- HOME

- Industry trends and insights

- A business owner's guide to closing the financial year

A business owner's guide to closing the financial year

The end of the financial year is one of the busiest times for business owners. They have to audit the transactions processed during the year and create financial statements, do tax true-up and submit returns to the government, generate payroll reports, and make payments to the statutory bodies—the list goes on.

If you have been running a business for several years, you know how overwhelming it is to wrap up all the pending tasks right before the deadline. If you're a budding small business owner who is new to the whole year-end reporting, you might not even know where to start. We have prepared this guide to walk you through the entire process. We have covered everything you need to know and to sail smoothly into the new year with a clean slate.

What is a financial year?

A financial year or fiscal year is a continuous period of 12 months used by businesses to track their earnings and expenses and prepare financial statements. In India, the financial year starts on the 1st of April and ends on the 31st of March of the following year. Currently, we're in the financial year of 1st April 2023 - 31st March 2024, in other words, FY 2023-24.

Financial year-end activities

Getting organised is the key to successfully closing your business's payroll and accounting tasks for the year. We've broken down the numerous things you need to complete into various sections:

- Reconcile accounts

- Review employee leaves

- Process leave encashment

- Collect proofs of investments and make tax adjustments

- File TDS returns

- Make payments to the statutory bodies

- Issue Form 16

- Close books of accounts

Reconcile accounts

You would've recorded your entity's day-to-day financial transactions in business ledgers throughout the year. It is now time to compare these financial records with the bank statements and ensure the money going in and out of the business is documented correctly in both the places. This process is called reconciliation of accounts. If you find any discrepancies between the two, you must identify the reasons for the mismatch, make adjustments, and balance the books.

Reconciling can be a tedious exercise when done manually. Your accounting team will drown in tons of paperwork, leaving room for miscalculations and errors. Luckily, accounting software, like Zoho Books, are built to make this process a breeze for you and your teams. With intuitive transaction matching capabilities, this kind of software helps you identify duplicate payments, track payments, and keeps you on top of your business finance.

Review employee leaves

Paid leaves, sick leaves, and casual leaves are some of the common leave types employees can take in India. You would have provided plenty of them to encourage your employees to take time off from work and rejuvenate themselves.

At the end of the year, your HR team must review their attendance records, check and approve if there are any pending leave requests, and calculate carry forward balances for each employee. This is where HR software comes in handy. Zoho People, a cloud based HR tool, can help you:

- Create a customisable leave policy for your company.

- Manage your employees' attendance.

- Automatically carry forward unused leaves to the next year.

Process leave encashment

Besides allowing employees to carry forward balance leaves, you can also allow them to encash unused paid leaves as an added perk. Leave encashment is not mandated by the Labour Department, and the policy to encash can vary from one organisation to another. In most companies, the leave encashment amount is processed during the first pay cycle of the following calendar year while the employee is still in service. If your business follows a similar policy, don't forget to calculate tax on the encashment amount as per Section 10(10AA)(ii).

Collect proofs of investments and make tax adjustments

Throughout the year, your employees would've submitted their tax-saving declarations, so they can maximize their take-home income. Now, you have to collect the corresponding proofs to ensure these declarations match your records.

Doing this manually can be a tedious exercise, but payroll software can help. Payroll software will streamline the process and validate the declared investments against the submitted proofs.

File TDS returns

Making TDS payments before the due date set by the government is mandatory in keeping your business compliant. For budding business owners, here's a brief explanation of what TDS is and how much you should deduct.

What is Tax Deducted at Source (TDS)?

Any person making payments such as salary, commission, rent, interest, and others specified under the Income Tax Act must deduct TDS if the amount is more than the exempted taxable income. You'll deduct the tax amount based on the rates set by the government. The latest TDS rates for FY 2022-23 and AY 2023-24 can be accessed here.

Essentially, TDS is a part of the income tax.

When and how much TDS should be deducted?

Before paying your employees each month, you're required to deduct TDS from their salaries as per the income tax slab they fall under. You have to deposit the deducted tax amount to the government on a quarterly basis through the Income Tax Department's e-filing website using Form 24Q.

