Account Verification

Once you finish setting up your account, your business representative will verify their identity through video KYC. After which, your business details will be be verified by Zoho Payments. You will be able to collect payments and payouts only when your verification is complete and your account is in the Active status. Learn more about account statuses.

Identity Verification via Video KYC

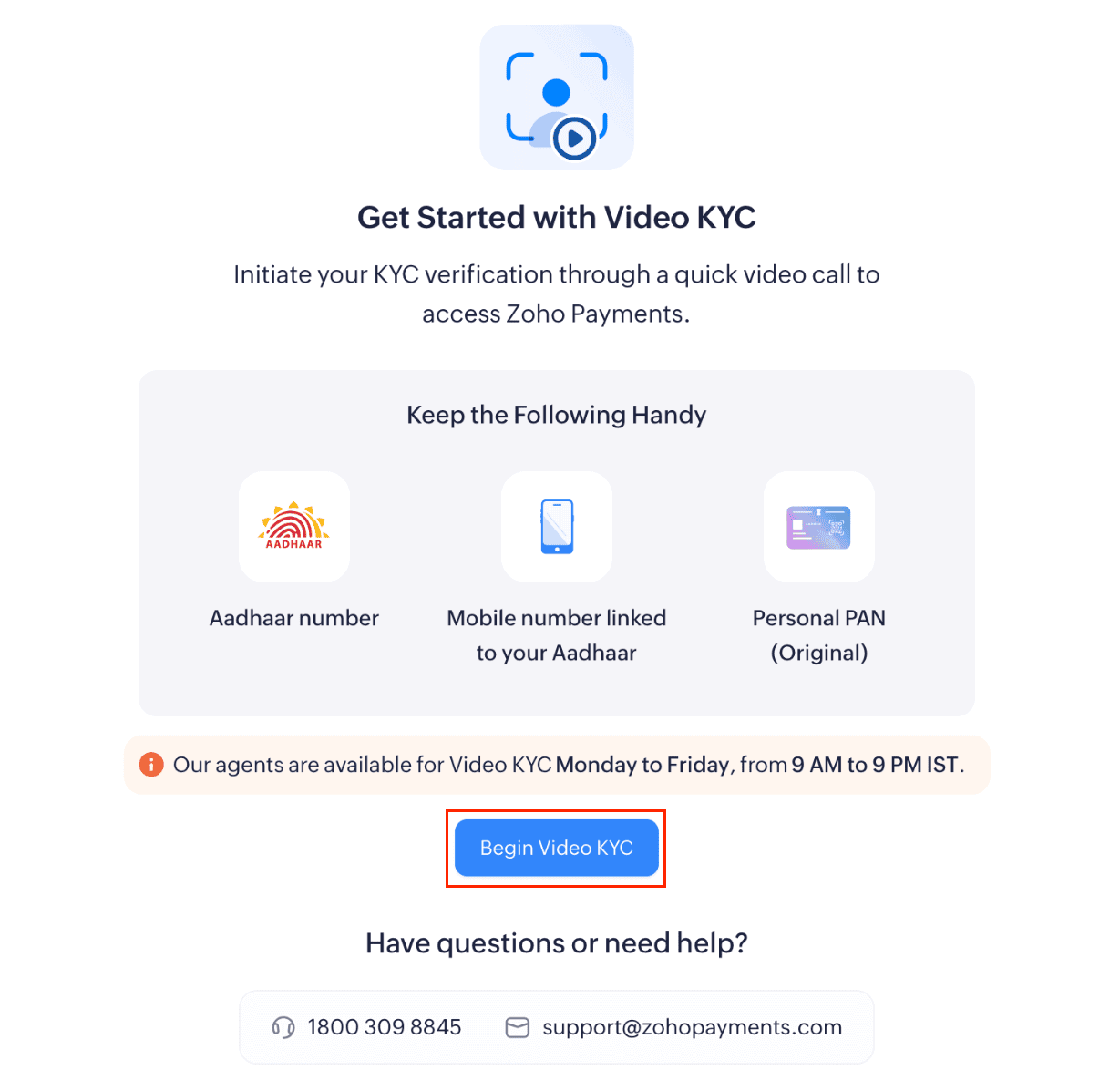

KYC, or Know Your Customer, is a process that verifies your identity before providing financial services. Video KYC is a secure, remote identity verification through a live video call between the business representative or owner and an executive.

