- HOME

- Accounting Principles

- A Complete Guide to Accounts Receivable (AR) Aging Reports

A Complete Guide to Accounts Receivable (AR) Aging Reports

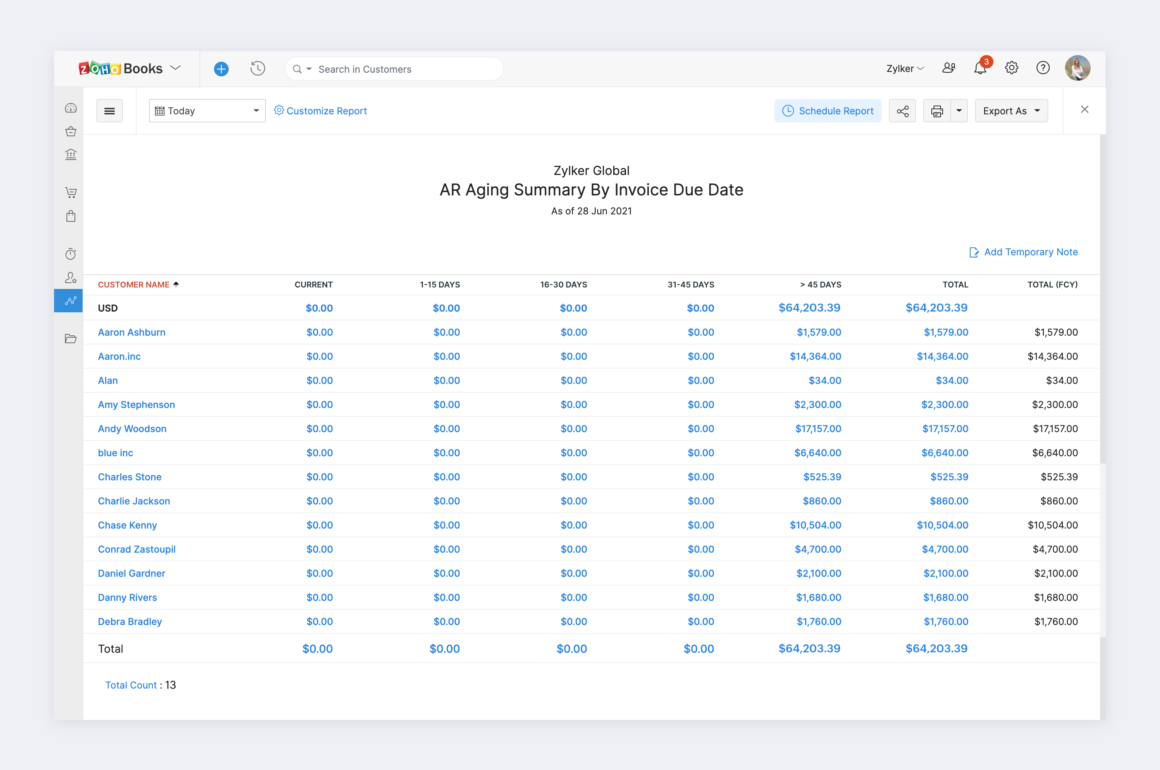

An accounts receivable (AR) aging report organizes all your unpaid customer invoices based on how long they have been outstanding. The report is usually divided into intervals such as 0-15 days, 15-30 days, 30-45 days, and more than 45 days. Monitoring receivables with this report helps business owners identify why their business may be slowing down and which customers are becoming credit risks.

Why AR aging reports are essential for SMBs

According to research conducted by Tide, 16% of small business invoices are paid late. That’s one in six. When payments are repeatedly not made on time, it leads to awkward conversations with customers, cash flow problems, increased payment recovery costs, and more.

An AR aging report helps you stay on top of your receivables, analyze whether your customers are paying on time, calculate credit risks to your business, and estimate bad debts. Whether it’s your finance team, a dedicated AR team, or even external shareholders like lenders, investors, and tax authorities, this report helps keep everyone on the same page.

Your finance team will better understand the pace at which receivables are collected from customers, empowering them to give more accurate insights into the financial health of your business. When evaluating a current customer or lead, they’ll be your point of contact for knowing whether doing business with them is worth the investment. This communicates a greater degree of competency to your external shareholders, leading to more investment and fewer compliance issues.

Once you understand the frequency at which you receive payments, you can even adjust your payment or sales policy. Instead of dropping customers who are on the borderline of being credit risks, you can follow up with them and use it as an opportunity to build stronger relationships. Additionally, you can incentivize timely payments with discounts or special offers, or you might want to add a late payment fee. These smaller, more targeted interventions ensure that you have a streamlined AR process.

How to prepare an AR aging report

An AR aging report or an aging schedule is usually prepared by listing out the customers’ names, the money they owe you at different time intervals, and the total of all your outstanding balances. It’s called an aging schedule because the accounts receivable are divided into different time intervals based on due dates.

