- HOME

- Taxes and compliance

- Statutory compliance: Guide to payroll compliance in India

Statutory compliance: Guide to payroll compliance in India

Every business function is governed by a set of rules, and payroll is not an exception. If you've been actively doing payroll in India, you would have definitely come across the term statutory compliance. In this guide, we will learn about the statutory rules that govern payroll in India so you get a clear understanding of how to stay compliant. We will be covering:

- What is statutory compliance?

- What is the need for it?

- What constitutes statutory compliance for India?

- How does staying compliant help both employees and employers?

Let's get started with the basics.

What is statutory compliance in payroll?

Statutory compliance refers to the legal framework put in place by the central or state government to regulate business operations. In this case, it's the framework surrounding payroll.

Why is statutory compliance important?

Every country has its set of payroll laws, and for business owners operating in that country, compliance is a must. Maintaining a spotless compliance record can benefit your business in many ways. It can facilitate business expansion within the country because you create trust with the government. It also shows that you know how to treat your employees well by adhering to labour laws.

In cases of non-compliance, there is a lot at stake for the businesses, such as monetary penalties and a tarnished brand reputation.

Therefore, dealing with statutory compliance requires companies to be well-versed with the labour regulations in the country of operation.

What constitutes statutory compliance in India?

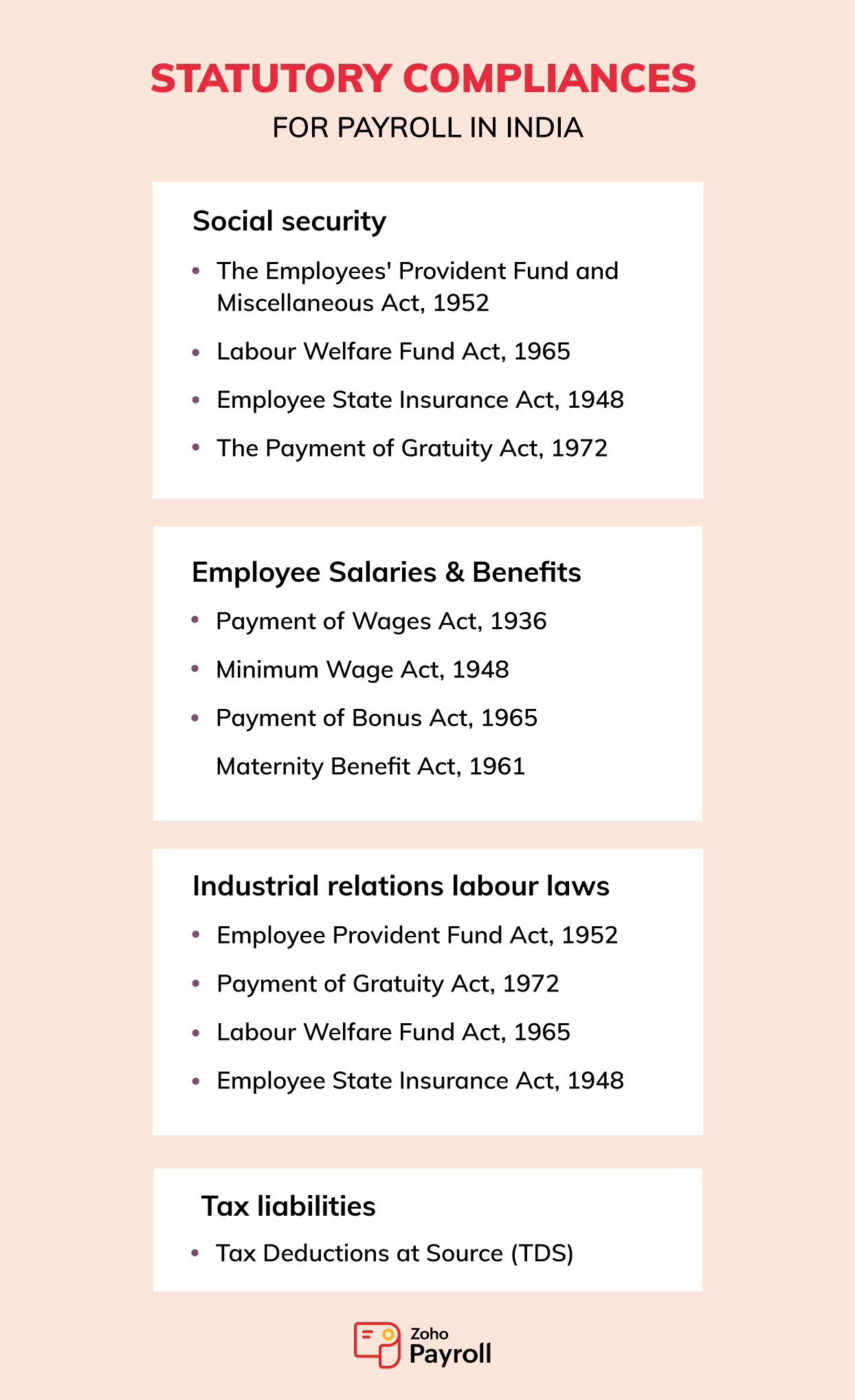

Depending on the industry and type of business, there are many labour laws that an organization has to comply with. For example, in order to protect the social security industrial workers, there's the Shops and Establishments Act and the Factories Act. For easy understanding, we'll classify the statutory compliances under five broad categories: statutory for social security, employee wages, labour laws, tax liabilities, and benefits.

Update: In 2019, the Ministry of Labour and Employment introduced four codes to consolidate 29 central statutory laws. These bills were classified into four major categories like labour wages, industrial relations, social security, and occupational safety, health, and working conditions. Read more about the four labour codes.