Zoho Payments requires your business representative to complete the video KYC as part of the account verification process. This is mandated by the Reserve Bank of India (RBI) for identity verification and onboarding.

Prerequisites:

- A stable internet connection.

- Business representative’s Aadhaar.

- Access to the mobile number registered with your Aadhaar for OTP verification.

- Original PAN of the business representative.

- The business representative must be physically present in India and available for verification.

Note: The Video KYC process can be completed only between Monday and Friday, from 9 AM to 9 PM IST. Ensure your business representative is available during this time.

After setting up Zoho Payments, your business representative must initiate video KYC. To initiate the video KYC:

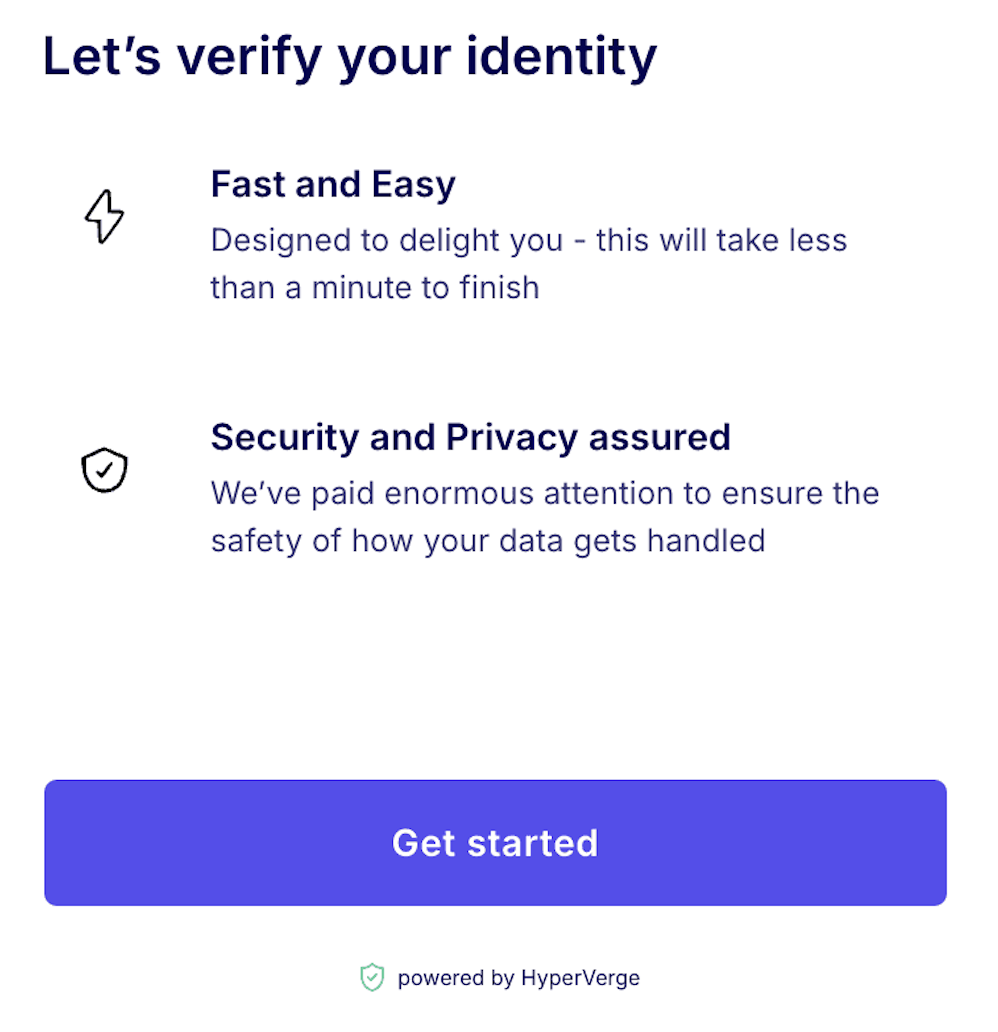

- Go to Zoho Payments and click Begin Video KYC. You will be redirected to a new tab to complete the verification process.

-

During the Video KYC verification, your business representative must:

Verify Aadhaar using DigiLocker

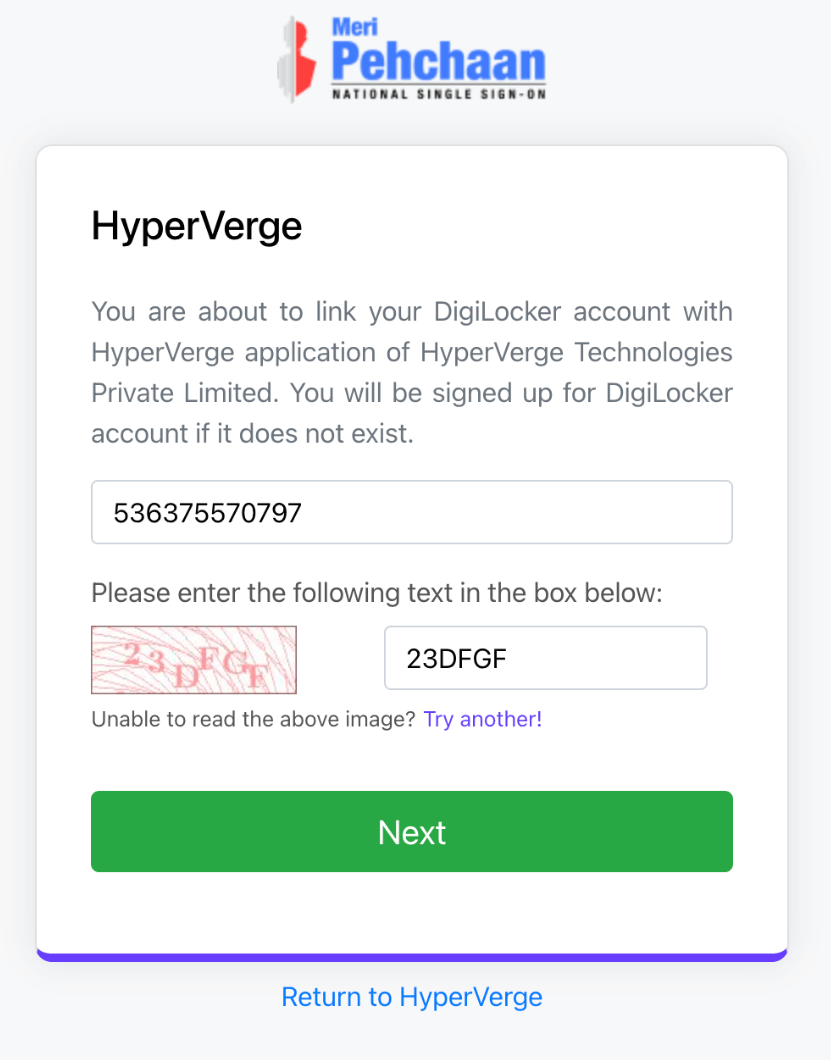

Zoho Payments uses DigiLocker to verify your business representative’s Aadhar during the video KYC process. If they don’t have a DigiLocker account, they can create one during the verification process. To verify Aadhaar:

Pro Tip: If you are unable to read the CAPTCHA code, click Try another! and enter the response.

