- HOME

- Expense Management

- What is expense management software? Benefits and features explained

What is expense management software? Benefits and features explained

Expense management refers to capturing, collating, verifying, and reimbursing expenses incurred by employees on behalf of the business to account for every penny spent by the business. Automating this with the help of an application is the purpose of expense management software.

Expense management software allows businesses to streamline the entire employee expense reporting process, helping businesses track and control their employee expenses. This article will dig deep into the capabilities, benefits, importance, features, and the use cases of expense management software.

What is expense management software?

Expense management software is an application that helps businesses track and control employee expenses through automation. Most expense management software on the market is equipped with technology such as optical character recognition (OCR) that captures and converts receipts to expenses. Many also automate the approval processes and help companies reimburse faster.

With advancements in artificial intelligence (AI), receipt scanning, line-level data extraction, expense categorization, and audits are increasingly being handled by AI to improve accuracy while comprehending a wider range of data. Automation across repetitive tasks, such as report creation and submission, helps businesses and employees leave the entire expense management process to the software while they focus on their core activities.

Businesses with sales teams that frequently travel, companies with multiple branches managing petty cash expenses, and on-site employees working on customer billable services are some that would benefit highly from expense management automation. Depending on the nature of your business and the complexity of your expenses, you must choose the right expense management software to maximize ROI.

Why is expense management software important?

If you are a part of a business that requires tracking business expenses incurred by employees, you know that manually collecting expenses, creating a report, checking for company policies, submitting a report, fixing errors, and following up for approvals until a reimbursement is issued is a long, arduous process—one that most employees hate and often dread.

According to a GBTA survey, 49% of employees believe setting up expense reports is a pain point, while 54% find entering expense data, and 55% report attaching the receipts to be issues when processing expense reports. As an administrator or approver, you are required to check every expense detail filled by the submitter, and verify, approve, or correct errors for the numerous reports submitted. This process is riddled with manual errors, fraudulent activities, and often proves to be highly time-consuming. This makes manual expense management a high-risk and costly business activity.

Expense management software helps businesses overcome these challenges with automation that minimizes human intervention. Receipt scanning technology digitally scans receipts and extracts data to fill in the details of your expense to ensure every expense is an accurate reimbursement request.

Automation engines run configured company policies across all expense requests. They help check out-of-policy expenses and raise notifications to ensure businesses have complete control over fraudulent expenses while maintaining policy compliance and budget adherence.

Automatic submission of expense reports at strict intervals is another feature that businesses leverage, especially for traveling sales teams. As sales employees scan or upload invoices from their travels throughout the month into the software, a quick automated report collects all auto-converted expenses into a report and submits the same to the designated approver, saving admins and employees substantial time lost in follow ups and report creation.

An Aberdeen Group report titled, "Expense Management Study: The Convergence of Mobile, Cloud, and Artificial Intelligence," states automated expense management saves companies 30% in expense processing costs, reduces errors by 65%, and lowers report approval times by 50%, proving the substantial impact of expense automation.

