Withholding VAT

Withholding VAT is an indirect tax where the customer deducts a portion of VAT from the payment due to their vendors. The withheld amount is then paid to a withholding agent, who submits it to the Kenya Revenue Authority (KRA) on an accrual basis.

In Zoho Books, you can create transactions, apply withholding VAT to them, and record payment for the remaining amount. Once the withheld VAT is paid to the KRA, you can also record payment for it in the respective transaction’s page. This ensures that your business stays compliant with KRA’s tax regulations.

Scenario: Patricia buys office supplies from a vendor for KES 10,000, including KES 1,600 VAT. She withholds 2% of the VAT (KES 200) and pays it to her withholding agent. The agent pays it directly to the Kenya Revenue Authority (KRA). In Zoho Books, the vendor creates a transaction for KES 11,600, applies the withholding VAT, and records the remaining payment of KES 11,400. After the withheld amount (KES 200) is paid to the KRA, the vendor records this withheld VAT again with the same transaction, ensuring tax compliance.

Enable Withholding VAT

To enable withholding VAT in your Zoho Books organization:

- Go to Settings.

- Select VAT under Taxes and Compliance.

- Click Withholding VAT Settings under Withholding VAT in the left pane.

- Slide the toggle near Withholding VAT.

- Select for whom you want to configure withholding VAT in the Enable Withholding VAT Settings For field. You can choose Customers, Vendors, or both.

Insight: If you are a withholding agent appointed by the KRA, select Vendors. If any of your customers is a withholding agent, select Customers. If both you and your customers are withholding agents, select Customers and Vendors. This allows you to accurately track and record VAT payments in Zoho Books.

- Click Save.

You can now withhold VAT in invoices and bills in your Zoho Books organization.

Create Customers

To create customers for whom you want to withhold VAT:

- Go to Sales on the left sidebar and select Customers.

- Click + New in the top right corner of the page, and enter the required details.

- If you want to edit an existing customer, select the required customer, and click Edit at the top of the customer’s Details page.

- In the Other Details section:

- Select the VAT Treatment of the customer as VAT Registered, and enter the VAT Registration Number.

- Check the option Is Withholding VAT Applicable? near Withholding VAT.

- Click Save.

The customer will be created.

Similarly, you can also create vendors for whom you want to withhold VAT.

Record Transactions

Create Invoices

When you send an invoice, your customer will deduct a portion of VAT and pay you the remaining amount. If they’re a withholding agent, they’ll pay the withheld VAT directly to the KRA; otherwise, they’ll pay it through their agent. Once the VAT is paid, you’ll receive an email with the payment details, and you can record it in the transaction.

To create an invoice:

- Go to Sales on the left sidebar and select Invoices.

- Click + New in the top right corner of the page.

- In the New Invoice page:

Enter the required details.

Select the Withholding VAT at the top of the Items table. The withholding VAT is 2%.

In the Items table, click the More icon next to the line item and select Show Additional Information from the dropdown. Ensure that the Withhold VAT option is checked for the line item.

