Latest from us

Filter By

Clear filter

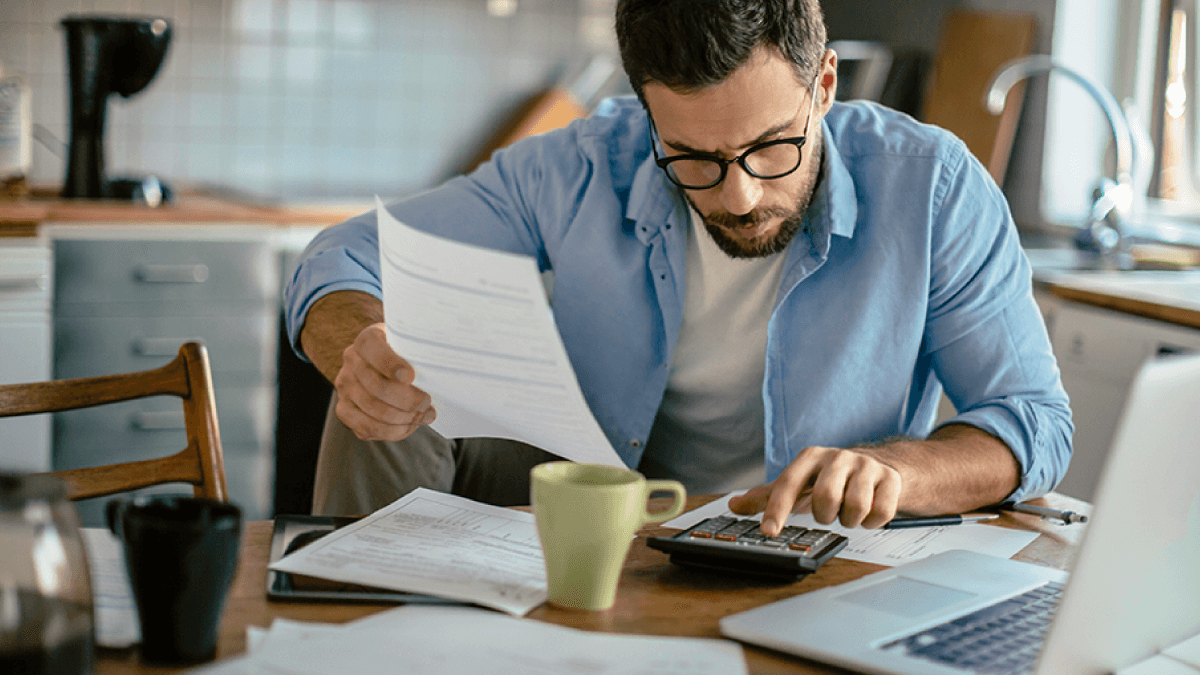

Accounting trends & insights

11 ways to streamline business accounting

Accounting trends & insights

Future of finance forecasting: AI-driven predictions and risk analysis

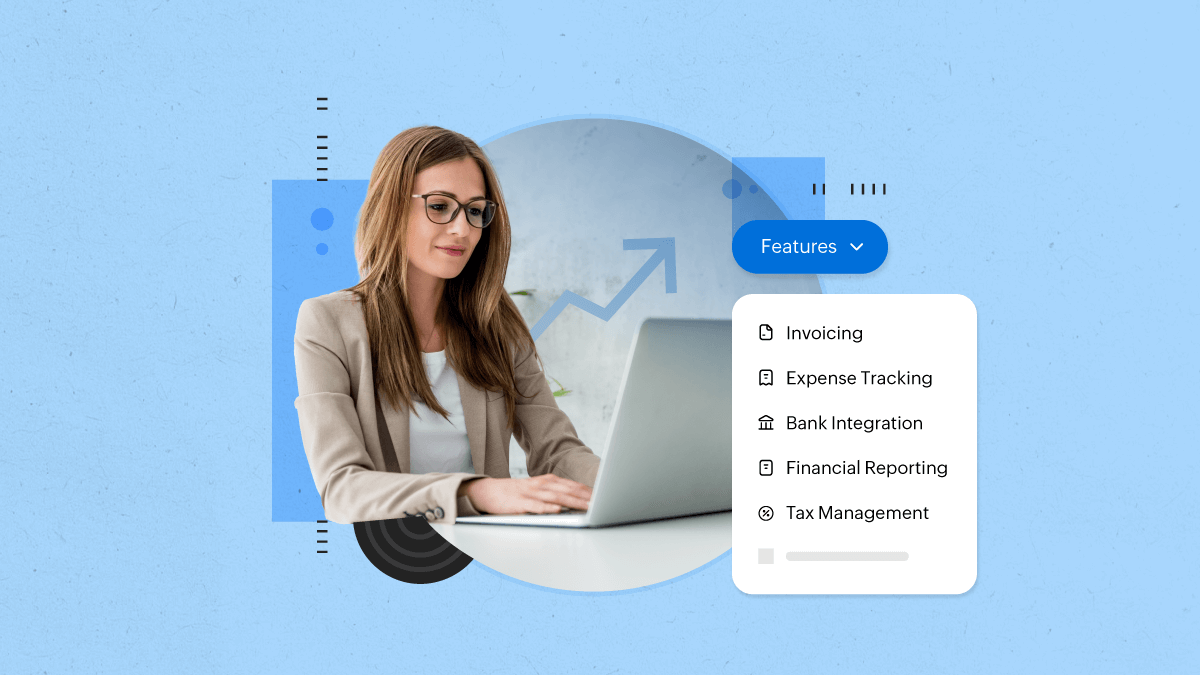

Accounting Principles

How to pick the right accounting software for your small business in the US (2026)

Accounting trends & insights

