- HOME

- Taxes & compliance

- All you need to know about GST accounting

All you need to know about GST accounting

Under the GST regime, multiple tax levies have been replaced by a single GST tax. This has led to major changes in the accounts the business owners must maintain. Previously, you would have maintained individual accounts for VAT, excise, CST and other service taxes with separate input, output, and credit entries for each. Now, the new tax regime means a completely new list of accounts, featuring the components of GST.

Prerequisites for maintaining records and accounts

- The maintenance of records and accounts is handled by:

- The business owner or the operator of the premises used for storage of goods: They should maintain accounts regarding the time period for which the goods were in the storage location (example: warehouse). This includes details regarding dispatch, movement, receipt, and disposal of goods.

- The transporter of goods and services: They should maintain records of the goods transported, delivered, and the goods stored in transit by them.

- Under the GST regime, all the records and accounts should be maintained at the principal place of business, i.e, the primary place where the business takes place.

- If more than one place of business is mentioned in the registration certificate, records and accounts related to each place of business should be kept at the respective workplaces.

- If a business owner chooses to maintain the records/accounts in electronic format, they should make sure they have a proper back-up of the records/accounts. Also, they should be feasible to produce the records/accounts when demanded.

When the turnover of a business exceeds the prescribed financial limit, the business is liable for an audit.

Records and accounts to be maintained under the GST regime

Every business owner registered under GST must maintain the following records:

Production or manufacture of goods - Details of all the goods manufactured or produced by the taxpayer.

Details of purchases - Details of all the inward supplies purchased by the taxpayer, including the name and address of the supplier.

Details of sales - Details of all the outward supplies sold by the taxpayer, including the name and address of the buyer.

Stock of goods - The current amount of goods available in the taxpayer’s inventory.

Input Tax Credit availed - The value of Input Tax Credit availed during the purchase of raw materials or other capital goods.

Output tax payable - The output tax payable on the sale of finished goods or services.

Output tax paid - The GST paid either by availing of input tax credit or in cash.

Any other records if required - Any additional record required by the Government for a particular business type, such as:

- Goods or services imported or exported during a tax period.

- Inward and outward supplies that attract the payment of tax on reverse charge, along with relevant documents such as invoices, bills of supply, delivery challans, credit notes, debit notes, receipt vouchers, payment vouchers, refund vouchers and e-way bills.

Accounts to be maintained under the GST regime

Every business owner should maintain the following accounts:

- Account of stock with respect to the goods purchased and sold. This account should contain all the related details like opening balance, amount of goods received and supplied, goods lost/stolen/destroyed/written off as gift or free samples, balance stock of raw materials, finished goods, scrap, and wastage.

- Account of advances received and paid, along with adjustments if any.

- Account of tax amounts, which contains details of tax payable, tax collected and paid, input tax, input tax credit claimed (along with tax invoice as proof), credit note, debit note, and delivery challan (issued or received during a particular tax period).

- Supplier details containing the name and address of the supplier from whom taxable goods/services, have been received.

- Recipient details containing the name and address of the buyer to whom goods/services were supplied.

- Address of the warehouse/garage or any other premises where the goods are stored. This includes goods stored during transit, along with the details of the stock stored at that instance.

- Monthly production accounts, where the quantitative details of the following are furnished:

- raw materials used for manufacture

- goods manufactured

- waste and by-products produced in the process

- Accounts containing the quantitative details of goods used in the provision of services, details of input services utilised and the services supplied

Note: In addition to this, the Commissioner of GST has the authority to apprise business owners to maintain additional accounts/documents for a specific reason or to maintain the accounts in a prescribed manner.

