US consumers reveal their holiday shopping preferences and budgets for 2024

A survey of 500 US consumers conducted by Zoho Survey at the end of August 2024 reveals key insights into how shoppers plan to navigate the upcoming holiday season.

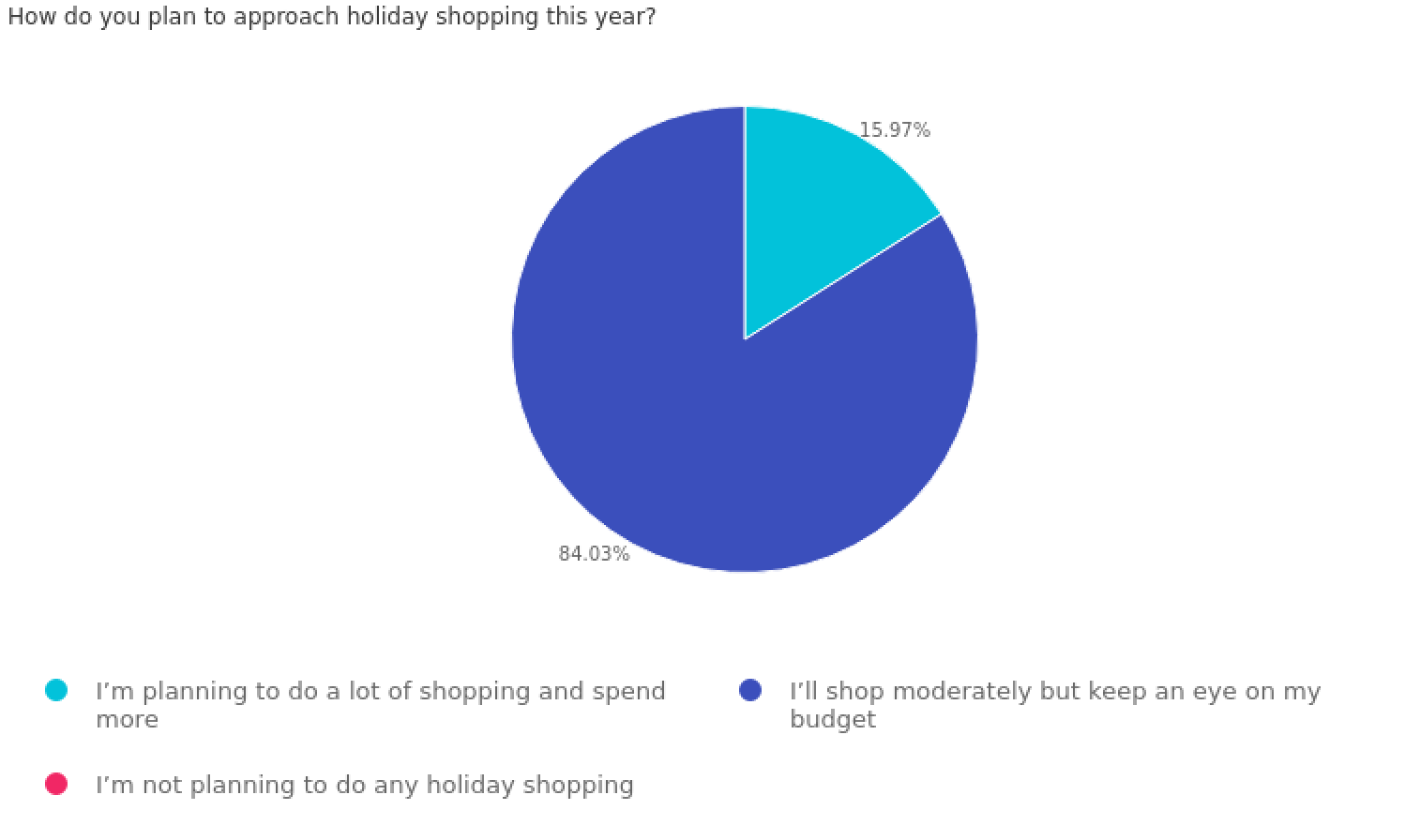

Shopping strategies: Moderation is key

When asked about their holiday shopping mindset, an overwhelming 84% of respondents indicated they plan to shop moderately while keeping a close watch on their budgets. Only 16% are gearing up for a splurge, indicating a conscious shift toward controlled spending amid economic uncertainty.