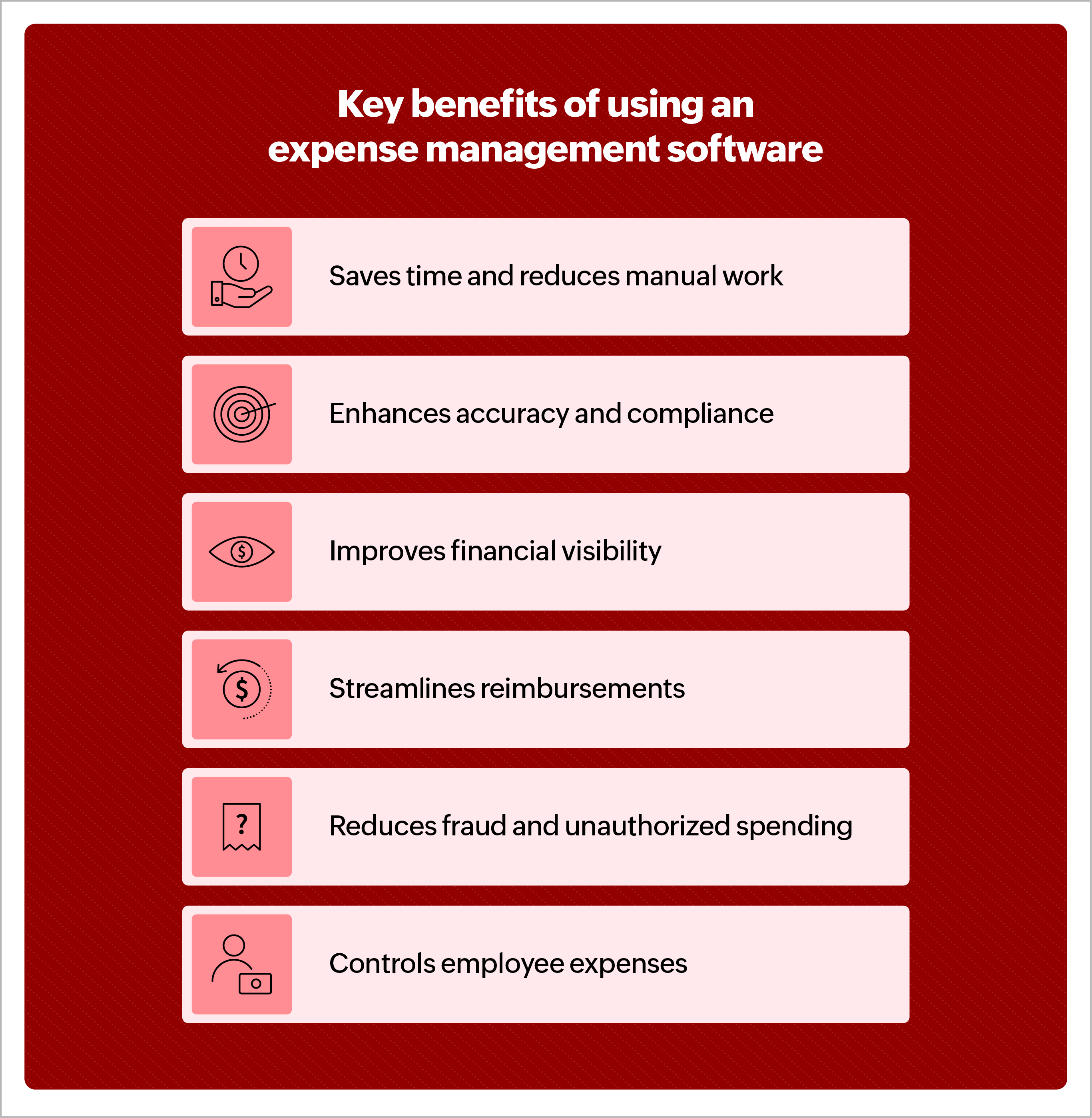

Key benefits of using expense management software

Saves time and reduces manual work

Employees take, on average, 20 minutes to complete one expense report and 18 minutes to correct one expense report. The average cost of processing an expense report is around $58, and 19% of manual expense reports are riddled with errors, which take about $52 to correct. These stats, published by the GBTA, help understand the value that automation brings to an organization that manages expense reports manually.

Enhances accuracy and compliance

Rule engines, workflows, and policies allow businesses to customize expense management software according to their company's requirements. This helps ensure continuous automated audits and approvals that highlight and restrict out-of-policy expenses, ensuring accuracy and compliance.

Improves financial visibility

With automated expense conversion of credit card transactions and easy expense receipt scanning, employee expense data is captured and tracked in real time. This gives businesses complete visibility to assess their real-time expense utilization, which can be used to course-correct the company's budgets and forecasts. Reports, notifications, and alerts allow administrators to keep track of budget utilization and make decisions for future expenses.