Input and Output in GST

The biggest change GST brings to the table is the concept of Input Tax Credit. The tax you pay on purchasing your inputs (goods or services used for furthering your business) can be used to offset the tax you will pay on your outputs (finished products or services). Another change is GST’s dual-component structure. The tax for intrastate transactions is divided into CGST (Central GST) that must be paid to the Center and SGST (State GST) that must be paid to the State. If it’s an interstate transaction, a single integrated tax called IGST (Integrated GST) has to be paid to the Center. Because of these regulations, the following accounts must be maintained by a registered business owner:

- Input CGST A/c

- Output CGST A/c

- Input SGST A/c

- Output SGST A/c

- Input IGST A/c

- Output IGST A/c

Electronic cash ledger

GST also introduces a concept called the electronic ledgers. Once you register for GST in the Government portal, you will get access to 3 types of electronic ledgers:

- The E-cash ledger serves as an e-wallet and can be used by the taxpayer to make any payments, such as tax, interest, and penalties. If the taxpayer does not have enough money in this ledger for a particular payment, they can simply recharge it online.

- The E-credit ledger will contain the input tax credit fetched from the taxpayer’s monthly returns. The credit will be of three types: CGST, SGST and IGST. This amount can only be used to pay tax and cannot be used for any other purpose.

- The E-liability ledger will contain the taxpayer’s total tax liability for a particular month. By default, this will be shown on the taxpayer’s GST dashboard.

How to pass your accounting entries

Let’s now consider a sample transaction and observe how the entries need to be made in the taxpayer’s different accounts.

Intrastate transaction

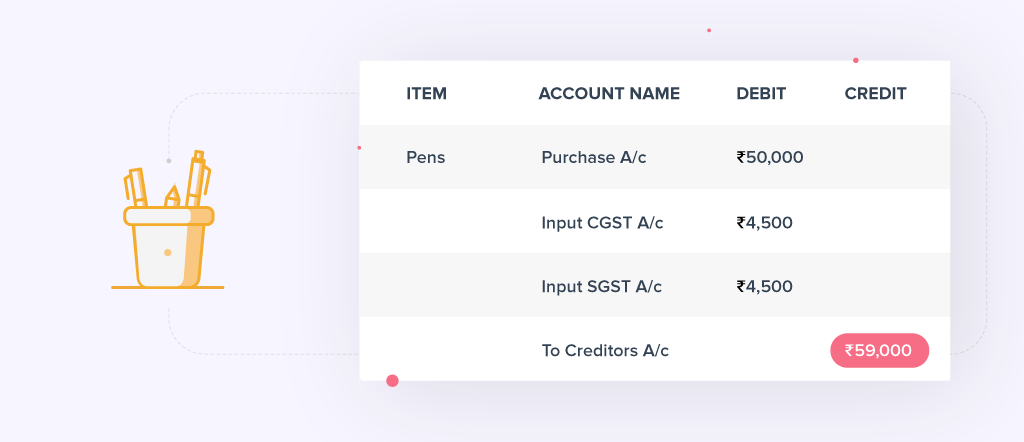

Let’s say Raj purchased pens worth Rs. 50,000 from a GST-registered dealer within his state. The tax applicable to his purchase is 18%, which is broken down into CGST (9%) and SGST (9%). Thus, he pays a total tax of Rs. 9,000 (18% of Rs. 50,000) which is split equally between CGST (Rs. 4,500) and SGST (Rs. 4,500). He can later claim this amount as input tax credit when he has to offset his output tax liabilities.

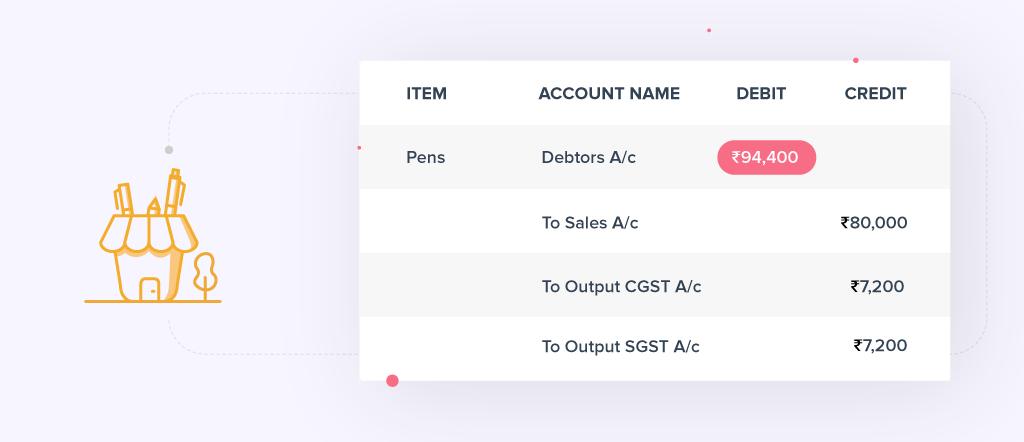

He now sells the pens to another GST-registered dealer for Rs. 80,000. His output tax liability will be 18% of Rs. 80,000, for a total of Rs. 14,400 that is split up equally between output CGST and output SGST.

