Here's how Zoho Invoice will simplify your transition to e-invoicing

-

Authorized GSP

Zoho is an authorised GSP (GST Suvidha Provider), enabling you to connect directly to the IRP (Invoice Registration Portal). Simply register your business in the IRP, choose Zoho Corp as your GSP and enter your credentials in Zoho Invoice.

-

Fully scalable

Zoho Invoice is an e-invoicing solution for businesses of all sizes. Our open APIs make it easy to adapt your existing software or connect with your ERP, while our servers effortlessly accommodate high traffic and ensure zero downtime.

-

Advanced security

At Zoho we give the utmost importance to protecting your data. We follow the industry's best privacy and security standards to safeguard your data from unauthorized access.

-

Quality support for free

Zoho Invoice is intuitive and user-friendly, but if you need any assistance we've got you covered. We offer detailed help documents, walkthrough videos, and a team of product experts available 24 hours a day, Monday through Friday.

-

Smart data validation

Zoho Invoice ensures that all your invoices are e-invoicing compliant and created in the prescribed format. It also pre-emptively validates your data to identify violations, incorrect data entries, and missing mandatory fields before uploading to the IRP.

-

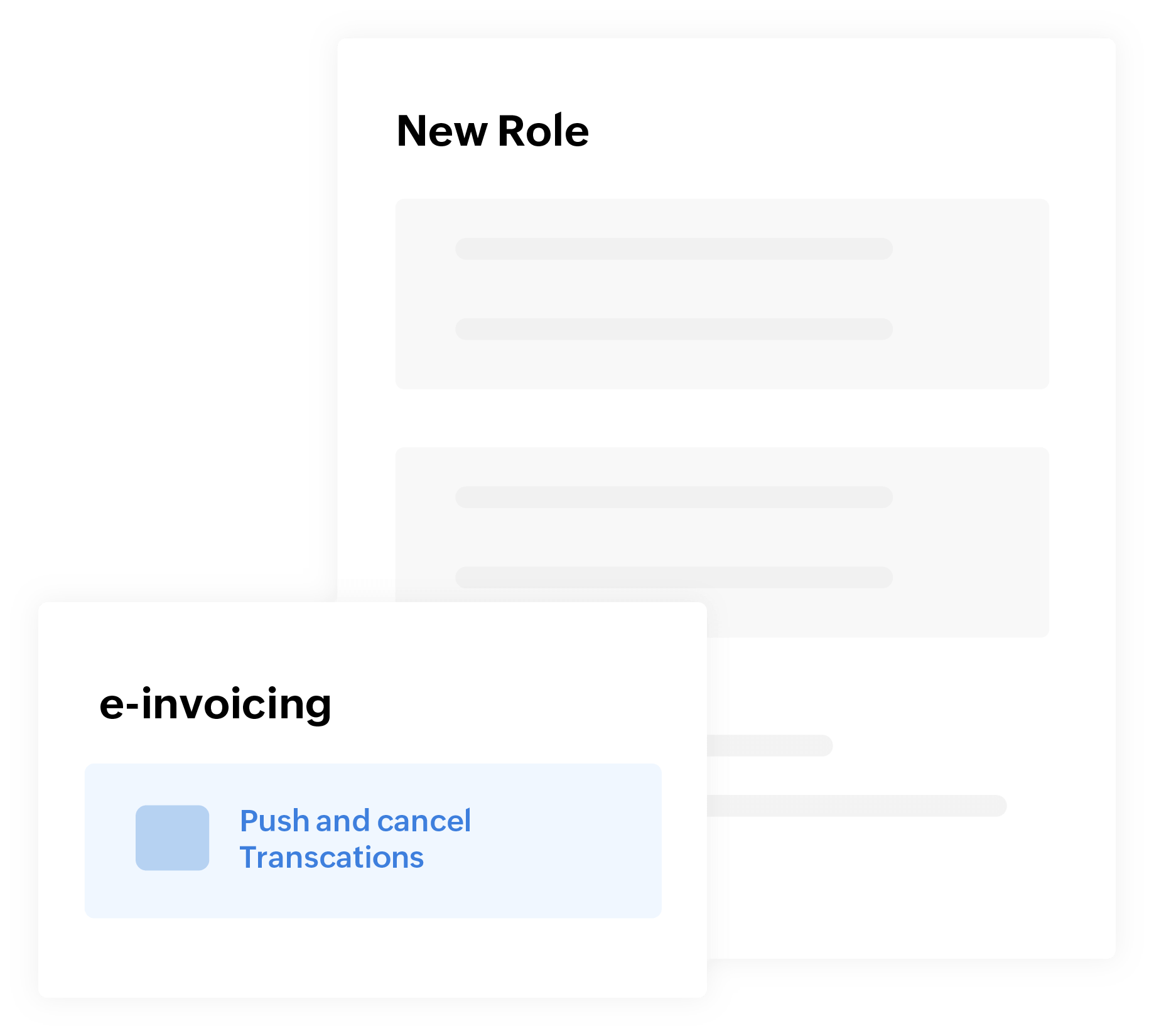

Role-based approvals

Set up a multi-level approval process to systematically check your invoices before they're submitted. Or grant restricted access to members of your team to push invoices to the IRP or cancel them based n their user roles.

-

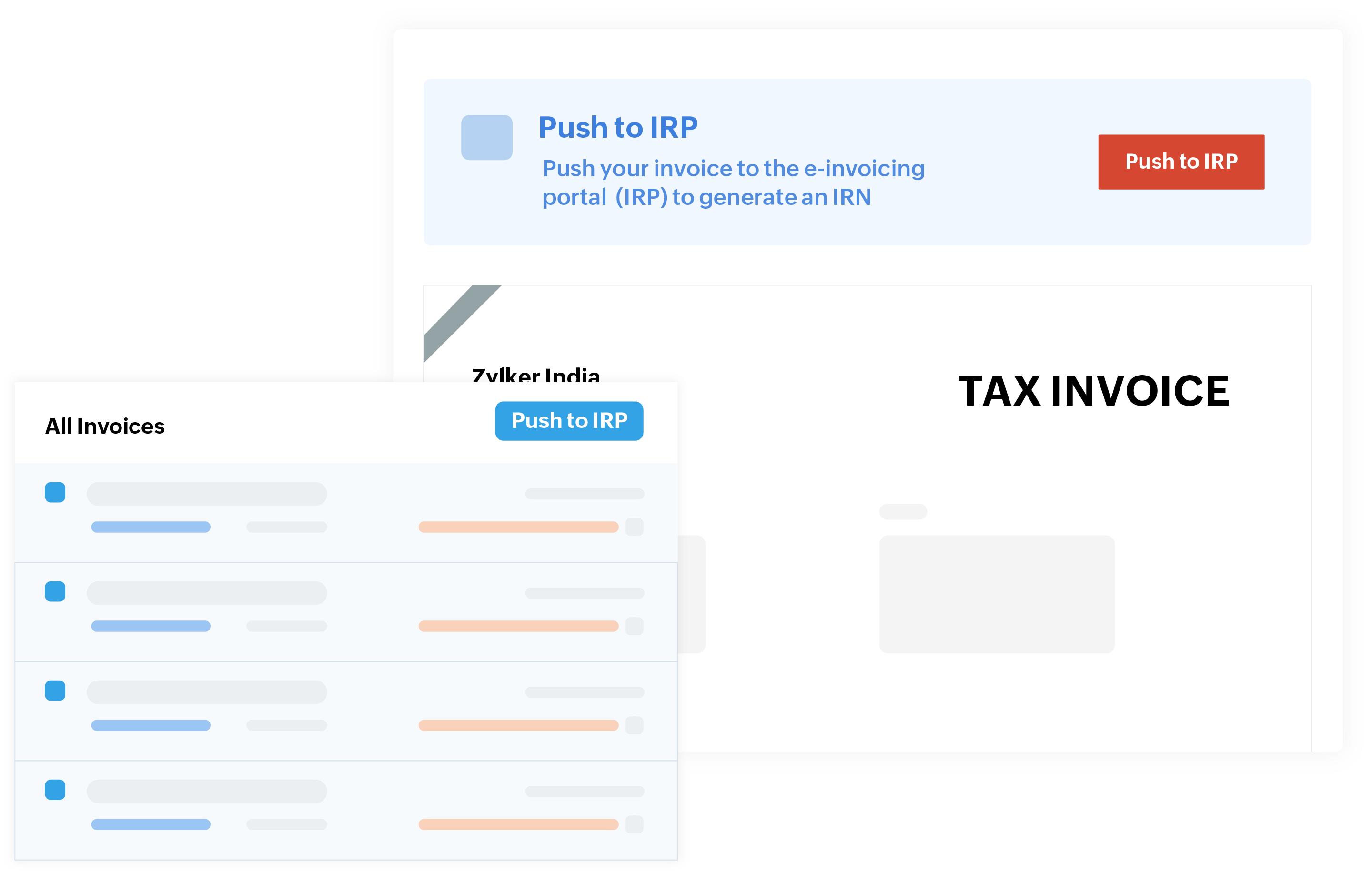

Easy uploads

Zoho Invoice lets you push individual invoices or bulk-upload lakhs of invoices to the IRP effortlessly. Your invoices will then be validated by the IRP and unique IRNs and QR codes will be generated for every invoice.