Streamlines reimbursements

With automation, the time saved in back-and-forth communications ensures faster processing of employee expenses, leading to faster reimbursements. These, in turn, ensure high employee satisfaction and positive motivation. With all the data available in one place, approvers and administrators can verify and process expense reimbursements quickly, and integrated accounting software ensures books are closed on time, every time.

Reduces fraud and unauthorized spending

With complete dependency on audit engines and scanning technologies, expense management software ensures fraudulent practices such as duplicate invoices, mismatched expense and receipt amounts, blocked merchant expenses, and more are automatically weeded out from the system. Company policy limits on expense categories configured in the app can automatically block or warn over-the-limit spends and control expenses.

Controls employee expenses

Employee expense management software with budget modules and category-level, user-level, or department-level spend limits ensures complete control over employee expenses. Many software solutions offer affiliated corporate cards that allow businesses to configure built-in limits so admins can control spend before it is incurred.

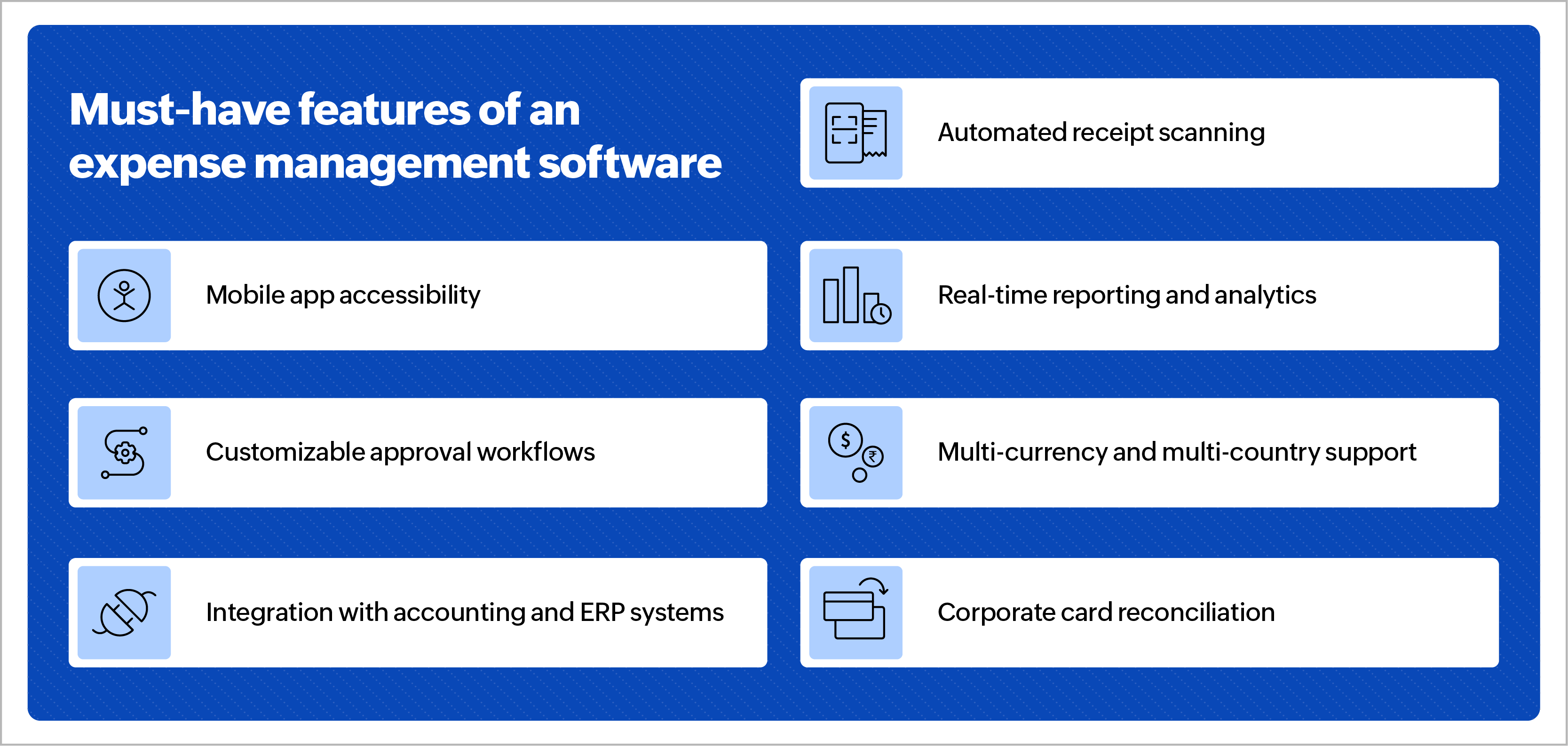

Must-have features of expense management software

Automated receipt scanning

One of the most fundamental requirements of expense management software is the ability to simplify receipt-to-expense creation. Optical character recognition (OCR) technology has been the go-to option for all software on the market. This technology is now being elevated to AI-powered OCR technology, bringing in higher accuracy and speed in the receipt scanning and conversion process.

Mobile app accessibility

With most expenses being incurred out of the office while on-the-go, mobile app accessibility is a must. Employees travelling often store receipts and lose them before they report the expenses, leading to considerable losses. A mobile app helps employees upload receipts on the spot, easing the capturing process while also ensuring real-time expense visibility for the company. For applications that support mileage tracking and reimbursement, GPS tracking through mobile apps helps track and record mileage accurately for faster and smoother reimbursements.

Real-time reporting and analytics

As employees raise expense requests in real time, from receipt scanning and credit card transaction fetching to mileage tracking, all business expenses are created in the application instantly, giving administrators live visibility into employee spending.

You can also gain financial insights through analytics, either included within the expense management application or integrated with advanced analytics applications. This allows businesses to run frequent reports that help forecast expenses, make budgeting decisions, negotiate vendor terms, and more.

Customizable approval workflows

