- HOME

- Inventory Management

- What is Inventory Valuation? | Importance, Methods and Examples

What is Inventory Valuation? | Importance, Methods and Examples

What is inventory valuation?

Inventory valuation is an accounting practice that is followed by companies to find out the value of unsold inventory stock at the time they are preparing their financial statements. Inventory stock is an asset for an organization, and to record it in the balance sheet, it needs to have a financial value. This value can help you determine your inventory turnover ratio, which in turn will help you to plan your purchasing decisions.

To give you an example, if you run a shoe business and you’re left with 50 pairs of shoes at the end of the year, then you need to calculate their financial value and record it in your balance sheet. Let’s look at how and why you’ll calculate the value.

Why is inventory valuation important?

Identifying the unsold items is just one step in inventory valuation. You also need a rate that you can multiply by the quantity to arrive at a final value. You may have paid different prices for these items throughout the year, so you need to choose a technique to calculate a common rate.

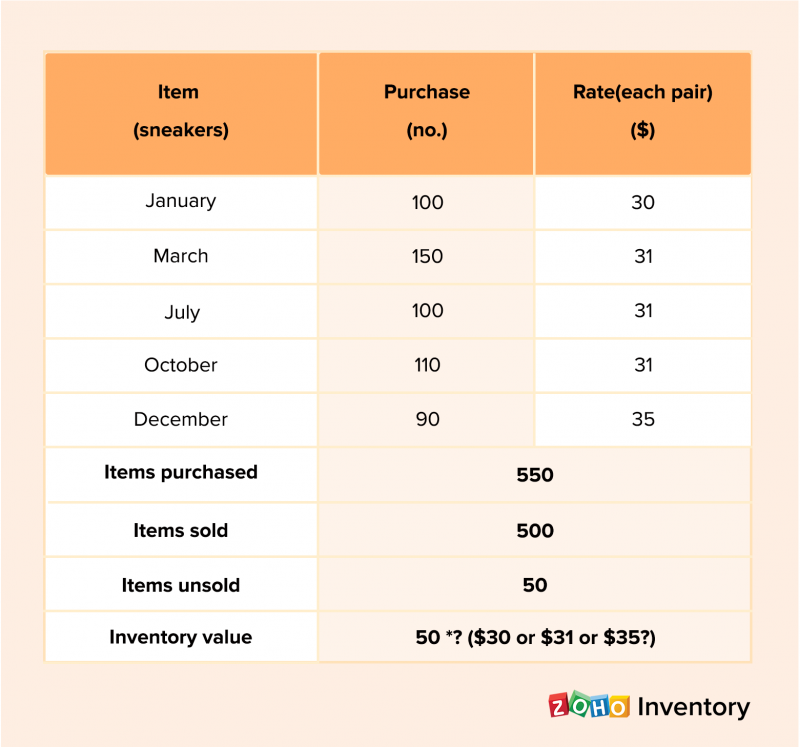

Continuing our previous example, let’s look at your purchases for a particular type of sneakers during the year:

At the end of the year, you have 50 pairs of unsold items, but due to the fluctuations in the price of the product, you’re facing a dilemma as to which rate you should use. Therefore, you need to choose a technique. In the following section, we will look at the different techniques of inventory valuation and share some pointers which can help you choose the right technique for your business.

What are the different inventory valuation methods?

There are three methods for inventory valuation: FIFO (First In, First Out), LIFO (Last In, First Out), and WAC (Weighted Average Cost).

In FIFO, you assume that the first items purchased are the first to leave the warehouse. In other words, whenever you make a sale, under FIFO, the items will be subtracted from the first list of products which entered your store or warehouse.

In LIFO, you make the opposite assumption: that the last items that enter your store are the first ones to leave.

The WAC method uses the item’s average cost throughout the year. The average cost per unit is calculated by dividing the total cost by the total number of units purchased during the year.

How do I value inventory using inventory valuation?

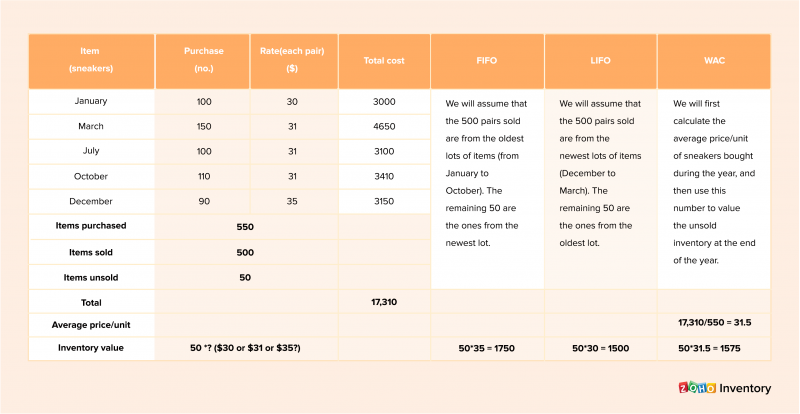

Let’s continue our above example and find out how each of these techniques calculates the value of your unsold stock.

From this table, you can see how the value of your unsold inventory at the end of the year will differ based on the valuation method that you choose. However, there are two caveats to keep in mind:

In the above example, the FIFO value is more than the LIFO value because you paid more per unit at the end of the year. However, this is not always the case. If your purchase price drops throughout the year, the FIFO value will be less than the LIFO value and the WAC value will change accordingly.

