- HOME

- Payment collection and compliance

- Best practices for collecting recurring payments

Best practices for collecting recurring payments

Let's say today a customer signed up for your subscription service, and that made your day. All you have to do now is sit back and relax since the payments will be transferred automatically to your account on time, right?

In reality, various issues like declined payment methods, fraud, and chargebacks stand in the way of recurring payments and affect the consistency of cash flow into your business.

The ability to collect recurring payments efficiently can make or break your business. So, to keep your cash flow steady and your business finances healthy, it's vital to be cautious and follow the right practices while collecting recurring payments. The way recurring payments are processed, the policies formulated around them, the way you deal with payment declines, how you communicate with customers, and the way you manage churn—all of this decides the sustainability of your subscription business.

In this guide, we'll go over some best practices to collect recurring payments. These practices will help you sustain your subscription business and avoid issues related to recurring payments.

Make security a priority

As a subscription business, you'll need to gather, process, and store customer data that includes their sensitive payment information. So if you fail to keep this data secure, it will not only cost you customers but put the bottom line and reputation of your company at stake.

To make recurring payments secure and protect customer data against identity theft, PCI compliance is mandated by card companies. As a business owner who stores, processes, or transmits card data, you are required to be PCI compliant.

However, maintaining PCI compliance can be a tedious process. It requires constant surveillance and incurs cost, but being non-compliant is not even an option. Without PCI compliance, you are not only susceptible to potential security risks but will also have to face penalties. Issuing banks incur a loss due to customer fraud resulting from data breaches, so a business that doesn't protect customer card information well enough will need to pay the estimated losses.

Thus, to avoid the whole struggle of staying PCI compliant, most businesses pick a payment gateway that complies with the PCI DSS. These payment gateways tokenize and store customer card details on their own servers and take on the burden of PCI-compliance themselves. They allow the customer's card details to be retrieved from their servers using a token and accessed on your website in the customer's account. So if your payment gateway provides tokenization, then you don't need to obtain PCI DSS certification.

It is recommended to choose a payment provider that is PCI Level 1 compliant, as it is the highest PCI level with the strictest requirements. To get more insights on this, read our article on choosing the right payment gateway for your business.

Moreover, in a typical card-not-present recurring transaction, since you can't verify whether the person using the card is the real card owner, your business is more vulnerable to the risk of fraud. There are some ways you can mitigate such risks of fraud by authenticating transactions with Address Verification System (AVS) and Card Verification Value (CVV). These tools enable the payment processor to check whether the billing address or CVV included with a transaction matches the data on file at the issuing bank for the associated card, ensuring only authorized card users can make purchases.

Get written permission from cardholders

What would you do if a customer suddenly claims that an amount has been debited from their account without their authorization? This is why it is essential to get the written permission to automatically debit recurring payments from your customers. In addition to identity verification, obtain a written mandate containing details such as the amount, the day of withdrawal, the period over which the payments will continue, and the customer's signature.

In addition to this, if you want to collect recurring payments by ACH, SEPA, and UK Direct Debit, your customers must issue you a Direct Debit Mandate which is an authorization from your customers to collect recurring payments. So getting written authorization mandates is essential to collect recurring payments.

Keep your policies transparent

To run your business smoothly and keep customer confidence intact, you must have transparent payment policies in place. Hiding some aspects of a new policy if you think might put off some customers is extremely risky and might backfire in the long run. If you aren't honest about your policies, you will lose customer trust and end up with chargebacks and churn.

To avoid this, make sure you offer complete transparency in your subscription, cancellation and refund policies, terms and conditions, and late fees.

You can mention certain important clauses upfront on your pricing or subscription web page to keep prospects informed of your payment terms. For instance, Dropbox has a super short and to-the-point Terms of Service section for its payment terms that include important clauses discussing Billing, Refunds, Downgrades, and so on. On the other hand, Slack uses another reader-friendly method to supplement the payment terms section by providing FAQs where questions regarding payments, payment methods, delayed and non-payments, and refunds are answered. Such FAQs related to payment terms help clarify common questions from customers, such as how refunds work, how to update new credit card information, and so on.

Communicate policy changes effectively

Most businesses make modifications to their payment policies from time to time, and they are obligated to convey these policy changes to their customers. Use channels like email, social media, business web pages, and billing statements to communicate any changes to your policies effectively.

Also, notifying your customers of any changes to be made in the authorization of their current payment method or any adjustments to the amount charged in advance is as important as notifying the customers before you bill them. Sending timely notifications of policy changes and other modifications associated with the recurring payments can save you from chargebacks and help maintain customer loyalty.

Avoid transaction failure due to insufficient funds

A common reason for transaction failures is insufficient funds. Some businesses try to resolve this issue by aligning the billing cycle with the customer's payday cycle, while some let their customers choose the payment dates that suit them best. If your products or services are expensive, it might be best to break down the amount into weekly or bi-weekly payments to make it easy for your customers to pay you on time.