Accounting software for startups: Essential features you need to look out for

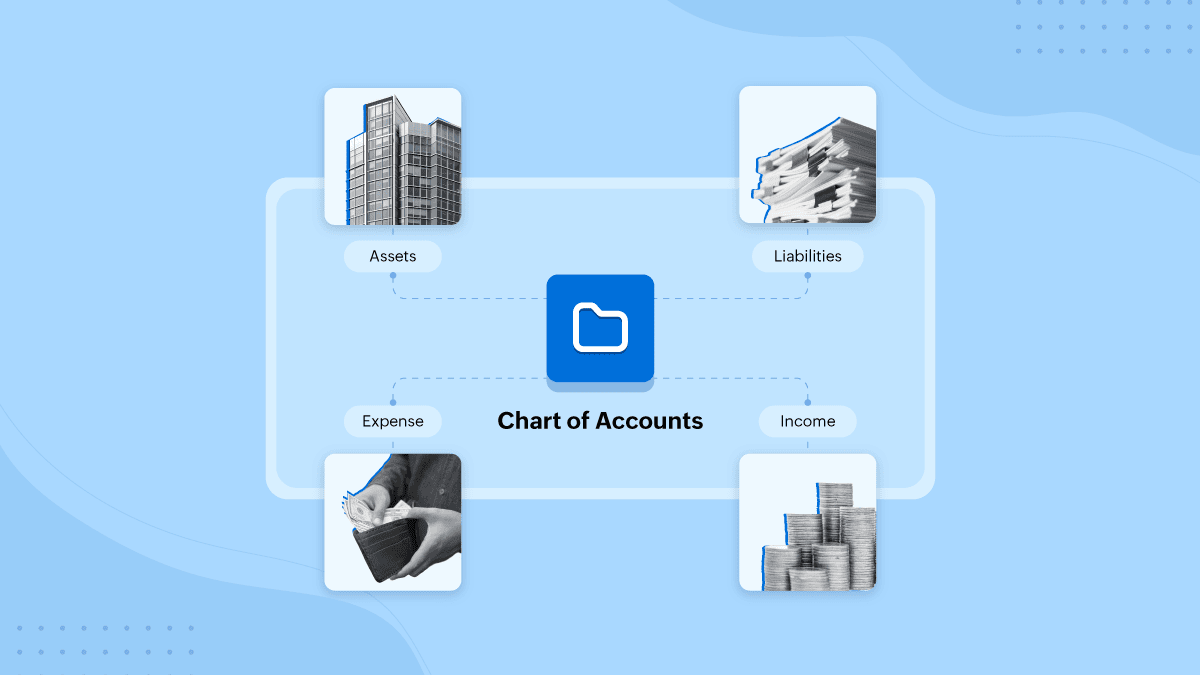

Accounting Principles

The chart of accounts: How to set it up & maintain it properly

Accounting Principles

Difference between bookkeeping and accounting

Accounting trends & insights

A beginner's guide for nonprofit organizations navigating accounting

Accounting Principles

What is IFRS and why does global accounting rely on it?

