- HOME

- Taxes and compliance

- ESI: registration, payment, & return filing

ESI: registration, payment, & return filing

Employees' state insurance, commonly known as ESI, is a social security scheme that provides socio-economic support to employees during unforeseen situations. Through this self-financing fund, insured employees and their dependents can claim medical care benefits, coverage for sickness, maternity leave, temporary or permanent physical disablement expenses, funeral expenses, and confinement expenses. If an injured person dies due to an employment injury or disease, their dependents are eligible for monetary support under ESI, too.

Who should register for the ESI scheme

ESI is managed by the Employees' State Insurance Corporation (ESIC) and mandated by the Ministry of Labour and Employment of the Government of India. Both an employer and employee contribute a shared 4% of the employee's gross pay towards the ESI fund each month.

Any business establishment in India employing 10 or more people should voluntarily register with the ESIC within 15 days from the date of applicability.

How to register your business for the ESI scheme

To make the registration process easy for business owners, the statutory body has made the registration process fully online. No physical copies of documents are required. However, there are a few soft copies of documents that you should have on hand to ensure a quick registration.

Documents required for ESI registration

- Certificate of registration

- Certificate of incorporation

- PAN card of the organization and its employees

- Memorandum of association and articles of association of the company

- A cancelled cheque

- List of all employees employed by the company and their salary details

- List of all shareholders and directors of the company

- Proof of address of the establishment (one of the below)

- Electricity bill, telephone bill, or gas connection bill

- Property tax receipt

- Rental or lease agreement

Step-by-step guide for the ESI online registration process

- Log in to the ESIC online portal and select Employer Login.

- Once on the Employer Login page, select Sign Up, and fill in your business's details in the fields.

- Once you complete that, a confirmation email will be sent to your registered email address with your login credentials.

- Go to Employer Login again and log in using the username and password you received in the email.

- Once logged in, you will be taken to the New Employer Registration page.

- Select the type of unit you run from the dropdown menu (factory or shop/establishment) and click Submit.

- On submitting, Employer Registration ‒ Form 01 will appear. You are required to enter the complete address, ownership details of the unit, and details of your employees. Once done, click Submit.

- After you submit Form 01, you will be taken to the Payment of Advance Contribution page. You have to pay an advance contribution for six months on behalf of eligible employees to complete the registration process. Click Pay Initial Contribution and select the online mode of payment.

- You will then be redirected to the SBI Payment Gateway, where you have to make the necessary payment.

- After successful payment, you will receive a system-generated registration letter called C-11 in your email inbox. The C-11 letter is valid proof of registration of your unit under the ESI Act. It contains a 17-digit registration number allotted by the statutory body.

Here's a tutorial with screenshots on how to register your business for ESI.

ESI payment due date and procedure

The last date to pay your ESI contribution is the 15th of every month. Employers registered under the scheme should deposit the due amount in a bank authorized by the statutory body before the deadline.

How to make payments for ESI online

- Log in to the ESIC online portal with your ESIC user name and password.

- Once logged in, you will see three categories: Employer, Employees, and Monthly Contribution.

- From the Monthly Contribution category, choose File Monthly Contributions.

- Check the preview to ensure everything is correct, and click Submit to file your monthly contributions.

- Once you have filed successfully, you can make payments online by choosing the Pay Online option and clicking Ok.

- Make note of the ESI challan number generated for future reference.

- You will be redirected to the SBI net banking page to make your payments.

- Once you complete the transaction, you'll be returned to the ESIC portal. There, the following information will be listed for your reference:

- Reference number

- Debit account number

- Challan number

- Amount

- Status

- Debit branch

- Date and time of the payment

Here's a step-by-step guide with screenshots for making online payments and generating ESI challans online.

ESI return filing due date and procedure

Employers should submit half-yearly returns using the Return of Contributions form (RC). For the contribution period of April to September, the due date to file returns is 12th of November and for the October to March period, the last date is 12th of May.

How to file ESI returns online

- Go to ESIC portal and log in using your username and password.

- Once you log in, you will see a section labelled Monthly Contribution. Select View RC under the Monthly Contribution section.

- All the contributions that you have made during the period and your employees' wages will be displayed. Verify the details are correct.

- If there is a missing contribution payment, you will be required to generate a new challan using the Modify Challan button from the Monthly Contribution section.

- Make due payments using the new challan to settle the missed contributions, if necessary.

- Once all the payments for the selected period are made, go to the Monthly Contribution section and click on Self Certification.

- Submit the return by checking the declaration box.

Note: If you have 40 or more employees, you have to upload a CA certificate before submitting the return. A CA certificate is issued by chartered accountants acknowledging that they have verified the returns based on the records and registers of the company.

Employers who have followed the above steps are considered to have properly filed their ESIC returns for that particular contribution period.