Approval automation allows businesses to route approval requests faster and eliminate multiple back-and-forth communication for a streamlined process. Although every business has a unique approval workflow that changes based on locations, departments, projects, and the like, custom workflows should be configurable in your expense management tool to ensure approvals can be automated for all business use cases.

Multi-currency and multi-country support

With employees now traveling across countries to build global businesses and hedge local market volatility, it is necessary that all expense management software have multi-currency, and multi-country support. Global businesses require the application to run in multiple languages, calculate foreign exchange on expenses, follow local regulatory requirements, and even allow multiple policies to be configured based on where the employees are based.

Integration with accounting and ERP systems

Employee expense management does not stop at employee reimbursements and expense reporting; it starts with an updated employee database and ends with the reconciliation of business accounts. From synced employee information to closing accounting books, software solutions need to calculate and report accurate entries of employee expenses to reconcile the balance sheet and comply with regulatory requirements.

Some of the more popular ERP and accounting applications such as SAP, Oracle, Zoho Books, QuickBooks, and Xero have out-of-the-box integrations with expense management applications making this a breeze. Make sure your expense management application integrates with your accounting and ERP systems.

Corporate card reconciliation

Corporate cards issued by the company allow employees to spend from the company's money instead of their own, eliminating the need for reimbursements. This gives employees the flexibility and ease to spend when necessary. Expense management applications that connect corporate cards can simply fetch the transaction data into the system and automatically convert it to an expense. Employees can simply snap a photo of their invoice and add it to the expense; the software reconciles the expense with the transaction to create and process the expense.

How can you choose the best expense management software for your business?

With a variety of options available in the market, choosing an expense management platform is similar to going through the generic buying decision making process: Need recognition > Information search > Evaluation > Purchase decision > Post-purchase activity. While the process is similar and self-explanatory, the criteria to evaluate the options differ from one business to another. Some common factors to consider when shortlisting options are features, integrations, ease of use, scalability, and pricing.

Start from shortlisting some of the top rated expense management tools across review sites like Gartner Peer Insights, G2, and similar resources. Compare them on the above mentioned criteria to understand their differences. AI chatbots like ChatGPT and Gemini are well equipped to help you with this research, too. However, make sure to use these tools as a reference and confirm the information through your own research. Reach out to the vendors for personalized demos, inquiry resolution, introductory videos, and more to learn the tool's capabilities better.

