VAT Settings

In Germany, Value Added Tax (VAT) is levied by the government on the goods or services provided by registered businesses. It is mandatory for all resident and non-resident businesses in Germany to register for VAT.

Configure VAT in Zoho Invoice

If your business is registered for VAT, you can enter your VAT information and configure VAT settings within Zoho Invoice.

Note: You can find the necessary details in the VAT Certificate issued by your German jurisdictional tax office.

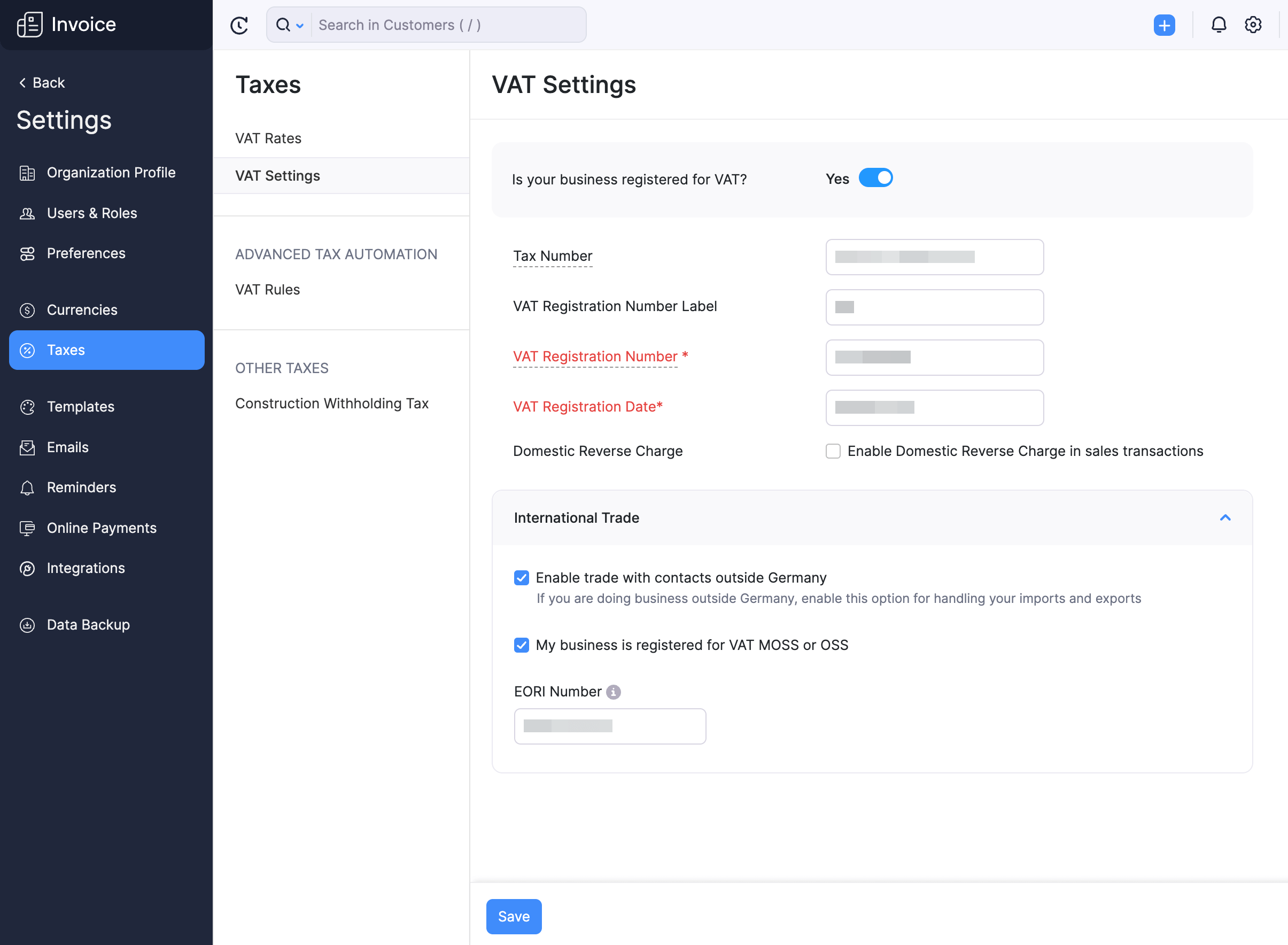

To configure VAT in Zoho Invoice:

- Go to Settings and navigate to Taxes.