Statutes on employee salaries and benefits

Payment of Wages Act, 1936

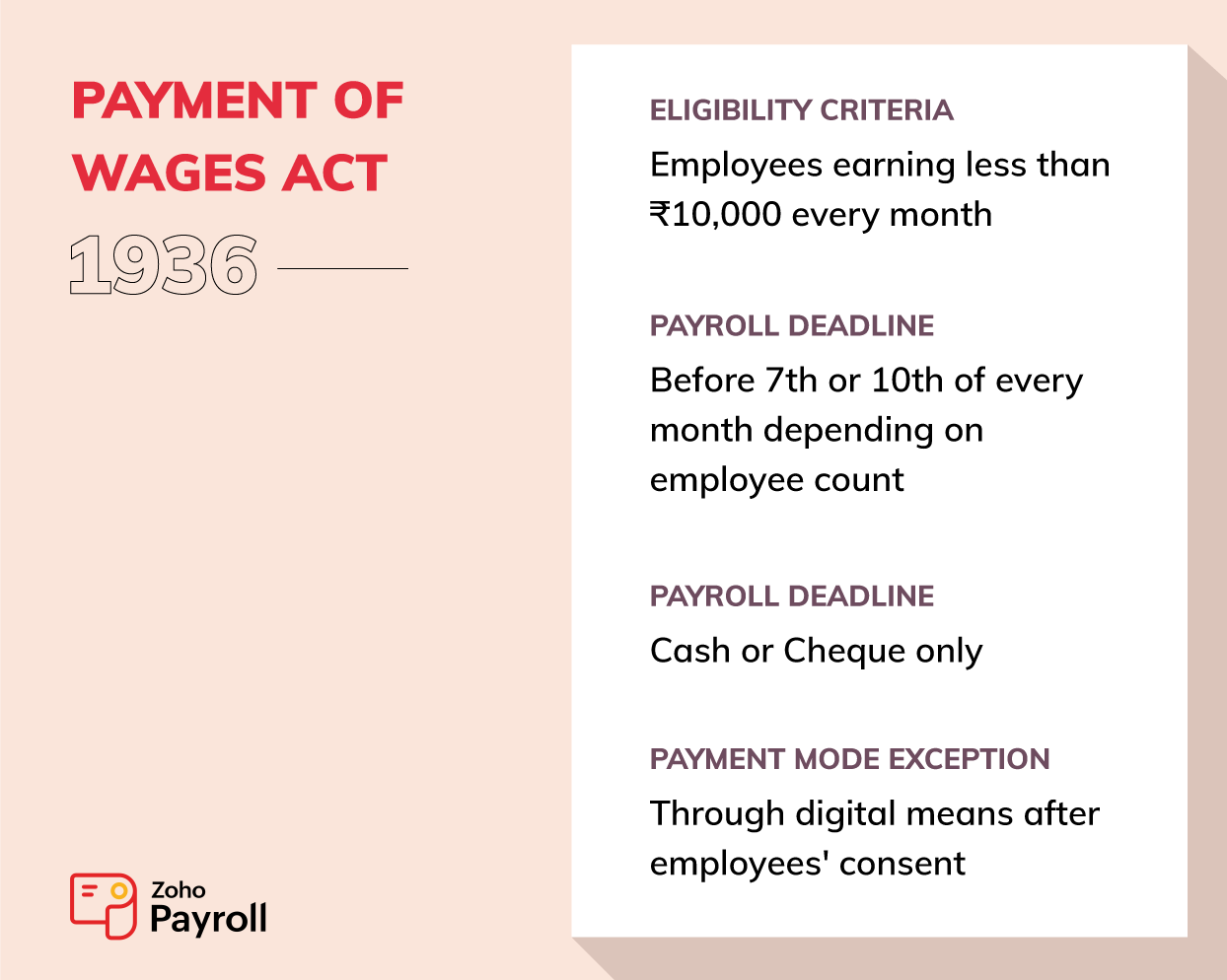

The Payment of Wages Act ensures that employees from various industries are paid on time by having penalties for wages paid late by a month.

According to this rule, employees should be paid before the 7th of every month for organizations with less than 1,000 employees. If the organization has more than 1,000 employees, they need to be paid by the 10th of every month.

