Collect W‑9 & Manage 1099 forms

From collecting W‑9 forms effortlessly to distributing 1099 forms securely, upgrade your business's 1099 and W-9 management with Zoho Books. Easily e-file your 1099-MISC and 1099-NEC forms directly with the IRS using Zoho Books.

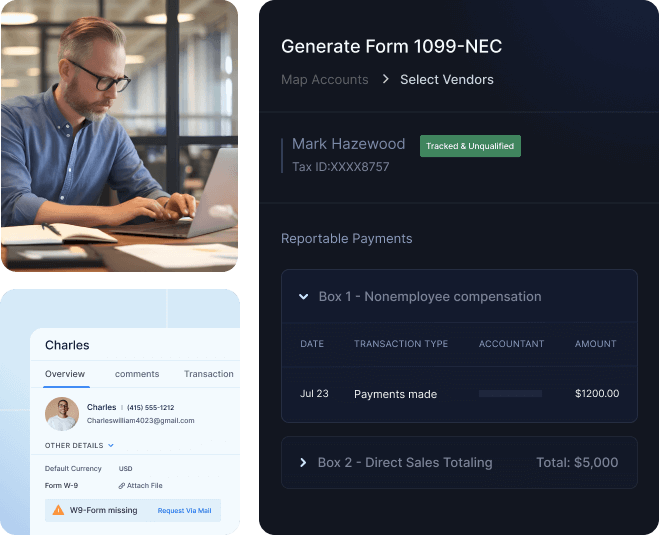

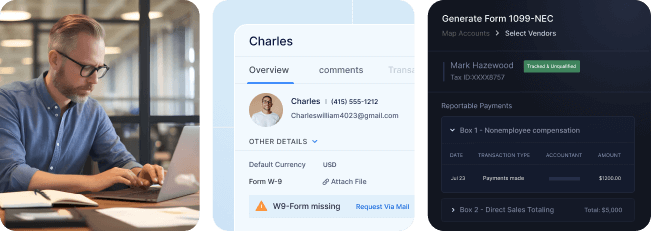

Streamlined W‑9 Management

Request, collect, and manage your W‑9 forms with Zoho Books. Upload and/or generate forms in one consolidated platform. Tag W‑9 forms to respective vendors and get notified of missing W‑9s, all while ensuring stress-free compliance.

Effortless 1099 Account Mapping

Map accounts to 1099 boxes without any hassle. Instantly view recommended accounts based on your tracked vendor payments—no need to recall past account selections. The intuitive mapping feature also flags if an account has already been mapped in other boxes or forms.

Automatic 1099-MISC and 1099-NEC Generation

Stay updated on your 1099-tracked vendor payments and automatically generate a list of vendors who meet IRS reporting thresholds. Gain access to a clear view of each vendor’s reportable and non-reportable payments, all in one place.

Customizable Reporting

Refine your 1099 reports without hassle. Add or exclude transactions as needed, update missing vendor details like address or email, and quickly track any overlooked vendors—all from one screen. Every change is saved in a detailed comment and history log, ensuring full visibility over report updates

Seamless Form 1099 E-Filing

Convenience doesn't have to be lost when meeting IRS e-filing requirements. Directly e-file your 1099-MISC and 1099-NEC forms with the IRS from Zoho Books, or export your 1099 data in an IRS-compatible format to upload via the IRS portal or file through Tax1099 and Yearli integrations. Choose the method that works best for you and eliminate the hassle of paper filing.

Secure 1099 Distribution to Vendors

Easily distribute 1099 forms to all your vendors. With Zoho Books, you can email forms, send in bulk, or share through our vendor portal, making it simple to fulfil your reporting obligations.

FAQ section

Form-1099 is a essential form that needs to be filed with the IRS to provide information on the various kinds of non-employment income earned in the respective tax year.

Those issuing 1099 forms are obligated to submit one copy to the IRS and share another with the income recipient. There are 20+ types of 1099 forms, but here are just a few:

Form 1099-NEC: Filed for non-employee compensation, such as payments made to independent contractors, freelancers, or consultants.

Form 1099-MISC: Filed for miscellaneous income such as rent, royalties, or prizes.Form W‑9 is an IRS form used to verify a contractor's identity and gather their Tax Identification Number (TIN). Employers are required to send out W‑9 forms to contractors to fill out prior to filing 1099 forms. Without a W‑9, you will have to withhold 24% of the payment.

If your business pays non-employees or independent contractors for services, you may need to file 1099 forms to report this non-employment income to the IRS. These forms are typically completed by financial institutions or businesses and sent to both the IRS and the individuals who were paid. Individual taxpayers do not file 1099 forms themselves. Businesses must file these forms if payments exceed $600 during the tax year.

The deadline to file your 1099-NEC is the 31st January of the respective tax year. For 1099-MISC, file with the IRS by the 28th of February of the respective tax year, or the 31st of March if you are e-filing.

The IRS has lowered the e-filing threshold to 10 returns, effective for 1099 filings starting in January 2024, down from the previous 250-form requirement.

Featured

View all

Form W‑9: Meaning, who should file, and how to download

Learn what a W‑9 tax form is, how to download and fill it out, and the specific instructions for a W‑9 tax form.

FAQs about backup withholding on contractor payments

Learn what backup withholding is, what the backup withholding rate is, and what form to use for reporting backup withholding.

A comprehensive guide on Form 1099-MISC and 1099-NEC

What are 1099-MISC & NEC forms in the US? Who should file independent contractor forms? What are the deadlines? Learn the details in our comprehensive guide.