- HOME

- Payroll administration

- Gross salary: Meaning, calculation formula, and components

Gross salary: Meaning, calculation formula, and components

When you hire an employee, you agree to pay them a certain amount for their services. This total amount is known as gross salary, which includes the benefits provided by the company and the deductions made.

Understanding the concept of gross salary is crucial, especially for those managing payroll, as it helps to clarify the differences between an employee’s total earnings and their actual take-home pay. This guide will explore the meaning of gross salary, its components, calculation rules, and significance in an employee’s salary.

Gross salary meaning

Gross salary refers to the total amount an employee earns before any deductions are made. It includes the basic salary, allowances (such as House Rent Allowance, conveyance allowance, medical allowance), bonuses, and any other perks provided by the employer.

It forms the foundation for calculating taxes, deductions, and the net salary that employees take home. Gross salary, also known as gross pay, becomes net salary after statutory deductions like provident fund, professional tax, and income tax are taken out.

Components included in gross salary

- Basic salary

Basic salary is the core part of an employee's Cost to Company (CTC) and excludes all allowances and benefits. These allowances and benefits such as the Provident Fund are calculated based on the employee’s basic salary. The employer pays this fixed amount to the employee without any deductions or exemptions. Usually, the basic salary is lower than the take-home pay or gross salary.

- House Rent Allowance (HRA)

Employers give House Rent Allowance to help employees cover their accommodation costs. Employees can use it to pay for rent on residential properties near the workplace, supporting their housing expenses.

- Other allowances

Allowances are additional payments made by the company beyond the basic salary. These can include allowances for transport, conveyance and medical, among others.

- Perquisites

Perquisites, or perks, provide additional benefits beyond basic salary and allowances. These perks can be monetary or non-monetary and depend on the employee's position within the organisation. Perquisites enhance the overall compensation package and come in addition to the base salary.

- Salary arrears

Salary arrears represent payments given to an employee when their salary is increased retroactively. Typically, the employer pays these arrears in a lump sum for the period between the effective date of the salary hike and the actual payment. For instance, if the company approved a salary increase in June that was effective from January, the employee would receive arrears for the past six months.

- Gratuity

Gratuity is a payment made by the employer to an employee as a token of appreciation for their service. Employers generally pay gratuity upon an employee's retirement or departure from the company. According to Section 10(10) of the Income Tax Act, employees receive gratuity only after completing five years of service, and the amount is considered taxable income.

- Provident fund contribution

Both the employer and employee contribute 12% of the employee’s EPF wage to the Employees' Provident Fund (EPF) each month. This contribution helps in building a retirement fund for the employee.

- Bonus

A company gives a bonus as an additional payment to an employee, typically once a year. The bonus usually depends on the employee's performance and achievements within the organisation.

Components excluded in gross salary

The employer incurs certain expenses for the welfare of employees that do not get included in the employee's CTC.

- Reimbursements for travel and food expenses incurred for official or business purposes.

- Refreshments and snacks are provided during office hours.

- Leave travel concession and leave encashment.

Deductions allowed from gross salary

Deductions such as income tax, professional tax, provident fund contributions, and corporate health insurance premiums.

Income Tax is generally computed by applying the appropriate tax rate to the taxable income.

These include determining the gross salary, accounting for eligible deductions and exemptions, calculating the tax due, and subtracting any tax already paid. Each of these steps is crucial in accurately assessing the final tax liability.

How to calculate gross salary?

To determine an employee's gross salary, use the following formula:

Gross salary = Basic salary + House Rent Allowance (HRA) + Other allowances

Assume there is an employee who works at Zylker Corp and her salary components are as follows:

| Components | Amount (in ₹) |

| Basic salary | 50,000 |

| House Rent Allowance | 15,000 |

| Conveyance allowance | 5,000 |

| Special allowance | 6,000 |

| Perquisites | 4,000 |

| Bonus | 10,000 |

Using the gross salary formula:

Gross Salary = Basic Salary + HRA + Conveyance allowance + Special Allowance + Perquisites + Bonus

Gross Salary = ₹50,000 + ₹15,000 + ₹5,000 + ₹6,000 + ₹4,000 + ₹7,000 + ₹3,000 = ₹90,000

Therefore, the employee’s gross salary is ₹90,000.

With Zoho Payroll, you can automatically calculate both gross and net salaries for your employees. The software applies the correct deductions at the right intervals, ensuring accurate salary calculations.