-

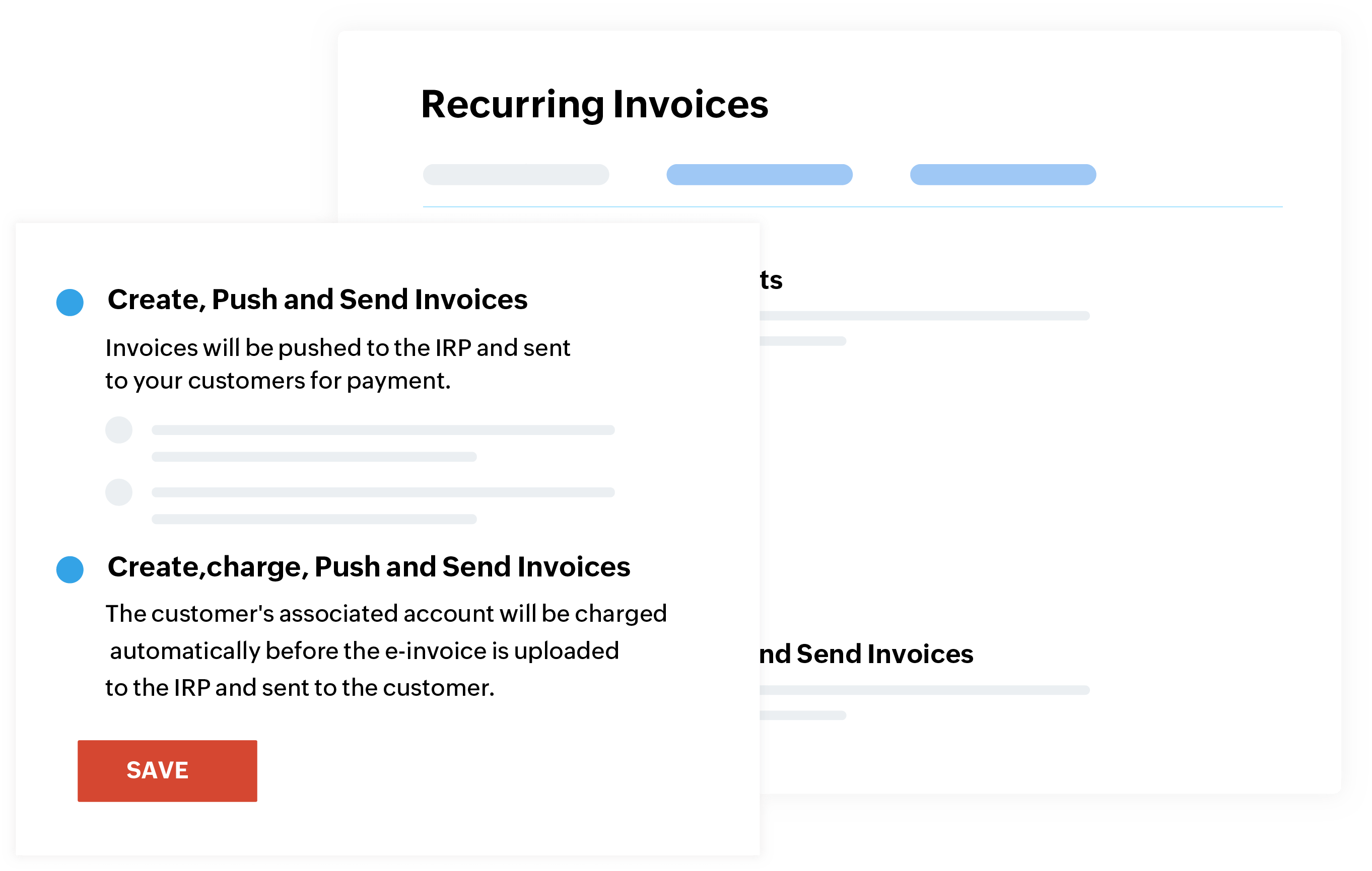

Recurring e-invoices

If you have regular customers, you can create billing profiles for them and set your e-invoices on recurring mode. This will let you auto-charge your customers, upload the invoices to the IRP, and then send the validated e-invoices to your customers.