- Select VAT Settings from the sidebar.

- Select Yes if you are a registered business under Is your business registered for VAT?

- Enter the 9-digit VAT Registration Number.

- Enter the VAT Registration Date.

Note: You cannot apply VAT on transactions created before this date in Zoho Invoice.

- Check the Enable Domestic Reverse Charge in sales transactions option to apply domestic reverse charge on services in your sales transactions.

Insight: Domestic Reverse Charge (DRC) is a legal measure introduced to stop fraudsters from avoiding paying their VAT dues to the government, which they had collected from their German customers.

- In the International Trade section, check the Enable trade with contacts outside Germany if you supply or import goods from other countries.

- Check the My business is registered for VAT MOSS or OSS option to track VAT according to the One Stop Shop scheme and enable VAT Rules for your organization.

Insight: Domestic Reverse Charge (DRC) is a legal measure introduced to stop fraudsters from avoiding paying their VAT dues to the government, which they had collected from their German customers.

If you sell services valued over EUR 10,000 to EU customers outside Germany, you should apply VAT based on their location. Once you start tracking OSS scheme in Zoho Invoice, you will be able to create VAT Rules and apply VAT rates on items based on the customer’s location automatically.

-

Enter your EORI Number. (Economic Operators Registrations and Identification) which is an identification number for vendors involved in trade with EU’s customs territory.

-

Click Save.