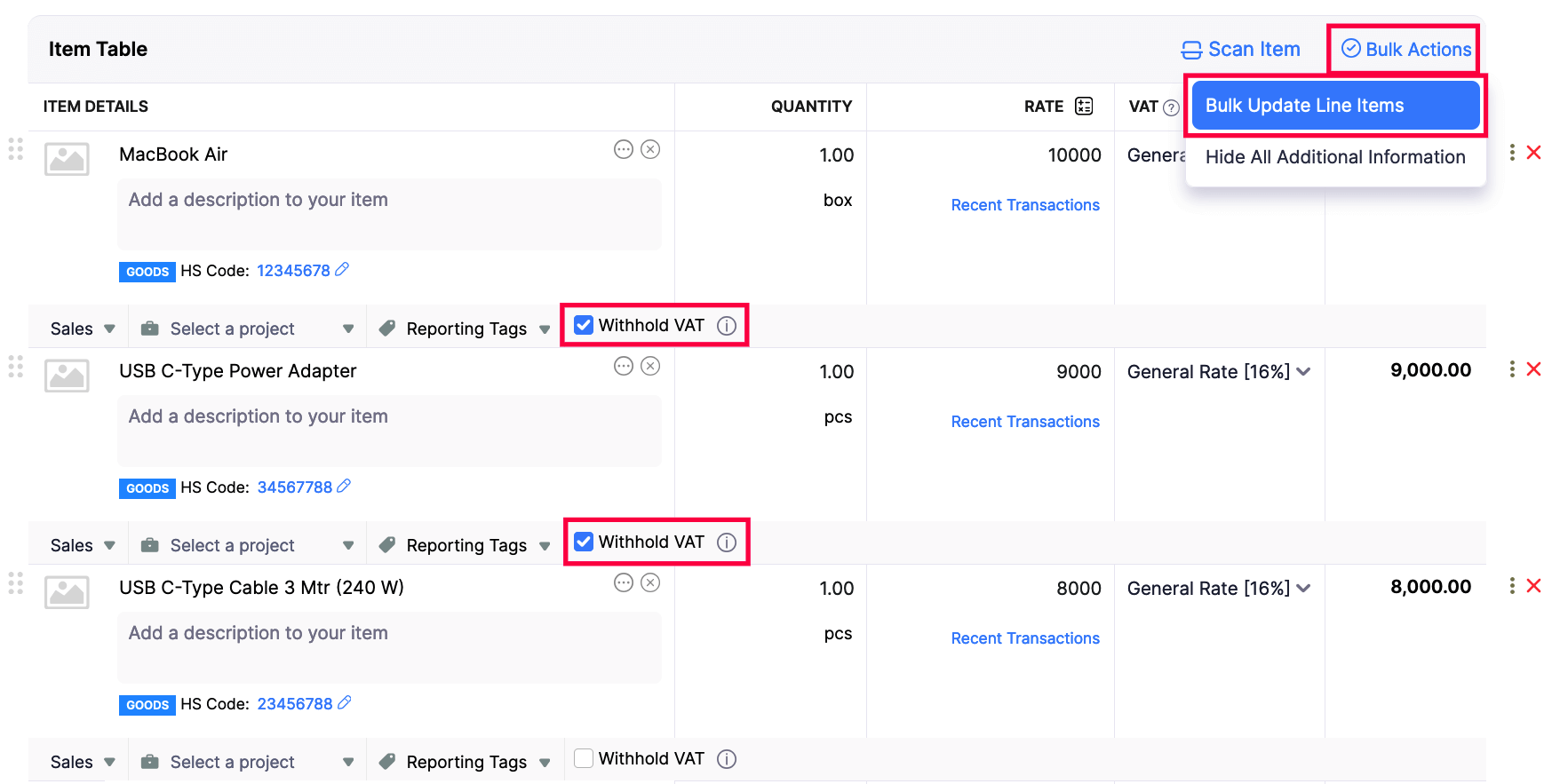

- To apply withholding VAT only for specific line items, click Bulk Actions next to the Item Table and select Bulk Update Line Items. Check Withhold VAT below the relevant items.

- To apply withholding VAT only for specific line items, click Bulk Actions next to the Item Table and select Bulk Update Line Items. Check Withhold VAT below the relevant items.

Click Save and Send, or Save as Draft and send it later.

The invoice will be created and sent to your customer. They will withhold the VAT, pay you the remaining amount, and submit the withheld VAT to the KRA through their agent. Once paid, you’ll receive an email with the payment details, for which you can record the invoice payment. Here’s how:

- Go to Sales on the left sidebar and select Invoices.

- Select the invoice for which you want to record payment and withholding VAT.

- Click Record Payment at the top of the invoice’s Details page, and select Record Payment from the dropdown.

- In the Payment page:

- Enter the required details.

- Check the option Yes next to Withholding VAT Deducted? if you’ve applied withholding VAT to your invoice. The withholding VAT amount deducted from the invoice will be displayed.

- In the Reference# field, enter the withholding certificate number you’ve received in the email.

- Click Record Payment.

Scenario: Patricia, a withholding agent, purchases goods for KES 100 and receives an invoice for KES 116, which includes KES 16 in VAT. She withholds VAT (KES 2) and pays the vendor KES 114. Patricia then pays the withheld VAT directly to the KRA. The vendor receives an email with the withholding VAT certificate number, and records payment for it.

The payment will be recorded for the remaining invoice amount.

View Customer Statements

Once you’ve recorded payment for your customer’s invoices, you can view the customer’s statement, which also includes the withholding VAT amount. To view the customer statement:

- Go to Sales on the left sidebar and select Customers.

- Select the customer for whom you want to view the customer statement.

- In the customer’s Details page, navigate to the Statements tab.

You can view the statements for the transactions, including payments recorded, payments received and the VAT amount withheld by the customer.

Similarly, you can also view statements for your vendors in the Vendors module.

Create Bills

If you are a withholding agent, you can create a bill for your vendor in Zoho Books and apply the withholding VAT. When you record payment for the bill, ensure that you record payment for the amount excluding the withholding VAT. Next, pay the withholding VAT amount directly to the KRA. On payment, your vendor will receive an email with the payment details, which they can record for tax purposes.

To create a bill:

- Go to Purchases on the left sidebar and select Bills.

- Click + New in the top right corner.

- In the New Bill page, enter the required details.

- Select the Withholding VAT at the top of the Items table. The withholding VAT is 2%.

- Click Save as Draft or Save as Open.

The bill is created, and you can record payment for the bill amount, excluding the withholding VAT. Here’s how:

- Go to Purchases on the left sidebar and select Bills.

- Select the bill for which you want to record the payment and deduct the withholding VAT.

- Click Record Payment at the top of the bill’s Details page.

- In the Payment page:

- Enter the required details.

- Check the option Yes near Withholding VAT Deducted? if you’ve applied withholding VAT to your bill. The withholding VAT amount deducted from the bill will be displayed.

- Enter the withholding certificate number in the Reference# field, if required.

- Click Save as Paid.

The payment will be recorded for the remaining bill amount. Once you pay the withheld amount to the KRA, your vendor will receive an email with the respective payment details.

View Reports

To view reports for the transactions where withholding VAT is applied:

- Go to Reports on the left sidebar.

- Select VAT3 Returns under VAT.

- Scroll down to the Net VAT Due section.

The Box 18 will display the total VAT withheld from sales transactions. Click the box to view the list of transactions where withholding VAT is applied.

Yes

Yes