Financial Management

Project Accounting: What It Is, Why It Matters, and Best Practices

Accounting Principles

What is accounting? A complete guide

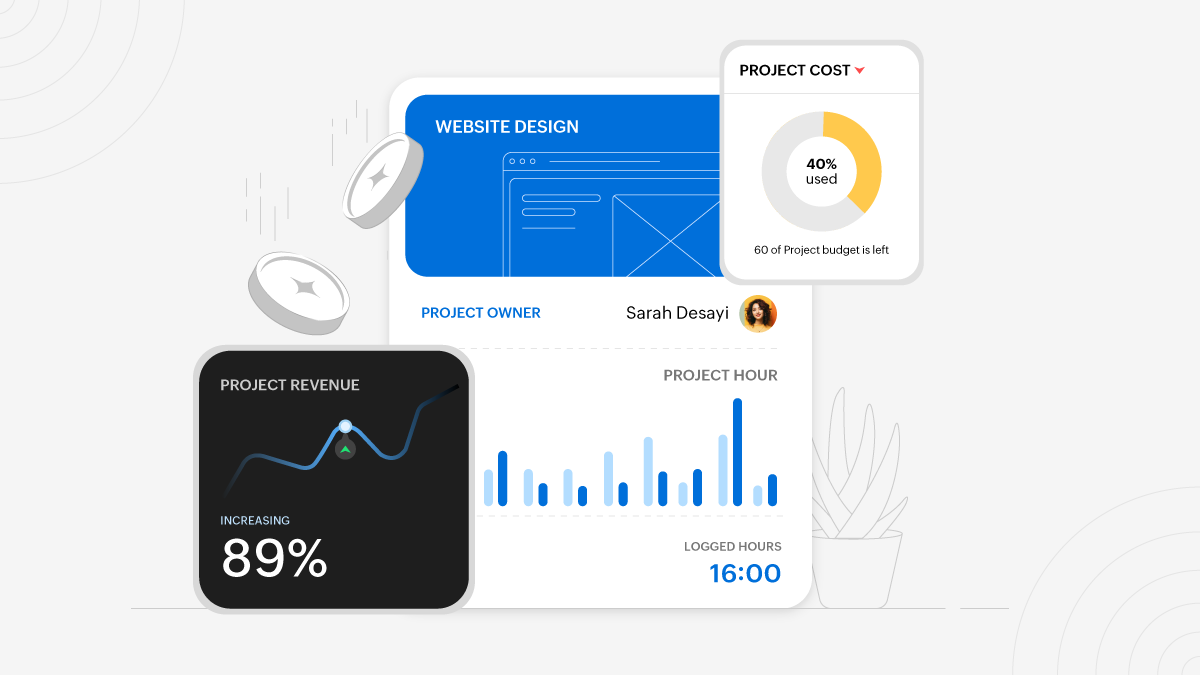

Accounting trends & insights

Maximizing project profitability with your accounting software

Accounting Principles

Mastering inventory accounting streamlined tracking and reporting

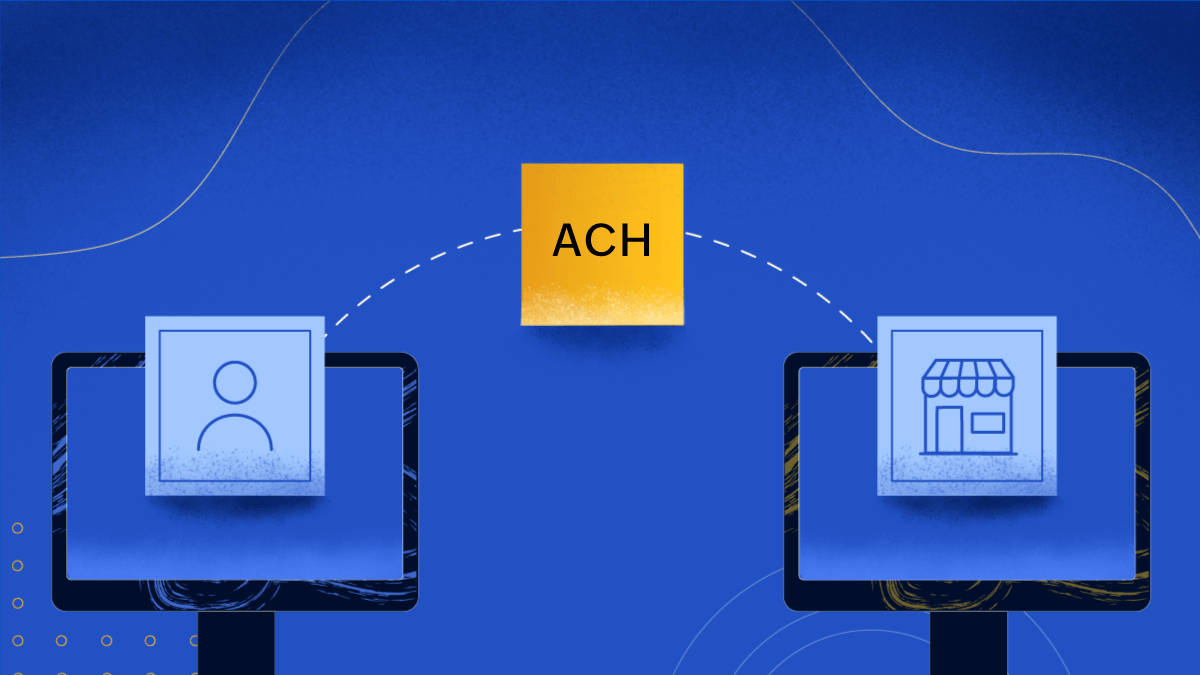

Banking & payments

Why timing matters: Understanding deferred expenses and prepayments

Banking & payments

A comprehensive guide to setting up online payments for your ecommerce business

Accounting Principles

Invoice Processing in Accounts Payable (AP): A practical guide from bill receipt to payment

Accounting Principles