- HOME

- Payroll administration

- What is salary? Meaning, types & payment modes

What is salary? Meaning, types & payment modes

When employees work or perform tasks for a company or individual, they expect timely compensation for their efforts. This compensation is known as salary, a regular payment given to employees in return for their continuous services. This payment is usually agreed upon in advance and continues as long as the employee stays with the organisation. In this article, you will learn the meaning of salary, its different types, and calculation process.

Salary definition and meaning

Salary is a regular payment that an employer gives to an employee for the work and services provided in a specific role. Generally, employers disburse this payment monthly, but some companies opt to make this payment weekly, bi-weekly, bi-monthly or even annually.

The job offer letter outlines the amount and payment frequency, which may change over time due to promotions or shifts in an employee’s working hours. It is also important to note that an employee can negotiate their salary during the interview.

A company fixes an employee’s salary amount and often includes benefits such as healthcare insurance, paid vacations, bonuses, and other allowances. An employee’s salary is based on the job position they work, location, and how long an employee has been working in a particular company.

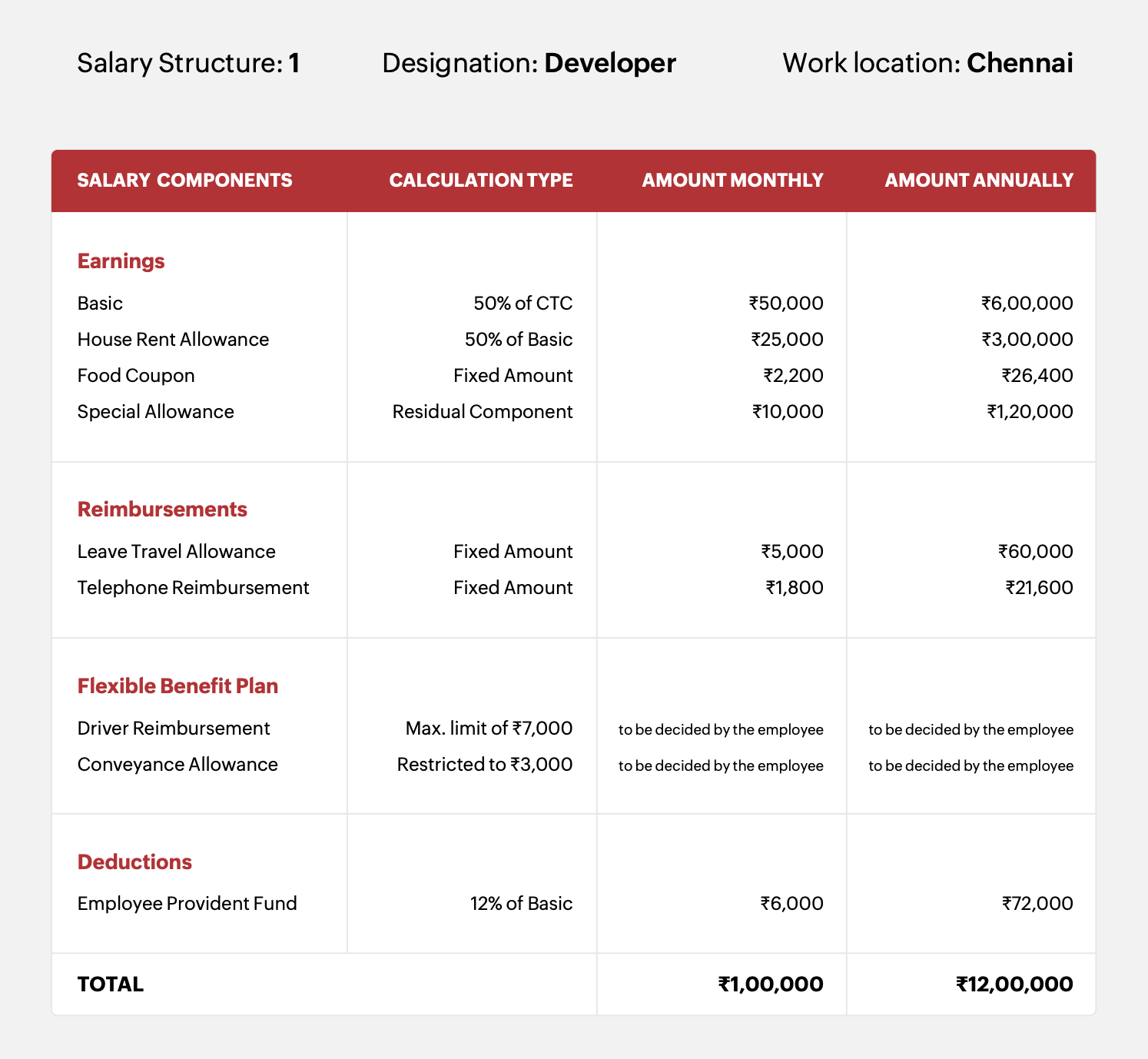

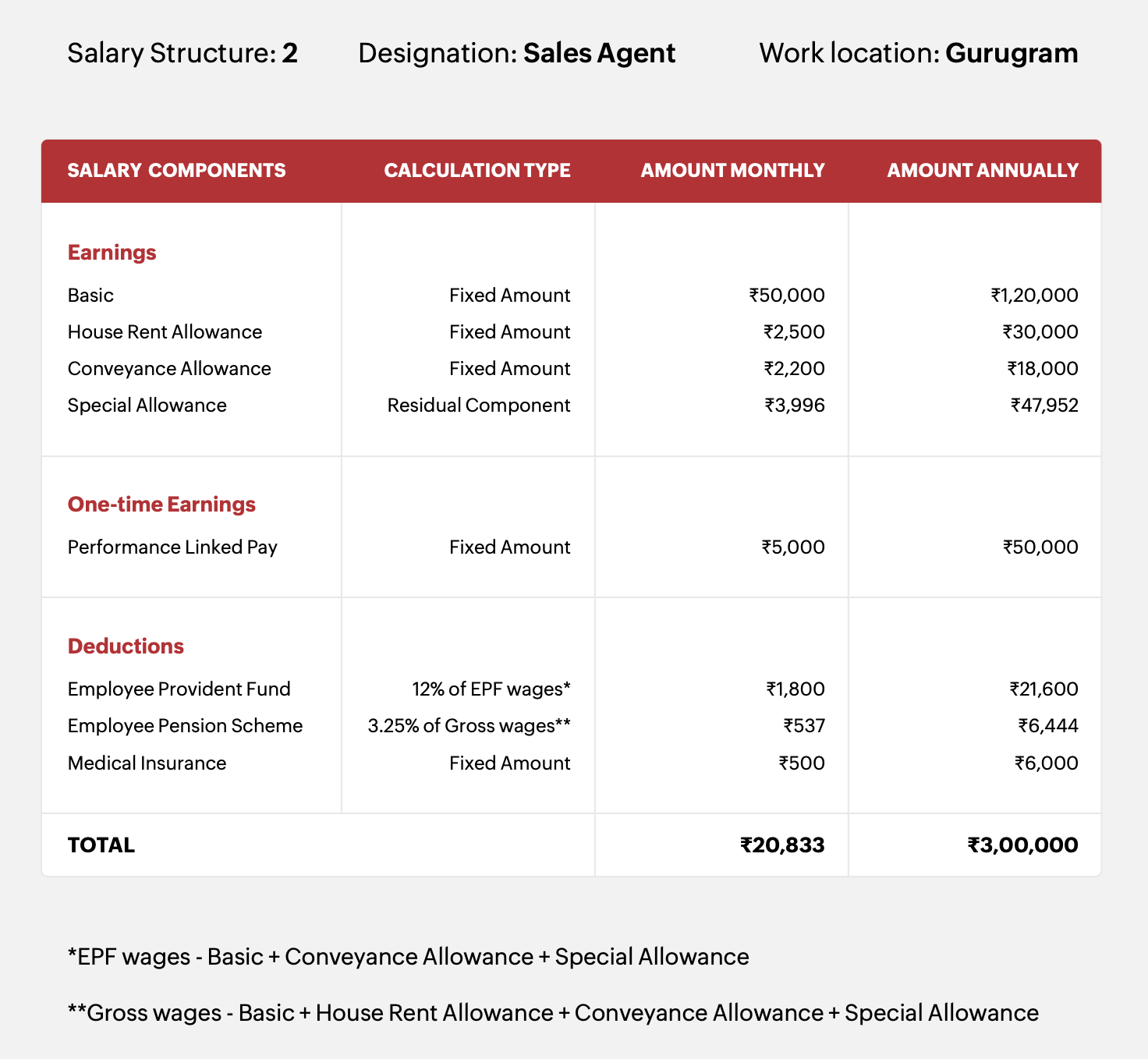

You can see the following two examples to understand how the salary structure varies depending on designation and location.

Sample salary structure of a software developer working in Chennai

Sample salary structure of a sales representative working in Gurugram

Learn in-detail about salary structure in India.

What are the different components of salary?

Salary is typically made up of four main parts: Fixed components, variable components, benefits, and deductions.