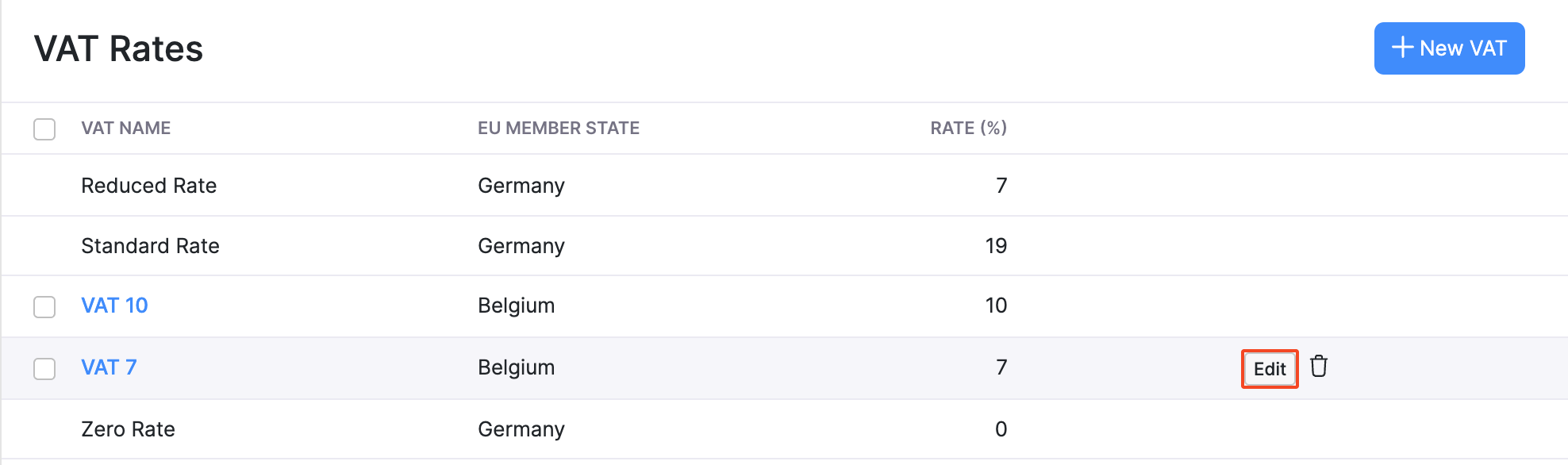

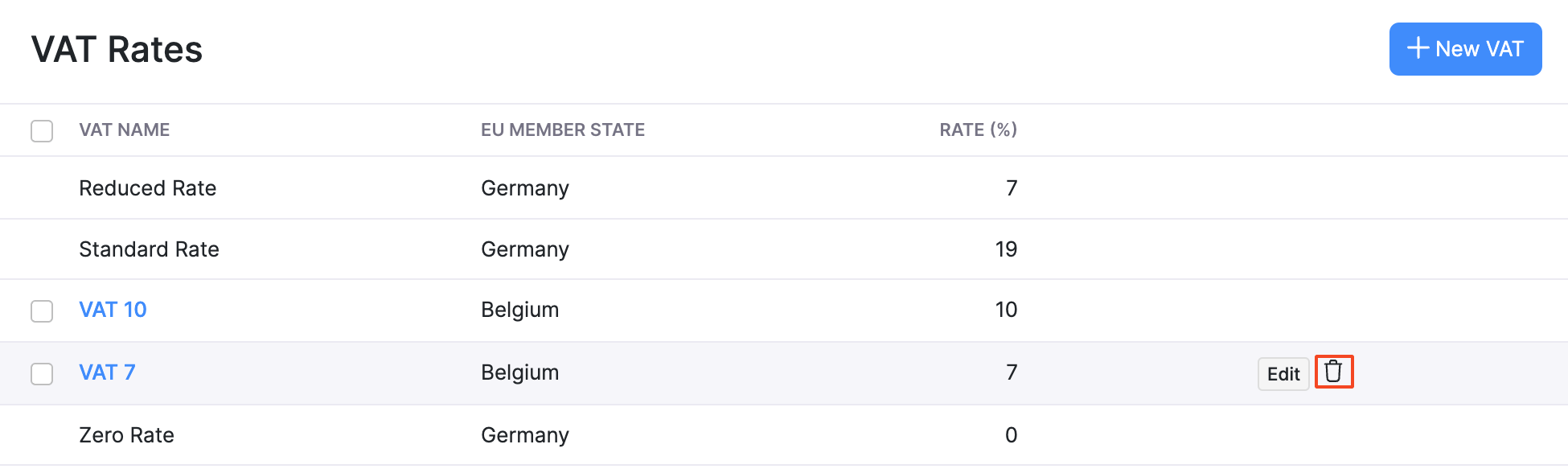

Manage VAT rates

Once you’ve configured VAT in the VAT Settings page, you can start applying the default VAT rates to your transactions. These include the Standard Rate [19%], Reduced Rate [7%], and Zero Rate.

Note: The default VAT rates cannot be edited or deleted.

To create and manage VAT rates, check the My business is registered for VAT MOSS or OSS option in the VAT Settings page.

