Chart the right course for your payroll operations from the day you hire your first employee.

Chart the right course for your payroll operations from the day you hire your first employee.

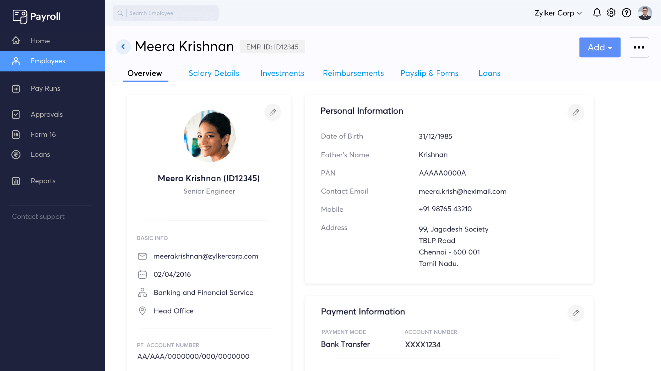

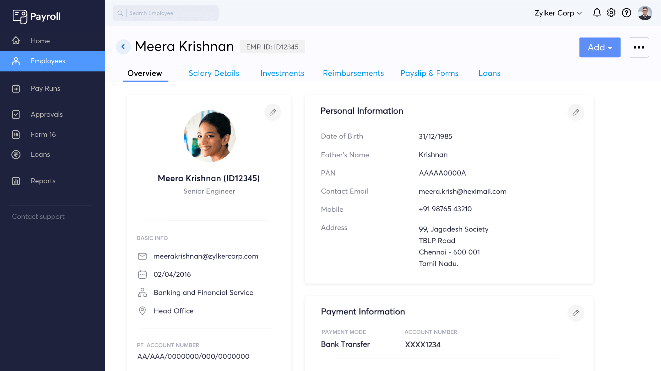

Bring all your existing data into Zoho Payroll with minimum effort. Follow our pre-defined template to import salary or previous employment details, and eliminate duplicates and reduce manual work.

Attract and retain the right talent with the right rewards. Revise the CTC, and pick the date from which the hike in pay will be reflected on the payslips.

Follow your employees' career progress by tracking their salary revision history and designation changes. Automatic updates in the self-service portal keeps employees informed too.

Reduce your payroll costs and data entry efforts by delegating routine document tasks to your employees. Employees can do things on their own from the client portal.

Enter your departing employee's last working day along with the full and final settlement date to process the pay automatically. You can encash unused leaves, send their final payslips, and Form-16 to an email address of their choice.

Acknowledge efforts of your long-serving staff. With automated gratuity calculation, let your parting employees reap their rewards immediately.