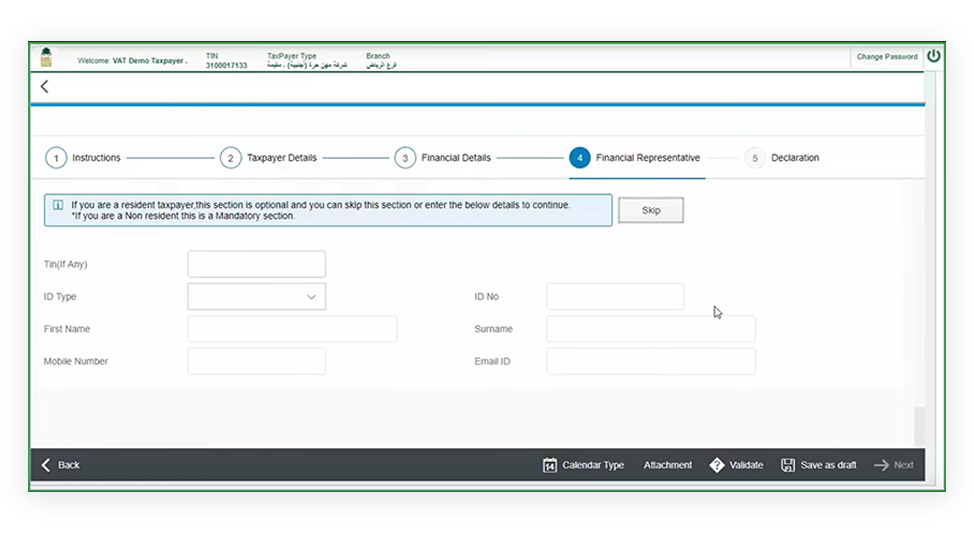

Financial representative details (only mandatory if you are a non-KSA resident)

Taxable non-KSA businesses must provide information regarding their designated tax representative in the Kingdom.

Each non-KSA business should provide the following details about its tax representative:

- Tax Identification Number (if they have one)

- ID number (such as a Saudi, Iqama, or GCC ID)

- Mobile number

Email address

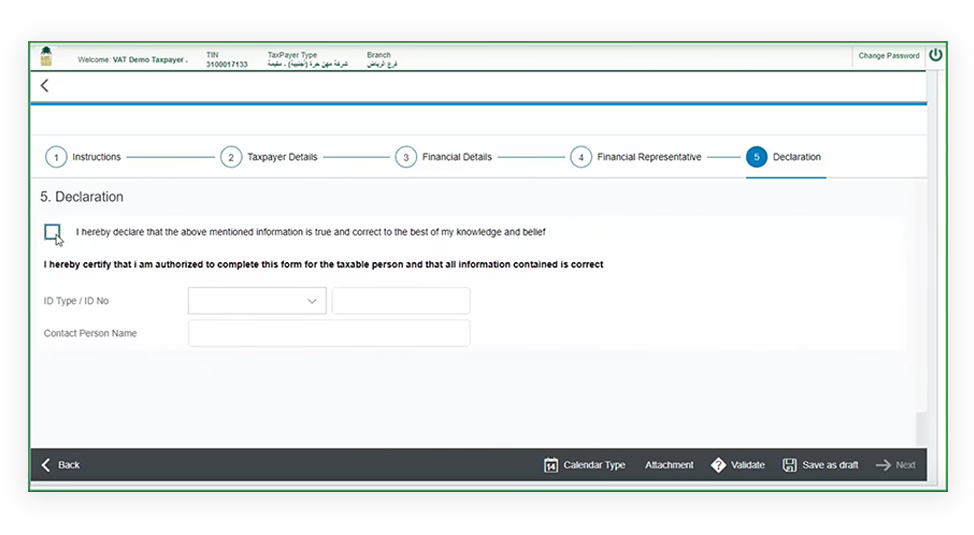

Declaration

Finally, the applicant should confirm the accuracy of the submitted information and provide their name and ID number.

Deregistration

Applications for deregistration should be submitted through the ZATCA e-portal. The taxpayer will be asked to attach certain documents as evidence of their eligibility to deregister.

Mandatory deregistration

- A taxable person should apply to deregister within 30 days if any of the following applies:

- a. If they no longer carry out economic activities

- b. If they are no longer considered a legal entity.

In these cases, the Authority will determine the date on which the deregistration will take effect.

A non-resident must apply to deregister if they have not made any taxable supplies in KSA in the last 12 months.

A resident must be registered for at least 12 months before deregisteingr. They can apply for deregistration if the following three conditions are satisfied:

a. The total value of annual supplies/expenses in the last 12 months does not exceed the voluntary registration threshold.

b. The total value of annual supplies made in KSA, or the total expenses in the last 24 months, does not exceed the mandatory registration threshold.

c. The total value of annual supplies/expenses in that particular month and the subsequent 11 months is not expected to exceed the voluntary registration threshold.

Voluntary deregistration

A taxpayer can opt for deregistration if:

- The value of their taxable sales in the past 12 months is between 187,500 and 375,000 SAR.

- The value of their taxable sales in the next 12 months (including the current month) is between 187,500 and 375,000 SAR.