- HOME

- Financial Management

- Here’s How You Can Manage Cash Flow at Different Stages of Business Growth

Here’s How You Can Manage Cash Flow at Different Stages of Business Growth

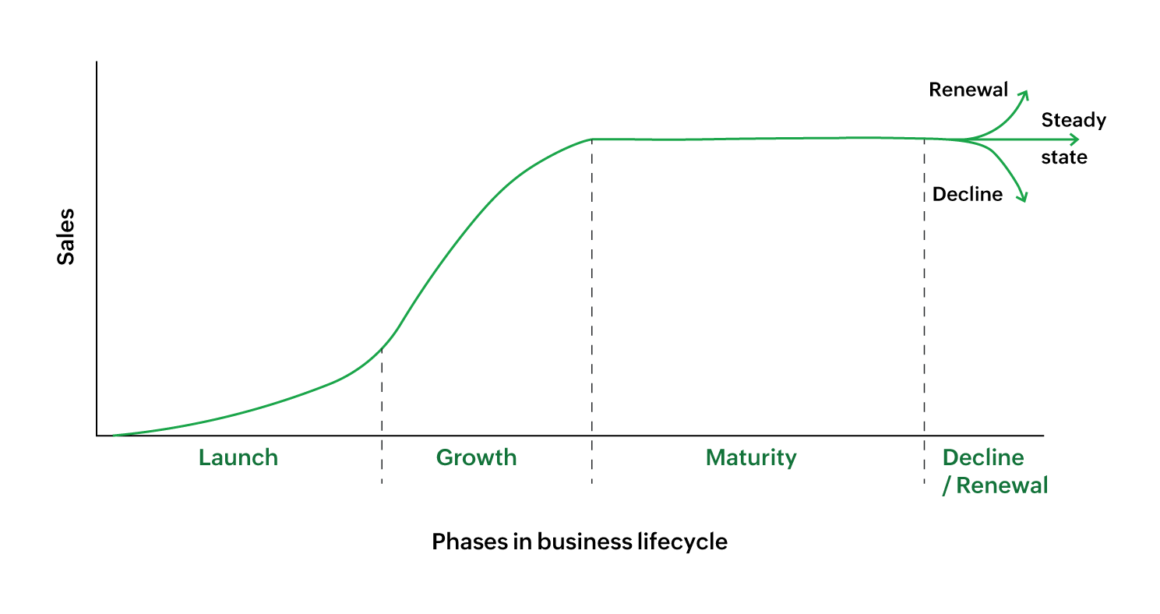

The life cycle of any business can be divided into four phases: launch, growth, maturity, and decline or renewal. Far too often, businesses fail to identify the actual stage their business is in, and miss opportunities for effective management. To take one common mistake as an example, a gradual increase in sales does not indicate your business is in a growth phase.

Having a proper understanding of each phase of the business life cycle will help you prepare for the opportunities and challenges in each phase. The characteristics of each stage may vary based on business type, but if there’s one common feature that affects business at all stages, it’s the cash flow.

In this article, you will read about the effects of cash in different phases as your business moves through its growth curve.

The different phases of business

Phase 1: Launch

This stage is the beginning of the business life cycle. The goal of this phase is to establish your business concept to your audience in order to achieve a positive cash flow. If you look at the graph for this stage, the sales are usually low in the beginning and then there’s a gradual increase. Businesses often concentrate on marketing their ideas to a targeted audience in order to boost their revenue.

Phase 2: Growth

The slope for the growth phase is a little steeper than the previous phase. This phase of a business is defined by a rapid increase in sales leading to an increase in profits, as your business gets more popular amongst a wider customer base. In order to be competitive in this phase, you will need to focus on building and promoting your brand and invest in activities that increase your brand value.

Phase 3: Maturity

If your business has reached this stage, you have a devoted set of customers but the competition is still cutthroat. This is why the slope on the graph is a flat line that represents your steady turnover. Your sales revenue will be somewhat constant because you are selling roughly the same products, year after year, at the same cost. Businesses in this phase focus on maintaining ground with respect to the economy, competitors, and the changing requirements of the customers. Keeping an eye on the bigger picture will help you focus on improvement and productivity in order to compete with other businesses.