The salary of an employee consists of various components. These components differ among the companies, but the common components of salary include the following:

Basic salary: This is a fixed, taxable amount that typically makes up 40 to 50% of the CTC. It forms the base income before any allowances or deductions and is primarily determined by the employee's role and the industry.

Allowances: Allowances are additional amounts, either partially or fully taxable, provided to employees. Depending on company policy, these can include house rent allowance (HRA), dearness allowance (DA), leave travel allowance (LTA), medical allowance, phone reimbursement, special allowance and others.

Performance bonus: It is given as a reward to employees for their outstanding performance under the Payment of Bonus Act 1965. This bonus is an additional payment on top of the basic salary, designed to motivate employees. The amount is usually determined based on the employee’s performance and company policies.

Professional tax: Employers deduct professional tax from the employee's salary at a prescribed rate and pay it to the state government. This is a state-specific statute, and the regulations can vary from state to state. The maximum annual amount is ₹2,500.

Employee Provident Fund (EPF): Employers and employees each contribute 12% of EPF wages monthly. EPF wages include basic salary, dearness allowance and other allowances, excluding house rent allowance. If monthly basic salary exceeds ₹15,000, only ₹15,000 is considered for EPF wages.

Employees' State Insurance (ESI): Applicable for employees working in organisations registered with ESIC and whose earnings are less than ₹21,000 per month. Employers contribute 3.25%, and employees contribute 0.75% of the gross salary.

Gratuity: It is a reward for employees who have served for a long time. In India, it significantly contributes to an employee’s retirement fund. Employees who complete 5 years of continuous service with a company become eligible for gratuity

Labour Welfare Fund: LWF is a statutory requirement managed by state governments in India. This scheme provides eligible employees and their dependents with medical care, housing, education, nutritious food, and recreational facilities. Both employers and employees contribute to the labour welfare fund, with the contribution amount varying by state.