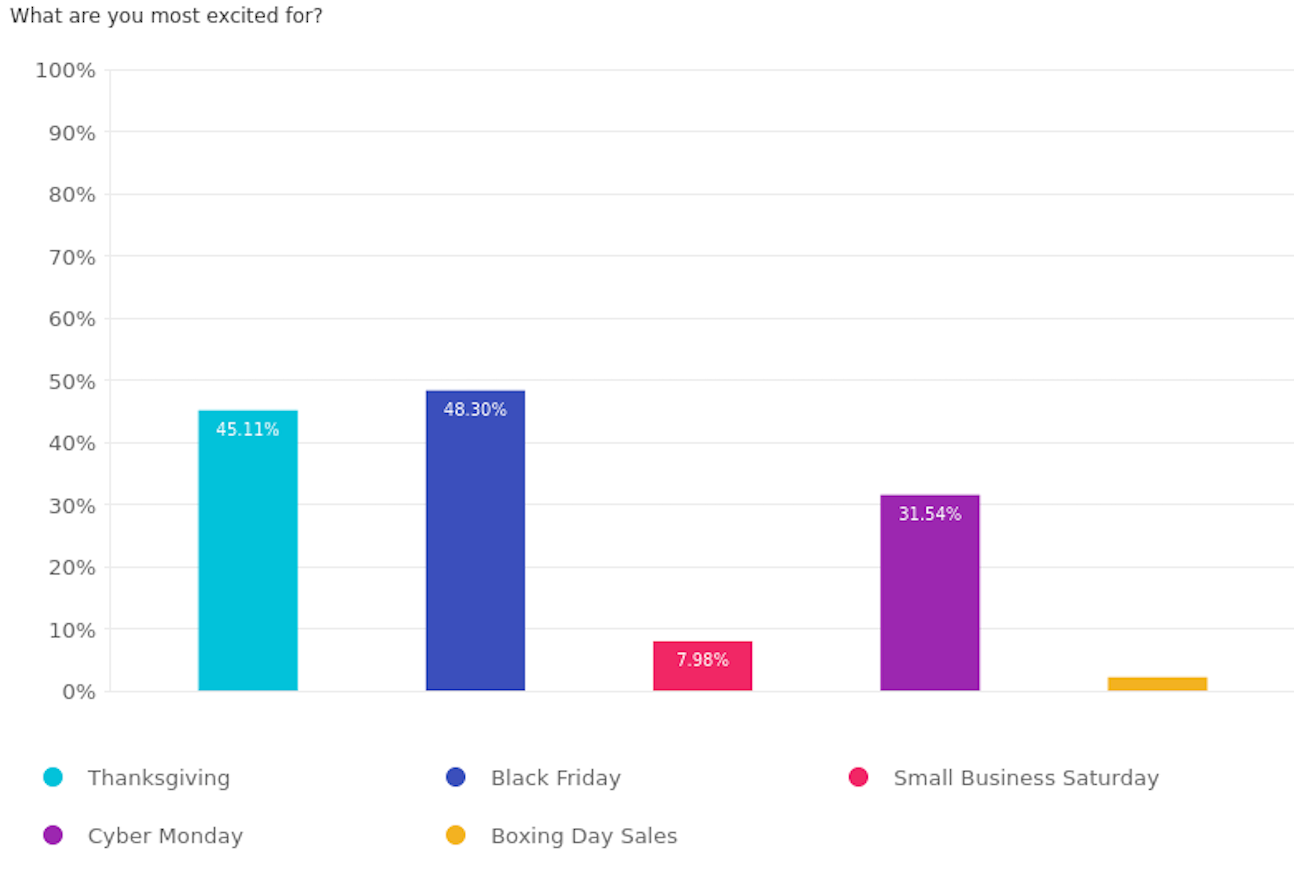

Consumers are prioritizing upcoming shopping events

This year, Black Friday takes the crown with nearly half (48.3%) of respondents marking it as the most anticipated event. With Thanksgiving close behind at 45.1% and Cyber Monday at 31%, consumers showed a strong preference for taking advantage of early holiday deals. Small Business Saturday trailed at 8%.