-

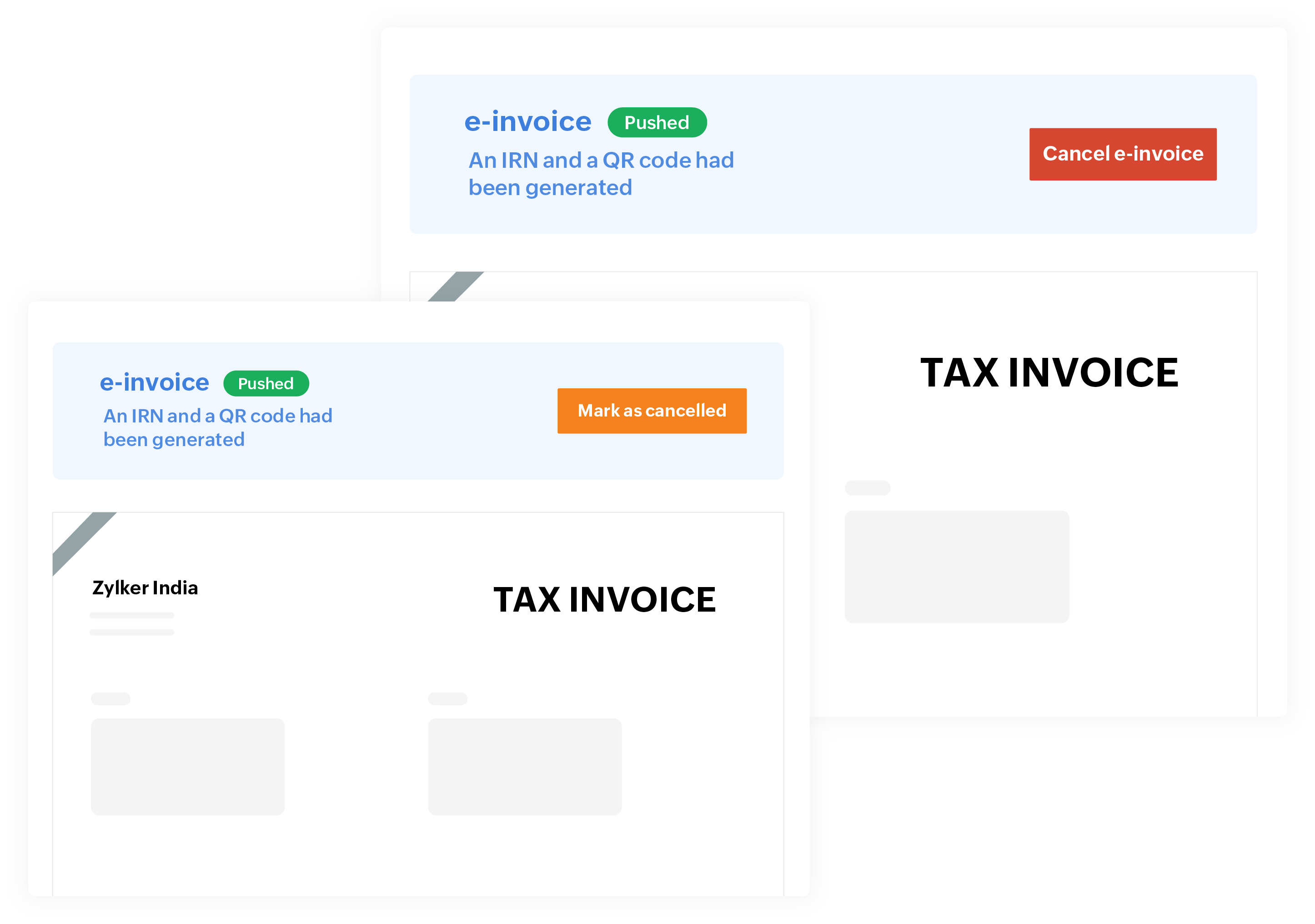

E-invoice cancellations

If you have to cancel your e-invoices for any reason, you can do it directly from Zoho Invoice within 24 hours of the IRN being generated. If it's been more than 24 hours, you must mark the invoice as cancelled and then delete the IRN from the GST portal.

-

Detailed status updates

Zoho Invoice always keeps you aware of your next step. It shows you the e-invoicing status of every invoice: yet-to-be pushed, pushed, push initiated, cancelled, marked as cancelled, or failed.

Frequently Asked Questions

-

When will the e-invoice system be implemented?

-

What does an e-invoice look like?

-

How does e-invoicing benefit businesses?

-

What is Invoice Registration Portal (IRP)?

-

What is a GSP?