This is not applicable for people earning salaries of more than ₹10,000 every month. The preferred mode of salary payments under the act is cash or cheque. Bank transfers are allowed only after consent from employees. The rules and regulations vary from state to state.

Minimum Wages Act, 1948

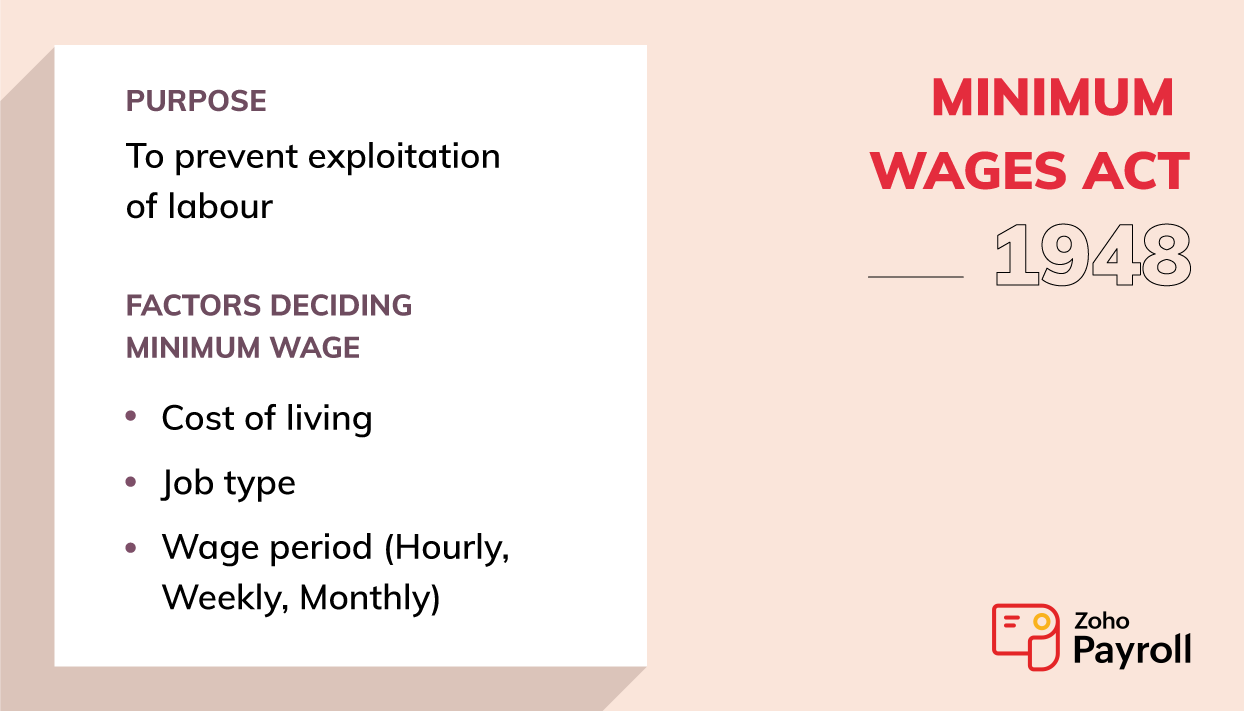

The Minimum Wages Act is a central legislation designed to prevent the exploitation of labour by fixing a minimum wage rate.