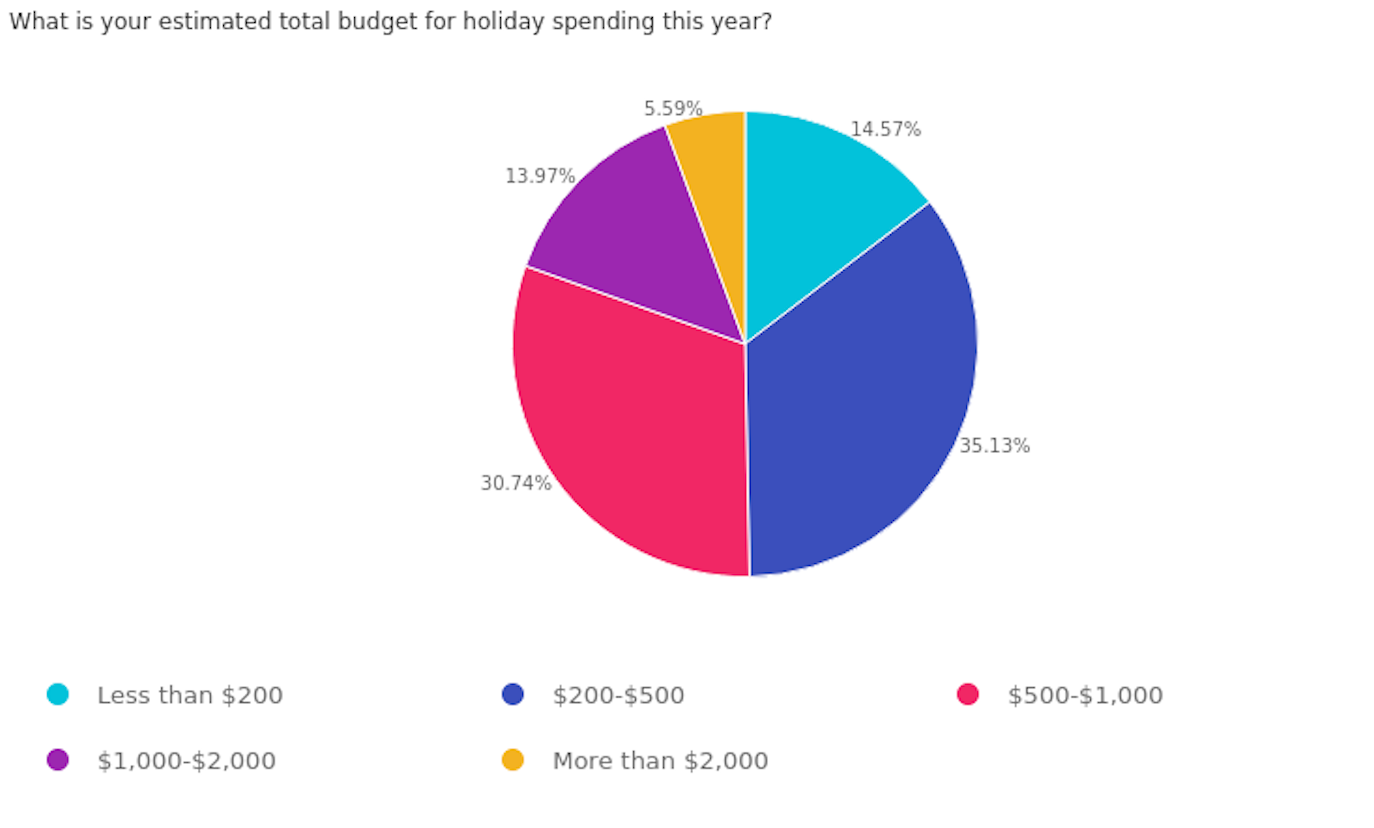

Budgets remain modest

Despite the holiday buzz, many US shoppers are keeping a close eye on their wallets. Over one-third (35.1%) have set a holiday spending budget between $200 to $500. Meanwhile, around 30.7% are willing to stretch up to $1,000, reflecting a cautious yet enthusiastic approach to holiday spending. Interestingly, only 5.6% of respondents are planning to splurge beyond $2,000 this season.

