- HOME

- Financial Management

- What are the methods to calculate cash flow?

What are the methods to calculate cash flow?

Not all financial transactions involve cash. Non-cash items also count while calculating net income in an income statement or assets and liabilities in a balance sheet. Cash flow for non-cash items is calculated by adjusting the company’s net income based on differences in revenue, expenses, and credit over a time period. The differences used to make the adjustments are taken from two or more balance sheets and income statements.

There are two ways you can evaluate a company’s cash flow: the direct method and the indirect method.

Direct method

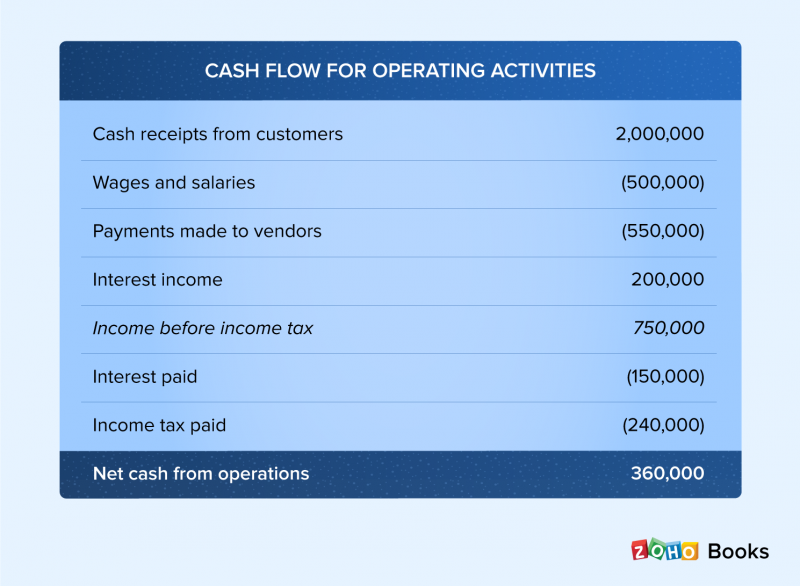

In the direct method, you use the cash flow information from the operations segment of the company’s cash flow statement. You add all the cash payments and receipts, including the amount paid to suppliers, receipts from customers, and cash distributed as salaries.

You arrive at these numbers by calculating the difference between the beginning and ending balances of each account in the balance sheet. This can help you determine the net decrease or increase in cash in these accounts.

Under the direct cash flow method, the values of the accounts in your operations section are recorded on the cash basis. After listing the cash receipts and payments, subtract the outgoing cash from the incoming cash to arrive at the net cash flow for operating activities. Once you add the cash value for investing and financing activities, you can see the net cash increase or decrease.

Let’s look at an example of calculating cash flow using the direct method. Here the values noted inside parentheses are negative, indicating outgoing cash.

Cash flow statement shows transactions only in cash format but most companies generate the balance sheet and the income statement using accrual transactions. Since these two documents act as inputs for generating cash flow statement, the accrual values have to be converted to cash for calculating cash flow.

This can be achieved using indirect method where adjustments are made to convert accrual transactions to cash before calculating cash flow. It is a time-consuming, complex process yet many companies adopt this for the sake of accuracy.

Indirect method

When you calculate cash flow using the indirect method, you need to adjust the net income by converting it from the accrual basis to the cash basis. Then, add the non-cash expenses including depreciation, amortization, unrealized gains and losses, and stock-based compensation. Many companies prefer this method over the direct method because all factors are taken into account.

