- HOME

- Accounting Principles

- Difference between single entry and double entry bookkeeping

Difference between single entry and double entry bookkeeping

What is single-entry bookkeeping?

Single-entry bookkeeping is a simple and straightforward method of bookkeeping in which each transaction is recorded as a single-entry in a journal. This is a cash-based bookkeeping method that tracks incoming and outgoing cash in a journal.

How does the single-entry system work?

In single-entry bookkeeping, you maintain a cash book in which you record your income and expenses. Start with your existing cash balance for a given period, then add the income you receive and subtract your expenses. After you factor in all these transactions, at the end of the given period, you calculate the cash balance you are left with.

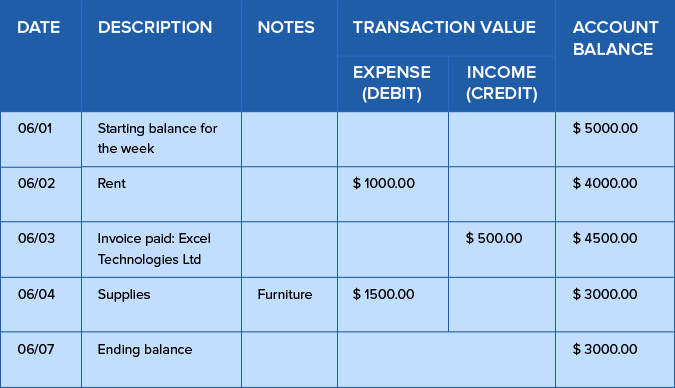

A typical cash book will have the following information:

- Date: The date on which the transaction takes place

- Description: A brief note on the transaction

- Transaction value: The value can be either incoming (debit) or outgoing (credit)

- Balance: Running total of how much cash you have in hand

In the following example, suppose you’re a business owner recording the debit and credit entries for all of the transactions that take place in a week.

1. Let’s assume you have a $5000 cash balance at the beginning of the first week in June. So this will be your first entry.

2. On the second day of the week you pay your rent, which is $1000. Since this is an expense, you subtract this amount from your cash balance. This leaves you with $4000.

3. Your customer pays an invoice for $500, which is income. So this amount is debited to your account and raises the account balance to $4500.

4. You buy office furniture for $1500. So you subtract this amount from the existing balance.

5. At the end of the week, you are left with $3000 in cash.

What is double-entry bookkeeping?

Double-entry bookkeeping is a method of recording transactions where for every business transaction, an entry is recorded in at least two accounts as a debit or credit. In a double-entry system, the amounts recorded as debits must be equal to the amounts recorded as credits.

How does the double-entry system work?

The key feature of this system is that the debits and credits should always match for error-free transactions.

The double-entry bookkeeping system works on the basic accounting equation, which is as follows:

Assets: The money that the company owns

Liabilities: Anything that the business owes

Owner’s equity: Owner’s investment in the company

Income: Money the business earns by selling its products

Expense: Money the company spends to run the business

You should always remember that each side of the equation must balance out. This is how we arrive at the term “balancing the books.” A small example will help you understand this equation.

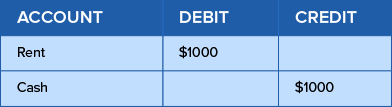

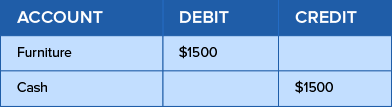

Let us take the same example that we used above, but this time use double-entry bookkeeping. Assume you are recording debit and credit entries for the transactions that take place in a week, using double-entry bookkeeping.

The starting balance for the week is $5000. In one week, you pay your rent ($1000).

You purchase some office furniture ($1500).

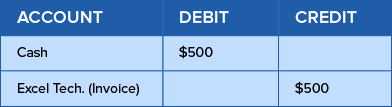

Meanwhile, Excel Technologies pays an invoice with a value of $500.

If you look at all three transactions, you can observe that total credit and total debit are the same: they both add up to $3000.

What documents are used to record entries?

In single-entry bookkeeping, the income and expenses for the transactions are recorded in a cash register, whereas the double-entry system starts with a journal, followed by a ledger, a trial balance, and finally financial statements.

Journal: This is an accounting book where the transactions are recorded sequentially, in chronological order. It need not be balanced.

Ledger: This is a book of final entries where the transactions are divided and recorded in separate accounts. It must be balanced.

Trial balance: This is a bookkeeping worksheet that reflects the credit and debit balance of all ledger accounts. One of the important features of the trial balance is that it maintains the arithmetic accuracy of transactions.

Financial statements: These are a collection of summary-level reports that reflect the organization’s financial results, position, and cash flow.

How is double-entry bookkeeping better than single-entry?

The double-entry system has several advantages over the single-entry system:

Recording method: Single-entry bookkeeping gives a one-sided picture of transactions recorded in the cash register. In double entry, changes due to one transaction are reflected in at least two accounts. The double-entry system is preferred by investors, banks and buyers because it gives them a more complete financial picture of an organization.

Error detection: In double entry, debits and credits must always be the same. If that is not the case, then there is an error. This makes it easy to spot errors and ensure that they are not carried forward to other journals and financial statements. In single entry, there is no method for error correction or detection.

Company size: The single-entry system is only appropriate for small enterprises, whereas the double-entry system can be used by all sizes of businesses, including large ones.

Preparation of financial statements: The information recorded in a single-entry system isn’t adequate for financial reporting or preparing profit and loss statements. Bigger organizations rely on these reports to track their performance, so they need the extra information captured by double-entry accounting.

Run your business with ease

Bookkeeping is an important activity for maintaining accurate financial records. Yet, many small businesses fail to implement it with efficiency. Bookkeeping can help you prepare a budget, check for tax compliance, evaluate your business performance and help you with decision-making. We bet you have thought about getting all of these operations in place for your business.

Zoho Books follows double entry bookkeeping as it is suitable for businesses of all sizes. Double-entry method of recording gives a complete picture of your finances, protects your business from manual data entry errors and automatically generates financial statements for managers and accountants for decision-making.

Check out our cloud-based, double-entry bookkeeping software and find out how it will be suitable for your business.