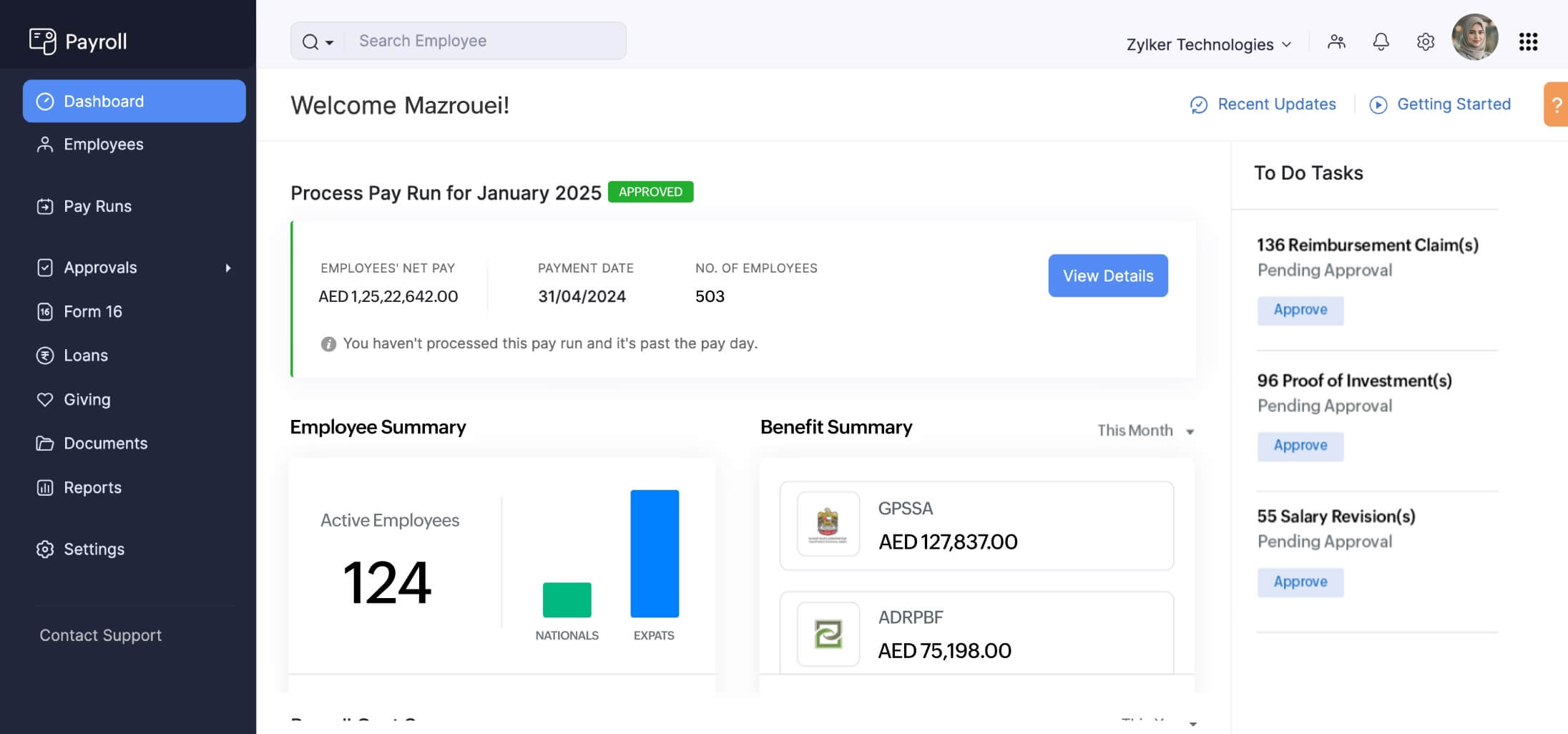

HR and payroll software for UAE

Simplifying HR and Payroll for the UAE

Your HRMS and payroll software should fluently talk to each other, as both these systems require shared data to run efficiently. Simplify payroll processing while staying compliant in the UAE through the effortless integration of Zoho People and Zoho Payroll.