What is Form 24Q and how do you generate it?

Form 24Q is a quarterly statement of employees' salary details, and the amount of tax deducted from them by the employer. The form can be generated with the help of your payroll software.

The form is made up of two parts, Annexure I and Annexure II. Annexure I contains details of the salary paid and the amount of TDS deducted for that quarter and, hence, must be submitted every quarter. Annexure II can be submitted in the last quarter as it contains the overall tax liabilities of the employees for that financial year. The due date to submit Form 24Q for each quarter is as follows:

| Last date for filing quarterly TDS returns | |

| Quarter period | Due date |

| 1st April to 30th June | 31st July |

| 1st July to 30th September | 31st October |

| 1st October to 31st December | 31st January |

| 1st January to 31st March | 31st May |

Before you close your accounts for the financial year, ensure you have deposited the TDS amount for all quarters before the deadline. Failing to file returns on time can attract a fine of up to ₹ 1 Lakh.

Make payments to the statutory bodies

Pay EPF dues to EPFO

The Employees' Provident Fund (EPF) is a mandatory payroll statutory that helps employees to build their retirement chest.

Both the employer and the employee must contribute 12% of the employee's PF wage towards the fund every month. As an employer, you're responsible for deducting this percentage from employees' salaries before processing them, adding your employer share, and paying the amount to the Employees Provident Fund Organisation (EPFO).

The payment has to be made online through EPFO's unified portal. The last date to pay EPF dues for a month is on or before the 15th of the following month. For example, if you've deducted contributions and paid your employees' salaries for November, you must make EPF payments on or before the 15th of December.

