- HOME

- Payroll administration

- What is CTC? CTC full form, meaning & calculation

What is CTC? CTC full form, meaning & calculation

Companies in India offer their employees' salaries in the form of CTC as it represents the total money spent by them on hiring and retaining employees. We will look at CTC full form, its components, and calculation rules in detail in this article.

CTC full form

The full form of CTC in salary is Cost-to-Company. It is the total expense an employer incurs by employing an individual in a year.

It includes the direct benefits an employee receives as part of their salary, such as basic pay, house rent allowance, and bonuses, along with indirect benefits such as insurance and provident fund contributions.

Understanding how each of these components make up an employee's CTC will help you in structuring the best compensation package for your teams.

Key components of CTC

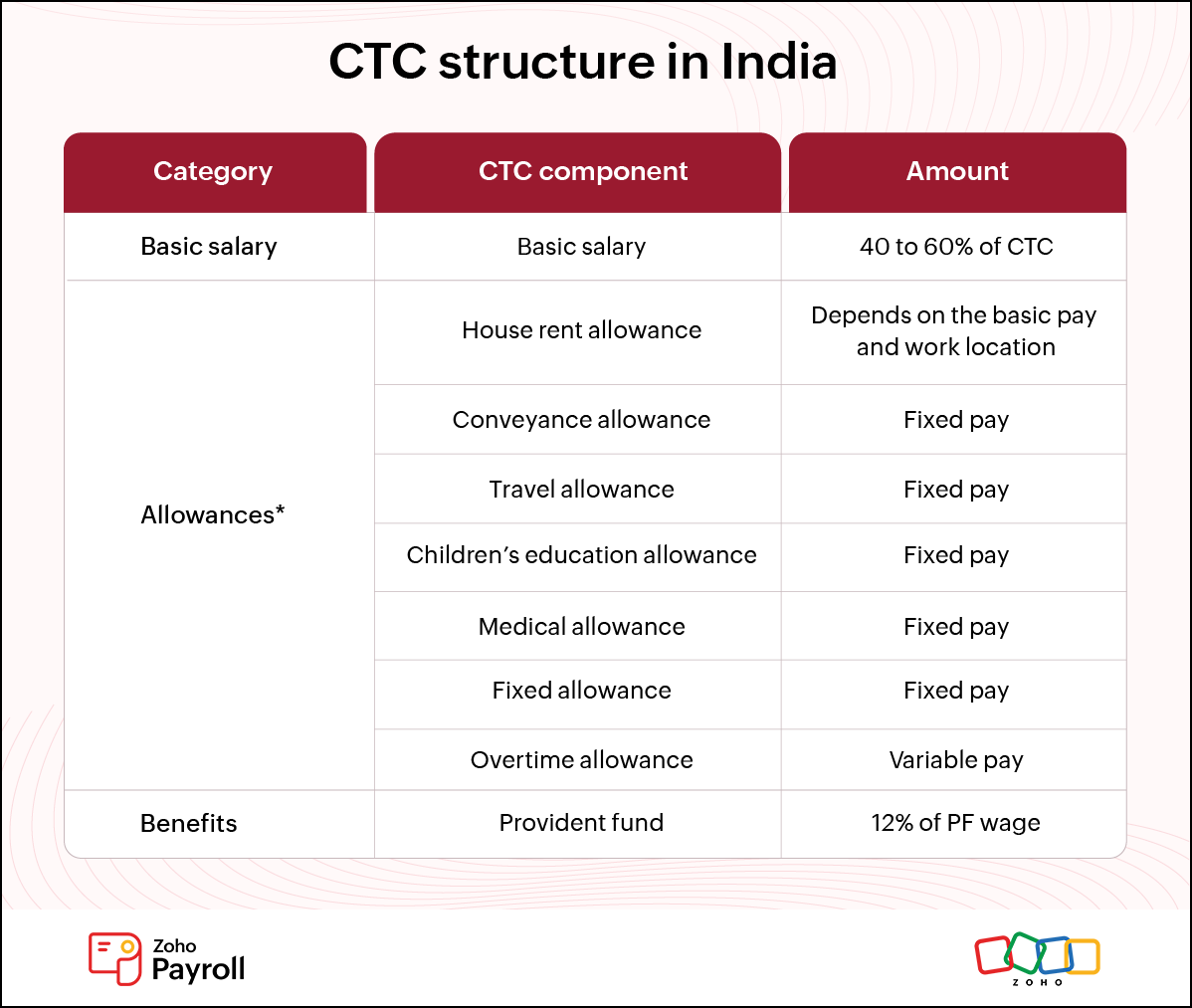

CTC is typically made up of four main parts: Fixed components, variable components, benefits, and deductions.

Fixed components

These are the guaranteed components of an employee’s salary, paid every month regardless of performance or company revenue. The amount to be paid is predetermined at the time an employee is hired and is typically mentioned on the job offer letter.

Basic salary: Forms the core of an employee's salary, contributing to 40 to 60% of the CTC. It is considered a part of the employee's take-home pay and is fully taxable. Other allowances and benefits like the Provident Fund are calculated based on this primary component.

