- HOME

- Enterprise

- Order-to-cash: A guide for enterprise automation solutions

Order-to-cash: A guide for enterprise automation solutions

Driven by the increasing pervasiveness of the cloud and changing customer expectations, inflexible business systems that were designed for an earlier tech era are going through an evolutionary period.

Especially with the ownership to usership transition happening across industries, companies are starting to operate on a continuum of business models, rather than focusing on one or two revenue sources. When combined with the aspirations to expand globally, this may create significant challenges in the sales cycle and buying process, impacting the customer experience.

To overcome this, companies need an operating model that efficiently supports current business models and also equips them to leverage new revenue streams as they take shape through innovation or acquisition. By making this the ultimate goal, businesses can approach the challenge starting with optimizing one of the high-impact areas: the order-to-cash process.

The path from order creation to final payment, called, the order-to-cash (O2C) cycle, is a cross-functional and multi-layered process traversing across different functions of the business, ranging from sales, commerce, legal, finance, marketing, customer support, and supply chain. Such cross-functional alignment makes it all-critical to fully understand what is happening in the O2C cycle.

This foundational guide walks you through each process of a typical order-to-cash cycle and how an agile billing solution can help orchestrate the whole process seamlessly, acting as a primer for your rapid business growth.

What is the order-to-cash process?

Order-to-cash is a collective term that refers to the end-to-end process of taking customer requests for goods and services, fulfilling them, and getting paid for them. It includes all the steps a company takes from the time it accepts an order to the point it collects payment for that order.

Although it seems like the order-to-cash process operates in the background, it plays a crucial role in shaping the customer's perception of the company and directly affects the bottom line. Billing errors and payment collection failures can negatively impact your cash flow, while poor order management and delayed deliveries can lead to disgruntled customers. Hence, optimizing the O2C cycle allows organizations to strategically implement tailored solutions that align with their evolving business models.

Order-to-cash cycle: A realistic walkthrough

From a sample of manufacturing and service companies, research done by Boston Consultancy Group (BCG) revealed that there are as many as 27 sub-processes across 7 different organizations' functions in the order-to-cash cycle. For a retail store, the order-to-cash cycle can be as simple as a customer paying for the items purchased at the checkout counter. But for most companies across different industries, it intricately works by involving almost every function of an organization, between taking the order and receiving payment.