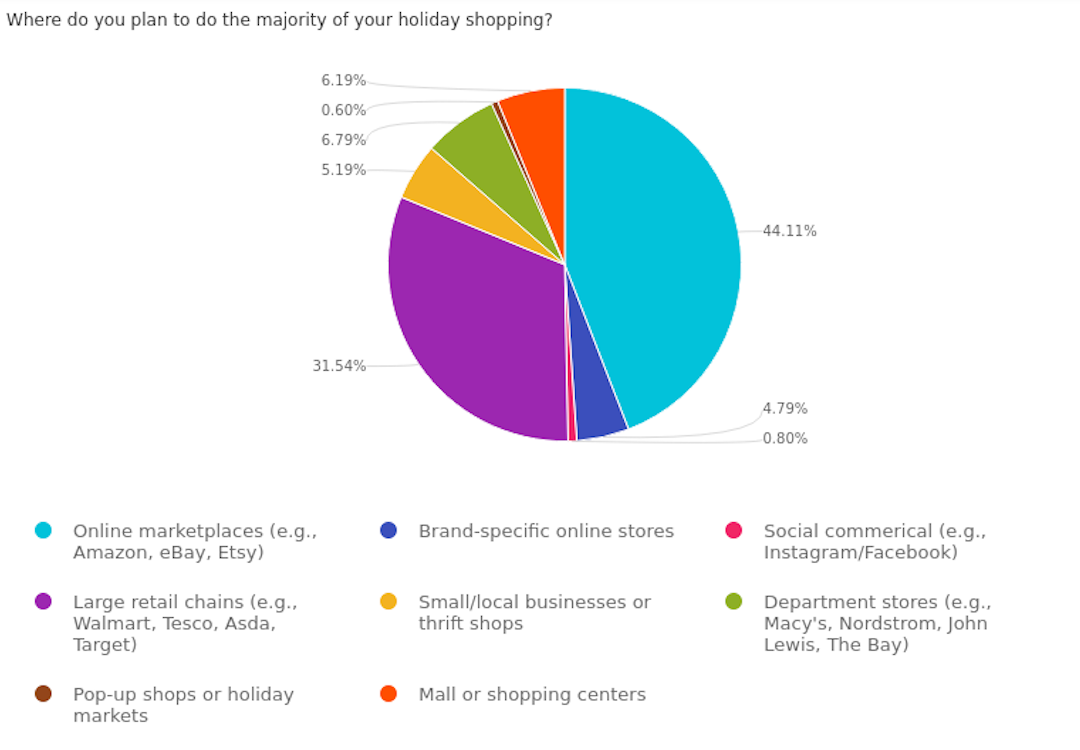

Where consumers are doing their 2024 holiday shopping

The digital shift continues to dominate, with 44.1% of respondents planning to shop primarily on online marketplaces like Amazon and eBay. However, large retail chains such as Walmart and Target still hold strong, with 31.5% preferring these outlets. Interestingly, brand-specific online stores are seeing less traction, with only 4.8% opting for them.

