- HOME

- Financial Management

- Building a cash buffer: How you can tackle a cash flow crunch

Building a cash buffer: How you can tackle a cash flow crunch

Uncertainty is possibly one of the most predominant moods running through most businesses today. Between employee turnover and a tumultuous global economy, staying competitive as a small or mid-sized enterprise has become challenging. But there are a few ways to make you can weather any storm that the future holds, and having a cash buffer is one of them.

What is a cash buffer?

A cash buffer, also known as a cash reserve or a reserve fund, is the amount your business has set aside for any unplanned expenses. Think of it as a piggy bank (but with more value and returns), where you’ve got money kept aside for a rainy day—you never know when you might need it, but when you do, it can make the difference between keeping your operations running smooth and having to shut shop.

Why is a cash buffer important?

In a study by Harvard Business Review, businesses that had less than two months of cash on hand as a buffer struggled to continue their business. Any fluctuations in seasonal sales can lead to some months being very profitable while others may not be. During these slow phases (and especially if you add a global crisis to the mix!), your business may need to pull money from its reserve fund to balance out the lack of sufficient revenue. And this goes for more than just seasonal sales and economic downturns. One of the most common issues that a business faces is inaccurate forecasting. For instance, you may think you’ll sell 1,000 units, but you may only sell 650. Cash buffers can help sustain your business through this as well.

Preparing a cash flow forecast, where you allocate funds and calculate receivables and payables, can help you plan out the future trajectory of your accounts to a certain extent. However, it’s impossible to predict every expense that could come your way. There may be a client who defaults on their payment, a surge in interest rates, or even a natural disaster that would require you to shell out more money to maintain your business needs. Building a cash reserve would help you manage unexpected expenses as well as your liquidity needs during a cash flow crunch, so you wouldn’t be pressured by financial anxiety or have to shut down your shop simply because of low funds.

Even without a crisis, your business can still fall back on this reserve to back up a new growth opportunity. There may be a sudden investment to make, or a new branch you may want to open to expand your business. At such times, you can tap into your cash buffer. Having a cash buffer increases your confidence when making large business decisions, gives you more opportunities to take calculated risks, and protects you when the going gets tough.

How much of a cash buffer do you need?

The amount of cash you’d need to reserve depends on your business. JPMorgan Chase Institute’s findings reveal that businesses are more resilient when they have a reserve equal to 62 cash buffer days or more. Furthermore, a survey conducted by Bankrate states that it’s great to have at least 3-6 months worth of expenses saved up as an emergency fund in today’s world.

However, before you decide the amount based on what’s commonly suggested, consider these factors:

Your business’s current and past performance, and the volatility of your daily cash flow. Take note of the cash flowing in and out of your business without having any unrealistic expectations.

Your cash flow forecast. Once you separate standard expenses (like rent and wages) from planned one-time expenses (like a marketing strategy), consider the possibility of another similar major expense coming your way, and how much would be required.

Your receivables and inventory. If your business generally receives income slowly, or if your inventory doesn’t move quickly, you should have more cash reserve.

Your business type (whether it’s sole ownership or otherwise). Think of whether you’d be able to continue your business without income for a while. For instance, if you are a sole owner, you may have personal savings that would help you operate without revenue, so your cash reserve doesn’t need to be that high. However, if you have a larger company or even a seasonal business where you can expect revenue fluctuations, you will need a larger cash buffer.

Your other resources and safety nets that would help reduce your business risks (like a borrowing arrangement with a bank).

Your business goals. For example, if you have a new project coming your way, you’ll most likely incur sudden expenses simultaneously, so adjust your buffer money accordingly.

Factoring in all of these details should give you a good idea of the amount you’d need to run your business for a fiscal year. However, keep in mind that unexpected fluctuations happen in any business, whether it’s dealing with more payables, a sudden spurt in sales, or having to cope with a global crisis.

Calculating your ideal cash buffer

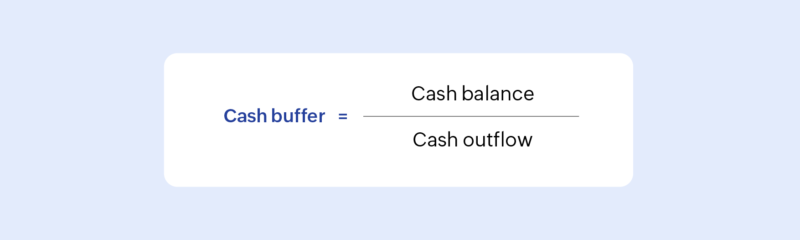

Here’s a direct formula that JPMorgan Chase Institute recommends to help you calculate how much cash reserve your business needs:

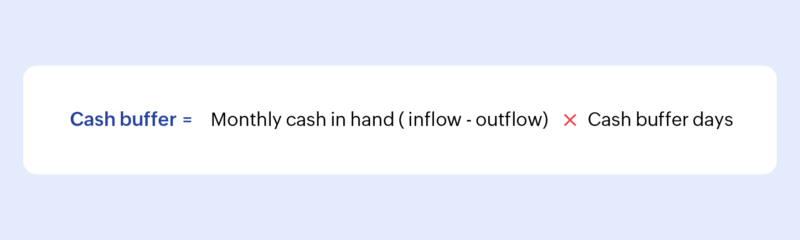

You can also use this formula to assess the amount you’ll need:

Note: Cash buffer days are the number of days you will use a buffer to cover your expenses without getting any revenue.

