Before shaking hands on a deal, businesses often negotiate about the terms of the deal such as the selling price, discounts, and delivery dates. Once this negotiation is over, it is good practice for the business to send a preliminary draft of the invoice to the buyer showing the agreed-upon deliverables. This document also acts as a tentative agreement and is called the proforma invoice.

Pro forma in Latin stands for ‘for the sake of form,’ implying that it is only a provisional document and will eventually be followed up with an official document. Although proforma invoices are widely used, it is easy to confuse them with regular invoices. This article aims to explain the meaning of proforma invoices using examples, demonstrate their uses, and demystify the differences between a proforma invoice and an invoice.

What is a proforma invoice?

A proforma invoice is a preliminary invoice that is sent to a buyer before a sale is confirmed. This invoice highlights the deliverables from the seller’s end such as the goods or services to be delivered, their prices, shipping information, and delivery date. After reviewing the proforma invoice, the buyer gives the green light to the seller. The seller proceeds to send a sales invoice and starts working on their part of the deal—manufacturing the products or providing the service.

When is a proforma invoice issued?

A proforma invoice is issued when a seller has discussed the preliminaries of a sale with the buyer but cannot proceed to send an official invoice since the final details of the deal aren’t confirmed by the buyer yet. A proforma invoice can be issued to let the buyer know what exactly to expect from the seller.

A proforma invoice use case:

Suppose that a computer parts manufacturer called Gary Components receives an order for 1,000 computer monitors. Upon receiving the order, without any negotiation or confirmation, Gary Components starts procuring the materials for the monitors and begins manufacturing them. In a month, the manufacturing is complete and Gary Components sends an invoice to the buyer. Looking at the invoice, the buyer is displeased because:

-

They think the price is too high and could have been negotiated

-

They wanted the delivery date earlier

-

They want longer payment terms

Gary Components can still make amends by lowering their prices, rushing to meet the deadlines, voiding their previous invoice, and creating a new invoice that meets the requirements of the buyer, but doing business this way is chaotic and inefficient.

Alternatively, suppose that Gary Components creates a proforma invoice that includes the price of the computer monitors, the delivery date, and the payment terms. Now the buyer has room to negotiate with the seller to find mutually agreeable terms. Upon agreeing, Gary Components sends a proforma invoice as a document of good faith and starts manufacturing the computer monitors. Once the manufacturing is complete, the proforma invoice can be converted into a sales invoice using invoicing software or an accounting tool.

Why do businesses use proforma invoices?

A proforma invoice is used:

-

To let the buyer know what to expect from the supplier and to invite negotiation

-

To show the supplier’s willingness to offer the goods and services at the discussed price, on the promised date

-

To acknowledge the buyer’s acknowledgment and intent to pay

-

To streamline the quote-to-cash process

-

To act as a quote for internal purchase approval protocols for the buyer

-

To save processing time and costs

On the other hand, a proforma invoice is not a legal agreement since it’s only a draft. A proforma invoice is also not a document requesting a payment.

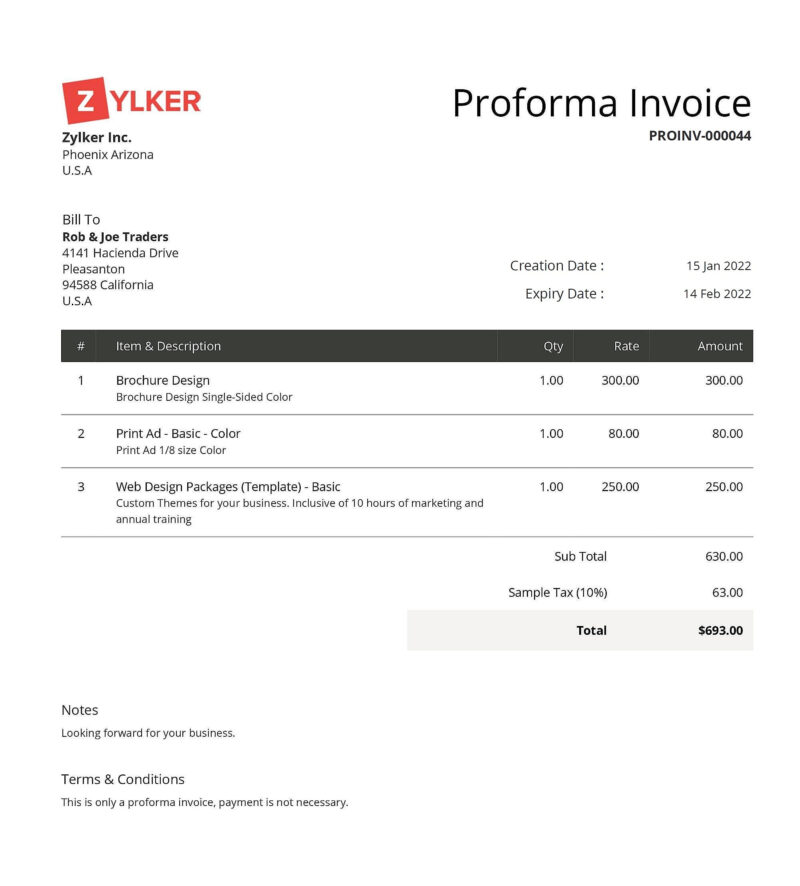

The fields in a proforma invoice:

Unlike an invoice that has a predefined set of fields to be included, a proforma invoice could contain anything that’s relevant at the time of creating it. In terms of its appearance, the only difference between a proforma invoice and a sales invoice is that the invoice number is mandatory for a sales invoice, whereas in the case of a proforma invoice, invoice numbers are mostly avoided.

However, the following fields are typically included in a proforma invoice:

-

The document title ‘Proforma Invoice’

-

Buyer’s details such as the company name, billing address, and shipping address

-

Seller’s details such as the company name and address

-

Payment terms

-

Invoice creation date

-

Invoice expiration date

-

Description of the goods or services

-

The prices of the goods and services

-

Quantity of the goods and services

-

Discounts

-

Taxes

-

Total

A proforma invoice sample:

To help you understand what proforma invoices look like, we’ve used Zoho Invoice to create a sample proforma invoice.

You can download this proforma invoice template and modify it using an external spreadsheet tool.

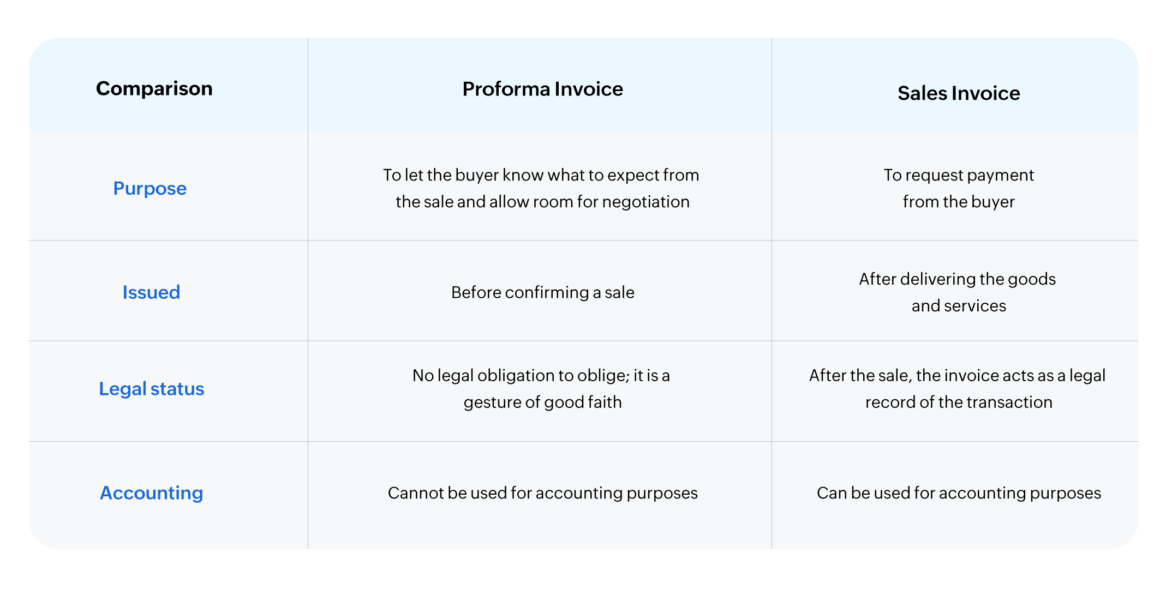

Proforma invoice vs. invoice:

The difference between proforma invoices and invoices isn’t about the way they look, but the intention with which they are sent. Here’s how proforma invoices and sales invoices compare—

Conclusion:

Sending a tentative summary of the deal before confirming the sale in the form of a proforma invoice streamlines the quote-to-cash process and also gives the buyer leeway to review the terms of the deal before it is actually made. Businesses that are scaling fast and looking for ways to improve their billing processes should definitely consider using proforma invoices.

If you are looking to start using proforma invoices, check out Zoho Invoice. Zoho Invoice is free invoicing software that helps freelancers and small businesses create estimates, convert them into professional invoices, and get paid on time.

6

6

Hi, you have nicely and clearly explained all about proforma invoice, love to read it. Thanks.

You clearly explained, and I well understood.

Thank you for the information about the proforma invoice which is clearly explained in detail thank you soo much

Very good and informative explation, Helpful

Clearly explained and would love to learn more.

thanks for your explaining