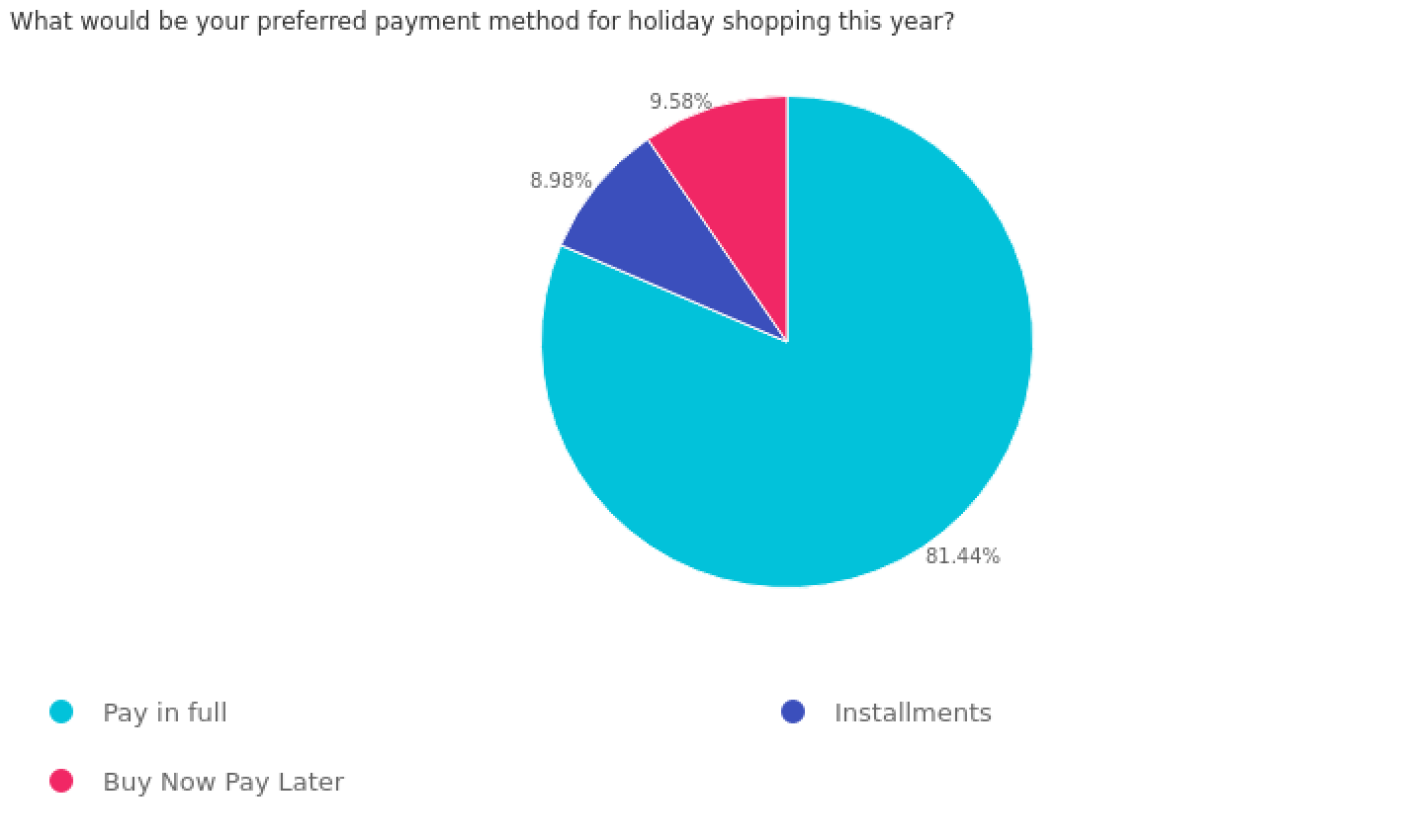

Payment preferences: Pay in full dominates

In a world where "Buy Now, Pay Later" (BNPL) options are increasingly available, it's intriguing to see that 81.4% of respondents still prefer to pay in full. Instalments and BNPL options, while popular in certain sectors, lag behind with less than 20% combined preference.