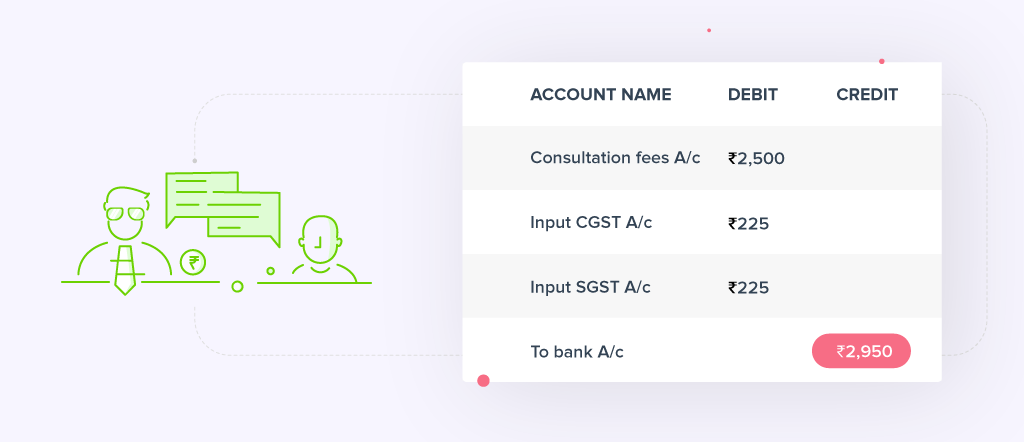

Let’s assume he paid a legal consultation fee of Rs. 2,500 to his CA by cheque. The tax he pays on this will include CGST of Rs. 225 (9% of 2,500) and SGST of Rs. 225 (9% of 2,500).

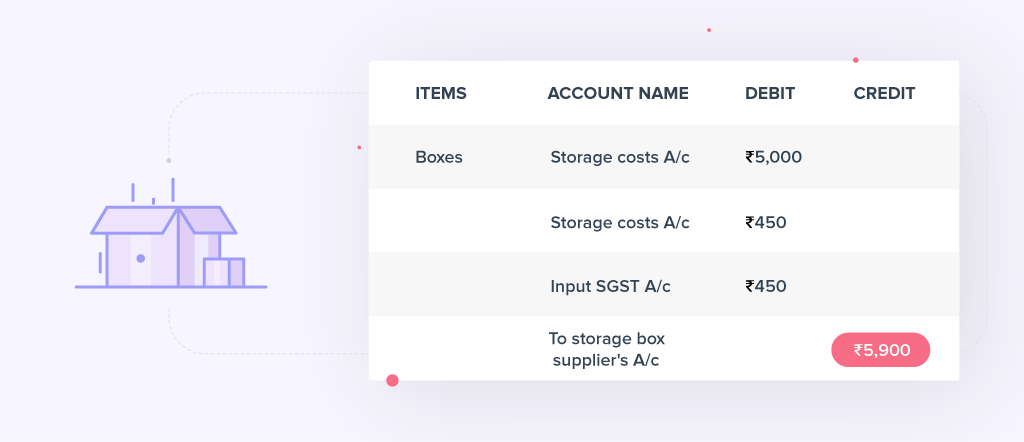

He also paid Rs. 5,000 to purchase the boxes and other materials used for storing the pens. The same tax rates apply here, so he pays CGST of Rs. 450 (9% of 5,000) and SGST of Rs. 450 (9% of 5,000).

Raj’s total tax liability

Let’s now observe how Raj’s total tax payable is calculated.