Either way, sending a pre-billing message that notifies the customers that their subscription will soon be renewed and a certain amount will be deducted from their account can be beneficial. It is recommended to notify customers 10 days in advance of the upcoming recurring transaction. Learn more about dealing with card declines here.

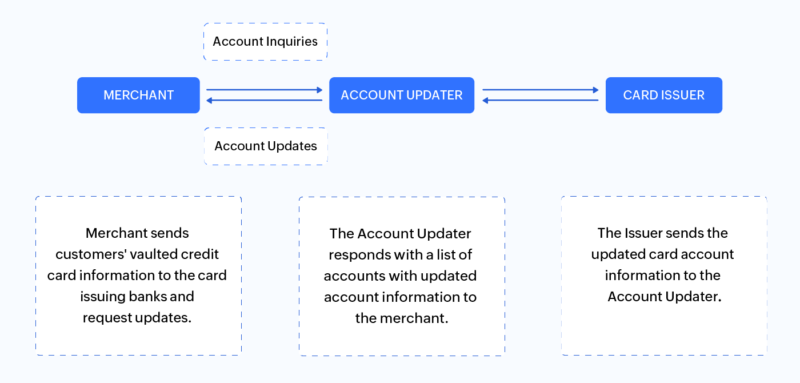

Ensure updated card information with Account Updater

Outdated card information is yet another common reason for payment declines. From replacing lost or stolen cards to adopting new technology (such as EMV smart cards), customers' card information may change for several reasons. When you fail to update card information in your database, it results in declined transactions.

Fortunately, credit card companies have created a helpful workaround to solve this issue by introducing the automatic account updater.

When the issuing bank re-issues a new card for the customer, they submit the new card details to the Account Updater database. The merchant inquires about their customer's credentials on file, and the Account Updater provides the updated card information when available.

This helps merchants retain their customers by maintaining the continuity of payments and preventing payment declines due to incorrect or outdated card details.

Manage churn with retrying process

When a transaction fails due to any technical error, and if no step is taken to resolve it, the customer will be churned out due to non-payment. This involuntary churn affects business revenue and damages the customer relationship as well. However, this can be mitigated with the smart retrying process. Smart retry is a part of the dunning management system where customers are notified automatically of the payment failure and retry attempts are scheduled to recover the payment. Typically, the declined card is retried up to five times at various intervals.

There might be some cases where, even after multiple reminders, the customer remains unresponsive to the payment decline and is on the verge of churning out due to non-payment. At times like these, when all else fails, you should step in manually and contact the customer to resolve the issue. While it’s time-consuming, even if there is the slightest chance to recover the payment, especially from a high-value customer, it is worth the effort.

Provide alternative payment methods

Direct bank debit methods like ACH, SEPA Direct Debit, and digital wallets can be used to avoid problems associated with payment cards. On an average, credit cards have a reported 13% churn rate. However, according to GoCardless, direct debit is more reliable in collecting recurring payments, with success rates of 95 -100% compared to 80% to 95% for credit cards. That is because, in bank-to-bank payment methods, there are fewer intermediaries and points of failure. Additionally, there are no expired or canceled card problems to deal with.

Impose late fee only as a last resort

Streamlined cash flow is the lifeblood of any business, and timely payments play a vital role in keeping your cash flow consistent. So, naturally, you want your customers to pay you on time. However, there will be certain customers who delay their payments. To deal with such customers and discourage late payments, most businesses charge late fees, where customers have to pay a certain amount when they fail to make their payment on time. There are some guidelines you need to follow when you decide to charge late fees.

Make sure your customers are aware of the late fee policy, either through a contract or specifying on all invoices in a way that grabs their attention.

Remind them of the late fee before their invoice is due and provide them with sufficient time to pay the amount.

Familiarize yourself with the local taxation laws and ensure the late fee complies with them.

You can also try a more positive approach by providing early payment discounts to encourage customers to pay their bills early, which can also reduce the risk of non-payment or late payment.

Zoho Billing is here for you!

It might be a bit overwhelming to check constantly and follow all these best practices to keep your business's recurring payments flowing smoothly. However, these best practices are especially important for a subscription business where subscriptions need to be constantly renewed through recurring payments and more transactions might lead to more payment failures. Thus, your billing tool must be able to provide multiple secure payment options and, on the other hand, should be able to manage customer and revenue churn due to declined payments.

Sound complicated? Don't worry! We built Zoho Billing to do all this for you.

Zoho Billing is an end-to-end billing software that helps you collect recurring payments smoothly. It has a smart and customizable dunning management system, supports different online payment methods, and offers secure PCI-compliant hosted pages to get your business paid on time. All this equips you to tackle payment collection challenges effectively.

Take Zoho Billing for a test drive today to see how it makes collecting recurring payments a breeze.