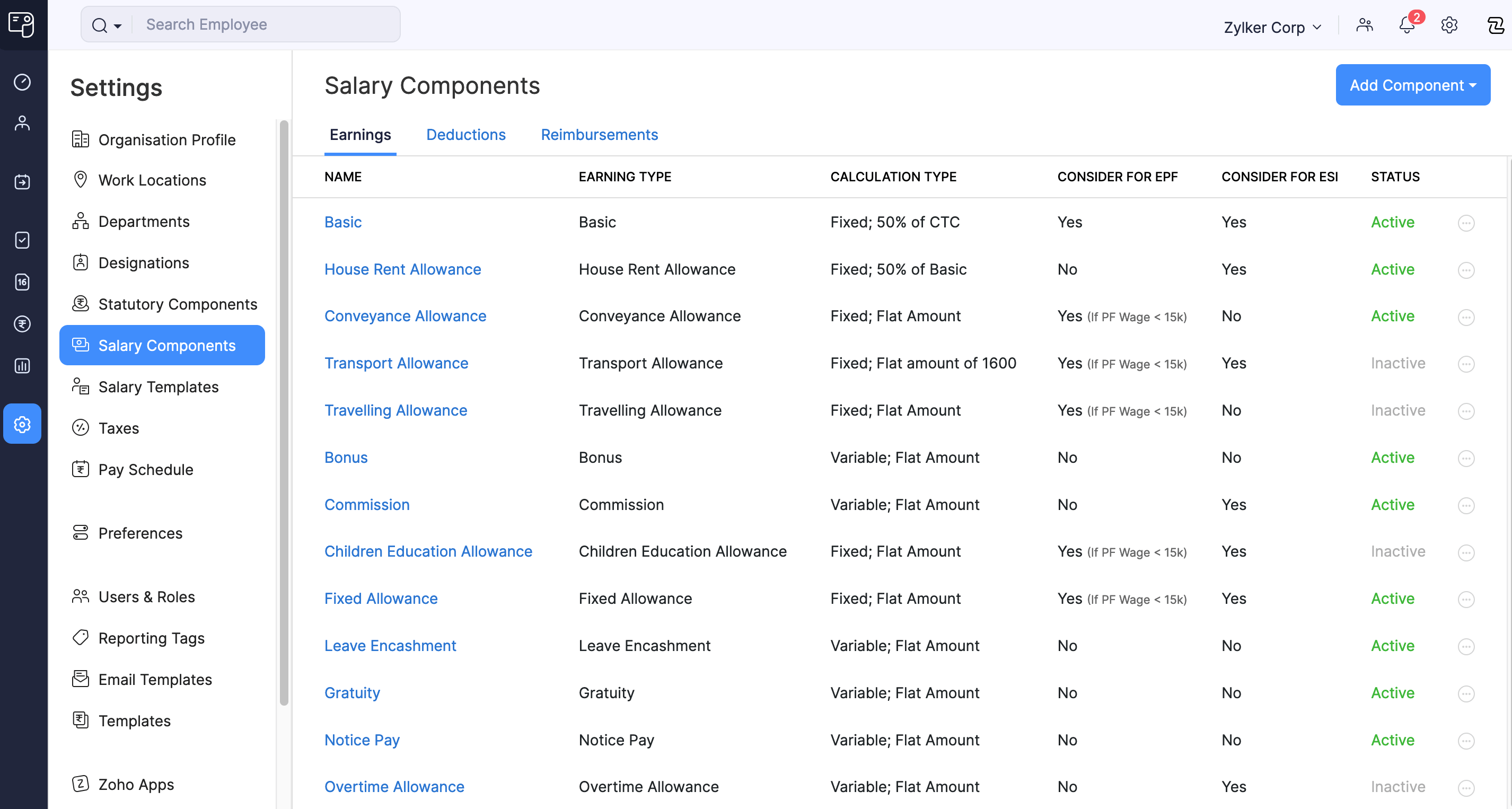

With payroll software like Zoho Payroll, these salary components are already in-built, and thus, processing your employees’ salaries becomes easier. The software automates salary calculations and reduces the workload of your payroll team. By ensuring compliance with regulations, it minimizes the risk of errors and penalties.

Salary components in Zoho Payroll

What is LPA in salary?

In salary, the term, 'LPA' stands for ‘Lakhs Per Annum’. It is a simple way to express annual earnings in lakhs, a common unit in India. For instance, if you earn '12 LPA,' it means your yearly salary is ₹12 lakhs. This notation simplifies discussions about salaries, especially in regions where compensation is commonly expressed in lakhs or crores. It helps you ensure clear communication and understanding of pay structures.

What is the salary date in India?

According to the Payment of Wages Act, 1936, the following is the employee’s salary date in India:

For companies with fewer than 1,000 employees, the salary for the previous month should be paid by the 7th of the next month.

For companies with 1,000 or more employees, the salary for the previous month should be paid by the 10th of the next month.

What are the different types of salary payments?

The following highlights the different types of salary payments in India:

Cash

Cash payments involve directly handing over payment face-to-face without using the internet. If opting for this method, ensure meticulous record-keeping in the accounting register.

Cheque

Cheques are a traditional method of salary payment in India. Typically, a physical cheque with the payment details is issued to employees on or before the payday.

Direct deposit

Direct deposit, also known as bank transfer, involves transferring employees' salaries directly into their bank accounts. Both the employer and the employee must have bank accounts for this method.

With Zoho Payroll, you can seamlessly handle every mode of salary payment. Whether it is cash, cheque, or direct deposit, Zoho Payroll can manage it all. It also generates payslips and makes payroll management efficient and hassle-free.

What are the advantages of salary?

When you decide to provide salaries, both employees and the company can enjoy the following four main benefits:

- Steady income

When a company pays a fixed amount every month, it ensures consistency. Each payday, employees receive the same amount, regardless of holidays, sick days or personal days. This steady income can reduce stress for employees when unexpected expenses arise. For the payroll department and the organisation, it means less administrative work and a simpler payroll process.

- Reflects responsibility

Salaried employees often take on more responsibilities than hourly workers. They might work longer hours or non-traditional schedules, and employers usually offer higher salaries to compensate for this. This helps companies attract and retain top talent by offering competitive pay for demanding roles.

- Additional benefits

Full-time salaried employees typically receive more benefits, such as healthcare and paid vacation time. These benefits often put them in a better financial position. Perks like maternity or paternity leave, or reimbursements can also significantly benefit employees and their families.

What is the difference between salary and wages?

The following table helps you understand the difference between salary and wages:

| Parameter | Wages | Salary |

| Payment | Paid on a daily or hourly basis | Paid every month |

| Job role | Hired for specific tasks or short-term jobs | Employed to contribute towards broader company goals and revenue |

| Pay structure | Based on hours worked, making it variable | Fixed pay structure, regardless of hours worked |

Understanding the difference between wages and salaries can help you determine which type of job aligns better with an individual. It is also important to note that both ‘salary’ and ‘CTC’ (Cost to Company) are terms you will encounter frequently and they are often used interchangeably.

The bottom line

Salary is more than just paying someone; it covers various parts of employment. Knowing about different salary components, calculations, and payment methods helps both employees and employers stay on the same page. Staying informed about salary-related details will help you keep the workplace organised and employees motivated.