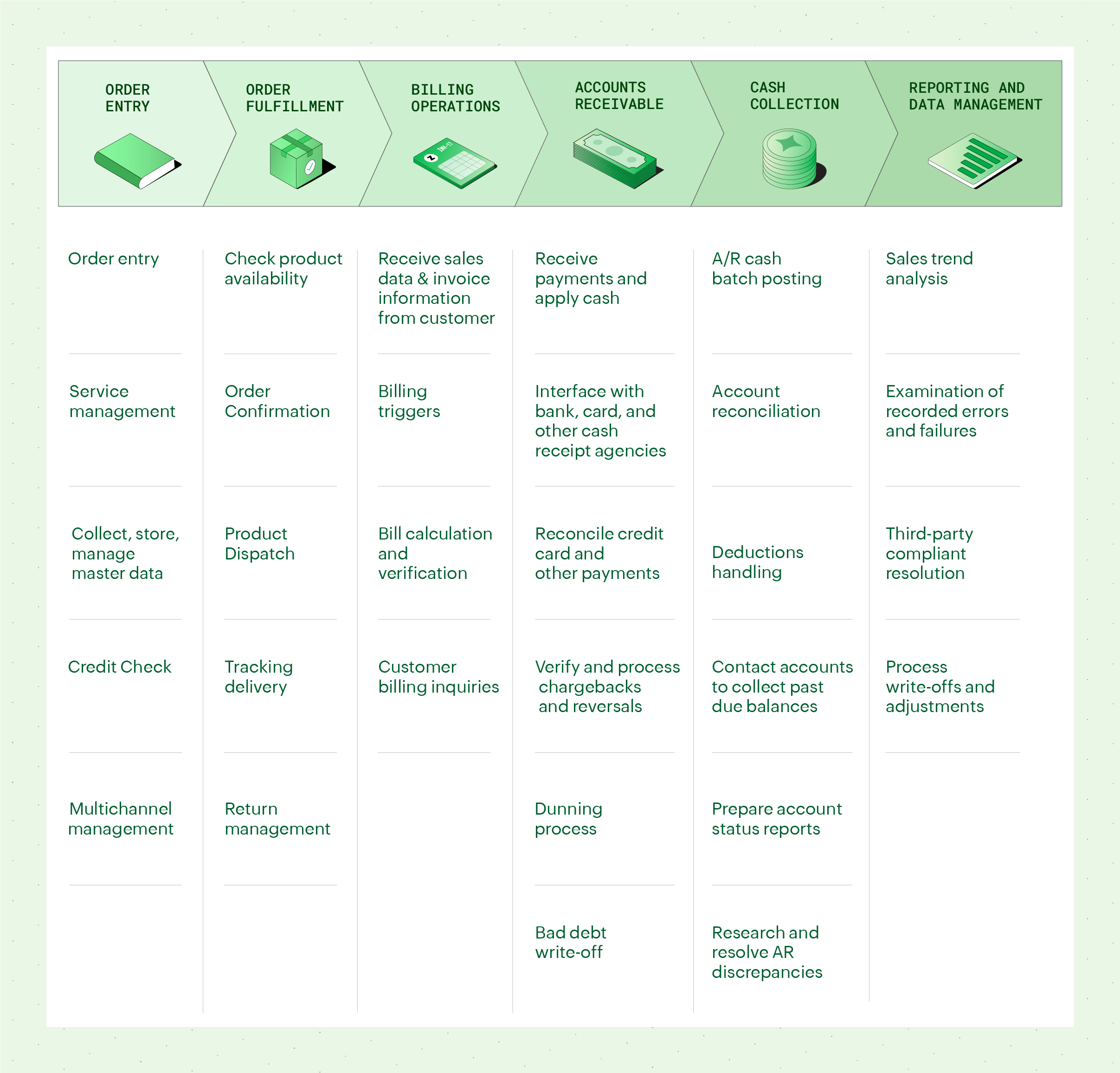

However, from the top-level, a typical order-to-cash process involves the following steps:

- Order entry

- Order entry Order fulfillment

- Invoicing

- Outstanding receivables and collections

- Reporting

Not every order goes through each of these steps. For instance, if you are a service-providing business, shipping wouldn't be included in your order-to-cash cycle, or the dunning process won't be necessary if the payment is collected smoothly. Likewise, for every order, the process may constitute fewer (or more) steps than the above list, and different terms might be used to define them. However, every business has an order-to-cash cycle, whether they acknowledge it or not.

Order entry

The order entry process involves almost every department in an organization, from customer service to warehouses and logistics partners, and comprises steps that overlap and interact. It kickstarts when a customer places an order.

When selling through diverse channels, orders can come from different retail outlets, web stores, marketplaces, and other sales platforms, which are then compiled into one dashboard with a centralized order processing system. The centralized order processing system ensures that every time customers place orders, the order information is collected and recorded and passed to the relevant production and distribution departments and partners where the orders get slotted into production based on priority.

Order fulfillment

In a simple sense, order fulfillment is the process of delivering the product or service to the customer. Order fulfillment happens in one or more distribution centers and typically involves multiple functions such as order processing, inventory management, supply chain management, quality control, and customer support to handle product exchanges or returns.

For instance, components of an order may be created in different manufacturing units and assembled at yet another site, or they can be created in one location, inventoried in another, and put together in a third location, while some businesses include third-party suppliers. To put it simply, the more complicated the assembly is, the more coordination is required across the organization. Whereas, service-related orders are met with catalog-driven order fulfillment that automates service activation and provides complete order workflow control and visibility.

The order fulfillment process should run like clockwork, orchestrating each sub-process for a great customer experience. For example, the inventory stock status has to be updated on a real-time basis. This ensures the company doesn't accept orders that can't be fulfilled within the stipulated time. Similarly, customers have to be notified of an out-of-stock situation, and the order has to be canceled to reduce the chances of billing errors.

Customer invoicing

Invoicing is the process of sending the customer a commercial document that includes details such as the order date, product specifics like price and quantity purchased, shipping times, information of parties involved in the transaction, and tax information to collect payment.