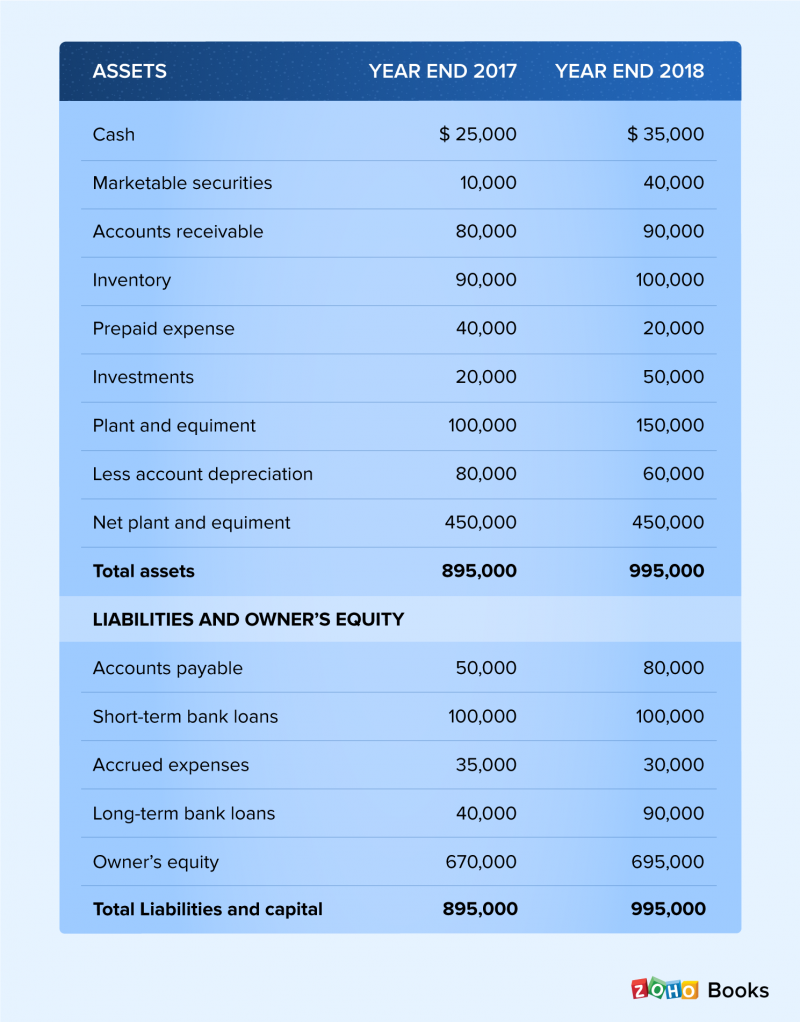

In order to calculate cash flow, you must have two years of balance sheets and income statements for reference. For this example, we’ll use the following comparative balance sheet for the past two years. The increase or decrease of cash in each asset and liability account is recorded in the cash flow statement.

