- HOME

- Taxes & compliance

- Input Credit Deductions & Refunds in Saudi Arabia

Input Credit Deductions & Refunds in Saudi Arabia

Claiming input credit

What is input credit?

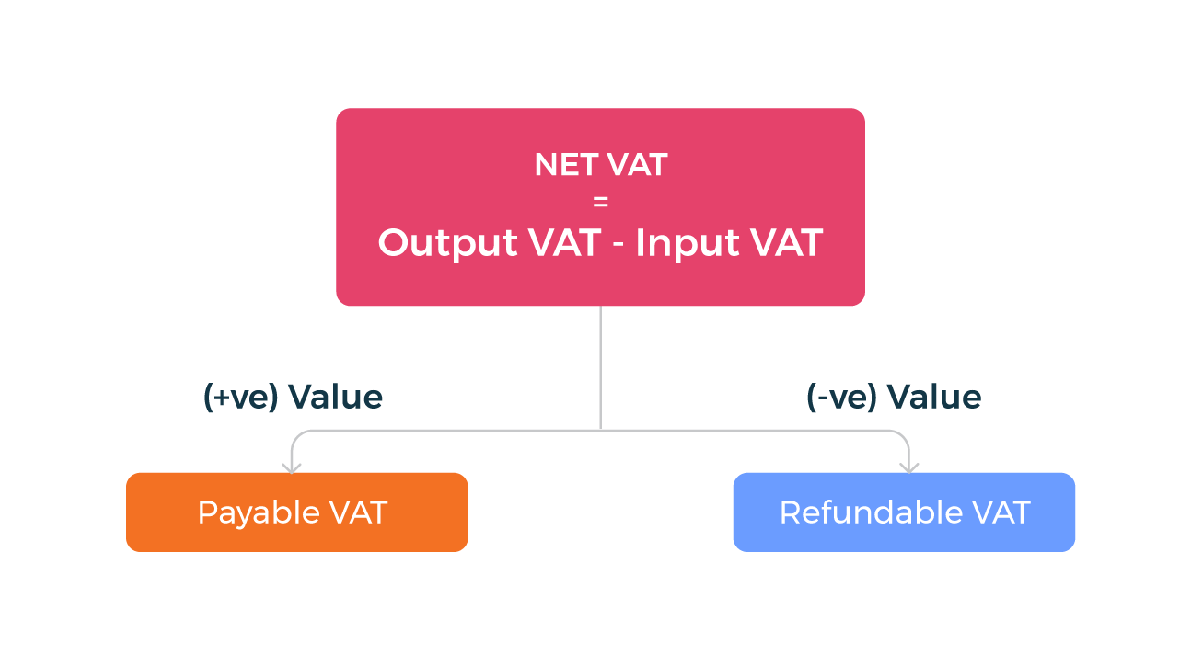

Let’s take a look at this flowchart to understand input and output taxes.

Input tax: The tax applied on the purchase of goods or services.

Output tax: The tax applied on the sale of goods or services.

When a business’s net VAT is calculated, if the value is positive, then the business owner owes VAT on their account. If the value is negative, the business owner can claim input credit.The VAT taxation structure allows businesses to claim input credits for the tax they paid while purchasing capital goods for their firm.

Input VAT deductions

Any business registered under the VAT regime can get a deduction on the input VAT on the goods and services it has purchased from registered suppliers. The following categories are eligible for input VAT deduction:

- Taxable supplies:

Standard-rated and zero-rated goods and services are eligible for input VAT deduction. This does not include purchases of exempt goods and services.

- Internal supplies:

Input VAT must be paid on supplies imported from other GCC states and internal supplies of goods within the KSA. This input VAT is eligible for deduction.

Note: If goods are purchased from a supplier located in a GCC state that has not implemented VAT, the supply will be treated as non-GCC import.

- Taxable imports from outside the GCC:

VAT paid on taxable supplies imported from non-GCC states can be deducted, if the import involves zero-rated or standard-rated goods or services.

Input VAT deductions on capital assets

Input tax on capital assets may be eligible for deduction, based on the registration status of the business owner.

If the capital assets were bought after VAT registration, eligibility depends on whether payment was made in full or in installments:

If the full amount is paid upon the purchase of the asset, the entire input tax amount can be deducted immediately.

If the payment is made in installments, VAT will be accounted for with each periodic payment, and only the corresponding amount of input tax can be deducted each time.

If the asset was purchased before VAT registration and tax was paid on the purchase, input VAT can be deducted after the business owner registers.

Timing of input VAT deductions

The timing of input VAT deductions depends on the accounting practice used by the business:

If the business uses the accrual accounting method, the input VAT for each purchase will be deducted in the tax period during which an invoice is issued for the supply.

If the business uses the cash accounting method, the input VAT for each purchase will be deducted in the tax period in which the invoice amount is paid.

Transactions ineligible for input VAT deduction

Input VAT paid on the following purchases is not eligible for deduction:

Sports, entertainment or cultural services

Catering service in hotels, restaurants, and similar venues

Restricted motor vehicles (vehicles that are not exclusively used for business purposes or intended for resale)

Goods or services used for non-business or personal purposes

Eligibility for VAT refunds

There are three situations in which taxpayers are eligible for VAT refunds. In all three cases, the taxpayer needs to request the refund specifically. Otherwise, the amount in the VAT account is carried forward to the next tax period.

- Net tax due is a negative amount

If the total VAT amount owed by a business is negative for a given tax period, the business is due a refund.

- History of excess VAT payment

If a business has paid ZATCA more than it owed, it can claim a refund.

- Credit balance

If a business has a positive balance in its VAT account, it can claim that amount as a refund.

Direct refunds vs. tax credits

While filing VAT returns, business owners can request to receive any refunds associated with that particular tax return in the form of tax credits. Once this is done, ZATCA will automatically carry the refundable amount forward to be applied on the next VAT return (or any other suitable VAT return filed by the business owner in the future).