- HOME

- Category: Taxes & compliance

Latest from us

Filter By

Clear filter

Taxes & compliance

Understanding the MSME 45-day payment rule in India: How Zoho Books can help

Taxes & compliance

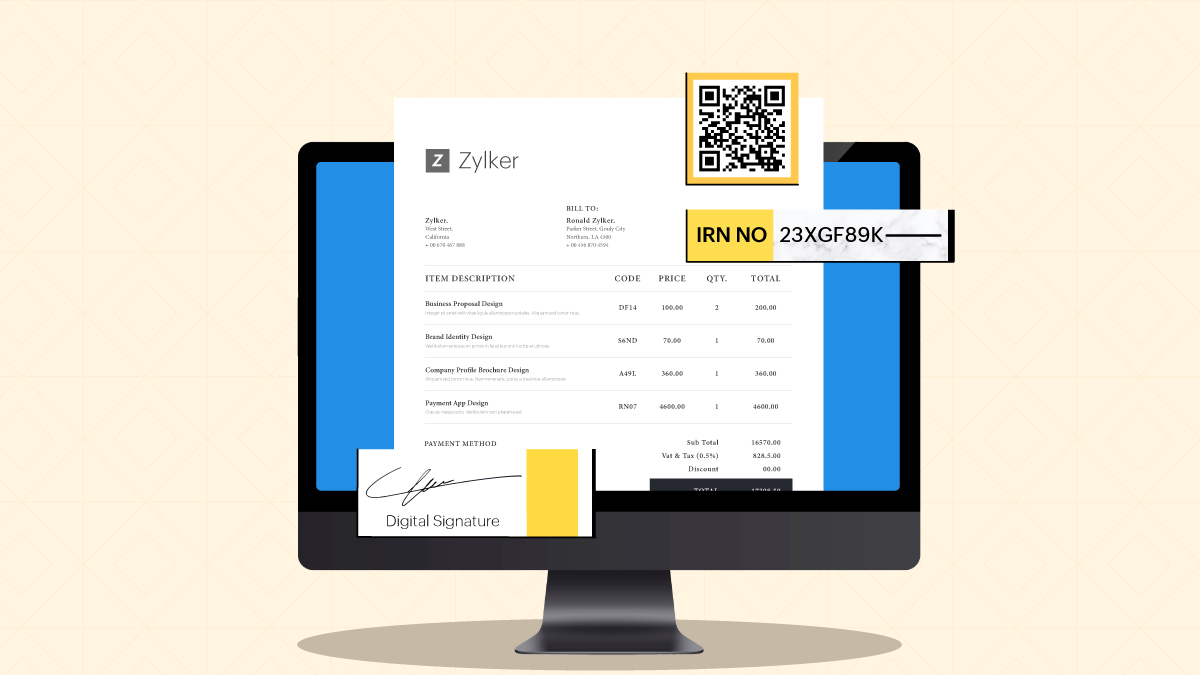

Streamline your transactions with these important e-invoicing features

Taxes & compliance

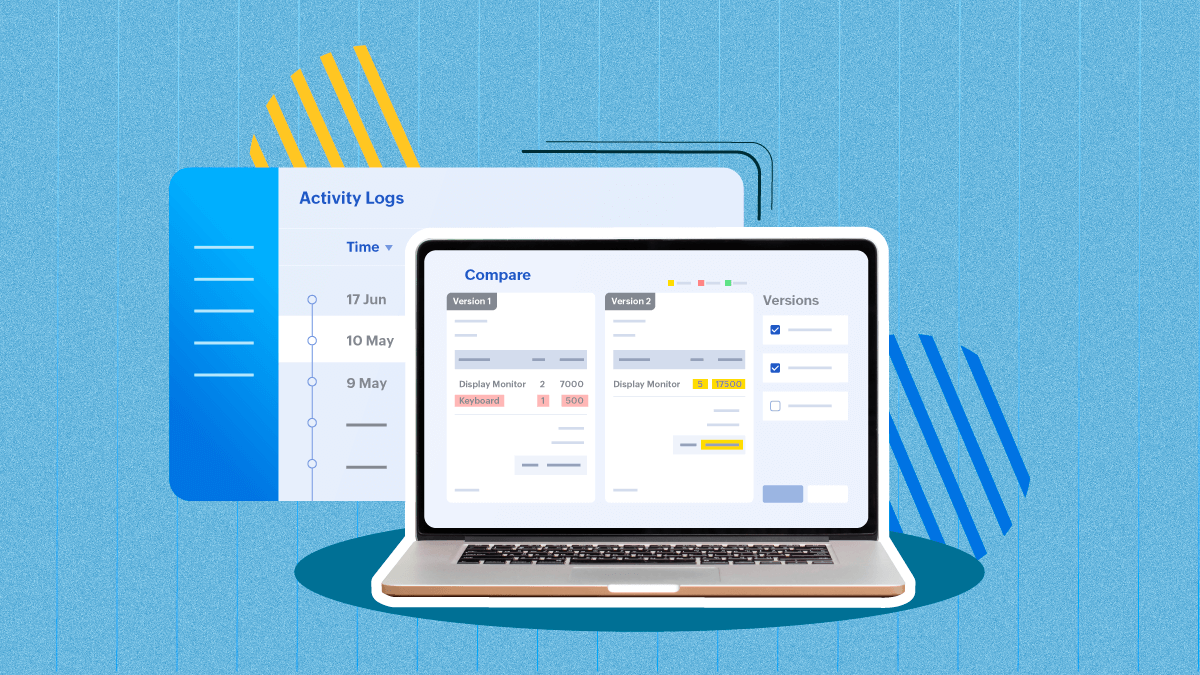

Staying audit ready: how to prepare your business for the audit trail mandate

Taxes & compliance

Basics of Invoice Furnishing Facility (IFF) in GST