Create VAT Rate

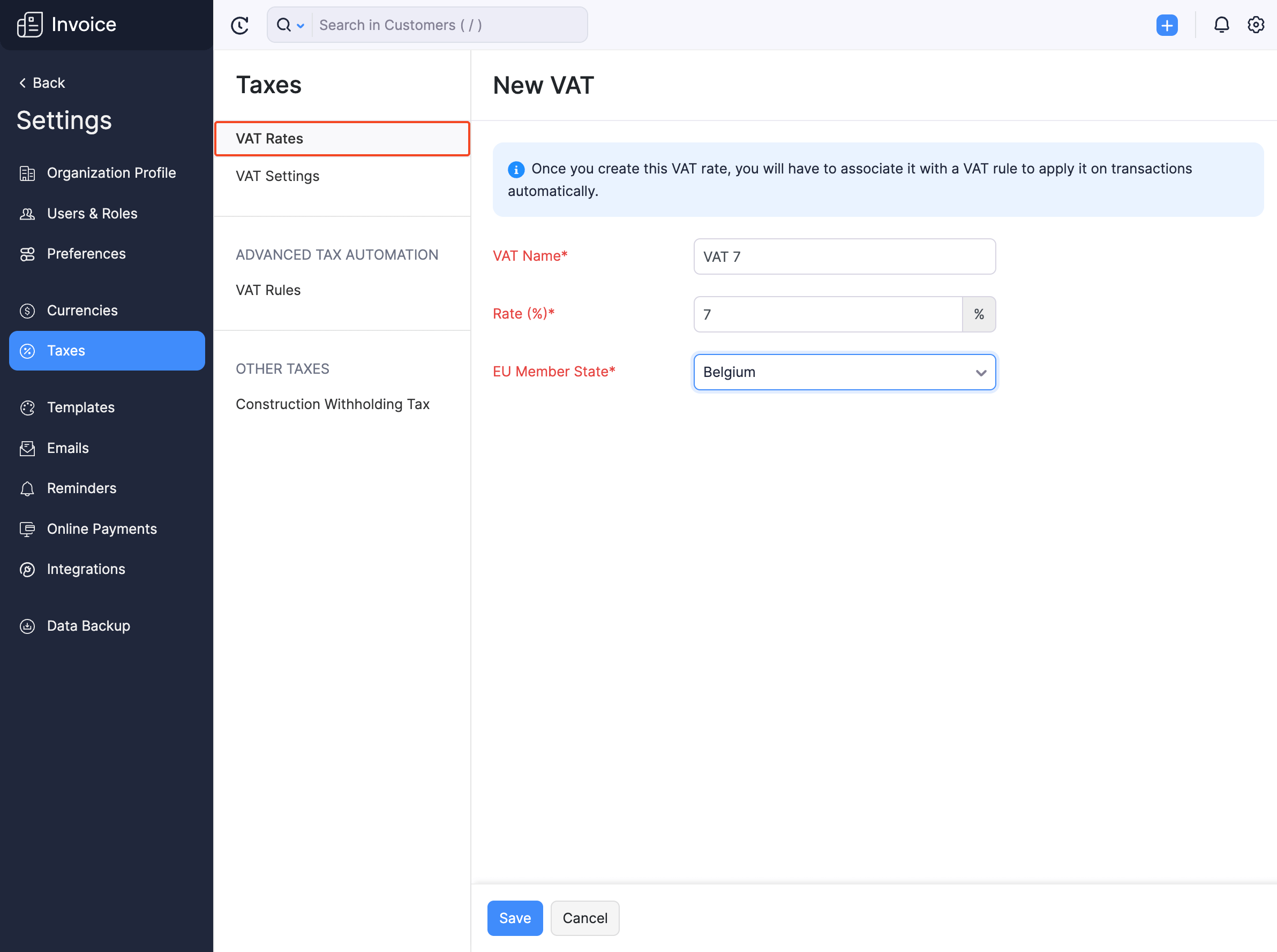

To create a VAT rate:

-

Go to Settings and navigate to Taxes.

-

Select VAT Rates from the sidebar.

-

Click + New VAT and in the pop-up that appears:

- Enter the VAT Name and Rate(%).

- Select the EU Member State you’re creating the VAT rate for.

- Select the Account to Track VAT from the dropdown, which includes all the Overseas Tax Payable type of accounts.

-

Click Save.

The VAT rate will be created, and you’ll be able to apply this to transactions.