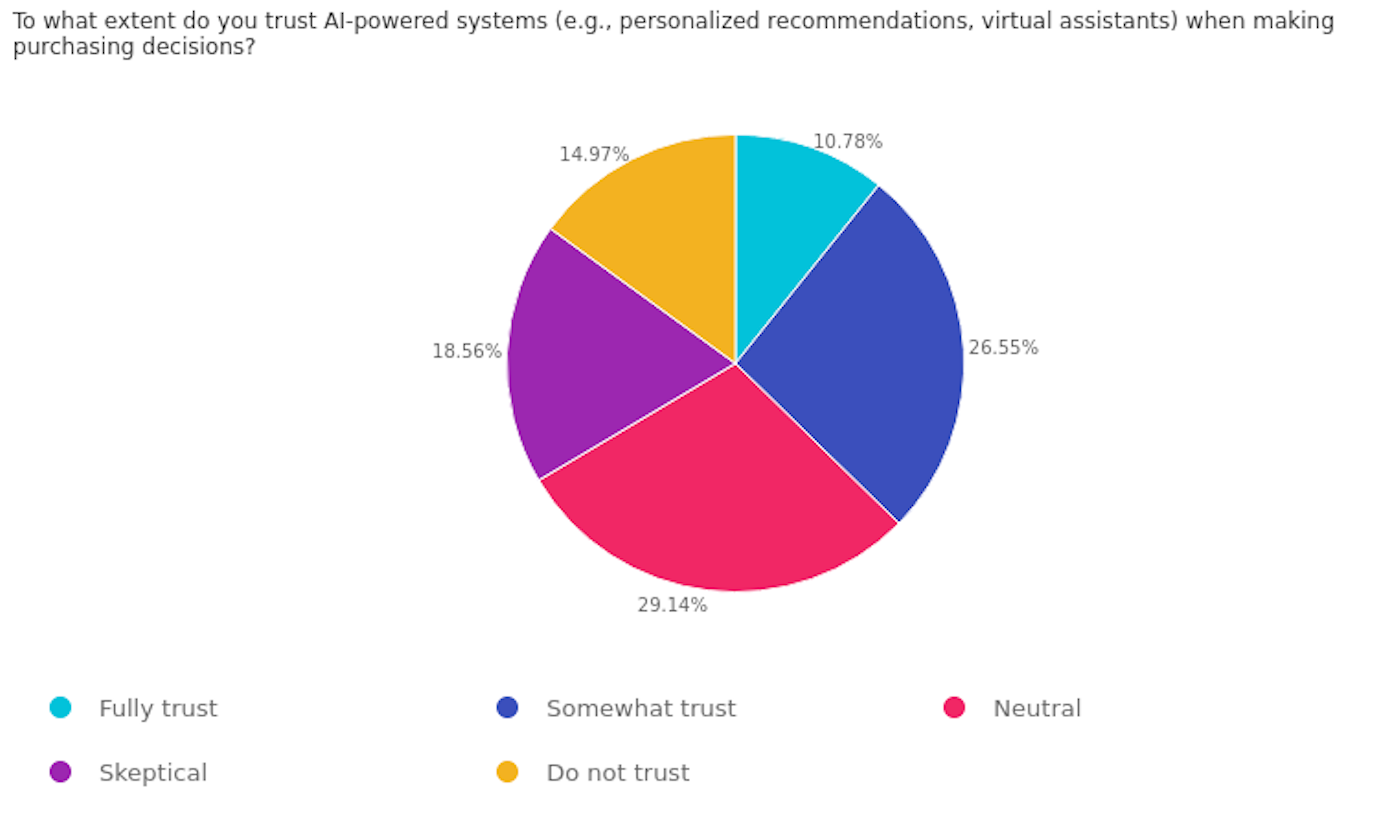

AI’s role in shaping the holiday experience

Opinions remain divided about AI-driven recommendations and personalized experiences. While 26.6% of consumers somewhat trust AI-powered systems, 29.1% said they remain neutral, and AI skepticism is still substantial, with 18.6% expressing distrust.

