- HOME

- Payroll operations

- What is a joining bonus and how does it work?

What is a joining bonus and how does it work?

A joining bonus, or a sign-on bonus, is a one-time payment offered by employers to new hires as an incentive for joining the company.

It has become a popular strategy for companies in India to encourage employee commitment right from the start. By understanding how joining bonuses work, the benefits they offer, and best practices for structuring them—employers can make informed decisions that drive growth and strengthen employee loyalty.

What is a joining bonus?

A joining bonus is a one-time reward employers provide to new hires upon accepting a job offer and starting their role. Typically paid as a lump sum, this bonus serves as a perk to attract talent.

Some employers, however, may choose to distribute the joining bonus over multiple instalments or offer it as stock options. When paid in instalments, the bonus amount is disbursed over a set period, encouraging the employee to stay with the company while receiving the full reward.

Benefits of offering joining bonus

- Gain a competitive edge

Employers often find it challenging to secure skilled candidates when other companies present attractive packages. By offering a joining bonus, employers can provide a higher upfront payment to new hires that makes the job offer stand out.

- Attract and retain skilled employees

When hiring experienced professionals, keep in mind that they often prioritise competitive compensation packages when evaluating job offers. A joining bonus can make your offer more appealing, attracting top talent while also encouraging long-term commitment. This retention advantage helps offset costs associated with hiring and training, making a joining bonus an effective tool for both recruitment and retention.

- Regularise base salary

Budget constraints can sometimes limit the base salary employers are able to offer. When a lower salary package is necessary, a joining bonus can help bridge the gap, effectively boosting the overall compensation package. Including a joining bonus as part of the total CTC (Cost-to-Company) enables employers to create a more attractive offer without adjusting the base salary.

How are joining bonuses calculated?

A joining bonus is typically calculated as a flat rate or a percentage of an employee’s CTC or basic salary. In India, this bonus usually ranges from 10% to 20% of the CTC, although the exact amount can vary based on both the employee’s CTC and company policy.

For example, if an employer offers a 20% joining bonus to a prospective employee with a CTC of ₹5,00,000, the bonus would be calculated as follows: 20% * ₹5,00,000 = ₹1,00,000

When are joining bonuses paid?

Joining bonuses are generally paid as a one-time lump sum, often with the employee’s first payroll. However, depending on company policy, employers may choose to distribute the bonus in instalments over a set period, or even delay payment until the employee completes a specific tenure, such as the probation period.

How to create a joining bonus policy

When creating a joining bonus policy, employers should include the following key factors to ensure clarity and consistency:

1. Eligibility criteria

Clearly defined eligibility criteria set the terms and conditions for receiving the joining bonus. These criteria include aspects like the employee's role, length of service, and type of employment. For example, a company may offer the joining bonus only to full-time employees, making part-time or contract workers ineligible. Defining these conditions upfront helps maintain transparency and ensures employees understand the requirements for receiving the bonus.

2. Type of bonus

Employers should specify whether the bonus will be paid as a one-time lump sum or in instalments. This clarification allows employees to know what to expect and helps employers manage expectations and streamline the payroll process.

3. Procedure for application, approval, and payout

Outline the steps for applying, approving, and disbursing the joining bonus. Providing these details within the policy ensures employees are informed about the necessary procedures and reduces potential confusion later on.

A quick summary

Employers can offer a joining bonus to new hires to attract top talent and gain a competitive edge in the industry. This bonus not only enhances the appeal of the job offer but also supports organisational growth by helping secure the right candidates.