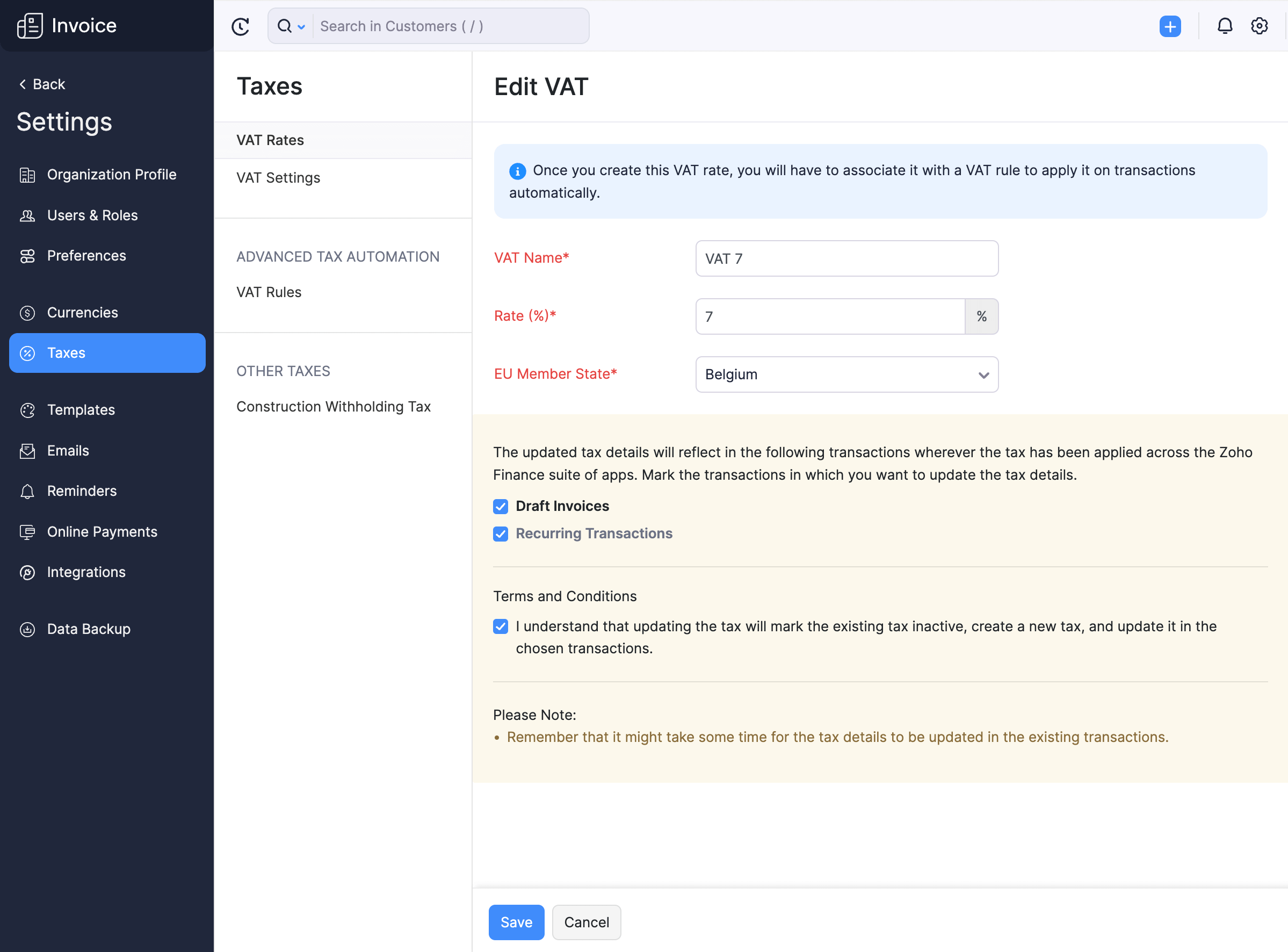

Edit VAT Rates

To edit an existing VAT rate:

-

Go to Settings and navigate to Taxes.

-

Select VAT Rates from the sidebar.

-

Hover over an existing VAT rate and click Edit.

-

Edit the fields as per your preference.

-

Select the draft transactions in which you want to update the edited VAT rate.

-

Click Save.

Delete VAT Rates

To delete an existing VAT rate:

-

Go to Settings and navigate to Taxes.

-

Select VAT Rates from the sidebar.

-

Hover over an existing VAT rate and click the Trash icon.

-

Confirm the action by clicking OK in the screen that follows.

The VAT rate will be deleted.

Advanced Tax Automation with VAT Rules

Advanced Tax Automation in Zoho Invoice lets you use VAT rules to automatically select the appropriate VAT rates for your items when you create a transaction. VAT Rules are a set of VAT rates that you can configure to be automatically applied in a transaction.

When you associate a VAT rule with a customer, the VAT rate specified in that VAT rule will be applied to all transactions that you create for that customer. If you associate a VAT rule to an item, the VAT rate specified in that VAT rule will be automatically applied to that item when you add it to a transaction.

Enable Advanced Tax Automation

To enable Advanced Tax Automation:

- Go to Settings and navigate to Taxes.

- Select VAT Settings from the sidebar.

- Check the My business is registered for VAT MOSS or OSS box to manage VAT rules and automate the location-specific VAT applied on transactions.

- Click Save.

Once you enable this, you’ll be able to see the Advanced Tax Automation section under Taxes.