House Rent Allowance (HRA): Provided to employees to cover rental expenses. It is calculated as a percentage of the basic salary and varies based on the city of residence (metro or non-metro). HRA is partially exempt from tax, provided the employee pays rent and can furnish rent receipts.

Dearness Allowance (DA): A cost-of-living allowance paid mostly to government employees to help offset inflation. It is a percentage of the basic salary and is fully taxable.

Conveyance allowance:Given to employees to cover commuting expenses incurred while performing office-duties. This allowance is exempt from tax up to a certain limit set by the government.

Medical allowance: Fixed amount paid to employees to cover their medical expenses. It is mostly taxed unless it is provided as a reimbursement against actual medical bills.

Learn in detail about the various allowances here.

Variable components

These parts of CTC vary based on the employee’s or company's performance. They are designed to incentivize and reward employees for their contributions, and some of the most commonly offered variable pay are:

Performance bonuses: One-time payments given to employees every year to reward outstanding performance.

Sales commission: A performance-based incentive paid to sales representatives monthly, based on the revenue generated from their closed deals.

Profit sharing plan: This plan distributes a portion of the company's profits among its employees, allowing them to participate in the organization's financial achievements.

Read more about variable pay and its calculation here.

Benefits

In addition to fixed and variable pay, most employers often include various benefits in the CTC to support the overall well-being of employees and their families. Here are some examples of such benefits.

Provident Fund (PF): A retirement benefit where both the employer and the employee contribute a percentage of the basic salary every month. The employer's contribution to the PF is a part of CTC.

Gratuity: A lump sum paid to employees upon retirement or resignation, provided they have completed five years of service with the company. It is calculated based on the last drawn basic salary and dearness allowance.

Health insurance: A plan offered by employers to cover the cost of medical expenses and surgeries for their employees and their dependents. The insurance premiums paid by the employers are also included in the CTC.

Deductions made from the CTC

There are certain amounts you have to deduct from the CTC to meet statutory obligations or provide benefits to your employees. It is necessary to calculate these deductions accurately as they reduce the employee's take-home salary.

Professional tax: This is deducted depending on the state where your organisation is located and your employee's monthly salary. The deducted amount must be paid to the state government's commercial taxes department.

Income tax: Based on the income tax slab applicable to employees, you must deduct a certain amount as tax deducted at source (TDS) before processing their salaries and remit the amount to the government.

Loan repayments: If your employee has taken any loans from the company, such as salary advances, the repayment amounts can be deducted from the CTC.

How is CTC calculated in salary

CTC in salary can be calculated by summing up the fixed salary, variable pay, and benefits. The following framework can be considered as the standard CTC structure for private sector employees in India.

Deductions made from the CTC include:

| Category | Amount |

| Income tax | Based on the employee's salary |

| Professional tax | Based on the work location and the employee's salary |

| Employees state insurance | Based on the work location and the employee's salary |

| Labour welfare fund | Based on the work location and the employee's salary |

CTC calculation example

Let's understand how CTC is calculated in salary with an example. Assume Piyush has recently joined a company in Karnataka with the following salary structure.

| Component | Monthly amount | Annual amount |

| Basic salary | ₹ 50,000 | ₹ 6,00,000 |

| House Rent Allowance | ₹ 25,000 | ₹ 3,00,000 |

| Medical allowance | ₹ 5,000 | ₹ 60,000 |

| Conveyance allowance | ₹ 5,000 | ₹ 60,000 |

| Fixed allowance | ₹ 15,000 | ₹ 1,80,000 |

| CTC | ₹ 1,00,000 | ₹ 12,00,000 |

The above table shows the total money spent on Piyush by his employer. Now, we will calculate the deductions from his CTC by considering his work location and salary.

Piyush and his employer will each contribute 12% of his basic salary towards the PF every month. Since his work location is in Karnataka, he is liable to pay a professional tax of ₹ 200 every month. Additionally, the income tax amount can be calculated according to the current tax rates set by the government.

| Benefit/ deduction type | Monthly amount | Annual amount |

| PF contribution | ₹ 6,000 | ₹ 72,000 |

| Professional tax | ₹ 200 | ₹ 2,400 |

| Income tax | ₹ 4,124 | ₹ 49,493 (New tax regime) |

These amounts are deducted from Piyush's monthly CTC and the remainder is paid to him as net salary or take-home salary, which is ₹ 89,676.

Frequently asked questions on CTC

What is the meaning of CTC?

CTC, or Cost to Company, represents the total annual expense incurred by an employer on an employee. It includes all fixed and variable components, benefits, and any other perks provided over the course of a year.

Is CTC the same as the take-home salary?

No, CTC is not the same as the take-home salary. The take-home salary, also known as net salary, is the actual amount an employee receives after all deductions such as income tax, provident fund contributions, professional tax, and insurance premiums are taken from the CTC. The take-home salary is usually lower than the CTC.

Is CTC monthly or yearly?

CTC is usually mentioned on an annual basis and represents the total yearly cost a company spends on an employee. For better understanding, employees often divide the annual CTC by 12 to get an estimate of their monthly earnings before deductions.

Is gratuity a part of CTC?

Yes, gratuity is a part of CTC. It is a lump sum amount paid to employees as a form of gratitude for their service when they retire or resign after five years of continuous service.