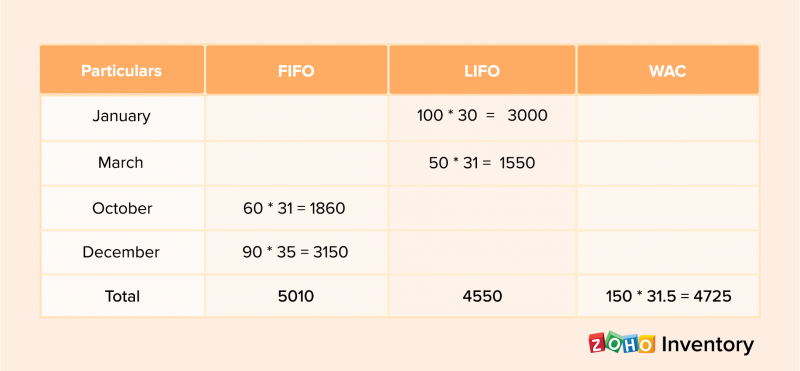

- If the quantity of items unsold at the end of the year is greater than the first or last order, then the calculation will be slightly different. For example, if you have 150 unsold items at the end of the year, then the calculations will look like this:

FIFO: Items bought first will be sold first

Use the newest purchase rate for the number of items included in the newest order, then use the previous rate for the remaining items.

90 * 35 = 3150 (All the items purchased in the month of December)

60 * 31 = 1860 (Remaining items to be valued using the rate from October)

Total 5010

LIFO: Items bought last will be sold first

Use the oldest purchase rate for the number of items included in the oldest order, then use the next rate for the remaining items.

100 * 30 = 3000 (All the items purchased in the month of January)

50 * 31 = 1550 (Remaining items to be valued using the rate from March)

Total 4550

WAC: Average cost per unit

150 * 31.5 = 4725 (The average price per unit will remain the same as there is NO change in rate and quantity purchased)

Here’s a table which summarizes the above working –

Which inventory valuation method should I use for my business?

Actually, there is no straight answer to this question. Your inventory valuation technique depends on the market conditions, and your financial goals for your organization. Here are a few scenarios which can help you to pin down the best inventory valuation technique for your business.

1. Applying for a loan for business expansion

If you’re planning to apply for a loan, then you will need to keep your stock as collateral. In such cases, it is preferable if the value of your stock is high, because higher valuation will give more assurance to the lender. If prices are increasing throughout the year, a FIFO inventory valuation technique will give you a higher value for closing inventory. If prices are decreasing, a LIFO technique will give you a higher value. The value of the closing inventory in your balance sheet is one of the factors used by financial institutions before approving a loan to a company, so the technique that gives you the highest inventory value will be the best for your company.

2. Attracting investors and keeping shareholders happy

A company with a high profit margin can get a lot of attention from potential investors and keep its existing shareholders happy. So if you’re looking for a new funding opportunity or if you want to please your shareholders with good earnings, then FIFO valuation will be beneficial under inflationary market conditions. Similarly, the LIFO valuation will be a better choice when prices are falling.

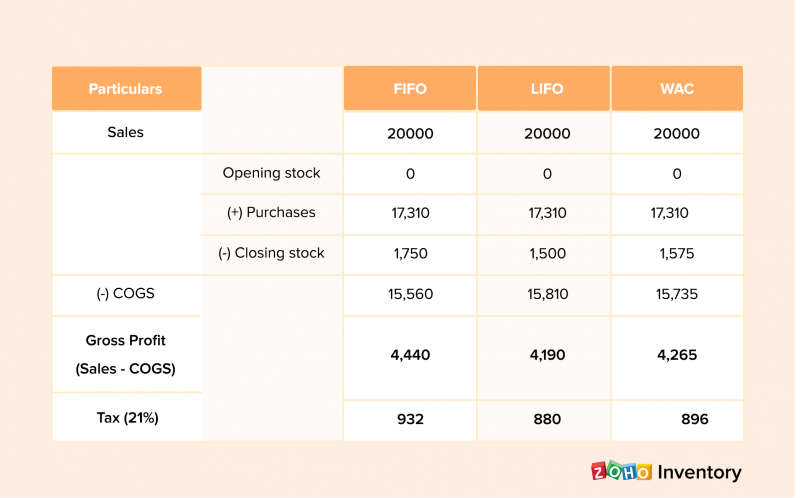

To make it clearer, let’s look at the same illustration, but with a new assumption that the sales price/unit is $20.

Because the FIFO method results in a higher gross profit, it will make the company more attractive to investors.

3. Saving taxes

If you’re looking for ways to cut down on your tax liability, then your inventory valuation technique can help. Assuming an inflationary situation again, a LIFO valuation technique will save you some money. To show how, let’s refer to the above example again:

You can see that the tax liability is the highest when you follow the FIFO valuation technique, because the profit is also highest. Under LIFO, the liability is lower because the profit margin is lower. However, keep in mind that we’re assuming the prices will go up during the year. During a depression, this scenario might play out differently.

Summing it up

The concept of inventory valuation can seem a little heavy at first. However, once we break it down and demonstrate each technique, it gets a lot simpler. That’s exactly what we tried to achieve in this article. If you got slightly overwhelmed, though, here’s a quick recap of what you need to know:

– Inventory valuation is the monetary value of your unsold stock.

– You need to choose an inventory valuation technique because the price you pay for items from your vendor might change throughout the year.

– There are three techniques of inventory valuation: FIFO (First In, First Out), LIFO (Last In, First Out), and WAC (Weighted Average Cost).

– Choosing an inventory valuation technique depends a lot on your financial goals and market conditions. Just don’t change valuation techniques too often, because it can complicate your bookkeeping and raise suspicions.

Whether you’re an established business owner or a newbie entrepreneur, you need to know about inventory valuation because inventory plays a big part in the asset category of your balance sheet. An understanding of inventory valuation and its importance can help you meet your business growth goals and make the best of current market conditions.