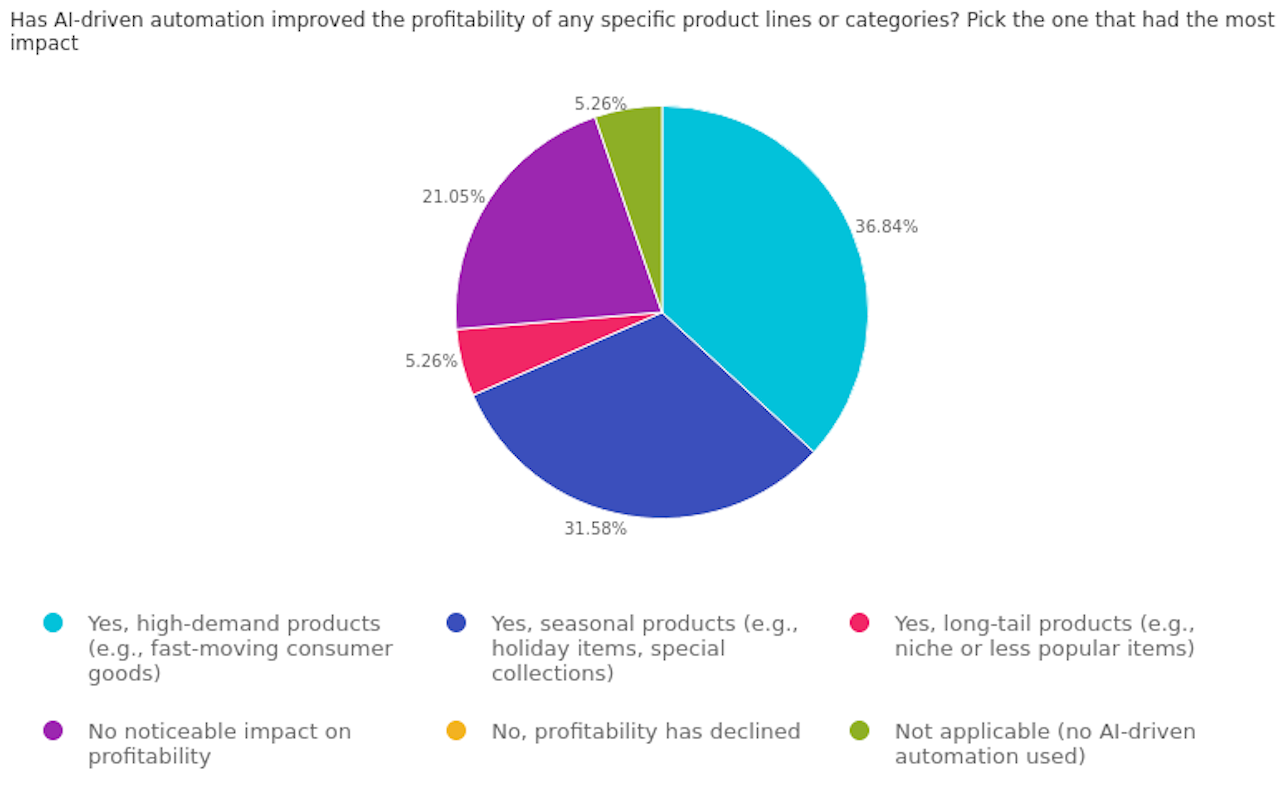

AI’s impact on retail profitability

In our survey, 36.8% of respondents highlighted that AI automation has significantly boosted the profitability of high-demand products, particularly fast-moving consumer goods. Seasonal items like holiday collections were the second most-frequently cited category, with 31.6% noticing improved returns.

Wrapping up the 2024 holiday insights

As the holiday season approaches, understanding the pulse of consumer sentiment is more vital than ever. These insights reveal just how dynamic shopping behaviors can be, shifting with the times while still holding on to tradition. Whether it's prioritizing budgets, seizing the best deals, or embracing new technologies, this year's shoppers are making intentional choices that reflect both caution and excitement.

Want to dive deeper into your own audience's needs?