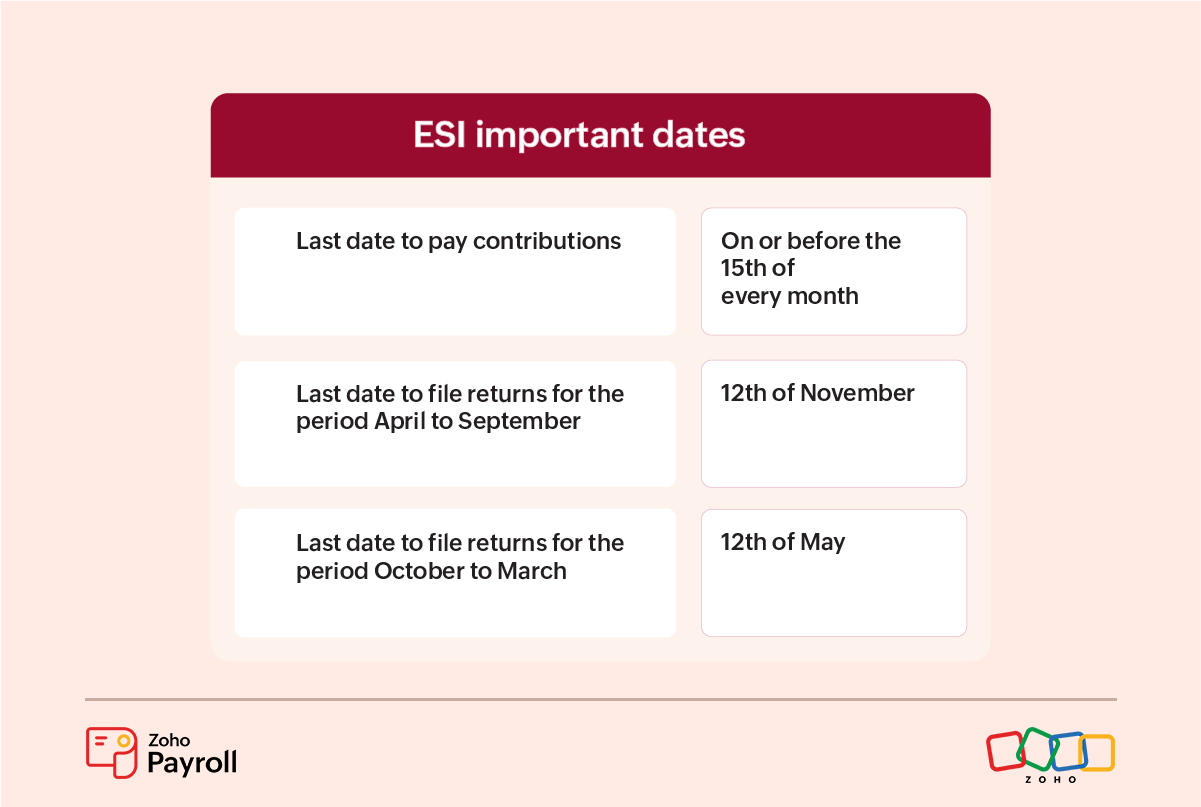

Pay ESI online and file returns

The Employees' State Insurance (ESI) is yet another payroll compliance in India that provides socio-economic support to employees. The insurance fund is built with contributions made by the employers and the employees. They are required to contribute a combined 4% of the employee's gross wage each month.

If your organisation is registered under the scheme, you must do the following things:

- Deduct contributions from your employees, add your share, and make payments through the ESIC online portal before the 15th of every month.

- File ESI returns bi-annually through the portal using the Return of Contributions (RC) form. The due date to file returns for the contribution period April to September is the 12th of November, while the date for the contribution period starting from October to March is the 12th of May.

Pay professional tax to the state government

Professional tax is a state-specific statutory levied on all employees, freelancers, professionals, and individuals who earn a living by any type of work.

Employers are responsible for deducting this tax from their employees' salaries, contributing their employer share, and paying the deducted amount to the respective state authorities. The maximum amount you can deduct as a professional tax is ₹ 2,500. However, the actual amount to be deducted and the interval in which it has to deducted are bound by individual state regulations.

Filing professional returns is also mandatory in some states. Employers can file returns through their state's commercial tax department's website. If you fail to settle the dues and file returns before the start of the next fiscal year, you will end up attracting penalties and a late fee.

Pay LWF dues to the state authorities

The Labour Welfare Fund (LWF) is a payroll statutory that aims to provide social security and improve the working conditions of employees. It is administered by the respective state government's Labour Welfare Board.

Since this is a state-specific statute, the eligibility to register, the deduction cycle, and the percentage to deduct vary from one state to another. If your organisation is registered under the scheme, you must collect contributions from your employees, add your contribution, and make LWF payments to the government before the deadlines.

Issue Form 16

Once you've settled dues with the government, you need to generate Form 16 and distribute it to your employees.

Form 16 is a document that contains the details of taxes deducted at the source by the employer from the salary income earned by the employee during a financial year. It helps your employees understand how much tax has been paid by them, the amount of deductions made under various payroll statutes, and the amount of tax they need to pay, if any, while filing income tax returns.

As an employer, you're required to issue this form on or before the 15th of June, immediately after the financial year ends for which Form 16 was generated.

The form should contain two parts: Part A and Part B. Part A consists of the basic details of an employee, tax deducted from their salaries, and amounts deposited to the central government. Part B contains a detailed breakdown of an employee's salary structure, and the contributions made by them towards various payroll statutes.

How to generate Form 16

Part A of Form 16 can be generated only through the TRACES website once the deductor submits Annexure II of Form 24Q. Log in to the website using your login credentials and Tax Deduction Account Number (TAN). Select Form 16A from the Downloads option and select the financial year for which you're generating the statement. Validate the details and download Part A.

Part B of the form can be generated using your payroll software. Go to the Form 16 module, upload Part A of the form, and hit Generate. Payroll software will create Part B and then the consolidated Form 16. Digitally sign the documents and publish Form 16 to your employees on time.

Close books of accounts

Books of accounts include a business's financial information like revenue, expenses, and the taxes paid. Closing of books is a year-end activity where companies finalise these reports and record the profit or loss the company made during the year into their balance sheets.

Closing of books will give you insights into your business's financial health and help you make strategic business decisions. It also prevents carrying over any expense or income made during the previous year to the next, so you will get to start the new year with a clean slate.