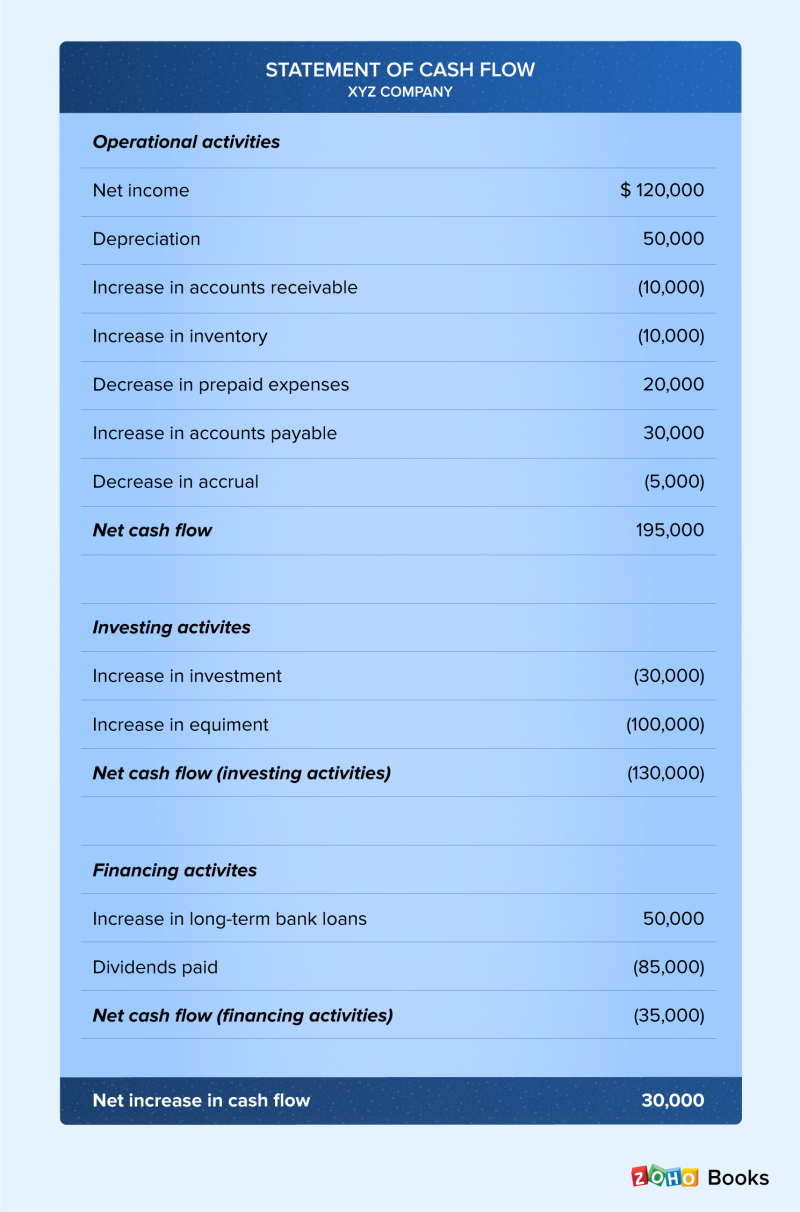

Let’s assume that a company’s net income is $120,000, the depreciation of its assets is $50,000, and it pays dividends worth $85,000. Here is its cash flow statement, prepared by analyzing the account values from the balance sheet.

There are a few rules to follow while recording increase or decrease on cash flow statement after observing the values on the balance sheet.

An increase in asset is debited and a decrease is credited

A decrease in liability account is debited and an increase is credited.

Decrease in equity is debited and increase is credited

Increase in expenses is debited and an increase in revenue is credited.

Cash flow from operations: Start by recording the net income and adding depreciation. Next, compare the two years of balance sheets and add the increase or decrease in each asset and liability account. In this case, there is an increase in accounts receivable, inventory, and accounts payable.

Whenever there is an increase in an asset account, it is marked as a negative value because you are debiting it. In this case, accounts receivable, inventory are asset accounts which are recording an increase, so that value is getting debited and is being recorded as negative.

Likewise, when there is a decrease in liability account, you record a debit from your account. Hence the value is negative. Since accrual account is a liability account and it is recording a decrease, you record a debit and hence the value is negative.

As you can see in the table, the value of accounts receivable is put in parentheses, indicating that it’s negative. This is because the firm gave a credit of $10,000 to its customers, so it has $10,000 less to use. Likewise, there is an increase in inventory by $10,000 as the business might have invested in stock. A decrease of $20,000 is noted for prepaid expense.

Further when you look at the liabilities account, there is an increase in accounts payable by $ 30,000. There is a decrease in accrued expenses, like wages or taxes by $ 5000. After all of these adjustments, the net cash from operating activities is $195,000.

Cash flow from investing activities: In this section we see that the company invested $30,000 in long-term investments. As you might guess, this section usually includes long-term investments plus investments in fixed assets like plant and equipment. The net cash flow from investing activities is the total of these two elements, or $130,000.

Cash flow from financing activities: This is the last section of the cash flow statement. It generally records transactions involving debt, equity, and dividends. In this case, we see that there is an increase in long-term bank loans of $50,000 and dividends worth $85,000 have been paid to investors. The value of dividends has been put in parentheses to show that it is negative cash flow (also known as cash outflow). The net cash flow for the financing section is negative $35,000.

Net cash flow: In this section, combine the net cash flow values from all three sections of the statement to see how the firm is faring overall. In this case, the result is a positive $30,000, which is the net increase in cash flow for the business. It is important to maintain positive cash flow as this money is used to make payments for things that run your business: expenses like buying raw materials or paying the employees.

Positive cash flow means your business is running smoothly.

Direct vs indirect cash flow

Type of transactions: In the indirect method, you convert net income into a cash flow statement by adjusting non-cash transactions. The direct method considers only cash transactions to produce a cash flow statement.

Cash transactions: Under the indirect method, net income is automatically converted to cash flow, whereas in the direct method the cash transactions are stored separately and then converted to cash flow.

Preparation time: Since non-cash transactions are taken into account and adjustments are made for them, it takes longer to prepare for applying the indirect method than the direct method.

Accuracy: The indirect method uses adjustments, so it is less accurate than the direct method, which does not use adjustments.

Company preference: The indirect method is used by more companies than the direct method.

Conclusion

Financial transactions can be recorded as either cash or accrual. Based on the type of transaction, cash flow can be calculated using either the direct method or the indirect method. The direct method uses the cash format to calculate cash flow. In the indirect method, accrual-based transactions are converted to the cash format before calculating cash flow. Even though the indirect method is time-consuming and complex, most companies prefer this over direct method for its accuracy. Many businesses record transactions in the accrual format and use them to generate income statements and balance sheets, which are used as inputs for generating cash flow statements.