- HOME

- Taxes and compliance

- What is gratuity? Meaning, formula, calculation, and eligibility

What is gratuity? Meaning, formula, calculation, and eligibility

Gratuity, simply put, is a reward for long-serving employees. In India, gratuity is generally considered as one of the prime contributors to an employee’s retirement chest. If you are a business owner or someone who’s overseeing the payroll for your organization, and if you have an employee who’s completed 5 years or close to 5 years, the employee becomes eligible for gratuity.

The Payment of the Gratuity Act, 1972 was first introduced on 21st August 1972 and was passed by the Parliament of India. It became applicable from 16th September 1972. As per the latest eligibility rules for gratuity, organizations that have 10 or more employees are covered by the act.

Gratuity eligibility criteria

How do you assess your employees for gratuity eligibility?

The general rule of thumb is that an employee becomes eligible for gratuity if they’ve completed 5 years of continuous service with a single employer. However, some employees are exempted from this rule, and will still be eligible for gratuity in the event of their death or disability during their service even if they haven’t completed 5 years of service.

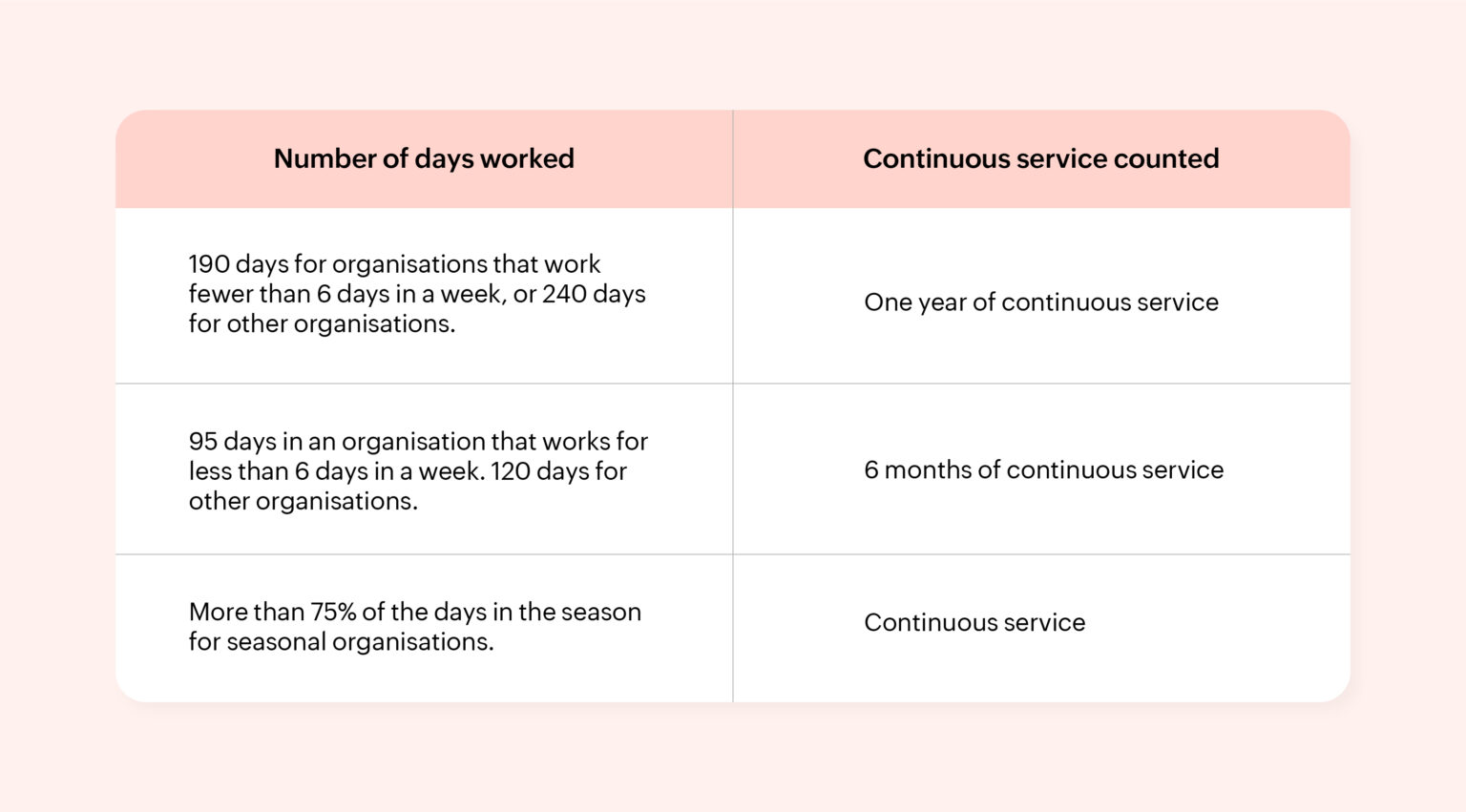

Evaluating continuous service

Since gratuity is time-based, it is important to understand how continuous service is calculated. Any employee who offers their uninterrupted service to their organization, leaving out absences that aren’t any fault of the employee, is considered to be in continuous service.

Summarizing the eligibility criteria

Since gratuity is a lump sum, there are strict eligibility criteria that your employees need to fulfill. Your employees will be eligible to receive gratuity if:

- They have retired from the job.

- They have resigned after providing 5 years of service in your company.

- They have passed away or become disabled due to an illness or accident.

Gratuity calculation for employees

To calculate gratuity, employers in India use a formula-based approach, where the gratuity payable depends on two factors:

- The employee’s last drawn salary amount

- Years of service

For calculating gratuity, the Payment of Gratuity Act has divided non-government employees into two categories: employees that are covered under the act and those that aren’t.

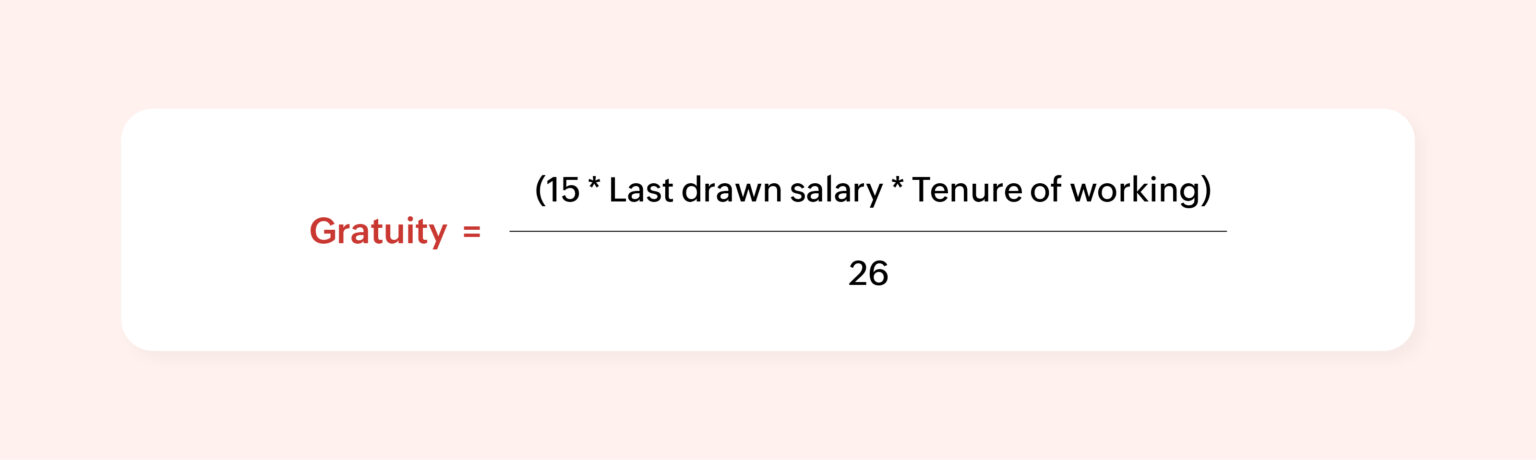

Gratuity formula for employees covered under the act

Last drawn salary includes basic pay, dearness allowance, and sales commissions.