Sign up for free trialRequest Demo

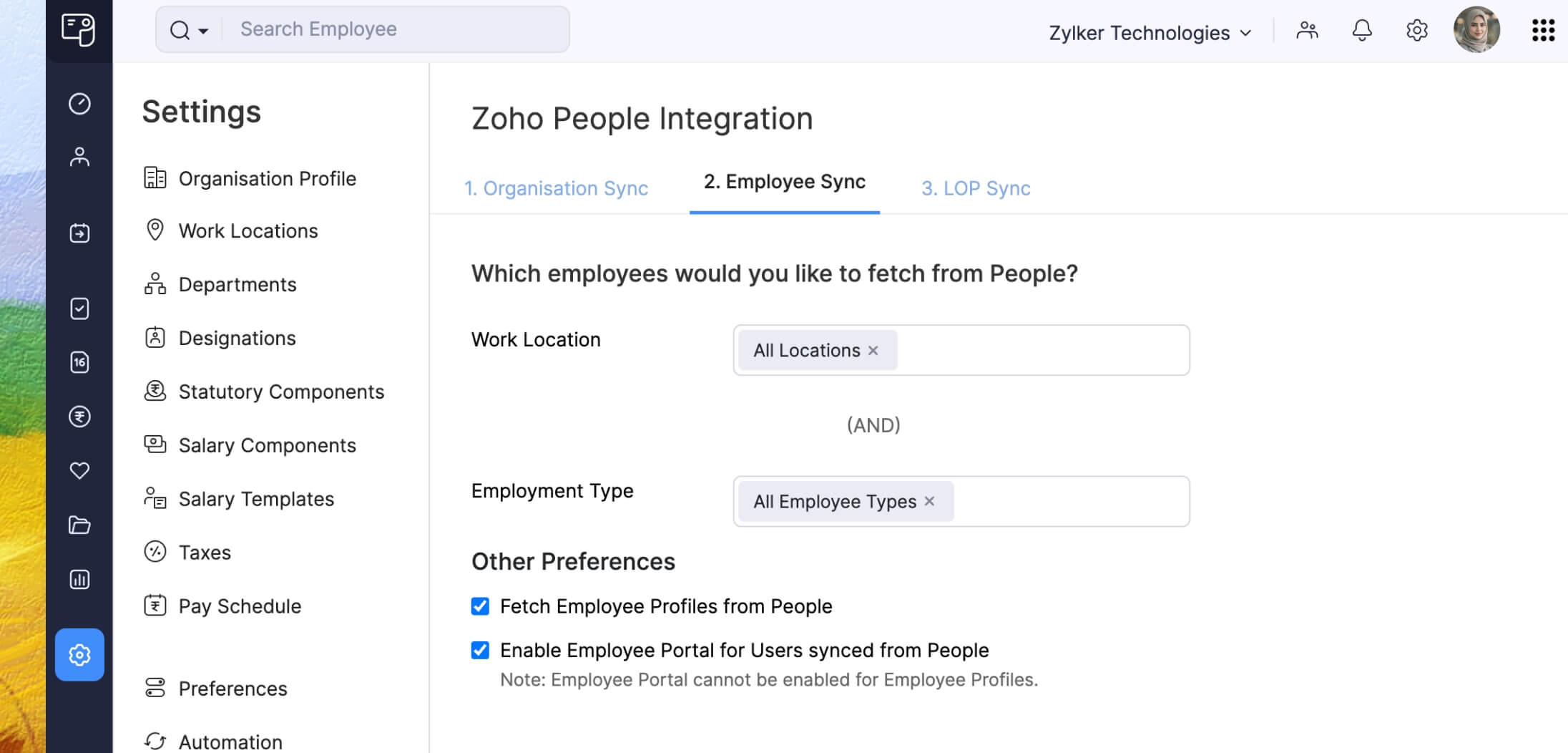

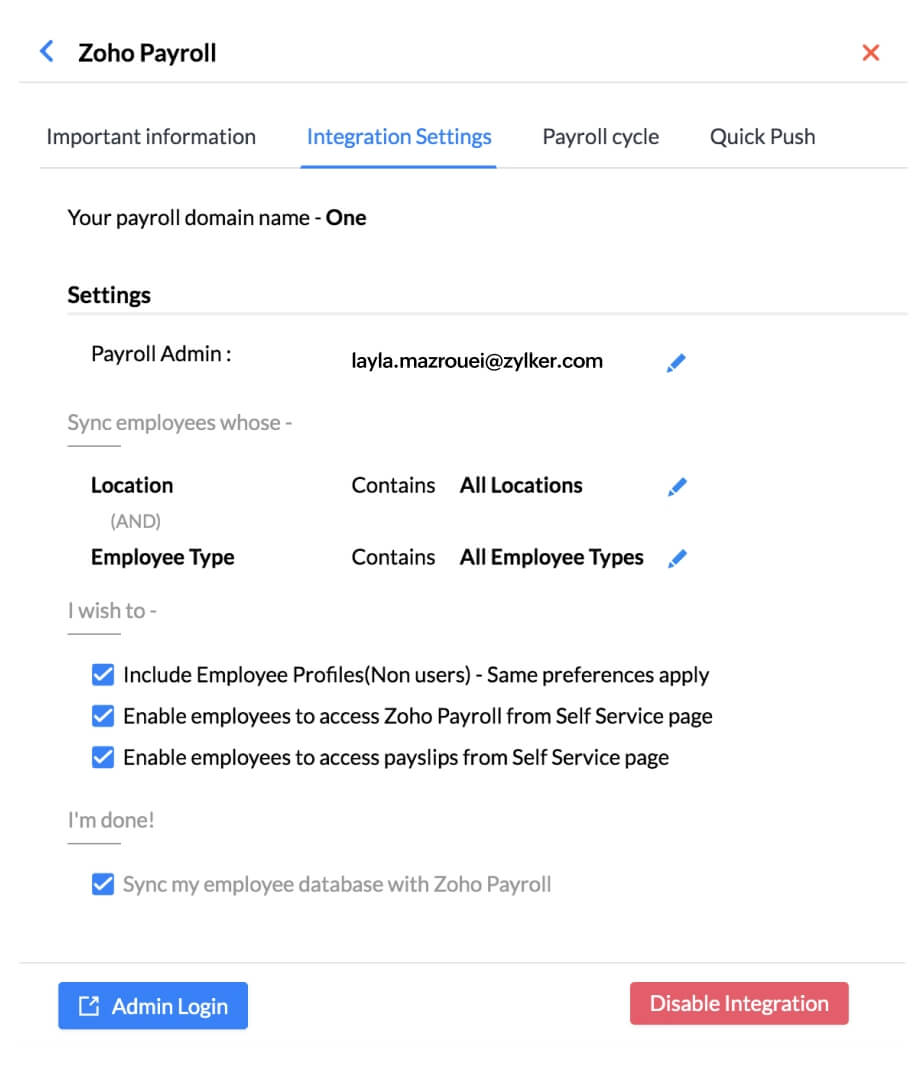

