- HOME

- Taxes & compliance

- Zoho Books is the best tool for GST compliance, and here's why

Zoho Books is the best tool for GST compliance, and here's why

The current tax system in India is complex, making it challenging for business owners to comply with regulations. This is mainly because there are multiple taxes that need to be filed with multiple tax authorities. It comes as no surprise that Indians on average spend 241 hours per year on tax preparation and filing (World Bank Survey, 2016).

The new GST law will simplify the current tax system by replacing multiple indirect taxes with a single, straightforward tax. The GST will have two components: Central GST (CGST) which needs to be filed with the Centre, and State GST (SGST) filed with the State. This simplifies the entire process for businesses because each component of the GST has its own clearly defined tax authorities. Business owners will know where to file taxes.

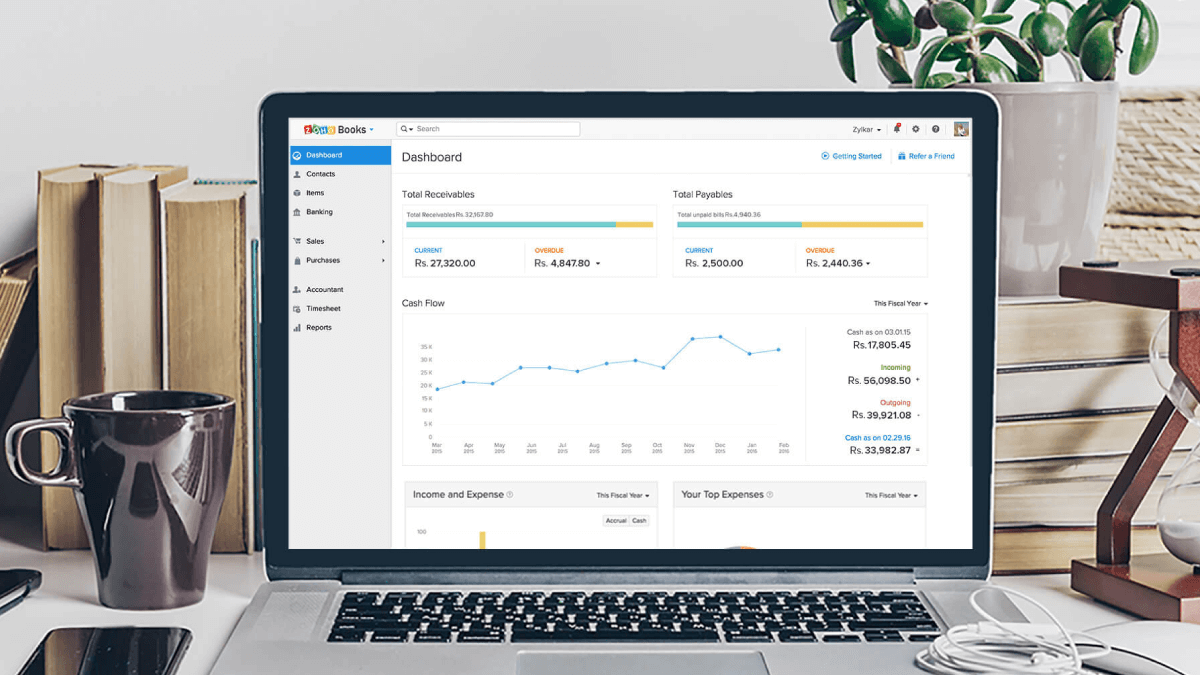

Since the GST is a complete overhaul of the existing tax system, you can expect quite a few changes in your financial compliance requirements. It may be a bit nerve-wracking to think of changing the way you’ve been doing business for so long. Having new paperwork, new tax preparation steps, and new filing processes to deal with is enough to throw you into a tizzy. But with a little planning and organisation - and the use of Zoho Books, online accounting system - getting your business ready for GST is actually achievable.

Here are some of the business compliance requirements for GST and some ways that Zoho Books can help.