Taxes & compliance

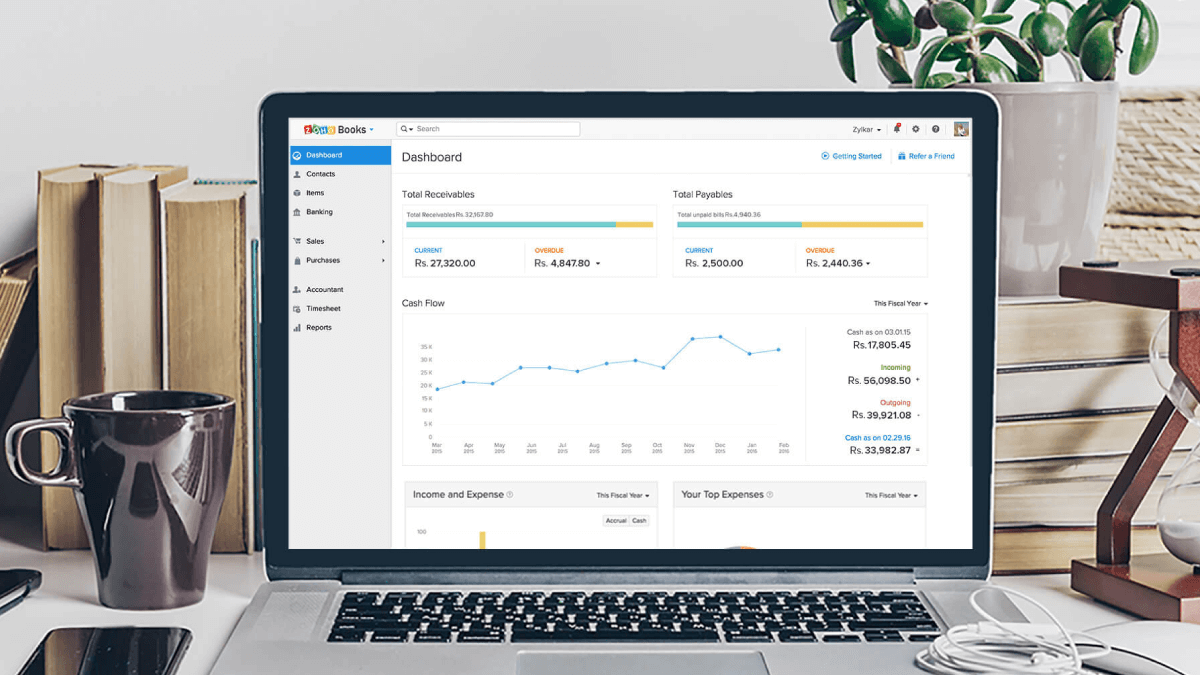

Zoho Books is the best tool for GST compliance, and here's why

Taxes & compliance

Composition scheme - A way to comply with GST if your business sells goods without invoices

Taxes & compliance

Transitional Provisions for CENVAT Credits in GST

Taxes & compliance

Impact of GST on Ecommerce Operators and Suppliers

Taxes & compliance

How is Goods and Services Tax different from Value Added Tax?

Taxes & compliance

