- HOME

- Accounting Principles

- Basic Managerial Accounting Formulas & Equations for Accountants

Basic Managerial Accounting Formulas & Equations for Accountants

Managerial accountants identify and provide information relating to the business. The information is generally in the numeric form and can be calculated using suitable formulae. The following list is a summary of some of those formulae used by managerial accountants to decipher financial information

Accounting equation

The balance sheet equation follows the accounting equation, where assets are on one side, liabilities and shareholder’s equity are on the other side, and both sides balance out.

According to the equation, a company pays for what it owns (assets) by borrowing money as a service (liabilities) or taking from the shareholders or investors (equity).

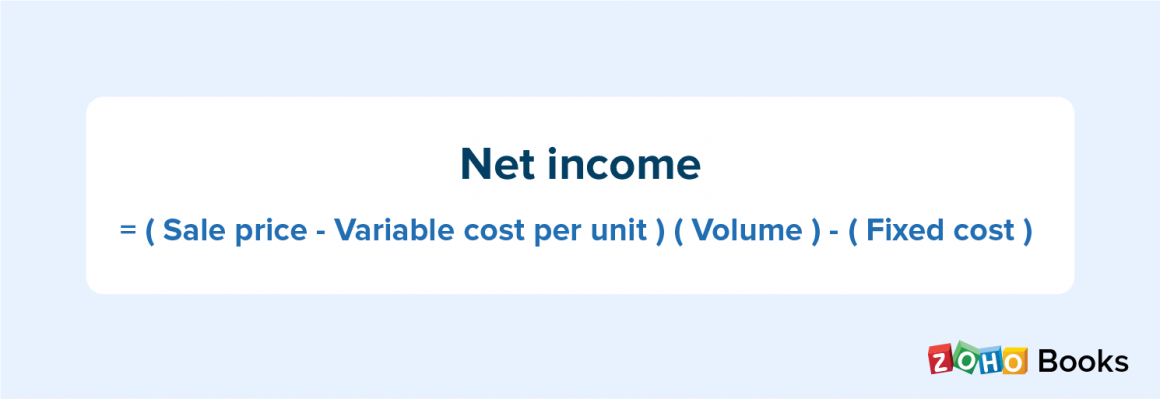

Net Income

Net income is calculated by subtracting total expenses from total revenue. In other words, it’s the money you earn, minus your expenses. It’s different from gross profit, which can be defined as the money earned by a company after deducting the cost of goods sold.

Cost of goods sold

This is the total cost of sales or services, which can also be thought of as the cost incurred to manufacture goods or services. Keep in mind that it only includes the cost of products which you sell. COGS does not usually include indirect costs, like overhead.

Contribution margin

This is a parameter that determines how selling an item or a group of items affects the business’ net income.

The contribution margin formula helps managers understand how their decisions will impact the company’s net income. To calculate contribution margin per unit, you subtract variable cost per unit from sales price.

To compute the contribution margin ratio, divide total contribution margin by total sales.

Cost-volume-profit analysis

This parameter helps you learn how changes in volume affect your costs and net income. To see how production volume affects total cost:

The variable cost for a product is the extra cost involved in producing one unit of that product. Volume is defined as the number of units produced. Fixed cost is the cost assigned to the product for that particular period. Net income is the difference between total sales and total cost, and it can be calculated as follows:

When you combine the formula for net income with total cost, you arrive at another formula that shows you how volume affects profits.

Break-even-analysis

This is a measure of how much you have to sell to break even, i.e., to earn no net loss or profit. The formula for break-even volume is as follows:

Price Variance

This shows you how a sudden change in the value of direct material affects the total cost.

In this equation, the standard price is the amount you expect to pay for per unit of direct materials, and the actual price is the price which you paid per unit for direct materials. The actual quantity is the number of units bought and used during production.

Quantity Variance

This measures how using too much or too little in direct material affects total costs. Logically, using small quantities of direct material should reduce costs, while wasting direct material increases costs.

The standard price in this equation is the price which you originally expected to pay per unit of direct materials. The standard quantity is the quantity of direct materials that you expected to use. The actual quantity is the amount of direct material that you actually used during production.

Conclusion

The formulas involved in managerial accounting serve the goal of helping the management understand the effect of their decisions and choose courses of action that will benefit the business. Some of the key formulas try to answer questions like how much does a customer need to sell to break even or how much effect will the item have on total profits. In recent times, most accounting systems are automated, so recording and verifying data is an easy as the software systems remove the rote calculations out of the process.