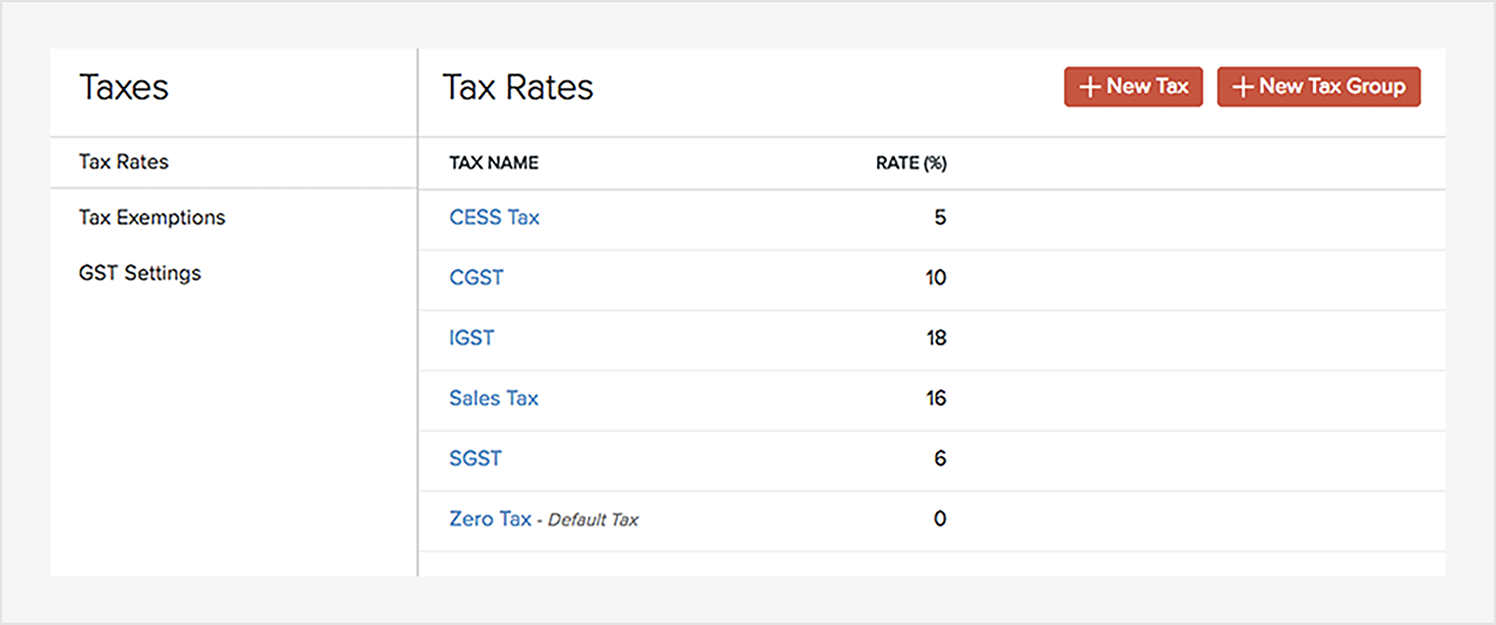

Setting up GST rates

The GST will have a four-tier tax structure consisting of a higher rate (28%), standard rates (18% and 12%), a lower rate (5%), and a zero rate (0%). These rates depend on the type of goods and services you sell. Since GST has dual components, these rates will be split equally between the State and the Centre. For example, if GST for a product is levied at 12%, then 6% will be levied by the State and 6% will be levied by the Centre. For interstate transactions, there is an Integrated GST (IGST) that combines central and state GST components. This requires a major change in the way you calculate and track taxes for all your transactions.

Zoho Books is built to handle GST calculations for you. You can set up different GST rates applicable for your business and have Zoho Books calculate the tax for each sale and apply it to your invoice instantly. This reduces the chances of making errors in tax calculations.