Another way to help you determine your cash buffer amount would be by understanding your cash burn rate and your cash runway. While your burn rate indicates how quickly you ‘burn’ your money and spend over your income, your cash runway tells you how long your cash will last if you’re burning money quickly. Figuring out your cash runway and cash burn rate will help your business (especially if you have negative cash flow) understand how much you would need to save.

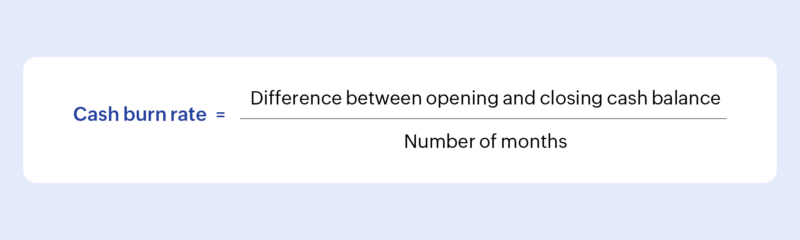

How to calculate your cash burn rate

1. Refer to your cash flow statement and note down the cash balance in the beginning and ending of a period.

2. Calculate the difference between these two balances.

3. Then, divide this difference by the number of months in that period.

For example, let’s say that you’re looking to find your burn rate by looking at the starting and closing balance for four months. If your starting balance in January is $10,000 and your closing balance by the end of May is $7,000, the difference would be $3,000 (10,000 – 7,000 = 3,000). By dividing this by the number of months, you would get $750 (3,000 / 4). This would be your monthly cash burn rate for that period.

If it is a negative value, you have negative cash flow and will need a bigger cash buffer.

How to calculate your cash runway

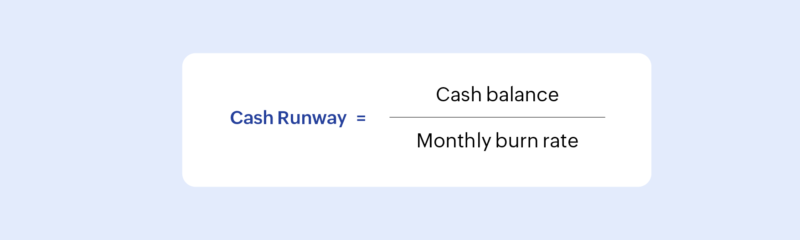

Calculate your cash runway for the month by dividing your cash balance by the burn rate:

For example, if your cash balance is $50,000 and your burn rate is $10,000 per month, it will take 5 months for your business to run out of cash.

Understanding your spending habits will help you determine the size of your buffer, and how long you would need it for.

How to build a cash buffer

You can build your cash buffer by saving smart, redirecting your finances, and making sure that a part of your revenue is kept aside regularly. In case you’re just starting out, open a bank account dedicated for cash reserves, and deposit a specific amount into this account on a monthly basis. You could also follow these tips:

Analyze your payables, cut down on unnecessary expenses, and set a monthly savings goal. Harvard Business Review recommends taking a realistic estimate of your cash flow during and after the pandemic, and to compare it with expenses that are necessary and removable. This way, you’ll identify what can be removed at an early stage to ensure that your buffer is used for essential expenses only.

Set up a direct deposit, where a portion of your earnings will automatically be transferred into your reserve. If your buffer is being drained quickly, see if a certain expense can be paused until you fill your cash buffer to the limit you’ve set, and then resume it. That way, you can redirect the money to the reserve fund.

Liquidate cash that’s tied with old assets and speed up inventory. Sell your products before their value dips further.

Treat your cash buffer like a non-negotiable fixed bill. This helps you build it consistently.

If you don’t have enough funds, start out small or even consider small business loans. You can also go ahead with invoice factoring or get a credit line with your bank, but take note of how close you are to the overdraft limit.

If you have an alternative source of income, move a certain amount from it to your cash reserve fund.

Final thoughts

A cash buffer can help you when your business needs to survive through a tough stage as well as when you want it to grow in the face of a new opportunity. Building one takes consistent effort and smart financial planning. Use these tips to plan the right amount of buffer your business would need, and once you’ve built it, use it with care. It can be easy to spend a lot thinking of the cash buffer as just a backup, but this may only drain your funds further. Instead, identify how you can use it best for your business and replenish the buffer once it’s used up.

Using online accounting software will help you forecast better, understand your cash position, and track income and expenses in real time. Zoho Books can ease your way through managing your financial needs and help you get one step closer to building your buffer!