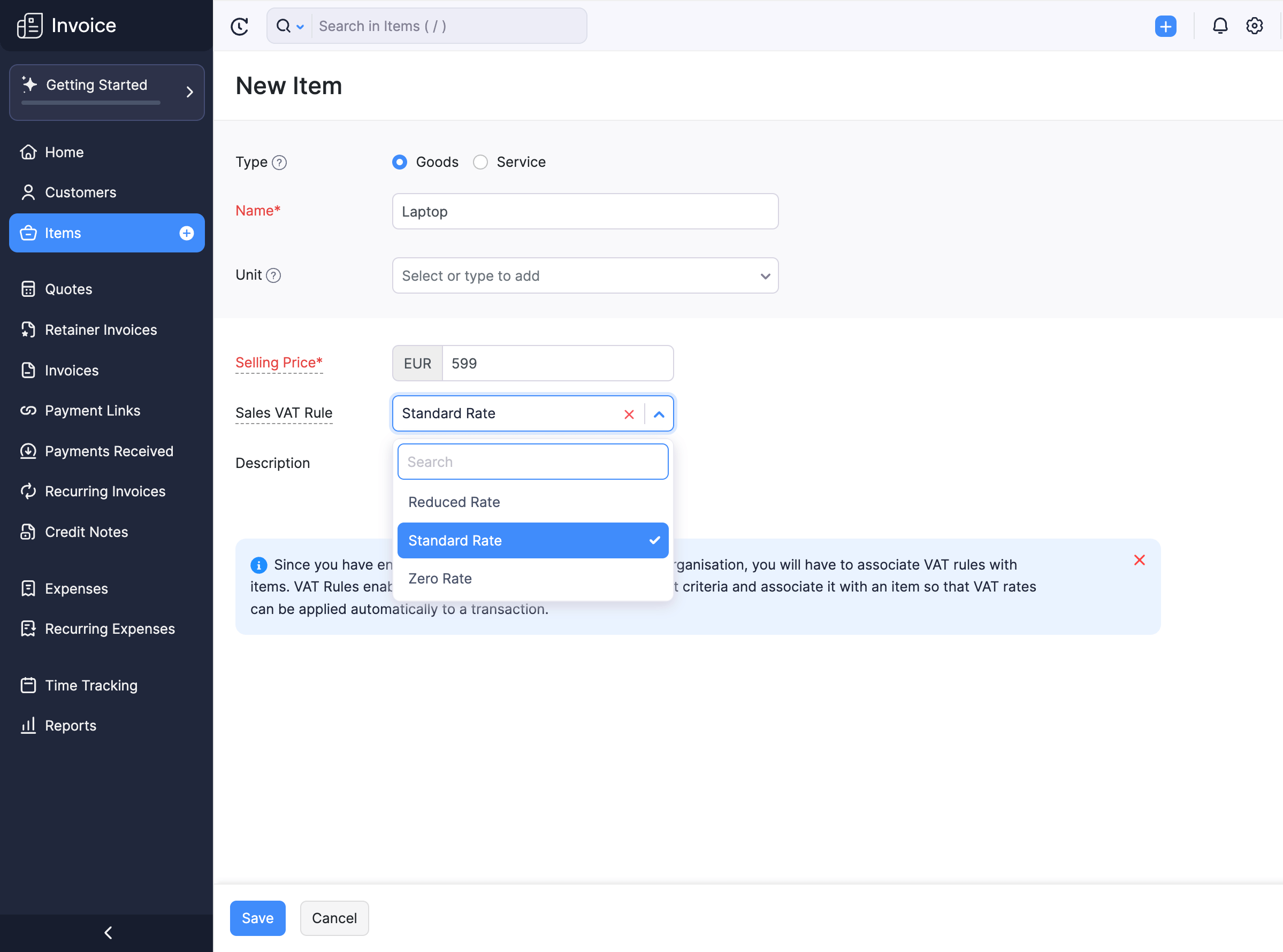

Assign VAT Rules to Items

You can assign VAT rules to new or existing items. Here’s how:

-

Go to the Items module on the left sidebar.

-

Create or edit an item.

-

Select the Sales VAT Rule.

-

Click Save.

All the transactions to which you add these items will have the VAT rate based on the rule assigned to them.

Note: While creating a transaction, if you have associated VAT rules to the customers and the items, the VAT rule associated with the customer will override the VAT rules associated with items.