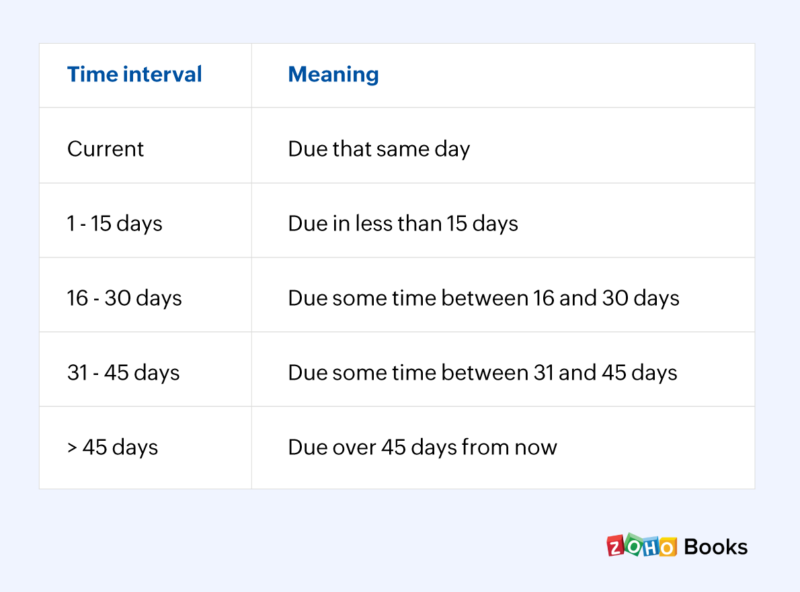

By default, the report divides customer balances based on the following intervals:

The end goal is to collect more payments when they are due, and estimate which customers are consistently running late with their payments.

For example, if you generate the report for June 30 and have an invoice with a due date as June 24, then it will be presented in the “1 – 15 days” column of the report. What you can infer from this is, the balance is due within 15 days and must be collected before July 8.

Here are a few customizations that are possible in an AR aging report:

Time frame: View data for the month, quarter, or year

Invoice date vs due date: Generate reports based on custom criteria

Due date intervals: Categorize unpaid invoices into custom buckets

Multiple currencies: Group customers based on currency

Display: See the number of invoices or the total outstanding amount

How to use an AR aging report

The longer an account receivable remains outstanding, the lower the chances of collecting payment. Hence, the main goal is to maximize your collections in as little time as possible.

For this, you need to first identify the maximum amount of money that each customer owes you. Then you must check if these amounts are current, or if they have been due for over 45 days (this can change depending on business).

According to the Pareto Principle, or the 80/20 principle, start out by assuming that 80% of the late payment problems are caused by only 20% of people on your list. In order to maximize your collections, you must focus on these 20% of customers.

Here are a few things you can do using AR aging report:

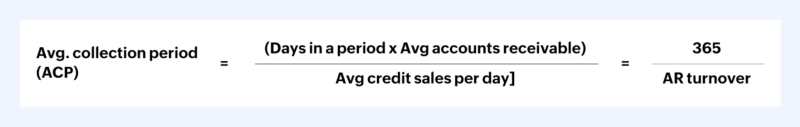

1. You can start off by calculating the average collection period for your business. This is a business analysis ratio that will help you determine the average number of days it takes to collect your sales. The ratio is a reflection of your AR management processes. Businesses must be able to manage this ratio to ensure there is enough cash to take care of their regular financial obligations.

Usually, a lower collection period is preferred over a higher one as it indicates how effective a business is in collecting payments on time. However, if your collection period is high, then your aging report will show more overdue accounts. Here’s when you might revisit your payment terms so that you can collect more of your dues on time.

2. Use the report to organize and filter out the customers that owe you the most and whose payments have been overdue for a long time. You can then send an email or call them up to ensure that the money is collected promptly. If the report shows a huge number of customers whose payments have been due for over 90 days, then it’s probably time to revisit your credit policy for new and existing clients.

3. When the customers are not responding to your emails and calls, you can do one of the following:

* Employ a collections agency to recover your funds that are past the due date

* Undertake action against the customer by filing a legal notice

* Writing off the due amount

Conclusion

An accounts receivable aging report, or AR aging report, helps you factor in outstanding invoices in your financial calculations, thus helping you maintain a healthy cash flow. Without this report, it can get difficult for your business to identify potential credit risks. Therefore, while preparing this report, you must make sure to include detailed customer information, an accurate amount collected, their total outstanding amount, and any relevant financial history for that customer.

The core functionality of an AR aging report is helping you collect payments on time. This is done automatically and more accurately when there’s accounting software, like Zoho Books, in place. In addition to generating these reports for you any time you need them, accounting software can also help you automate payment reminders to customers, which increases the likelihood of you getting paid faster.