- Click Next to receive an OTP on your Aadhaar-registered mobile number.

Insight: If you don’t have a DigiLocker account, you will be automatically signed up, allowing you to proceed with the verification.

-

Enter the OTP and click Continue.

-

Enter your 6-digit DigiLocker Security PIN and click Continue.

-

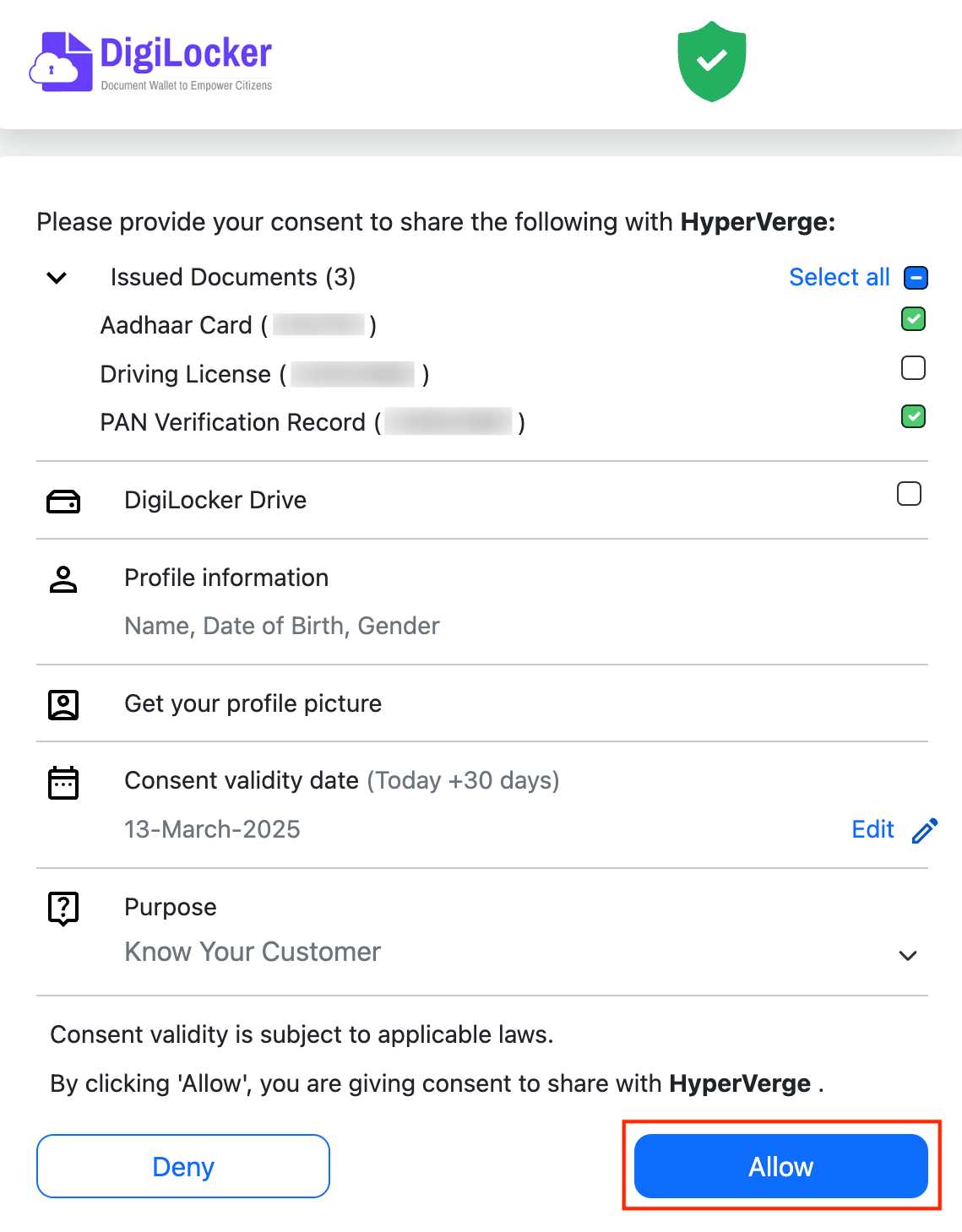

Click the Issued Documents dropdown and check the Aadhaar Card and PAN Verification Record options.