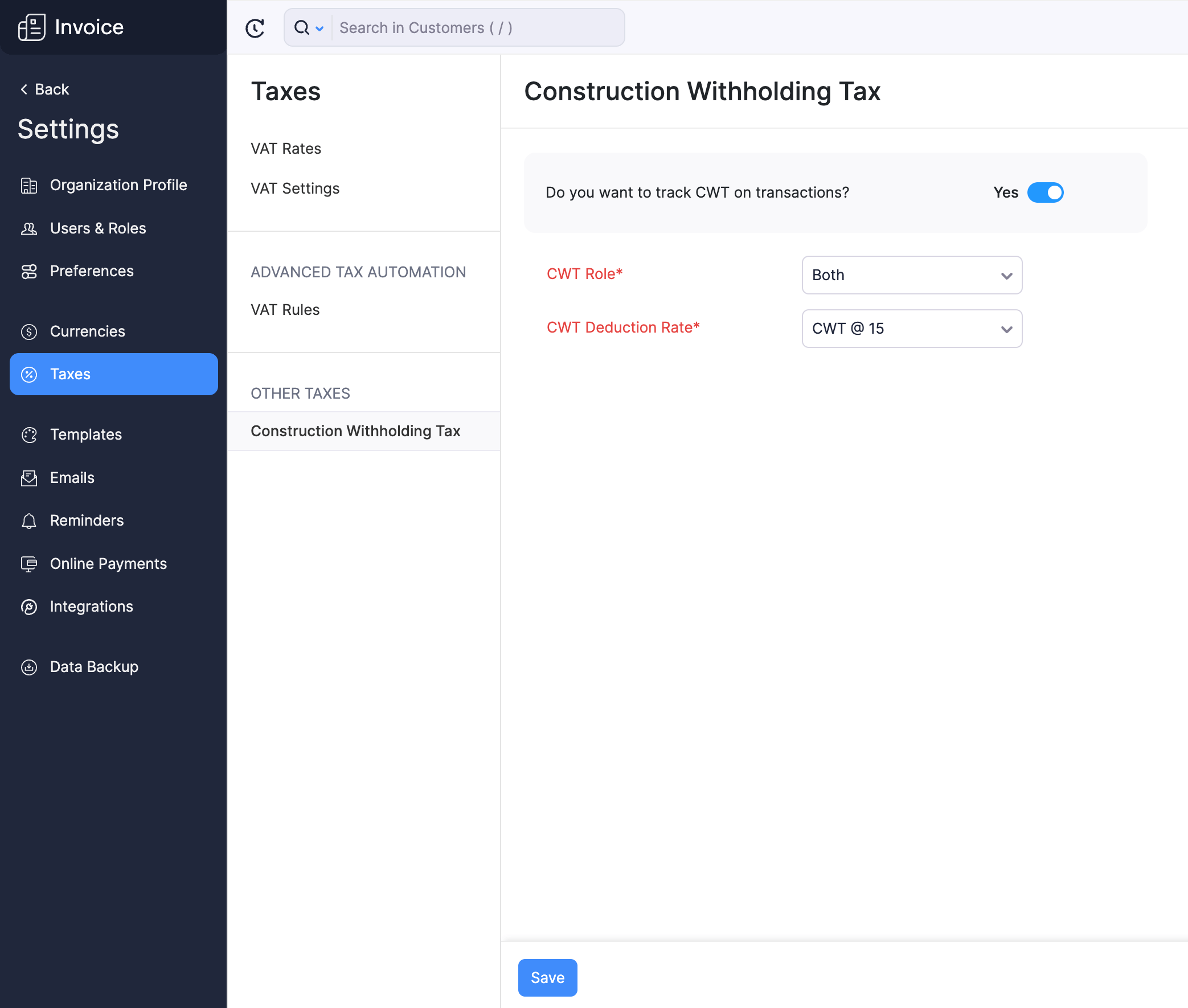

Construction Withholding Tax

In Germany, the Construction Withholding Tax refers to a tax regulation applied on construction services where the contractor is required to withhold 15% of the subcontractor’s invoice amount and pay it directly to the German tax authorities.

If you want to enable CWT tracking for your transactions:

-

Go to Settings and navigate to Taxes.

-

Select Construction Withholding Tax from the sidebar.

-

Select Yes if you want to track CWT under Do you want to track CWT on transactions?

-

Select if you are a contractor, subcontractor or both in the CWT Role dropdown.

-

If you are a subcontractor, select the CWT Deduction Rate from the dropdown.

-

Click Save.

You will now be able to track CWT deductions in your transactions using the CWT Suffered reports.

Thank you for your feedback!

Thank you for your feedback!