- Total input CGST = 4,500 + 225 + 450 = 5,175

- Total input SGST = 4,500 + 225 + 450 = 5,175

- Total output CGST = 7,200

- Total output SGST = 7,200

- Net CGST payable = Output CGST - Input CGST = 7,200 - 5,175 = 2,025

- Net SGST payable = Output SGST - Input SGST = 7,200 - 5,175 = 2,025

Total tax payable = 2,025 + 2,025 = 4,050

If Raj has any ITC left after paying his tax obligations, it will be carried over to the next year.

Interstate transaction

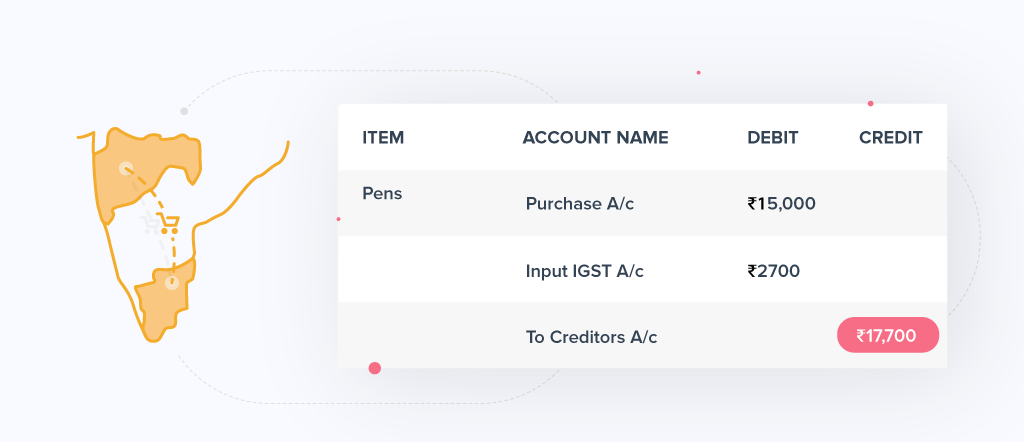

Let’s say Raj purchased pens worth Rs. 15,000 from a GST-registered dealer from outside his state. The tax rate on his purchase is 18%. Thus, he pays an IGST of Rs. 2,700 (18% of 15,000), which he can later avail as input credit.

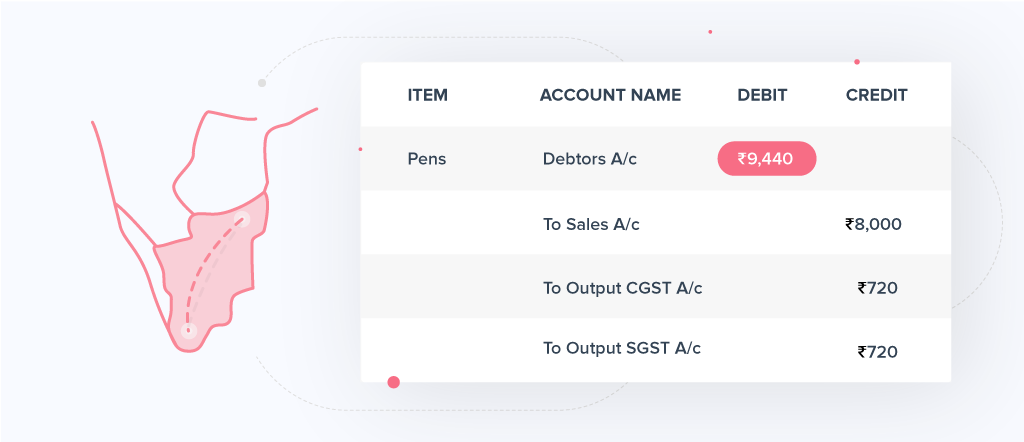

He now sells some of his pens locally for Rs. 8,000. His output tax liability will be 18% of Rs. 8,000, for a total of Rs.1,440 that is split up equally between output CGST and output SGST.