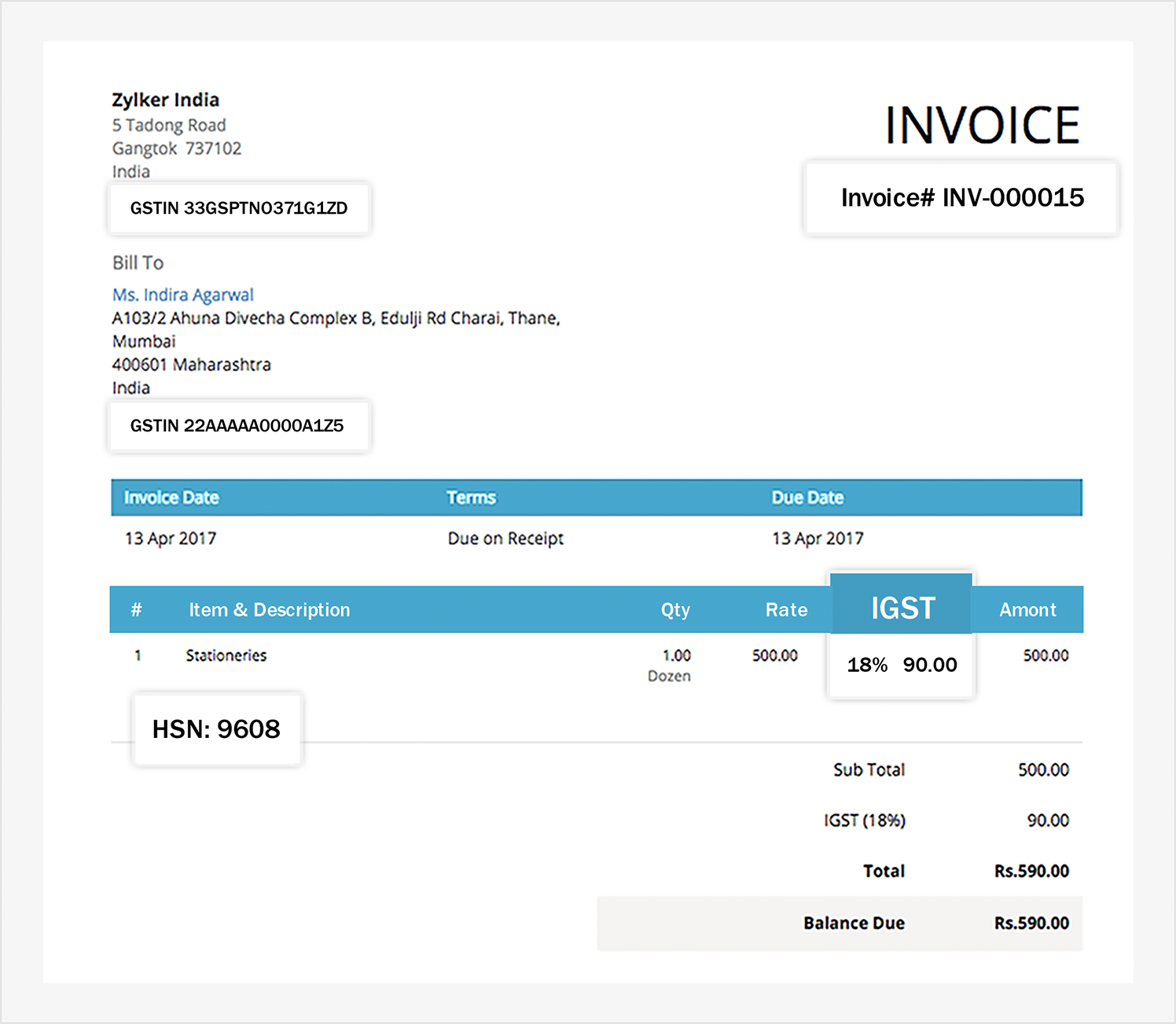

Customising your tax invoices

The Ministry of Finance has released a draft of the GST invoice rules, which specifies the elements that every tax invoice must contain. For example, they must include the name, address, and GST Identification Number (GSTIN) of both the seller and the customer, as well as the place of supply. If you are exporting or importing products, your invoices must include HSN or Harmonised System Nomenclature, a tax code which specifies the tax rate applicable for the products that you sell, along with the GST rate.

Without a proper system for following these rules, there is a significant risk that you might miss some critical information or follow the wrong format - either of which can render the whole transaction invalid.

In Zoho Books, all the details of both the seller and the customers, along with the HSN code, and the corresponding GST rate are automatically filled in when invoices are created. Zoho Books also comes with fully customisable invoice templates. This means you can add and rearrange information fields in your invoice templates as needed. You can also set your own format for the invoice numbers that are generated automatically when invoices are created. Zoho Books will ensure that you follow GST’s invoicing rules and regulations.