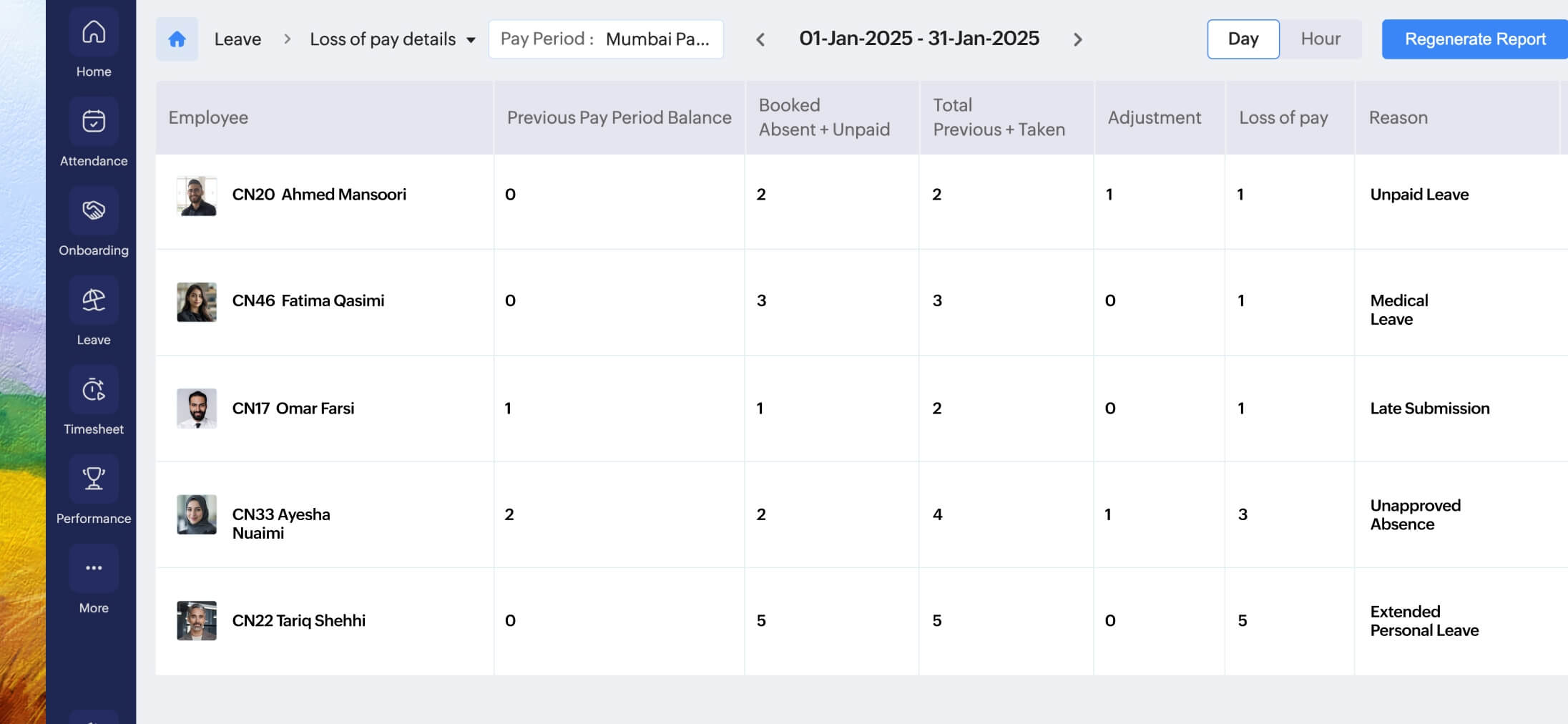

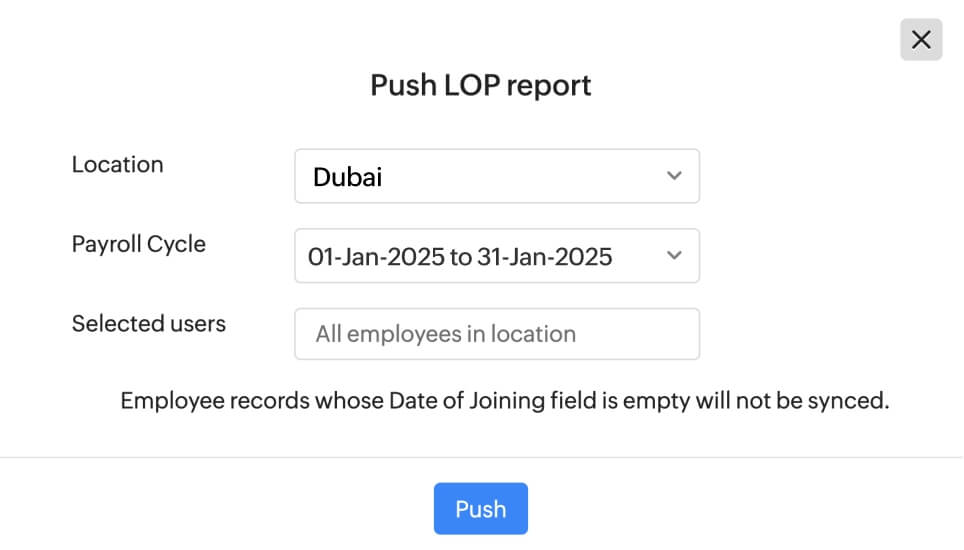

Push your data from HR to payroll

Seamlessly sync your employee information, leave and attendance details, and loss of pay (LOP) reports from Zoho People to Zoho Payroll, making way for error-free payroll processing.