The minimum wage varies from state to state or sector to sector since provincial governments also have a say in this.

Some of the most common factors considered before fixing minimum wages include the cost of living, wage period (hourly, weekly, or monthly), and job type.

Payment of Bonus Act, 1965

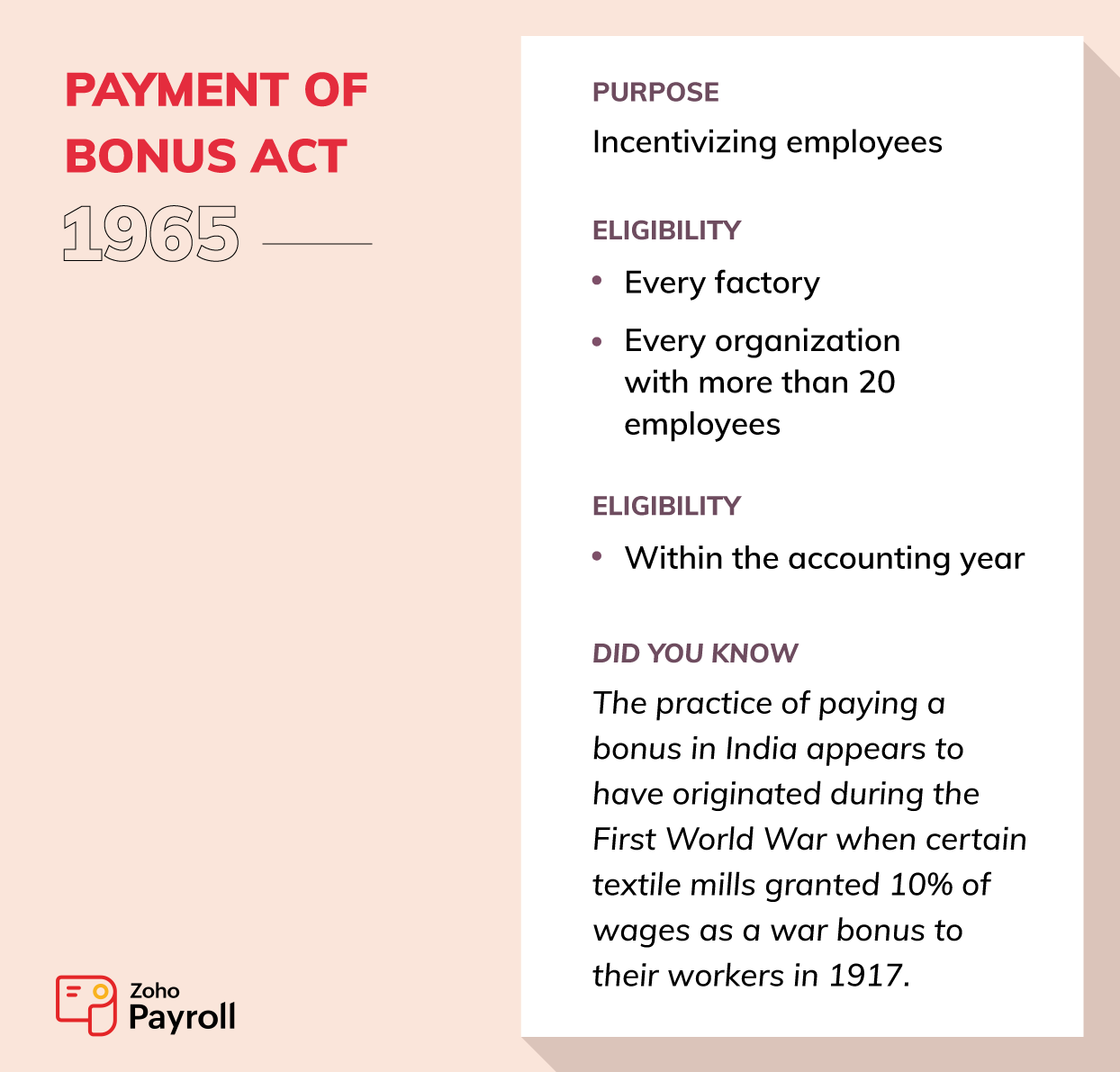

The practice of paying a bonus in India appears to have originated during the First World War when certain textile mills granted 10% of wages as a war bonus to their workers in 1917.