Example: Let’s assume the employee’s last drawn salary is ₹ 70,000, and the employee has worked with the company for 20 years and 8 months. The formula to calculate gratuity will be: (15 * 70,000 * 21) / 26

We are considering the tenure of working to be 21 years because the employee has already worked for more than 6 months into their 21st year of employment. If the employee had worked for 20 years and 5 months, then only 20 years would be considered.

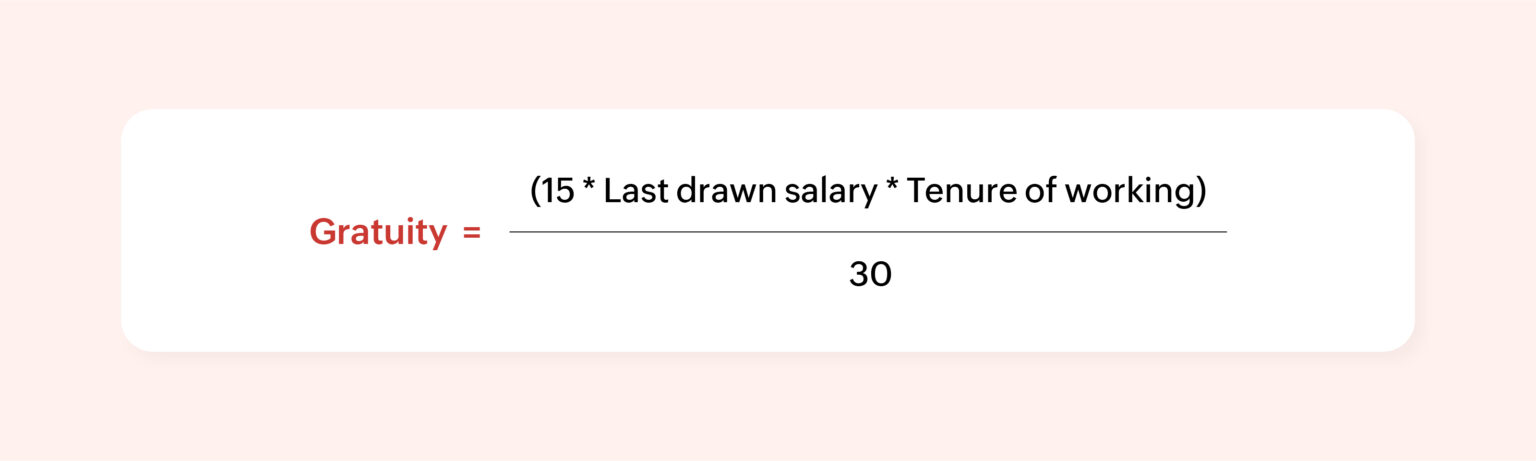

Gratuity formula for employees not covered under the act

Last drawn salary includes basic pay, dearness allowance, and sales commissions.

Example: Let’s assume the employee’s last drawn salary is ₹70,000, and the employee has worked with the company for 20 years and 8 months. The formula to calculate gratuity will be: (15 * 70,000 * 20) / 30

We are considering the tenure of working to be 20 years because, in this scenario, only the number of completed years is taken into consideration.

You can also use our gratuity calculator to quickly compute your lump sum amount.

Tax calculation on gratuity

Depending on your employees’ eligibility for receiving gratuity, there are three different ways in which your employees get taxed.

If it is a government employee (under either central or state government) who is eligible for gratuity, they’ll be exempt from income tax.

For employees who are covered under the Payment of the Gratuity Act, only the last fifteen days of the drawn salary will be exempt from income tax.

For employees who are not covered under the Payment of the Gratuity Act, then the least of the following 3 amounts will be exempt from income tax:

- ₹ 10 lakh

- The actual amount of gratuity received

- One-half month’s salary for every year of employment that the employee has completed with the employer

Payment of gratuity to your employees

Regardless of your long-serving staff loyalty, there are some scenarios in which you can withhold the entire gratuity amount or collect a partial amount back as outstanding dues.

If any of your employees get terminated because of unethical behavior at work or lack of respect for repeated warnings or even ends up damaging your office property, you can deduct these from their gratuity pay. In order to cover these expenses, businesses are also allowed to take an insurance policy from LIC. As an employer, you can also completely forfeit the gratuity payout if your employees exhibit violent behavior, or get involved in lawless acts.