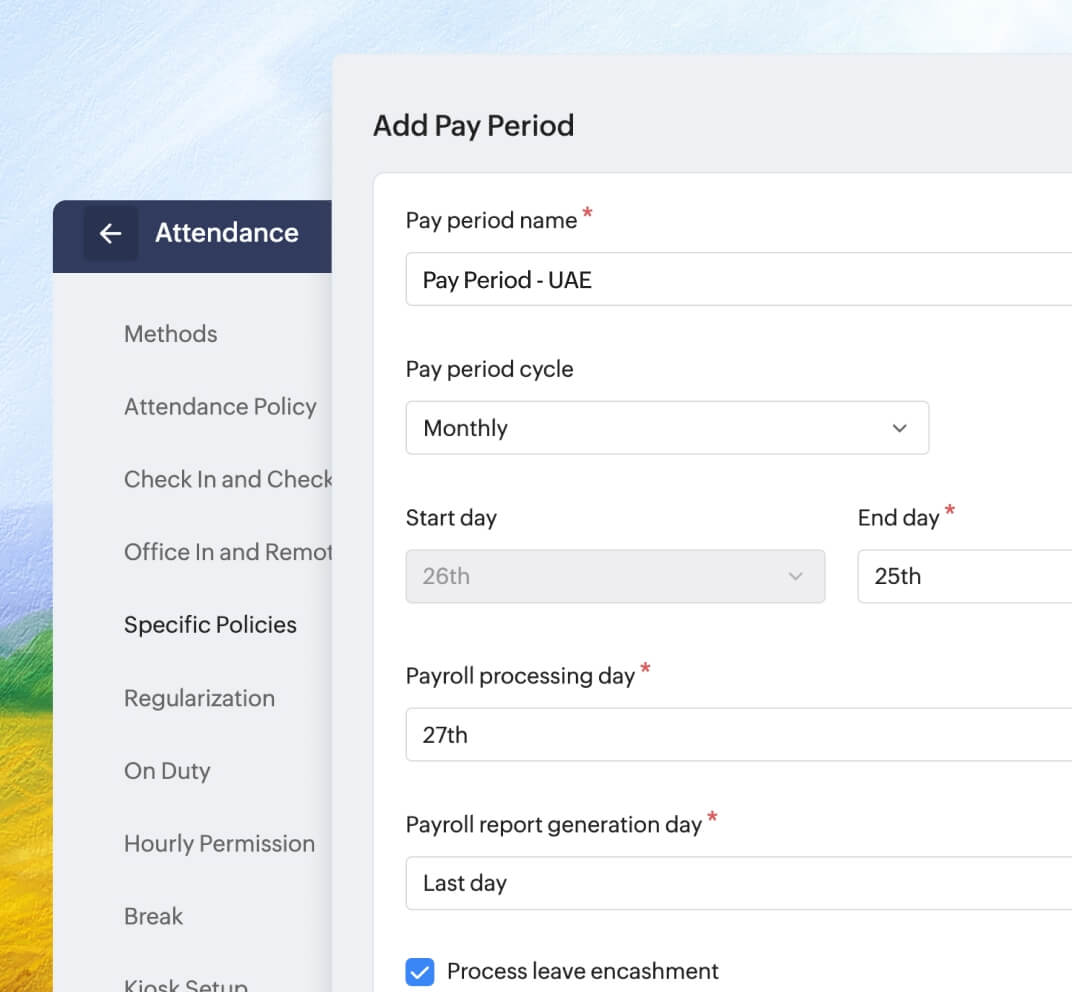

Process payroll accurately

Configure pay periods for different locations and define the pay schedule—weekly, bi-weekly, monthly, or semi-monthly—based on what works best for your business.

Pay employees on time

Seamlessly sync loss-of-pay information from your HR platform to your payroll system in a single click to accurately calculate total paydays and pay your employees on time.

