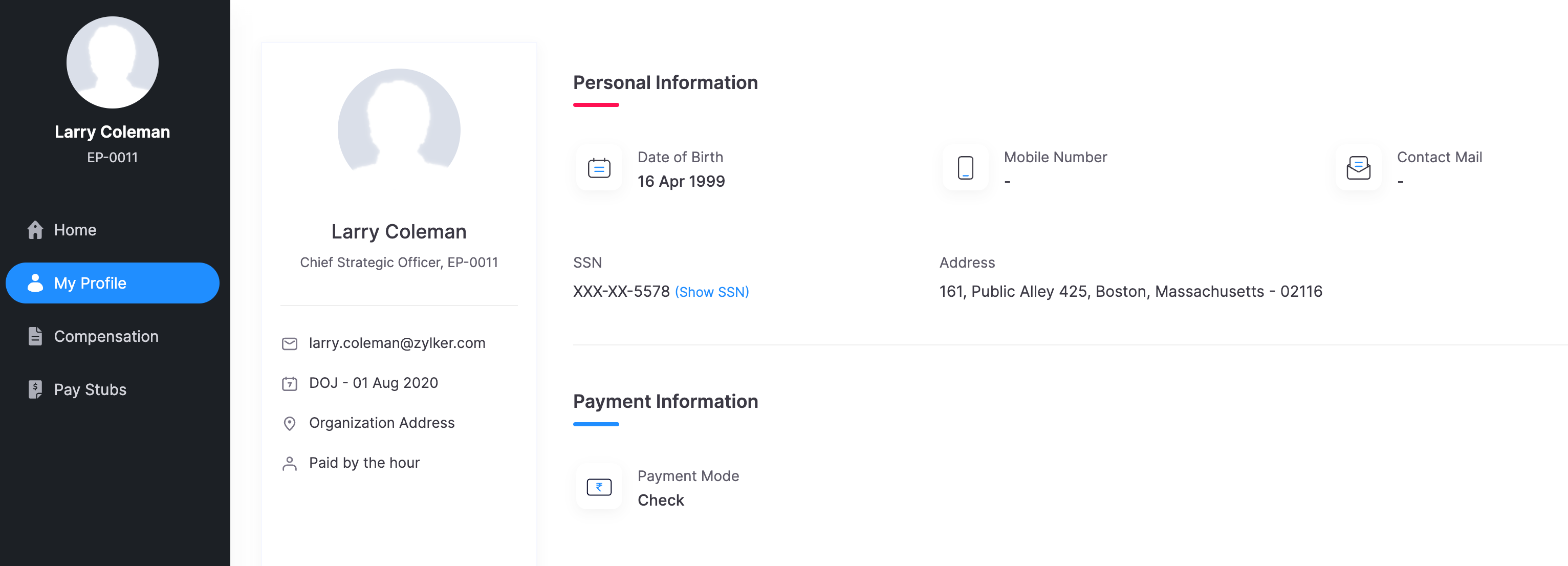

My Profile Page in Zoho Payroll Employee Portal

The My Profile page in the Employee Portal provides you with a comprehensive view of your personal and payroll-related information. Here, you can access and verify key details, including your identification, payment, and tax information.

This page is organized into three main sections: Personal Information, Payment Information, and Tax Information.

Let’s go over each section in detail.

Personal Information

This section displays your basic personal details, helping you confirm that all your information is accurate and up-to-date. Here’s a breakdown:

| Field | Description |

|---|---|

| Full Name | Your name as registered with your organization. |

| Designation | Your role in the organization. |

| Your official email address for communication. | |

| Date of Birth | Your birth date as recorded in the system. |

| SSN | Partially masked Social Security Number for security. Select Show SSN to view the full number. |

| Address | Your residential address on record. |

| Mobile Number | Contact number for quick communication (if provided). |

Payment Information

This section includes details about how you receive your salary, helping you confirm the accuracy of your bank information. Here’s a breakdown:

| Field | Description |

|---|---|

| Payment Mode | Method of salary disbursement, e.g., Direct Deposit or Check. |

| Bank Name | Name of the bank where your account is held. |

| Routing Number | Unique bank identifier used for processing transactions. |

| Account Number | Partially masked account number. Select Show A/C No to view the full number. |

| Account Type | Type of account, such as Savings or Checking. |

Tax Information

The Tax Information section provides insight into your federal and state tax withholdings, including details that impact your tax deductions. This section is particularly helpful for tracking your tax status and ensuring your withholdings align with your preferences.

If you want to receive your annual W-2 Form via email, enable the Do you want to receive W-2 Form via email every year? This makes the W-2 accessible digitally, reducing the need for paper copies.

You’ll find information related to both your federal and state tax withholding.

Federal Tax Withholding

| Field | Description |

|---|---|

| Multiple Jobs or Spouse Works | Specifies if you or your spouse has multiple jobs, impacting your withholding rate. |

| Federal Filing Status | Your federal filing status, such as Single, Married, or Head of Household, which affects tax brackets. |

| Other Income | Additional income sources (if any) that influence withholding calculations. |

| Dependent Amount | The amount associated with dependents, used to reduce taxable income. |

| Deductions | Claimed deductions, which lower the taxable income. |

| Additional Withholding Amount | Any extra amount you choose to withhold for federal taxes to cover additional tax liabilities. |

State Tax Withholding

| Field | Description |

|---|---|

| State Filing Status | Filing status for state taxes, such as Single or Married, which impacts the withholding rate. |

| State Allowances | Number of allowances claimed, influencing the amount withheld for state taxes. |

| Additional Withholding Amount | Extra amount withheld for state taxes, if specified, to account for additional state tax liabilities. |

By organizing the tax information into separate federal and state tables, we hope to provide you with a clear, easy-to-follow view of your tax settings.