Here are some tips for choosing the right business expense management application for your company based on employee size.

Small businesses with less than 100 employees

Most expense management software providers, such as Zoho Expense, have a free version for a limited number of employees. As employees set up their sales teams and initiate employee travel, expense management is often handled manually through emails, spreadsheets, and the like. At this stage, adopting an expense management solution and leveraging the free versions while the employee count is low can help small businesses try the product before they buy it. When used extensively, companies can identify gaps, issues, and challenges with the product before investing and implementing it. Small businesses can choose plans that fit their needs and scale as the business grows.

Medium-sized businesses with 100–500 employees

Medium-sized businesses are usually growing businesses with the majority of their challenges relating to the uncontrollable growth rate. These growing pains are usually because of resource crunch during high demand. From prioritizing to streamlining, businesses in this stage focus on improving productivity with the existing workforce.

An expense management platform that can automate your business's current workflow and expedite the process so admins can manage more in the same time is your solution. Look for applications that allow customizations without restricting scalability or complicating the process.

Businesses depend on software providers for prompt inquiry resolutions and customer service when required. As a mid-sized business, you are bound to process a large amount of expenses in short time periods requiring quick help and service in case of errors or downtime. Ensure the expense management provider offers robust customer service and uptime guarantee.

Large businesses with more than 500 employees

Large enterprises prioritize things differently than other companies. Expense management for larger organizations is a complicated and evolved process that has seen a bunch of changes as the business grew. From multiple locations to multiple currencies, languages, processes, departments, and more, the complexity of an enterprise can only be handled by niche and deep-featured software solutions.

An expense management solution for your large business would require multi-currency management, custom workflows, multiple language options, unrestricted storage, unlimited receipt scans, integrations with the existing tech stack, and other features. Look for custom plans offered by software providers to build your own enterprise solution.

Real world use-cases and success stories

Let's take a look at this case study of RedDoorz where Zoho Expense's solution helps them unify multi-lingual and multi-policy expense management across multiple countries. The application helped the business streamline their expense management process with a customizable solution that is offered in multiple languages.

Another example is Oberoi Realty that adopted Zoho Expense to automate their project employee expenses. They achieved 99.5% accuracy and were able to onboard 140% more users in just a few months. Their priority was to manage project-level petty cash and employee expenses, which Zoho Expense's software was able to achieve effortlessly.

"Managing imprest accounts and expenses across multiple projects in different locations was a major hurdle for us. We needed a solution that could handle project-level automation and provide control across all our sites."

— Pankaj Pandit, Chief Information Officer, Oberoi Realty

Here's a quick recap of the key takeaways:

- Expense management software is an application that helps businesses track and control employee expenses through automation.

- Expense management software helps businesses overcome challenges such as manual errors, fraudulent activities, and time-consuming processes with automation that minimizes human intervention.

- Expense management software helps save time, improve accuracy, provide visibility, streamline reimbursements, reduce fraud, and control expenses.

- Some of the features to look for in expense management software are receipt scanning, mobile app availability, custom workflows, analytics, multi-entity support, integration capabilities, and corporate card reconciliation.

- Depending on your processes, nature of business, size of business, tech stack, and more, choosing the right expense management solution requires a thorough evaluation and shortlisting process.

Choose the right expense management software for your business to improve financial efficiencies and overall productivity. Sign up for Zoho Expense's 14-day free trial today to experience it firsthand.

- Dhwani

Dhwani Parekh is a seasoned FinTech content writer with more than 7 years of experience in SaaS marketing. As a contributing expert at Academy by Zoho Expense, she focuses on uncovering trends that empower businesses to streamline their financial operations, especially business travel and expense management. With deep industry knowledge and a pulse on the rapidly evolving landscape of business spend, Dhwani’s content adds tremendous value to Academy by Zoho Expense.