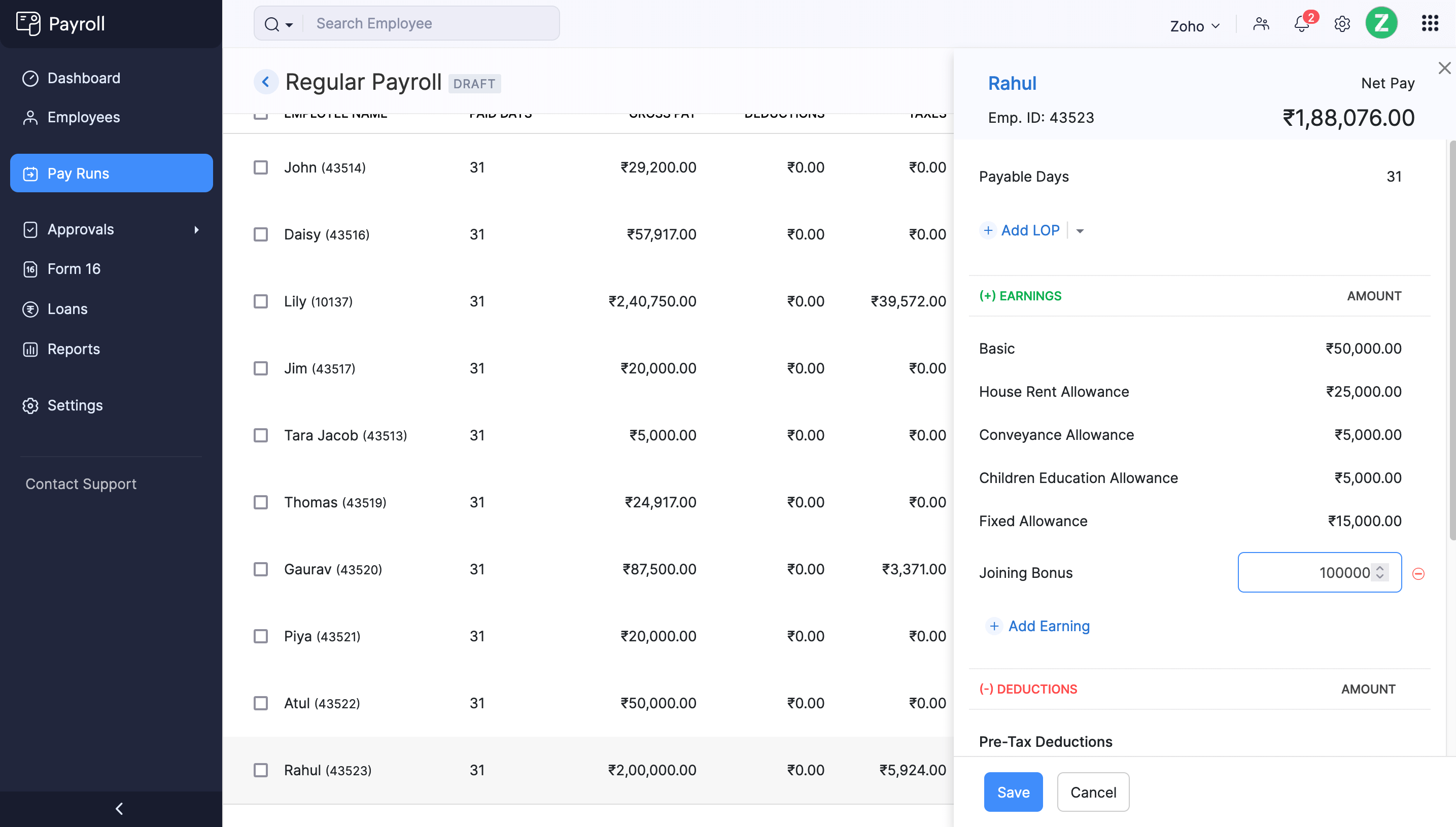

To streamline the bonus payout process, payroll software like Zoho Payroll offers automation that ensures accurate salary payments. With Zoho Payroll, you can add a joining bonus for specific employees and process it either with their monthly salaries or through off-cycle pay runs.

Hire the right talent for your company, while effortlessly staying on top of your joining bonus processes.

Frequently asked questions on joining bonuses

Is joining bonus part of CTC?

Yes, a joining bonus is included in an employee’s CTC and is considered a taxable component under Section 15 of the Income Tax Act, 1961. Employers deduct applicable taxes before paying out this bonus.

Why do companies give joining bonuses?

Companies offer joining bonuses to attract top talent, minimise the risk of candidates choosing competitors, and encourage early engagement and performance. This bonus can also help retain new hires during their initial employment, offsetting the costs of onboarding and training.