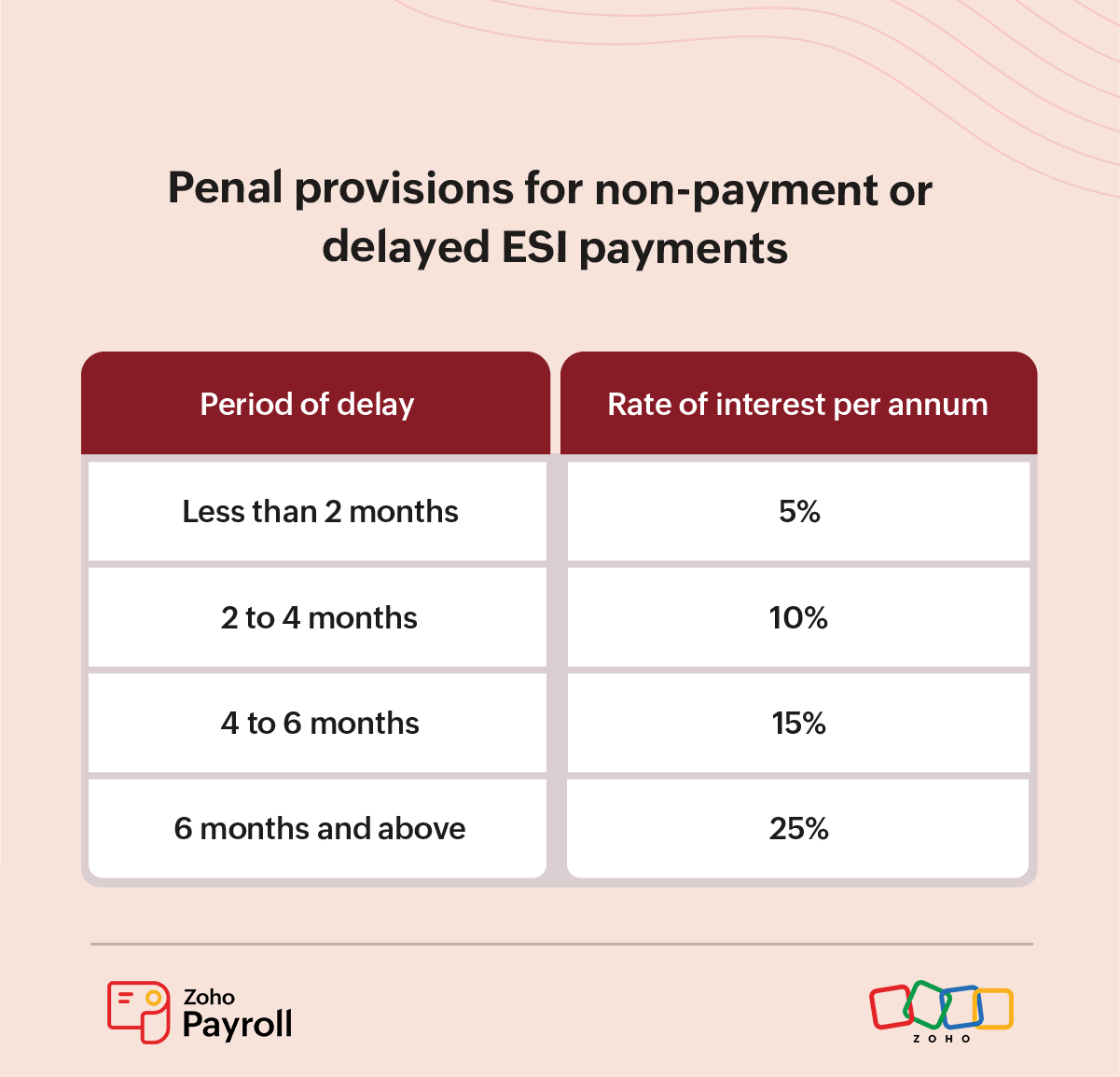

Penalty for non-compliance with the ESI Act

The amount deducted by the employer under the ESI Act is considered entrusted to them by the employee for the purpose of contributing towards the ESI fund. Any delay in payment or non-payment of contribution amounts is considered "Breach of Trust" which is a crime punishable under IPC 406 and 409. It is also an offense under section 85 of the ESI Act.

An employer who fails to pay their contribution has to pay a simple interest at the rate of 12% per annum for each day late.

The ESI department can also levy penal provisions on the employer for delays in payment or non-payment.

ESI compliance forms for the employer

| Form | Description |

| Form 01(A) | Form of Annual Information |

| Form 1 | Declaration Form |

| Form 2 | Addition/Deletion in Family Declaration |

| Form 3 | Return of Declaration Form |

| Form 6 | Register of Employees |

| Form 9 | Claim for Sickness/Temporary Disablement Benefit/Maternity Benefit |

| Form 11 | Accident Book |

| Form 12 | Accident Report |

| Form 12A | Claim for Maternity Benefit for Sickness |

| Form 13 | Claim for Sickness or Temporary Disablement or Maternity Benefit |

| Form 14 | Claim for Permanent Disablement Benefit |

| Form 15 | Claim for Dependent Benefit |

| Form 16 | Claim for Periodical Payment of Dependent Benefits |

| Form 19 | Claim for Maternity Benefit and Notice of Work |

| Form 20 | Claim for Maternity Benefit by a Nominee |

| Form 21 | Maternity Benefit - Certificate of Expected Confinement |

| Form 22 | Funeral Expense Claim |

| Form 23 | Life Certificate for Permanent Disablement Benefit |

| Form 24 | Declaration and Certificate of Dependent's Benefits |

Stay compliant with payroll software

Maintaining spotless statutory compliance is a must for every business owner. If anything goes wrong, you will have to pay hefty fines and tackle a tarnished brand reputation. Zoho Payroll, cloud-based payroll software, keeps you legally compliant so you can focus on growing your business.

Using Zoho Payroll, you can automatically calculate and deduct employees' ESI contributions before processing every pay run. It allows you to maintain a clean statutory record by generating ESI summary reports and ESIC return reports in real time.