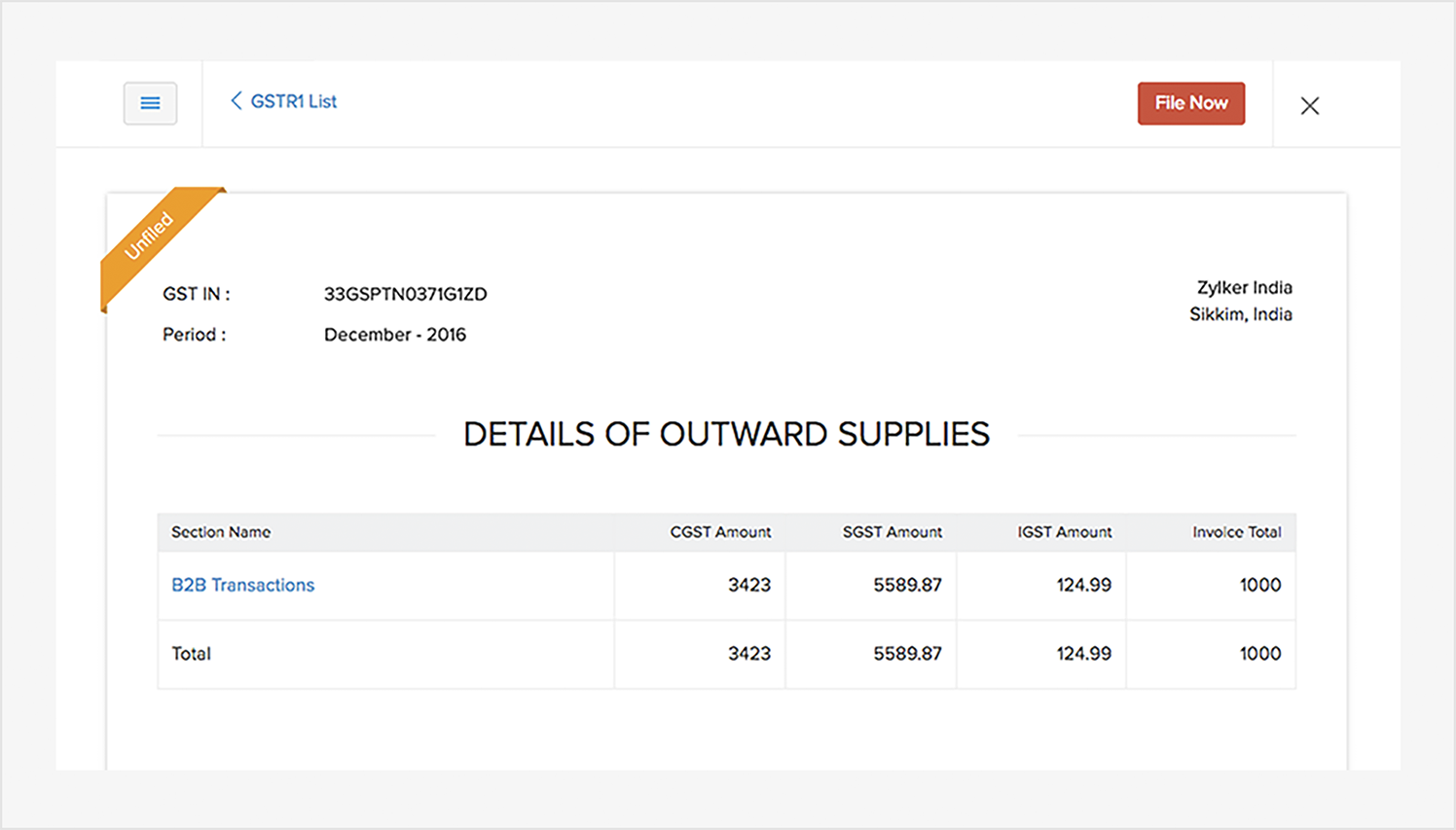

GST filing and reporting

There are 11 types of GST returns that must be filed by various kinds of taxpayers and at various times. Out of these returns, GSTR1 (outward supply), GSTR2 (inward supply), and GSTR3 (finalised details of both inward and outward supply) should be filed on a monthly basis by all businesses. Typically, businesses wait till the end of the month to manually compile all of their reports and file their taxes, which can take days to complete.

You can file GSTR1, GSTR2, and GSTR3 within Zoho Books in a single click, without having to spend time trying to enter transactions or fill in forms manually. All your sales and purchase information are automatically sent to the Government by Zoho Books when you file returns. To help you ensure that you file your returns on time, you will be notified automatically a few days before the filing deadline every month.

Zoho Books syncs with the GST Network portal, where all the details pertaining to your returns and your vendor’s returns will be stored. When your vendor submits his or her returns, which includes details of your transactions through the portal, it will be fetched in your Zoho Books account automatically. Once you verify and reconcile these transactions, you can include them in your GSTR1 report and file them in just a few clicks. It’s a level of convenience that you’ve never enjoyed before.

Go beyond tax compliance; get prepared for the future

Adapting to a tax system that is going through frequent changes can be challenging. This is especially true when you have to change key business functions that you’ve been doing a certain way for a long time. With Zoho Books, you can streamline the entire process, save time, and reduce inaccuracies in your tax preparation. If your business is small scale with turnover less than 25 lakhs, take our free accounting solution for a spin and future-proof your accounting.