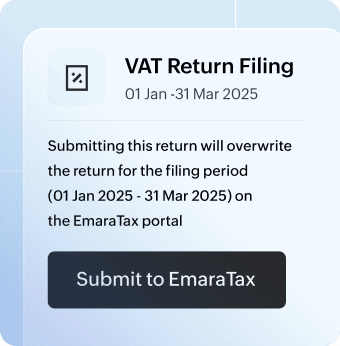

File your VAT returns in Zoho Books

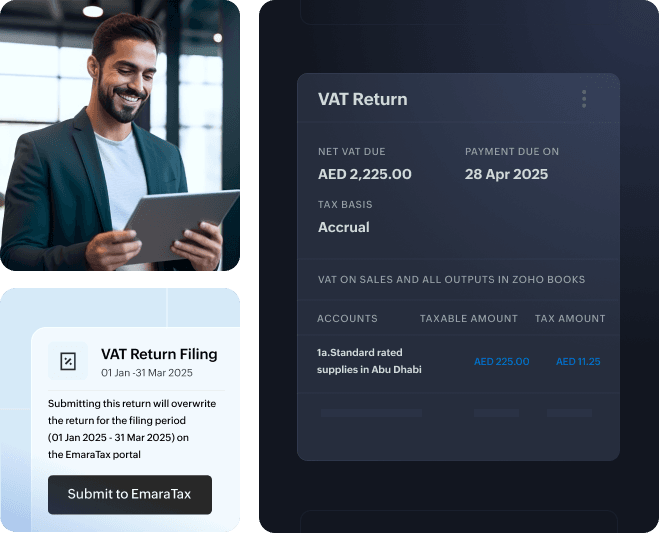

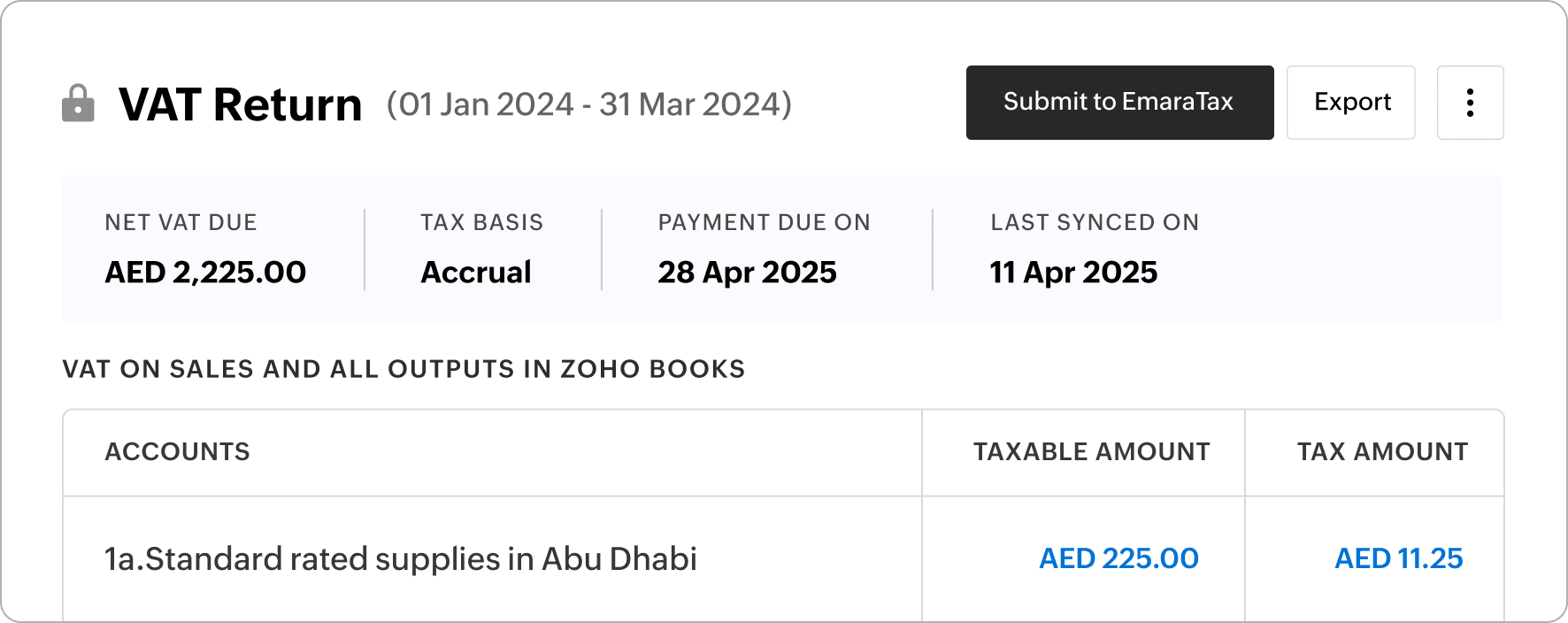

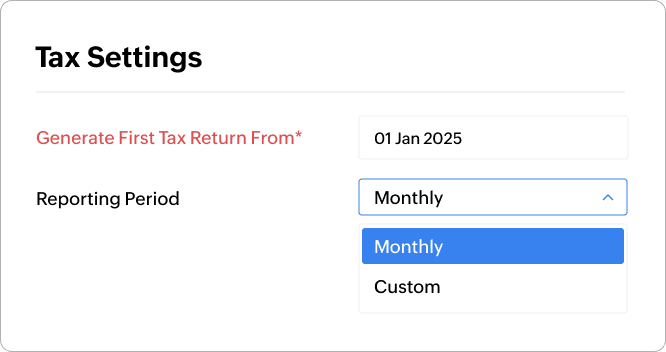

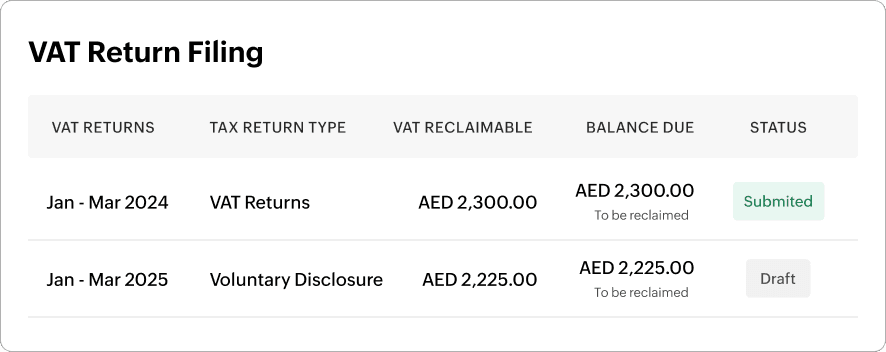

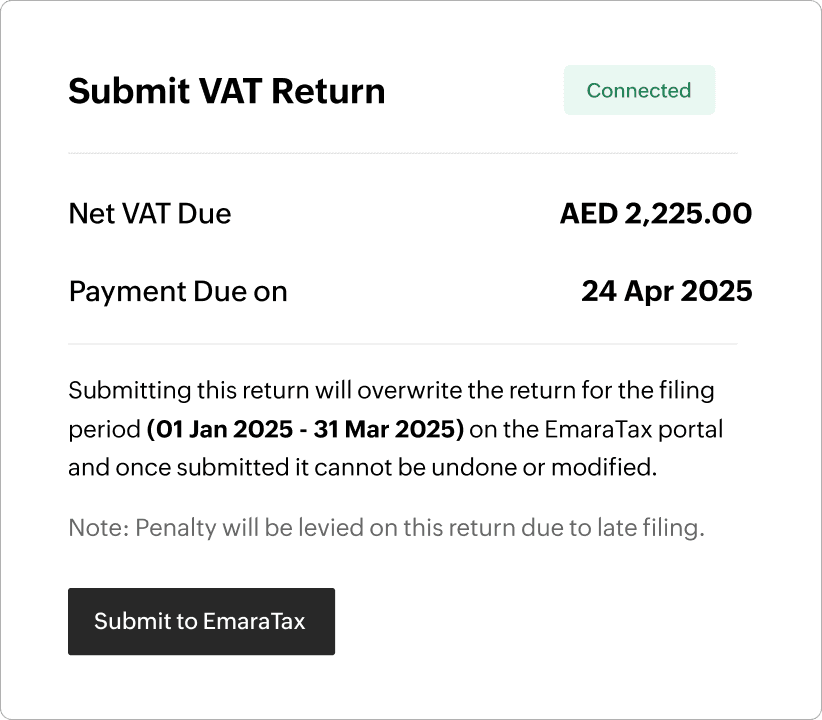

Zoho Books is recognised as a Digital Tax Integrator by the Federal Tax Authority. Your favourite VAT-compliant accounting software, now lets you directly file VAT returns with the EmaraTax portal. No more manual recording, no more errors, and no more late submissions!

Your ideal e-filing solution

The art of filing in seconds

Articles and guides

View all

Zoho Books will help your business stay VAT compliant, and here’s how

The VAT regime has had a major impact on business owners and their accounting. This new tax system has been in the works for quite some...

All your questions about Value Added Tax in the UAE answered: FAQs

Value Added Tax (or VAT) is an indirect tax applied on the consumption of most goods and services. It is also referred to as a type of general consumption...