Phase 4: Decline or renewal

In this phase, also called the post-maturity phase, businesses may find it difficult to cope with the new challenges posed by competitors. At this stage businesses can take several courses, depending on how their leadership responds. They may continue at a steady state, find a way to renew the business to fuel further growth, or eventually decline if there is no scope for sustained business and no successful attempt at renewal.

How to cope with the effects of cash flow in a business lifecycle

Launch phase

When your business is at this stage, your big needs are likely for money and time to establish your idea in the market. You may spend extra to establish your business and your sales might also be low, leading to a sluggish cash flow. The challenge is not to spend away the little cash that you have saved for your business.

To use your cash judiciously, invest in budgeting and forecasting in order to monitor your spending. Make sure to establish strict payment terms so that your receivables reach you on time. Using this discipline, you can build cash reserves that will keep your business on track during lean times.

An important parameter to understand for your business is the break-even point. This is defined as the point below which your business will need to source additional finances or liquidate some of its assets to meet your fixed costs. Knowing about the break-even point may not change your cash flow, but it will help you estimate how much you can spend to reach your goals.

Financially, it might be tough to hire an accountant at this stage, but their advice could help you set realistic goals for the next phase of your business.

Growth phase

The acquisition of new customers leads to consistency in revenue and increased profit. The extra inflow of cash that comes along with this phase is called positive cash flow, which must be used thoughtfully to move your business forward.

In this stage, suppliers will be reluctant to grant your business credit because you don’t yet have a long track record with their company. You will need to hire more people to work for your business, which means you need to spend more on wages. Most of your money will be spent on payments to suppliers and employees before it comes back into the cash cycle in the form of payments for the sales you’ve made to your customers.

You may experience a time lag in receiving those payments, though, as customers (especially retailers) will take full advantage of the credit terms that you offer.

Other factors like working capital, debt, and the cash cycle can also influence your cash flow at this stage. To keep your business healthy, your cash must be planned, monitored and measured, and put to judicious use. Forecast your business goals and plan the cash required to achieve your growth objectives.

If your payments still don’t turn up on time, your business should not come to a standstill. You can explore several financing options like revolving credit lines to keep your business operations going.

Maturity phase

At this stage, the cash flow does not change dramatically. Your mature business is likely to have stable sales due to market acceptance of your products. Operations will become profitable early in this stage, leading to net positive cash flow. This excess cash is usually used to pay off debts incurred during the launch and growth phases.

However, some businesses in this stage might see steady sales but thin profits. Using this limited cash flow, businesses need to find ways to power new ideas and make this stage sustainable.

Growing the value of the business is possible if you analyze your value chain and find places where you can cut costs. Doing this might help you reduce the cost of what you sell, eventually attracting new customers, which in turn increases the inflow of cash.

You can also check for new ways to provide additional benefits to retain your existing customers. You can even invest your working capital in distribution and promotion of your products in order to attract new customers or identify new markets to target for revenue generation.

One pitfall in this phase is that the market value of products tends to decrease with new competition in this space. Keep an eye on how these new competitors affect your customer base and consider investing resources in enhancing your existing products to stay competitive.

Decline or renewal phase

If a business is in decline, it will see a fall in market share, a drop in sales, and reduced profits leading to cash flow problems. This can prevent you from making payments on time, leading to increased debt.

You may be able to stabilize your business by further cost-cutting or catering to the needs of a niche audience. There are also ways that you can try to renew the declining business, such as acquiring a new business in the same market that has the scope to grow in the future. A successfully renewed business has the scope to help you jump back in the market competition.

However, if your business can’t be rescued, then an ethical closure is required. When you are legally closing your business, you will have to liquidate your assetsinto cash, which is used to pay back the secured loans from creditors. Following this, you must ensure that all your debts are paid, you have settled with all your stakeholders in a fair manner, and all employees have been paid properly.

Conclusion

Cash flow is the lifeline for your business. From launch to decline, cash flow is the one common factor in the financial health of your organization. To keep your business healthy, it is important to understand the effects of cash flow at each stage of the business life cycle and know how to respond. If you know when to spend, when to seek extra funding, when to cut costs, and when to cash out, you can keep working towards your business goals no matter where on the cash flow graph you are.