-

Click Allow.

Your Aadhaar will be verified.

Verify PAN through a video call

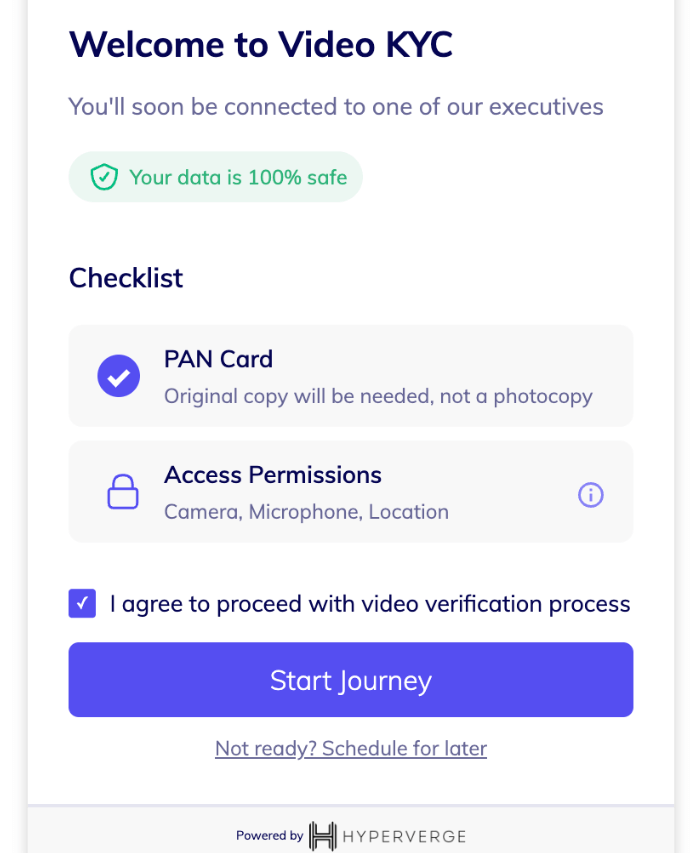

After verifying Aadhaar, your representative will be redirected to the Welcome to Video KYC page from where they will be connected to a Zoho Payments executive for PAN verification.

To verify PAN:

-

In the Welcome to Video KYC page, check PAN Card and agree to proceed with the video KYC process.

-

Click Start Journey.

-

Click Allow to access your camera, microphone, and location.

-

Please wait patiently while an executive from Zoho Payments connects with you.

-

Follow the instructions provided by the executive and then complete the verification.

After a few minutes, go back to Zoho Payments and reload the tab to check your video KYC status. If your verification is successful, you’ll be able to access Zoho Payments. If the status shows Rejected or Unknown, contact support@zohopayments.com for assistance.

Insight: If you are not able to complete the video KYC, you can end the video call by providing a reason, and then complete the verification later.

Note: You will be able to access Zoho Payments only when you’ve completed your account setup.

Business Details Verification

After the video KYC verification is complete, our underwriting team will verify your business details that you provided while setting up Zoho Payments to onboard your account. During this assessment, Zoho Payments might reach out to you for additional information and documents if necessary. Learn more about the documents that are required for business details verification.

Bank Account Verification

Zoho Payments will verify the bank account details that was provided while setting up the account. This is to avoid payout failures and ensure your payouts are deposited to your bank account. Zoho Payments uses penny drop or penniless verification to verify your bank account in real time.

Once your identity, business details, and bank account are successfully verified, your account status will be Active.