The Payment of Bonus Act provides an annual bonus to employees in certain establishments, including factories and organizations that employ more than 20 people. Under the act, a bonus is calculated based on an employee's salary and the profits of the organization.

Employees that have completed 30 working days and have earned ₹21,000 per month or less (basic + DA, excluding other allowances) are eligible for receiving the bonus from their respective organization.

Maternity Benefits Act, 1961

This act protects the employment of women during the time of her maternity and grants her full paid absence from work. This act is applicable for all organizations that have more than 10 employees. It's also one of the most important statutory regulations that the organizations have to follow.

For a female employee to be eligible for the benefit, they must have been working as an employee in an establishment for a period of at least 80 days within the past 12 months. Payment during the leave period is based on the average daily wage for actual absence.

This act applies to organizations, including factories, mines, plantations, government establishments, shops and establishments under the relevant applicable legislation, or any other establishment dictated by the Central Government.

Maternity benefits according to the latest amendment include the following:

- The duration of maternity leave has been increased from 12 weeks to 26 weeks.

- Prenatal leaves can be applied up to a period of 8 weeks.

- The Maternity Benefit Amendment Act has also introduced an enabling provision relating to "work from home" for women, which may be exercised after the end of the 26-week leave period. This is dependent on the nature of work.

Statutes on tax liabilities

TDS (Tax Deducted at Source)

This is one of the most important statutory regulations that every organization has to adhere to. It was introduced to collect tax from the source of an individual's income. TDS is applicable on various income types such as salaries, interest, and commission.

Every employee is taxed at a different tax rate depending on their salary. With the latest union budget announcements, employees in India can choose between two different tax regimes.

Here's the classification of tax slabs for employees, based on which the TDS is computed.

Old tax-regime

| Income tax slab | Tax rate |

| Up to ₹ 2,50,000 | Nil |

| ₹ 2,50,001 - ₹ 5,00,000 | 5% above ₹ 2,50,000 |

| ₹ 5,00,001 - ₹ 10,00,000 | ₹ 12,500 + 20% above ₹ 5,00,000 |

| Above ₹ 10,00,000 | ₹ 1,12,500 + 30% above ₹ 10,00,000 |

New tax-regime

| Income tax slabs for FY 2023-24 | Tax rate |

| Up to ₹ 3,00,000 | Nil |

| ₹ 3,00,001 - ₹ 6,00,000 | 5% on income which exceeds ₹ 3,00,000 |

| ₹ 6,00,001 - ₹ 9,00,000 | 10% on income which exceeds ₹ 6,00,000 |

| ₹ 9,00,001 - ₹ 12,00,000 | 15% on income which exceeds ₹ 9,00,000 |

| ₹ 12,00,001 - ₹ 15,00,000 | 20% on income which exceeds ₹ 12,00,000 |

| Above ₹ 15,00,000 | 30% on income which exceeds ₹ 15,00,000 |

The way forward

We're sure it wasn't easy to get through this guide, even though we've only highlighted the basic information that businesses need to be aware of. Now, imagine if you have to manage all these compliance requirements manually or through outdated systems?

Statutory compliance can make or break a company's reputation. There's tons of rules and regulations involved, and these have to be adhered to perfectly, every time. Some are modified by the Central or State government, as well. Historically, payroll administrators did this manually. Today, there are systems that can help reduce the burden on payroll teams. With cloud-based payroll software, you can put statutory compliance on auto-pilot mode and always keep a spotless compliance record.

References

- https://labour.gov.in/sites/default/files/thepaymentofwagesact1936_0.pdf

- https://clc.gov.in/clc/sites/default/files/MinimumWagesact.pdf

- https://labour.gov.in/sites/default/files/thepaymentofbonusact1965.pdf

- https://labour.gov.in/sites/default/files/the_maternity_benefit_act_1961_0.pdf

- https://www.esic.nic.in/Tender/ESIAct1948Amendedupto010610.pdf

- https://www.epfindia.gov.in/site_docs/PDFs/Downloads_PDFs/EPFAct1952.pdf

- https://clc.gov.in/clc/sites/default/files/PaymentofGratuityAct.pdf

Comments(5)

It is good and easy to understand

Crystal Clear Explanations! Kudos! ZOHO!

Easy to understand

Great and easy to understand. Keep posting

It is good and easy to understand