Here's what you need to know about making a GST compliant sale

Taxes & compliance

Crucial Features for Seamlessly Achieving E‑invoicing Compliance

Taxes & compliance

Understanding GST compliance rating - an overview

Taxes & compliance

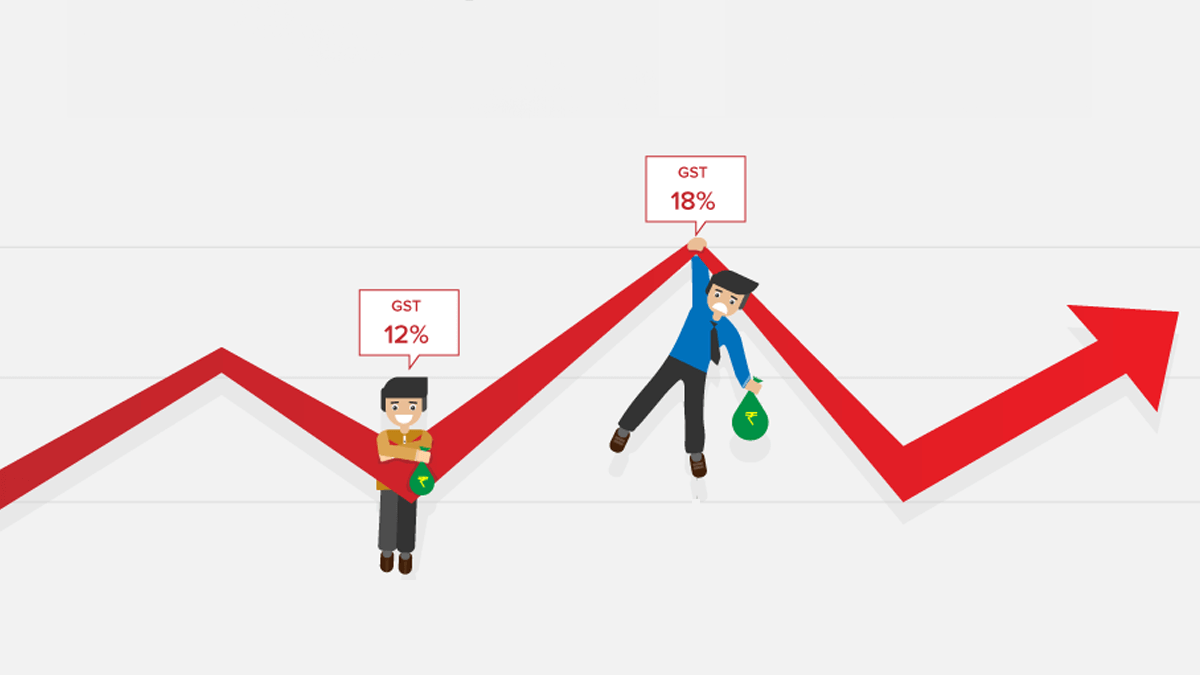

A detailed overview of the 4 tier GST tax structure

Taxes & compliance

The impact of GST on day-to-day services in India

Taxes & compliance

Impact of GST on Small and Medium Enterprises (SMEs)

Taxes & compliance