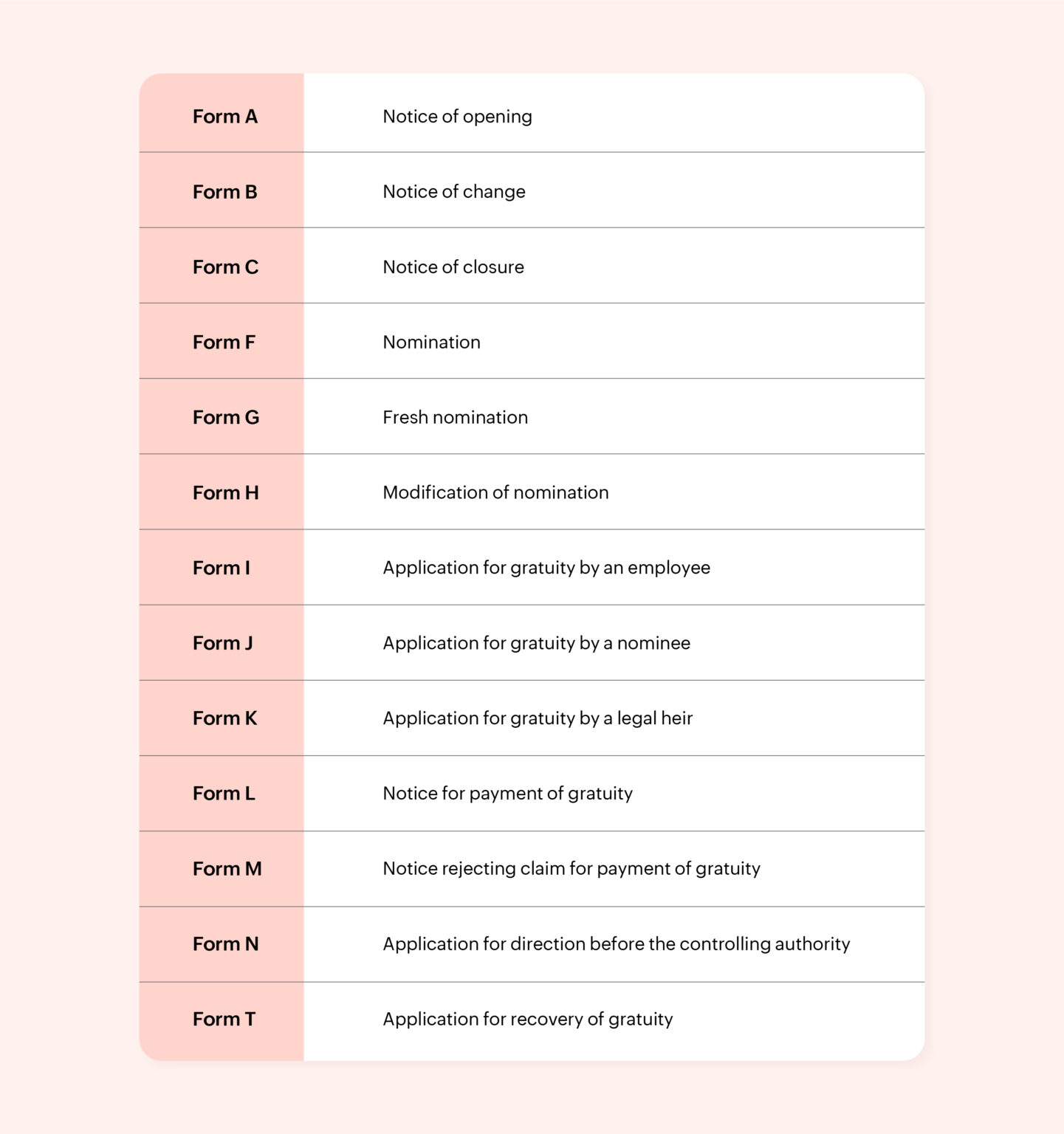

Gratuity compliance forms

There are important compliance forms that you need to be aware of. We’ve listed them below along with their purpose.