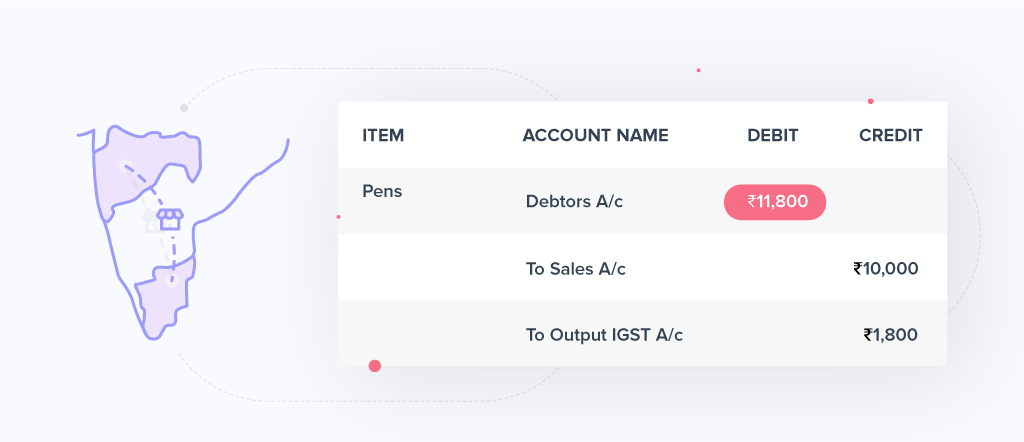

He sells his remaining pens outside his state for Rs.10,000. The output tax liability for these will be an IGST of 18% of Rs. 10,000, which equals Rs. 1,800.

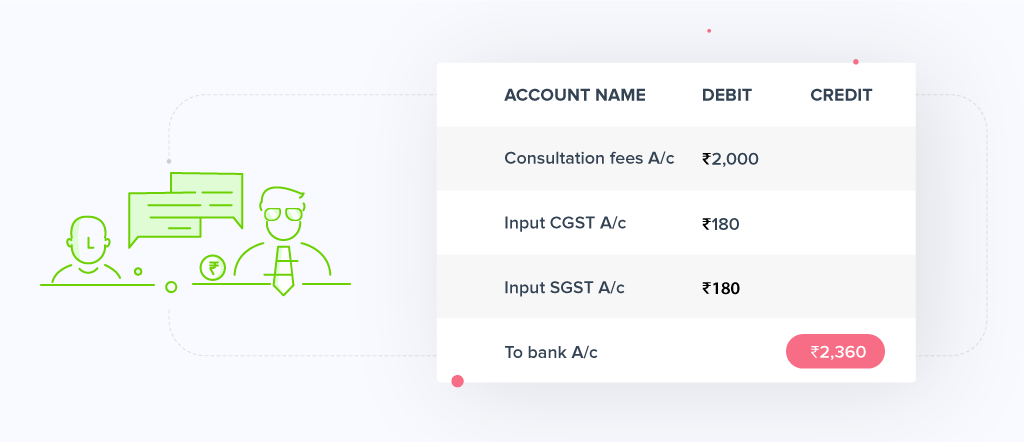

Let’s assume he paid a legal consultation fee of Rs. 2,000 locally to his CA by cheque. The tax he pays on this will include CGST of Rs. 180 (9% of 2,000) and SGST of Rs. 180 (9% of 2,000).

Raj’s total tax liability

- Total input SGST = 180

- Total input IGST = 2,700

- Total output CGST = 720

- Total output SGST = 720

- Total output IGST = 1,800

- Net CGST payable = Output CGST - Input CGST = 720-180 = 540

- Net SGST payable = Output SGST - Input SGST = 720-180 = 540

- The IGST credit of Rs. 2,700 can be used to offset the IGST liability of 1,800, leaving Rs. 900 in credit.

- The remaining Rs. 900 will first be applied to the net CGST liability of 540, leaving Rs. 360 in credit.

- The leftover Rs. 360 can be applied to the net SGST liability.

- After all of the credits have been used, the remaining output tax payable equals the SGST liability minus the remaining IGST credit.

Remaining tax payable = 540 - 360 = 180

Retention period

The GST law dictates that every registered taxable person must maintain their book of accounts for a period of at least 6 years from the last date of filing of the relevant annual return. These records and documents should be maintained at all the related business locations as mentioned in the registration certificate.