Depending on the industry, customer invoicing can occur upfront as soon as the deal is finalized or during the order processing or fulfillment stages, but key activities like maintaining master data files, generating customer billing data, transmitting billing data to customers, and resolving billing inquiries are common across all industries.

These operations involved in customer invoicing might seem pretty straightforward. Still, there are complexities that most companies can't foresee when they scale and end up succumbing to notorious manual billing errors that sometimes turn fatal for the business.

Here's a simple example. Assume a business wants to apply discounts if the total amount exceeds a specific value. Manually handling such a simple operation, even for limited orders, becomes arduous over time. When it comes to enterprises with over 500,000 users and millions of events, manual billing is simply unthinkable.

It's for this reason that billing automation has come to light. Automating the order-to-cash process significantly reduces the time and resources needed to perform complex billing operations and directly saves costs.

With an automated billing solution, the business just has to set custom rules to automatically trigger discounts when total charges cross a threshold value. During the actual invoicing run, the software will automatically trigger the set functions in accounts receivable contract accounts to streamline business processes. The platform can also support the integrated posting of accounting documents and account maintenance activities, such as settling credits against new receivables, collecting and mediating data, calculating the bill by rating, discounting, and applying rebates, and then matching it with customer information.

Outstanding receivables and collection management

Once the order is fulfilled—the goods are delivered or the service has been provided to the customer—the accounts receivable process begins. This involves invoice generation, payment collection, and reconciliation of payments against the ledger.

After sending the invoice, collecting accountants monitor all inbound payments and work with customers to collect payments in arrears. If the invoice amount is received on time, typically the purchase order number is used as a tracking reference to ensure each payment is correctly matched to the corresponding order. If not, the outstanding receivables are followed up on until a predefined point, after which they are either written off as bad debt or a third-party collection agency is assigned on a contingency fee-basis.

To prevent overdue invoices, collection accountants proactively evaluate, identify, and prioritize the accounts that have invoices past their due date which haven't been paid. They investigate, rectify, and resolve invoicing errors and reissue invoices if errors have occurred. However, manually doing all this and more is unsystematic and suboptimal over time.

The automated receivables management solution driven by the company's collection policies and strategies allows the business to systematically prioritize collection personnel's workload, set payment and call-back reminders, record customer contacts and invoice disputes, and automate customer query management. Such efficient handling helps reduce DSO (Days of Sales Outstanding), improve collection rates, and enhance customer relationships.

Reporting

The final step is focused on measuring the effectiveness of the order-to-cash process and tracking performance data at an individual, departmental, and organizational level. The reporting analytics helps analysts and executives understand critical metrics and KPI trends, their driving factors, and the potential impact of changing corporate policies and processes.

Many companies focus on core metrics such as Days Sales Outstanding (DSO), Days Payable Outstanding (DPO), Days Inventory Outstanding (DIO), and Cash Conversion Cycle (CCC) to measure the effectiveness of their order-to-cash process. However, with an efficient reporting tool, the business can go beyond and create a causal analysis framework to assess relevant KPIs for each step in the order-to-cash process. This can help answer questions like "What is the forecast DSO trend?," "Why is it trending higher (or lower)?," "What might happen to DSO or DPO if the business changed the standard terms?," "How does the DSO compare against industry benchmarks?," and so on.

Ending it with an emphasis on the crucial touchpoint—Billing

Order-to-cash is one of the most critical and complex processes of an organization that encompasses all activities from receiving an order to fulfilling it and collecting payment for the goods or services. As it is a complicated process that has no off-the-shelf solution, few enterprises ever consider making improvements until a crisis jolts them into realizing the pitfalls of inefficient O2C processes.

At present, O2C processes constitute siloed systems that are owned by different functions, with billing standing out as a critical area for improvement. Billing impacts multiple aspects of a business—evolving customer expectations, new business models, product propositions, and competitive pricing—which have become key to customer retention.

A business's billing system is one of the consistent interfaces between the business and the customers, adding tremendous responsibility to it. Taking on the task of transforming your order-to-cash billing system is a huge and long-term but rewarding commitment. In today's market, where customers expect to be in control of product and service configuration, an efficient billing system has the potential to become a one-stop solution for product and marketing support. The prudent way to monetize rapidly evolving, global businesses is a billing system that can evolve at the same pace.