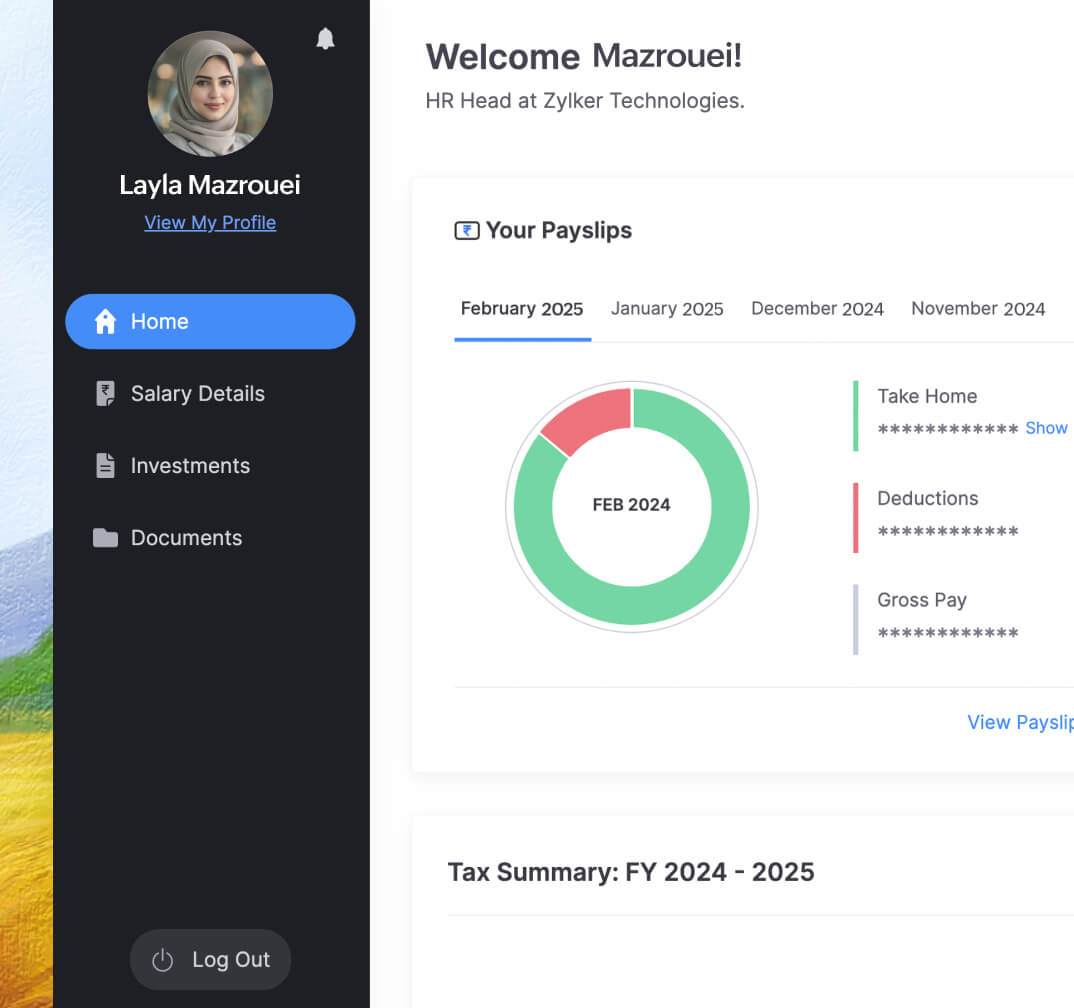

Enable self-servicewith mobile accessibility

Elevate payroll efficiency by granting employees full visibility into their pay structure. Enable access to payslips, reimbursement submissions, benefits claims—all in one centralized hub for quick and easy payroll management.

Benefits of the Zoho People and Zoho Payroll integration

Personalize salary components

Customize your system to meet your specific needs by selecting different earnings, allowances, and deductions for different employees.

Stay compliant with UAE regulations

Ensure compliance with the UAE Labor Law, which specifies precise provisions for salaries and benefits, including setting the right working hours, overtime, paid leave, maternity leave, and more.

Customize the contributions for Social Security by each party and have them transferred seamlessly for employee pensions and health insurance, along with other benefits.

Zoho Payroll also generates Salary Information Files (SIF) for compliance with the Wage Protection System.

Customize pay to fit your varied needs

Craft multiple pay rates for varied salary structures, stay compliant with tax regulations, configure seamless approvals, monitor detailed salary deductions, and establish custom deductions—all automated for payroll excellence.

Effortlessly navigate exit procedures

Execute automatic payroll for employees exiting the organization, streamlining processes like cashing in unused leave, making final settlements, and more with seamless precision.