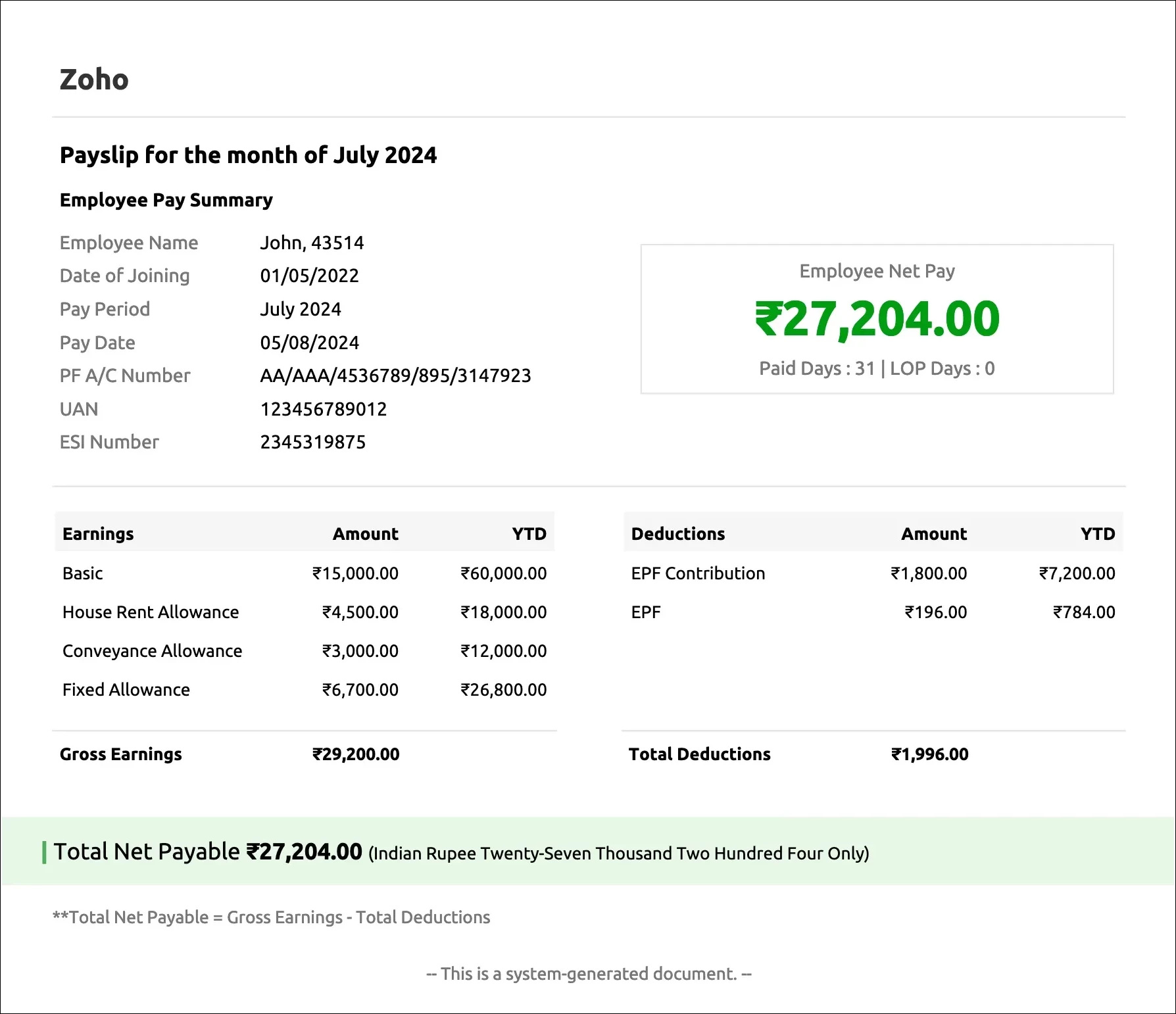

Below is a sample gross salary calculation using Zoho Payroll.

Difference between gross salary and basic salary

When calculating or paying income tax in India, understanding the distinction between gross salary and basic salary is crucial. Here are the key differences:

| Parameters | Gross salary | Basic salary |

| Definition | The total earnings an individual receives from all sources before any taxes or deductions. | The fixed amount paid to an employee by the employer without including allowances or deductions. |

| Inclusions | Includes all forms of compensation such as bonuses, overtime, commissions, and allowances. | Includes only the core pay or wages of an employee. |

| Importance | Critical for tax purposes since it encompasses the total earnings, including all benefits and allowances. | It forms the core part of the salary, on which allowances and other benefits are based. |

Difference between gross salary, net salary and CTC

The following are the differences between gross salary vs net salary vs CTC:

Net or in-hand salary

Net salary, or take-home pay, is the amount an employee receives after all deductions, such as income tax, employee provident fund, gratuity and professional taxes are subtracted from the gross salary. The net salary could be nearly the same as the gross salary if the income tax is negligible or if the employee's earnings fall below the taxable income threshold.

Gross salary

Gross salary is the total income an individual earns before any deductions or taxes are applied. This amount is typically shown on the payslip and forms the basis for calculating taxes and other deductions. It is different from net salary, which is the final amount received after all deductions.

Cost to Company (CTC)

CTC represents the total annual salary package an employer spends on an employee. This includes the basic salary, benefits, bonuses, and other forms of compensation. CTC is commonly used in job postings and offers letters to convey the overall value of the compensation package to potential employees. It is important to understand that CTC is not the same as gross salary, as CTC also includes benefits like ESOPs, meal coupons, and others.

Learn in detail about the difference between gross, net salary and CTC here.

A quick summary

Overall, understanding the concept of gross salary is essential for managing payroll and finances effectively. It encompasses the total earnings before any deductions, including base salary, allowances, bonuses and perquisites. Mastery of these concepts is crucial for compliance and employee satisfaction.

Frequently asked questions

What does monthly and annual gross salary mean?

Monthly gross salary refers to the total income you receive in a month before taxes or deductions. This figure is typically detailed in your job offer letter and shown on your payslip.

Annual gross salary represents your total earnings over a year before taxes and other deductions. It includes not only your base salary or wages but also additional income such as bonuses, overtime pay, commissions and investment earnings.

What is the meaning of fixed gross salary?

Fixed gross salary refers to the total amount an employee receives after working for a company. It remains consistent every pay period before any deductions. This salary does not vary based on performance, overtime or other factors. It includes the base salary and any fixed allowances or benefits but does not account for variable components like bonuses or incentives.

Are gross salary and in-hand salary the same?

No, gross salary and in-hand salary are not the same. Gross salary represents the total amount your employees earn before any deductions. In contrast, in-hand salary, or take-home pay, is the amount remaining after deducting taxes, EPF, income tax and professional tax. A gross salary is always higher than your in-hand salary.